Is green hydrogen a net zero game changer?

Portfolio manager Tal Lomnitzer discusses how the global race to net zero is driving investment into the low-carbon energy transition, and why green hydrogen sits at the centre of this megatrend.

4 minute read

Key takeaways:

- In 2021, global investment into the low-carbon energy transition rose by more than 25% from the previous year.

- Hydrogen has the potential to transform the carbon footprint of energy-intensive industries, and plays a key role in achieving net zero.

- In particular, investment in green hydrogen fuel is rising. Produced using renewable energy sources, it releases no emissions and is expected to become a larger portion within the energy mix.

Imagine a future where cars don’t emit toxic fumes, but instead release only steam into the atmosphere. That may sound far-fetched, but that is exactly what harnessing hydrogen energy means. Applying this energy source across industries could prove to be a game changer in achieving net zero by 2050.

The great energy transition

In 2021 alone, global investment into the low-carbon energy transition totalled US$755 billion, an increase of more than 25% from the previous year.1

While most of this investment was directed toward renewable energy and electrified transport, there is growing investment into green hydrogen, which may prove to be the next step in the decarbonisation journey.

The many shades of hydrogen

While we’ve all heard about hydrogen as a sustainable fuel, there are different forms of it or colours and so one can be excused for not knowing which is which. The main ones are:

- Black/brown hydrogen is produced from burning coal or lignite (aka brown coal). It is estimated that for every tonne of brown hydrogen, around 10-12 tonnes of carbon dioxide are produced. This process is the most carbon intensive.

- Grey hydrogen comprises the majority of industrial hydrogen. The production process involves combining natural gas with water vapour to create hydrogen. Large volumes of carbon dioxide are produced and released into the atmosphere, but as hydrogen replaces carbon-intensive energy alternatives, the net emissions can still be positive.

- Blue hydrogen is produced in the same way as grey hydrogen, but the emissions are captured and stored. Blue hydrogen could also play an important role in achieving net zero by 2050, particularly as governments are increasing taxes on carbon emissions or paying credits for reductions, helping to make blue hydrogen and carbon capture, utilisation and storage (CCUS) more economically-viable industries.

- Green hydrogen is produced by electrolysis, a technique which splits water molecules into hydrogen and oxygen. While electrolysis uses vast amounts of electricity, the electricity used is from renewable sources such as solar and wind, and therefore releases no emissions.

Green hydrogen only makes up a fraction of the energy mix, but it is expected to play a significant role in the future, with demand from heavy industries expected to multiply, including for rail, marine and heavy-road transportation.

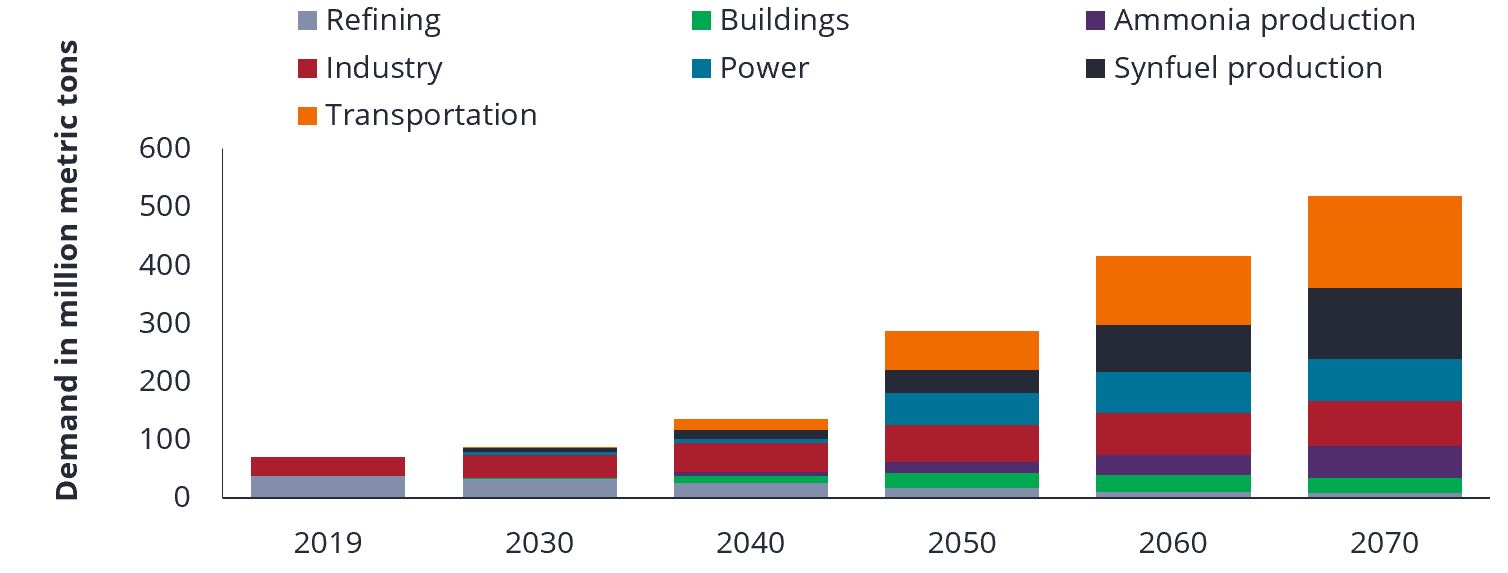

Forecast global hydrogen sector demand in sustainable development scenario 2019-2070

Source: International Energy Agency, September 2020. Forecast data may not be realised.

Renewables growth vital for green hydrogen

Vital to the scaling up of green hydrogen production as its power source, renewable energy generation has dramatically accelerated, while the cost per gigawatt has continued to decline. In less than a decade, renewables have grown from supplying less than one per cent of energy in Europe to 15 per cent. As this trend continues, this will support the growth of green hydrogen production.

Unlimited investment potential spanning multiple industries

Today, more than 75 governments have announced hydrogen policies and goals compared with 2019, when only France, Japan and Korea out of the G20 nations had national strategies.2

The outlook is undeniably promising because hydrogen has the potential to transform the carbon footprint of entire energy-intensive industries, from manufacturing to transportation. As the world rushes to reach net zero emissions by 2050, green hydrogen sits at the centre of this megatrend.

In summary, we believe green hydrogen will fall in production cost and will be a net zero game changer as part of the energy matrix – including nuclear, wind, solar and long-duration energy storage (LDES).

1 Energy Transition Investment Trends 2022, BloombergNEF.

2 Global Hydrogen Review, 2021 – International Energy Agency.

Natural resources industries can be significantly affected by changes in natural resource supply and demand, energy and commodity prices, political and economic developments, environmental incidents, energy conservation and exploration projects.

Commodities (such as oil, metals and agricultural products) and commodity-linked securities are subject to greater volatility and risk and may not be appropriate for all investors. Commodities are speculative and may be affected by factors including market movements, economic and political developments, supply and demand disruptions, weather, disease and embargoes.

Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market.

Carbon Capture Utilisation & Storage (CCUS) involves capturing carbon dioxide produced by power generation or industrial activity, such as steel or cement making; transporting it; and then storing it deep underground. CCUS technologies also enable carbon removal or “negative emissions” when the CO2 comes from bio-based processes or directly from the atmosphere.

Heavy industries are capital intensive, involve large-scale undertakings including equipment, land, high costs and has also been extended to include those that cause harm to the environment.

Long Duration Energy Storage (LDES) is the technology that enables renewable energy to power grids and accelerate carbon neutrality in an affordable, reliable and sustainable way, as well as help increase the security of supply and create new use cases for renewable energy.

Net zero aims to reduce greenhouse gas (GHG) emissions to as close to zero as possible, with any remaining emissions reabsorbed from the atmosphere.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.