Subscribe

Sign up for timely perspectives delivered to your inbox.

Global Head of Portfolio Construction and Strategy Adam Hetts explains why, given the unique nature of this year’s sell-off and subsequent recovery, sector and style decisions should not be based on a traditional recovery playbook.

This article is part of the latest Trends and Opportunities report, which seeks to provide therapy for recent market shocks by offering long-term perspective and potential solutions.

The unique nature of this year’s sell-off is giving rise to an equally unique recovery environment.

| Value | Core | Growth | |

|---|---|---|---|

|

Large

|

-9.8% | -16.9% | -23.2% |

|

Mid

|

-11.8% | -16.5% | -25.1% |

|

Small

|

-12.2% | -17.2% | -22.3% |

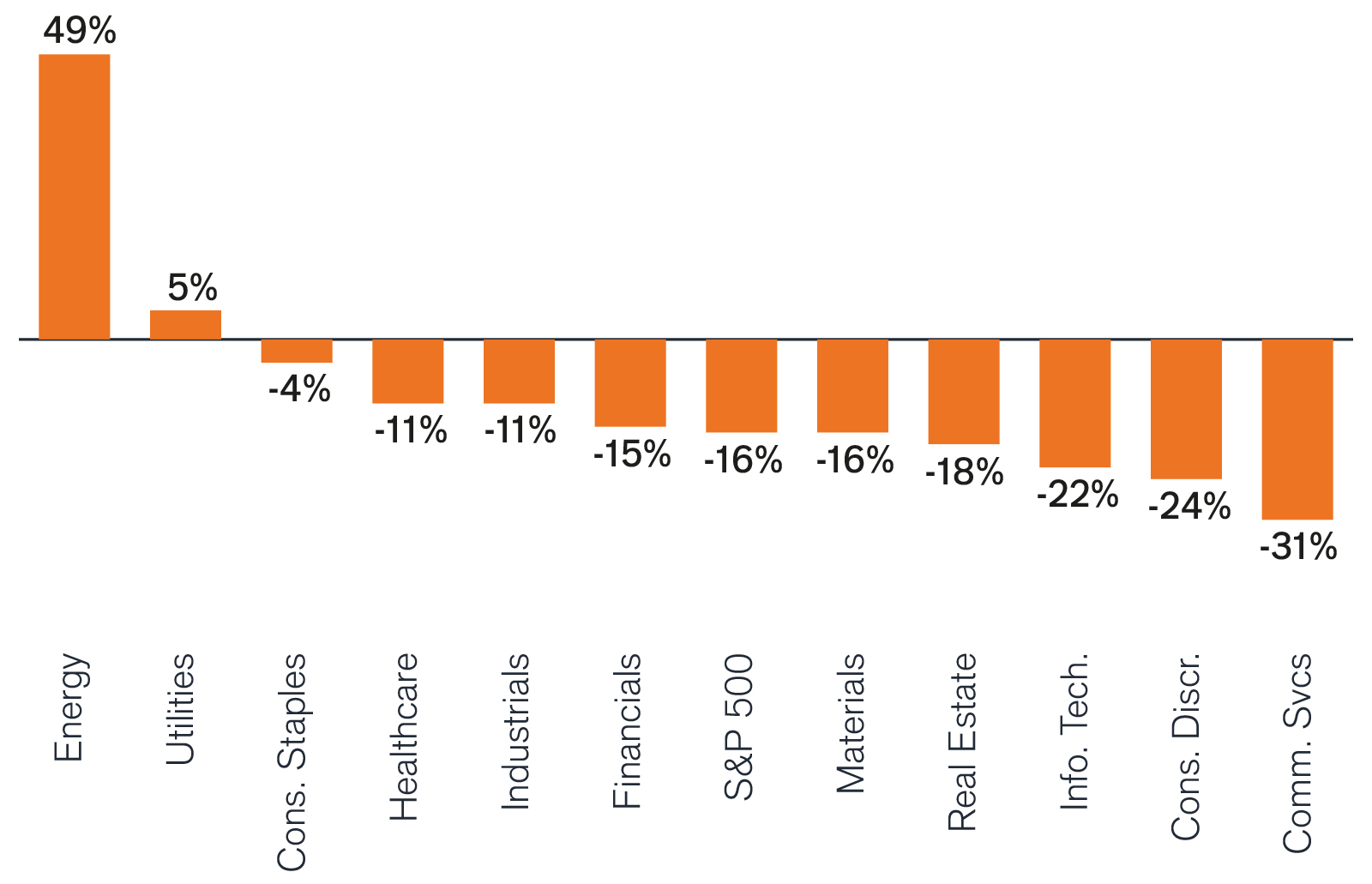

Source: Morningstar, YTD returns through 8/31/22; Style/size table based on Russell indices, sector chart based on GICS sectors of S&P 500 Index.

| Key Risk | Defense | |

|---|---|---|

| Margins | Inflation | Wide margins, pricing power |

| Ownership | Slowing Growth | Nimble management to navigate a downturn |

| Advantages | Slowing Growth | Competitive advantages and durable growth opportunities |

| Tenacity | Rate Volatility | Low leverage and/or long-term financing |