Late to the party: Are the best of money market returns behind us?

Head of Fixed Income Strategy Seth Meyer and U.S. Head of Portfolio Construction and Strategy (PCS) Lara Castleton discuss the potential benefits of moving out of money market funds into duration assets as the Federal Reserve (Fed) ends its rate-hiking cycle.

4 minute read

Key takeaways:

- As short-term rates have risen, investors have flocked to money market funds as a low-risk option to access higher yields.

- While short-term money market funds can offer attractive yields, we believe there could be a hidden danger for investors in being underexposed to duration assets as interest rates hit peak levels.

- Historically, duration assets have outperformed money market funds once the federal funds rate has peaked, while also providing much-needed defensive characteristics during times of market stress.

After the pain of 2022’s great interest-rate reset, investors are now enjoying time in the sun in the form of higher yields. This is evidenced by the roughly $600 billion of asset flows into money market funds in 2023 so far.1 Additionally, our Portfolio Construction and Strategy (PCS) Team’s proprietary database of investor portfolios shows allocations to money markets have increased 240% in 2023 from the year prior.

While the lure of seemingly easy returns in money market funds might be hard to resist, we think there could be a hidden danger to this approach as the US Federal Reserve (Fed) looks set to pause or end its rate-hiking cycle. An allocation to money market funds may serve investors well for their short-term liquidity needs, but we do not advocate for using them as a proxy for a broad fixed-income allocation, for a couple of reasons.

1. The case against money markets once the federal funds rate peaks

Some of the best periods to add duration have historically been around the time short-term rates peak. This makes sense as peak rates have typically been followed by falling rates, which is inherently good for duration risk. Ironically, the times when it has been best to add duration has also been when money market funds look most enticing.

As shown in Figure 1, in both the current and previous hiking cycles, flows into money market funds have lagged the peak in the federal funds rate, which means investors are piling into these funds after their yields have already started to fall.

Figure 1: Late to the party

Source: Bloomberg, Investment Company Institute (ICI), Janus Henderson Investors, as of 12 May 2023.

Source: Bloomberg, Investment Company Institute (ICI), Janus Henderson Investors, as of 12 May 2023.

While it may seem counterintuitive, increasing duration when the federal funds rate peaks has historically resulted in better outcomes than taking the easy money in money market funds.

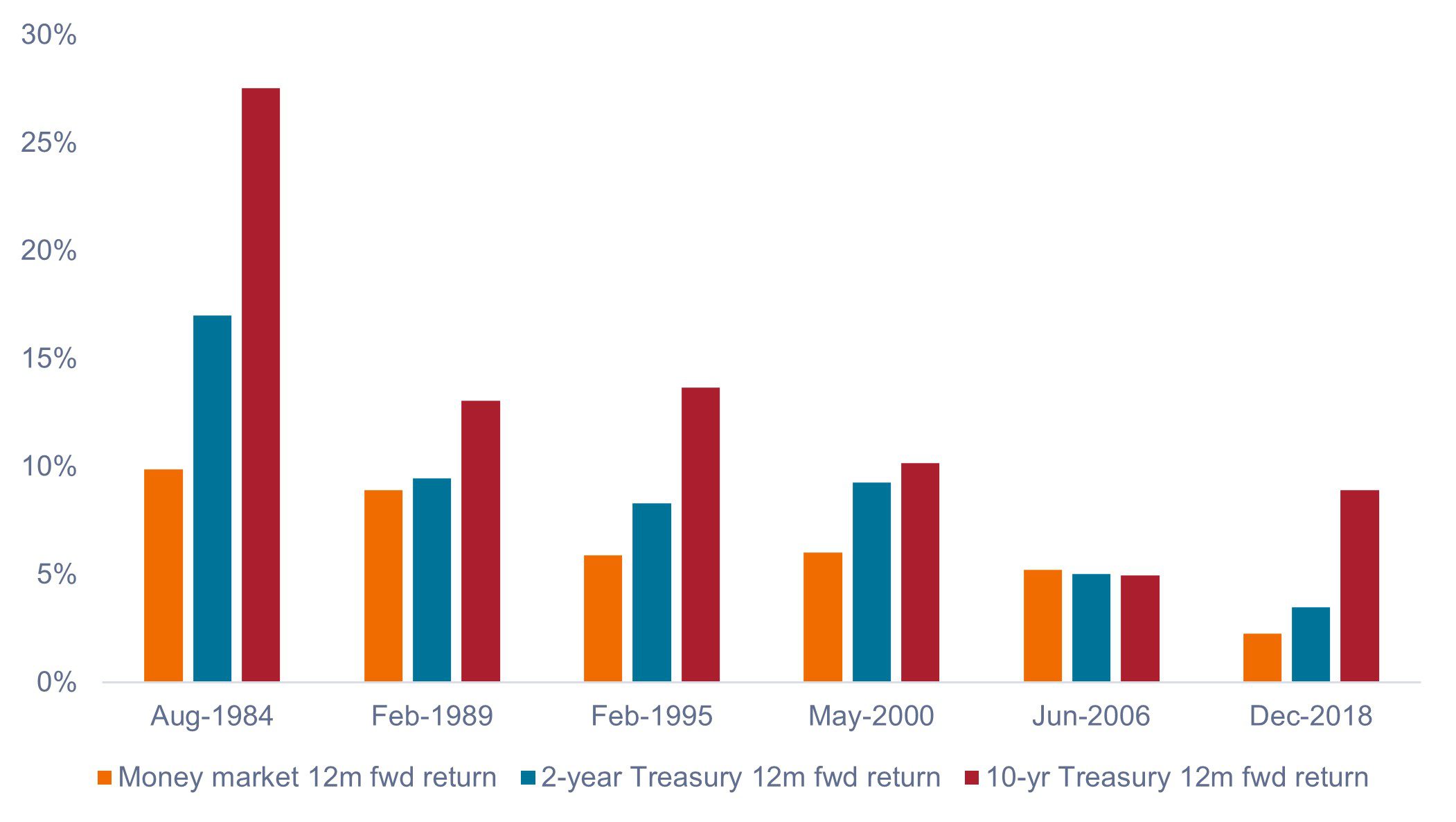

As shown in Figure 2, in each of the previous six rate-hiking cycles, once the federal funds rate has peaked, duration assets have outperformed (except for 2006, when they performed very much in line). This makes sense to us as well, as rising rate environments typically result in a cooling economy and subsequent rate cuts to boost economic activity.

Figure 2: 12-month forward returns once the federal funds rate peaks

Source: Bloomberg, Janus Henderson Investors, as of 10 May 2023. Each date represents date of the peak in the federal funds rate during a Fed hiking cycle. 12-month forward returns are calculated from the month of the peak in the federal funds rate for that cycle. Peak federal funds rate for each cycle: August 1984: 11.75%, Feb 1989: 9.75%, Feb 1995: 6.00%, May 2000: 6.50%, June 2006: 5.25%, Dec 2018: 2.25%. Past performance does not predict future returns.

Source: Bloomberg, Janus Henderson Investors, as of 10 May 2023. Each date represents date of the peak in the federal funds rate during a Fed hiking cycle. 12-month forward returns are calculated from the month of the peak in the federal funds rate for that cycle. Peak federal funds rate for each cycle: August 1984: 11.75%, Feb 1989: 9.75%, Feb 1995: 6.00%, May 2000: 6.50%, June 2006: 5.25%, Dec 2018: 2.25%. Past performance does not predict future returns.

2. Fixed income’s job is to provide not just income, but also defense

With short-term interest rates hitting levels not seen since 2008, it’s easy to focus on attractive yields and forget that fixed income’s other mandate is to play defense within a multi-asset portfolio. Bonds are there to serve as a ballast when equity allocations experience volatility or large drawdowns.

While money market funds might not suffer major drawdowns in the case of a pullback in equity markets, they’re unlikely to provide a counterbalance, either. Therefore, we think investors should consider that duration assets may rally and help soften portfolio volatility during times of market stress.

For example, if the U.S. were to experience an economic slowdown in which equities sell off by 10% and the Fed responds with 50 basis points of rate cuts, a money market fund is unlikely to show any capital appreciation. Compare that to a 10-year Treasury, with duration around 8.4 years, which may rally over 4% and help offset volatility on the equity side.

A way forward

We understand that the case for adding duration is being complicated by the attractive yields in today’s money markets. While we haven’t seen yields at these levels in years, we think investors could be missing out on the opportunity to gain price returns in fixed income as the Fed rate-hiking cycle comes to an end.

Whether implementing a barbell strategy by pairing AAA collateralized loan obligations (CLOs) with agency mortgage-backed securities (MBS) or taking advantage of dislocations in securitized areas of the market, we believe there are plenty of opportunities in fixed income that can provide compelling returns going forward.

With over 15,000 portfolios analyzed, our Portfolio Construction and Strategy (PCS) Team can help investors define and determine their optimal allocation to duration and credit risk to meet their portfolio objectives. Please reach out to a PCS consultant for a customized analysis of your portfolio via your Janus Henderson relationship manager.

1 Investment Company Institute (ICI), as of 10 May 2023.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of issue.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Money market

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.