Recessionary dynamics

The consensus was complacent about recession risk and is now underestimating its likely severity.

The assessment of global economic prospects here in recent quarters has been consistently more pessimistic than the consensus forecast. The consensus is now shifting to acceptance of US / European recessions but these are widely expected to be “mild” and / or “short-lived”. The view here remains bleaker, based on three considerations.

First, global six-month real narrow money momentum continued to weaken during H1 2022, reaching a level historically associated with serious recessions. The further decline into mid-year suggests no economic recovery before Q2 2023, allowing for an average nine-month lead.

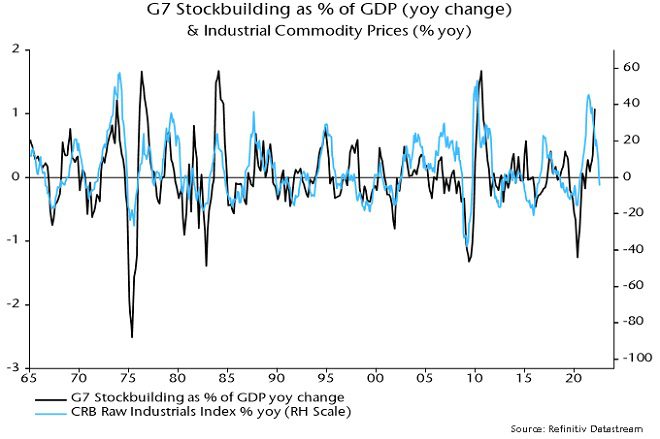

Secondly, the 3.33 year stockbuilding cycle is judged to have peaked in Q1 2022, with a downswing likely to last at least 12 months, again suggesting no recovery before Q2 2023. The prior upswing, moreover, was exaggerated by overordering of inputs due to perceived supply shortages, raising the possibility of a larger-than-usual drag during the downswing.

Thirdly, recessions involve self-reinforcing dynamics that magnify and prolong weakness unless offset by policy intervention. Evidence that a tipping point into a serious recession may have been reached includes:

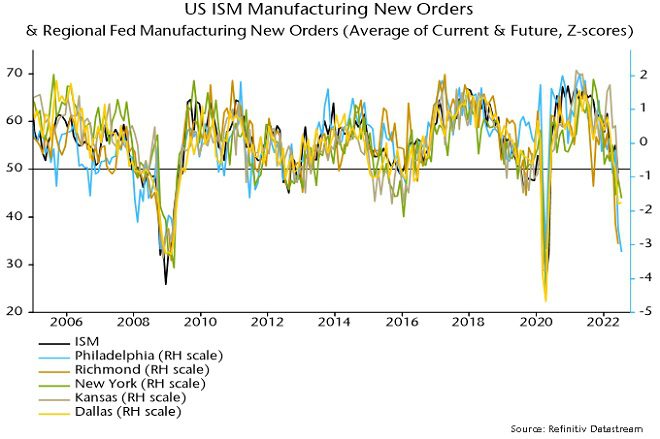

Weak business surveys. US / Eurozone PMI composite output indices fell below 50 in July, while an average of current and future new orders balances in the Philadelphia Fed manufacturing survey plunged to a level reached only before / during major recessions – see chart 1.

Chart 1

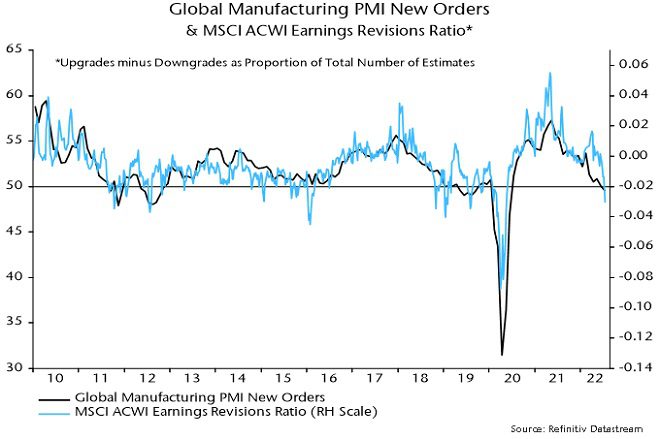

Earnings downgrades. The MSCI ACWI earnings revisions ratio had been holding up relative to business surveys but has recently fallen sharply – chart 2.

Chart 2

Commodity price falls. The CRB raw industrials index is now down on a year ago, confirming that a stockbuilding cycle downswing is under way, during which prices are likely to soften further – chart 3.

Chart 3

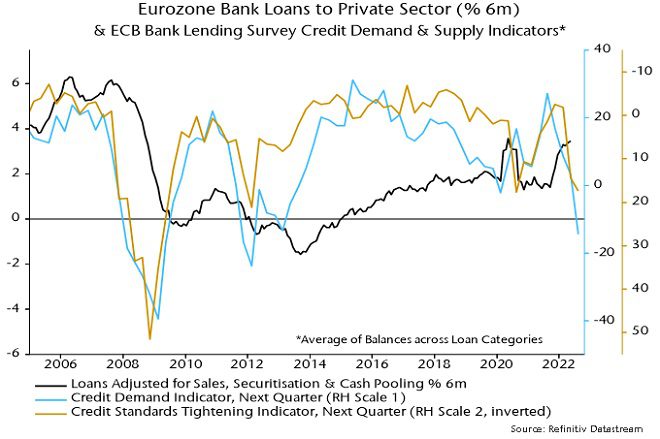

Credit restriction. Credit tightening and demand balances in the July ECB bank lending survey reached recession-consistent levels – chart 4.

Chart 4

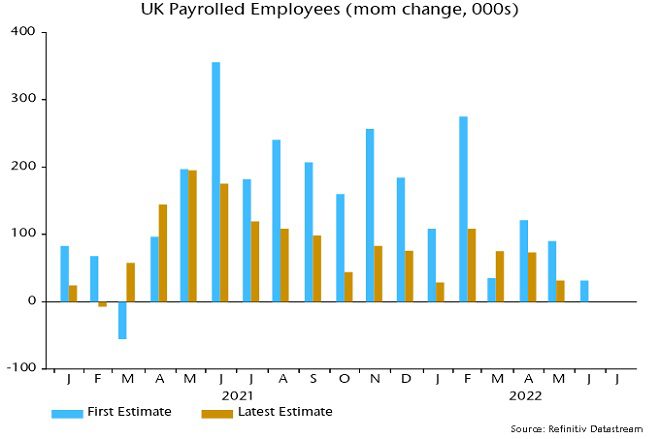

Softer labour markets. The 13-week change in a four-week moving average of US initial claims is at a level historically associated with recessions, while the monthly increase in UK payrolls in June was the smallest since March 2021, with recent downward revisions to initial data suggesting an actual fall – chart 5.

Chart 5

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.