What’s next for biotech’s M&A boom?

Portfolio Manager Andy Acker says a move by the Federal Trade Commission (FTC) to block a biotech deal could temporarily reduce appetite for large mergers and acquisitions (M&A) in the sector – but could create opportunities for small caps.

4 minute read

Key takeaways:

- The FTC is suing to block Amgen’s proposed $28 billion acquisition of Horizon Therapeutics, but the regulator’s case is based on a new theory that may be hard to win.

- Even so, after a promising start in 2023, large M&A could slow near term as the case is considered.

- Alternatively, smaller biotech deals could accelerate, as many biopharma companies face significant patent cliffs and must act to replace lost revenues.

With small- and mid-cap biotech stocks trading at attractive valuations, merger and acquisition (M&A) activity got off to a strong start in 2023. By early May, some $69 billion in biopharma deals were announced, roughly the same as the total value for all of 2022.1

Then, the Federal Trade Commission (FTC) threw a curveball: In a surprise move, the regulator sued to block Amgen’s $27.8 billion acquisition of Horizon Therapeutics, a deal first announced in 2022. What is surprising is that the usual basis for an FTC suit – too much product overlap – does not exist in the Amgen/Horizon deal. Instead, the FTC is basing its case on the possibility that Amgen might use its heft to bundle Horizon’s products with other drugs from the Amgen portfolio, allowing for sizable rebates that would put potential competitors at a disadvantage.

A slowdown in large M&A …

Without legal precedent, the FTC suit creates uncertainty not just for the Amgen/Horizon deal but future M&A in the sector. The lack of precedent also places the burden of proof on the FTC. And here, the regulator could face an uphill battle since the argument is based on what Amgen might do, not what will or has occurred (like getting a speeding ticket as you leave the driveway because you might drive too fast.) In our view, this reasoning lowers the odds of the FTC succeeding.

Still, we believe the suit could slow down large M&A deals (those greater than $15 billion in value) until the case is resolved, most likely in the second half of 2023. Year to date, we had seen an uptick in larger acquisitions, including the Amgen/Horizon merger and Pfizer’s buyout of Seagen for $43 billion.

… could lead to a pickup in small deals

On the other hand, smaller biotech M&A (deals less than $10-$15 billion) could now accelerate. After all, the need for M&A is not going away. Over the next few years, many large-cap biopharma companies must replace revenues from blockbuster drugs – medicines with $1 billion or more in yearly sales – going off patent. In fact, by the end of the decade, as much as $200 billion in annual drug revenues are at risk from loss of exclusivity,2 including immunology therapies Humira ($21.2 billion in sales) and Stelara ($9.7 billion3), which come off patent this year. As such, the industry has stockpiled an estimated $500 billion in cash on their balance sheets and is motivated to shop.4

At the same time, innovation among small- and mid-cap biotech firms is picking up. As we’ve noted before, 2022 was a year of clinical progress, with companies delivering positive data across multiple major disease categories, including muscular dystrophy, Alzheimer’s, age-related macular degeneration (a leading form of blindness in the elderly), and obesity. Now, more than 80 therapies are up for Food and Drug Administration review in 2023, setting the stage for what could be a record year of approvals, with 18 medicines launching as of mid-May.5 What’s more, given the breakthrough nature of many therapies, these drugs could represent the start of new product cycles, which typically drive revenue growth for a decade or more.

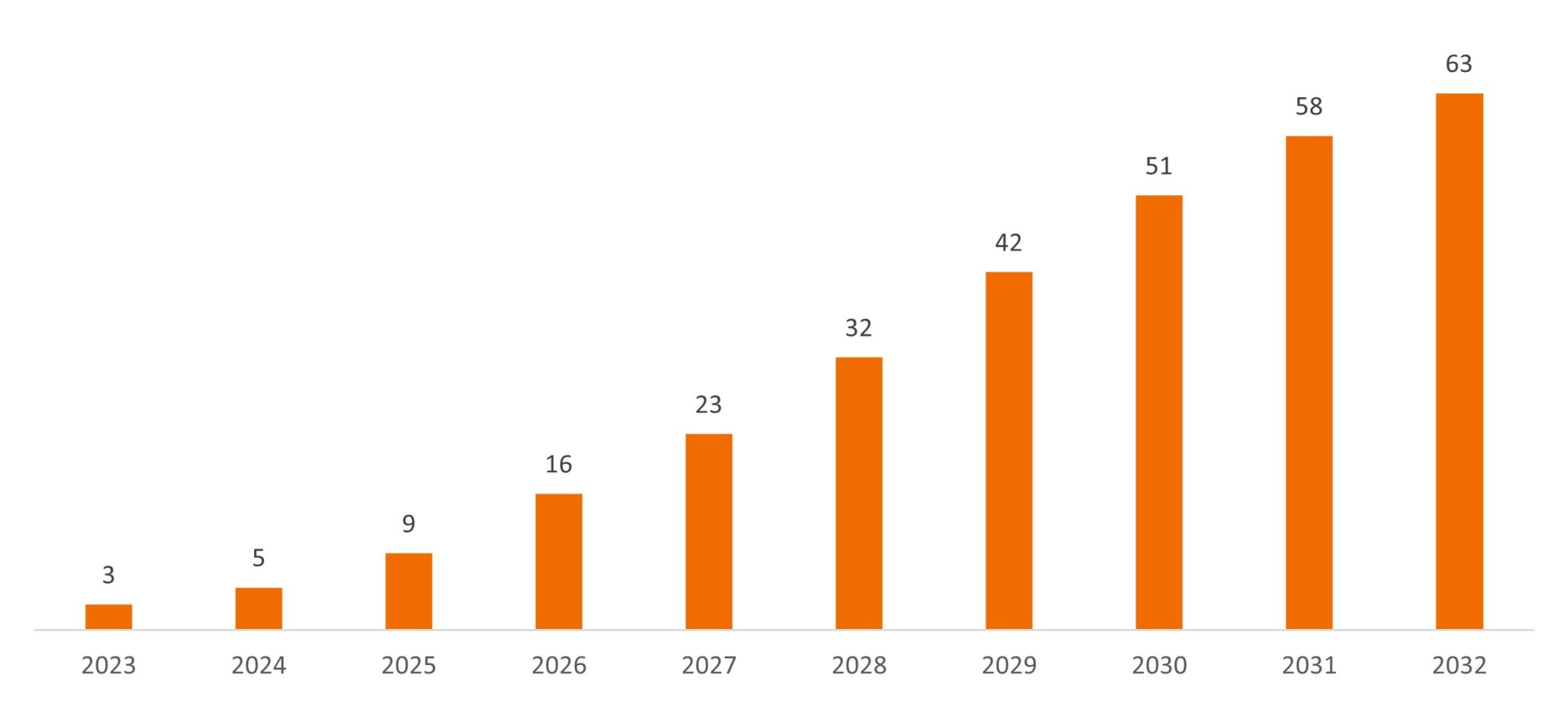

Cumulative sales potential of 15 drug launches

Risk-unadjusted consensus revenues (US$B)

Source: Jefferies Research, as of 24 March 2023.

Source: Jefferies Research, as of 24 March 2023.

Tight capital markets and restrictive lending conditions have also made small- and mid-cap biotech companies more open to being acquired. Appetite for initial public offerings declined as interest rates rose in 2022, while banking turmoil in the U.S. has restricted an important avenue of funding for small-cap biotech. With these sources of capital now curtailed, M&A has become increasingly important to the continuation of clinical trials and the commercialization of new medicines.

If larger deals can’t be completed, the biopharma companies needing to access innovation may have to do as many as three small deals for every large deal – a trend that could benefit investors focused on innovative small- and mid-cap biotechs. Case in point: In late May – after the FTC suit was filed – gastrointestinal drugmaker Ironwood Pharmaceuticals announced it would buy Swiss biotech VectivBio for $1 billion, a 40% premium to VectivBio’s pre-announcement share price.6

1 Jefferies Research, as of 8 May 2023. Data reflect announced deals equal to or greater than US$500 million in value.

2 BioPharma Dive, “Big pharma’s looming threat: a patent cliff of ‘tectonic magnitude,” 21 February 2023.

3 Sales figures are for 2022 and sourced from company reports.

4 Jefferies Research, as of 24 March 2023.

5 Food and Drug Administration, as of 19 May 2023.

6 Bloomberg, as of 19 May 2023.

IMPORTANT INFORMATION

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.