A bird in the hand: are yield returns king again?

Portfolio Managers Seth Meyer and Brent Olson discuss how high yield fixed income can help to bring defensive characteristics to multi-asset portfolios in a rising rate environment.

7 minute read

Key takeaways:

- While duration risk has typically been confined to appraisals of fixed income assets, we believe its scope should be broadened to include equities within multi-asset portfolios.

- As inflation remains high, and interest rates continue to rise, asset classes that outperformed in the low-rate environment following the Global Financial Crisis might not be best positioned to continue their outperformance.

- In our view, when added to the equity sleeve of a multi-asset portfolio, high yield fixed income can help to play defence by reducing portfolio duration in a rising rate environment.

Warren Buffet, CEO of Berkshire Hathaway, famously quipped the following during a speech at Allen & Company’s 1999 Sun Valley Conference: “Now, Aesop was not much of a finance major, because he said something like, ‘A bird in the hand is worth two in the bush.’ But he doesn’t say when.” Mr Buffet went on to say that the cost of borrowing – or the level of interest rates – determined the price of when. “And that’s why,” he continued, “sometimes a bird in the hand is better than two in the bush and sometimes two in the bush are better than one in the hand.”

With characteristic wit, Mr Buffet was pointing out that the current value of a financial asset is not only affected by the level of interest rates and expected future returns, but also by the timing of future returns. In essence, the further into the future the payoff on an investment, the more sensitive it is to changes in interest rates. All else equal, in a falling rate environment, investors are rewarded for investment returns to be received further into the future (think growth stocks and long duration bonds), while in a rising rate environment, investments that have a shorter payoff duration tend to fare comparatively better (think value stocks and short duration bonds).

Mr Buffet shared this anecdote at Sun Valley in 1999 – much to the chagrin of a room full of Internet CEOs – at a time when technology stocks were enjoying record price returns and sky-high valuations. What he was paying attention to – that many of his detractors were not – was that at the time, interest rates were already on the rise, and the higher discount rates were going to smack the prices of growth stocks whose nosebleed valuations were predicated on the expectation of profits a very long way in the future. In many ways, the backdrop of 1999 might not be too dissimilar to the environment in which we presently find ourselves.

Exhibit 1 illustrates this concept. Two hypothetical investments have the same $100 payoff, but their payoffs take place in different years. Ignoring the effect of reinvestment, Investment A, with a payoff in year 3, performs relatively better when rates fall, while Investment B, with its payoff in year 1, does relatively better when rates rise.

| Change in present value if: | |||

|---|---|---|---|

| Hypothetical investment | Payoff profile | Rates fall from 3.5% to 1.5% | Rates rise from 1.5% to 3.5% |

| Investment A | $100 in year 3 | +6.0% | -5.7% |

| Investment B | $100 in year 1 | +2.0% | -1.9% |

Source: Janus Henderson Investors.

Expanding the Application of Duration

While our example is a simple one, if we take this concept to the real world and extend the timeline of the expected payoff, and if the change in interest rates becomes more pronounced, the “when” effect substantially impacts relative returns between asset classes, all else equal. Arguably, this “when” law has been the unsung hero for the past decade’s outperformance in growth stocks (despite technological innovation and space-bound CEOs accepting all the praise).

The sensitivity of asset prices to the timing of returns (duration) is a concept with which bond investors are well acquainted. But while duration has typically been an important risk to evaluate within bond allocations, it isn’t as much discussed in regard to multi-asset portfolios that include an allocation to equities. There are legitimate reasons for this, most notably that duration is more difficult to quantify on equity securities because the terminal value is unknown (unlike a bond), and cash flows (dividends) are variable, unlike stable bond coupons. There is, therefore, a high degree of ambiguity in calculating duration on equities.

Nonetheless, in our opinion, it’s safe to say that equities are typically long-duration instruments. According to a 2010 paper from S&P Indices (Blitzer, Dash & Soe), between 1976 and 2010, the long-run historical average duration of the S&P 500® Index was 23.7 years.

High yield bonds – a low duration option within equity allocations

As investors consider their portfolio positioning for a higher rate environment, we believe managing duration on both the equity and fixed income sleeves within a multi-asset portfolio can yield favorable results relative to a duration-agnostic approach. As we think about managing duration in an equity sleeve, investors might consider using high yield bonds to achieve that purpose, for the following reasons:

- High yield historically has been positively correlated to equity markets – the 30-year correlation on the Bloomberg Corporate High Yield Index and the S&P 500 is 0.64. If this positive correlation continues, investors may be able to rely on high yield fixed income to compliment, and move in correlation with, their equity allocations.

- Low duration – going back to 1992, the duration on the Bloomberg Corporate High Yield Index has averaged 4.2 years, considerably lower than Blitzer’s estimated 23.7 years for the S&P 500®. Therefore, if investors are looking to be more defensive and reduce overall portfolio sensitivity to interest rates, an allocation to high yield bonds within their equity sleeve may help to achieve that.

- Returns and risk – while high yield bonds have a significantly lower duration, the asset class has still been able to capture over 70% of the return of the S&P 500 since July 1992. (For the 30-year period from 1 July 1992 to 29 June 2022 the Bloomberg Corporate High Yield Index returned 6.9% annualised, compared to 9.8% for the S&P 500). Therefore, we believe that by adding high yield to equity sleeves, investors can play duration defence without being entirely “risk-off”.

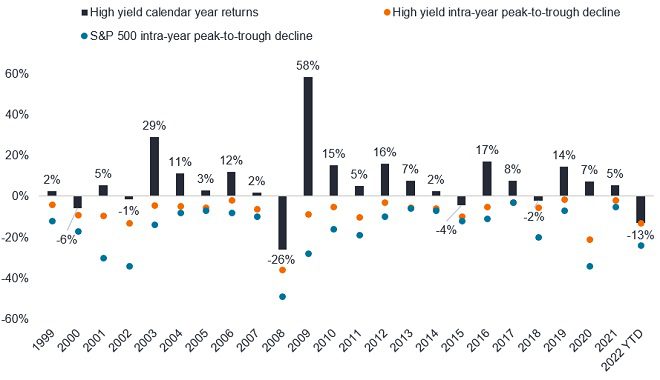

Exhibit 2: High yield calendar year returns vs. intra-year declines

Annual returns in high yield have been positive in 18 of 24 years, with lower intra-year drawdowns than the S&P 500

Source: Bloomberg, J.P. Morgan as of June 21st, 2022. YTD = year to date. Past performance does not predict future returns

Who is king of the castle?

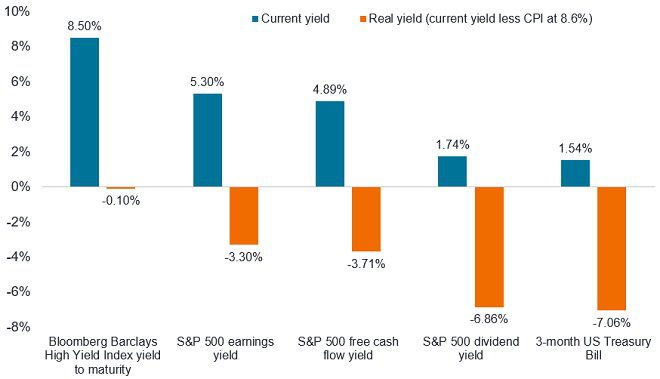

It’s been a long time since anyone has uttered the term, “Cash is King”. Since the Global Financial Crisis (GFC), cash – and cash, or yield, returns – have been anything but King. But, in our view, if interest rates continue to rise, and remain elevated, higher yielding assets make sense for investors aiming to reduce overall portfolio duration while still maintaining exposure to risk assets. The higher yields on high yield bonds have pushed their real yield close to positive territory, while real yields on equities and cash remain deeply negative (see exhibit 3).

Exhibit 3: Nominal and real yields

Real yields on high yield look attractive relative to alternatives

Source: Bloomberg, Janus Henderson Investors, as of 21 June 2022

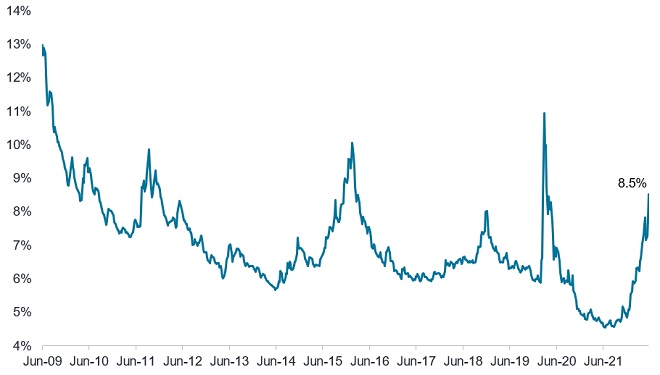

Furthermore, with the recent sharp move up in Treasury yields and the widening of credit spreads, the yields on high yield bonds are close to being as attractive as they have been since the GFC, excluding the COVID selloff. In our view, this presents an attractive buying opportunity in high yield. And while it is possible that yields remain at, or increase further from, current levels, yields have historically tended to rally expediently after rising above 8.5%. Since January 2011, the Bloomberg Corporate High-Yield Index has only closed above current yield levels (+8.5%) on less than 7% of all trading days (Exhibit 4).

Exhibit 4: Bloomberg US Corporate High Yield Index – yield to maturity

Yields on high yield bonds approaching post-GFC highs

Source: Bloomberg, as of 21 June 2022.

While investors who are concerned about inflation and a possible recession might be hesitant to add to their high yield positions within their fixed income sleeves, the option of adding high yield as a low duration, defensive component to an equity sleeve might prove useful. In our view, the dexterity of high yield allows it to straddle fixed income and equity and perform important functions within either asset class.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments. High yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings. Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Equity securities are typically more volatile than investment grade fixed income instruments since bondholders have priority in being paid in the event of a bankruptcy.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Bloomberg US Corporate High Yield Bond Index measures the US dollar-denominated, high yield, fixed-rate corporate bond market.

S&P 500® Index reflects US large-cap equity performance and represents broad US equity market performance.

Volatility is the rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. Higher volatility means the higher the risk of the investment.

Yield is the level of income on a security, typically expressed as a percentage rate. At its most simple, for a bond, this is calculated as the coupon payment divided by the current bond price. Yield to maturity is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date and will reinvest each interest payment at the same interest rate.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall. High yielding (non-investment grade) bonds are more speculative and more sensitive to adverse changes in market conditions.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- Emerging markets expose the Fund to higher volatility and greater risk of loss than developed markets; they are susceptible to adverse political and economic events, and may be less well regulated with less robust custody and settlement procedures.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.