Subscribe

Sign up for timely perspectives delivered to your inbox.

Global Head of Portfolio Construction and Strategy Adam Hetts introduces the PCS Team’s latest Trends and Opportunities report, which seeks to provide therapy for recent market shocks by offering long-term perspective and potential solutions.

This article is part of the latest Trends and Opportunities report, which seeks to provide therapy for recent market shocks by offering long-term perspective and potential solutions.

In our last installment of Trends and Opportunities early this year, we focused on U.S. mid caps as an equity portfolio’s “new center of gravity,” examined the merits of being broad in ex-U.S. equities to avoid the growth/value dance, and explained how multisector bond strategies shine when examined through the lens of “empirical” duration.

Since that publication, investors have grappled with severe market shocks from slowing growth, inflation and interest rate volatility. In this edition, we aim to offer some therapy for those shocks by providing a long-term perspective on the markets and economy and presenting quality equities and mortgage-back securities (MBS) as potential solutions to help investors build a resilient portfolio. We also continue the discussion on many of the strategies we covered earlier this year.

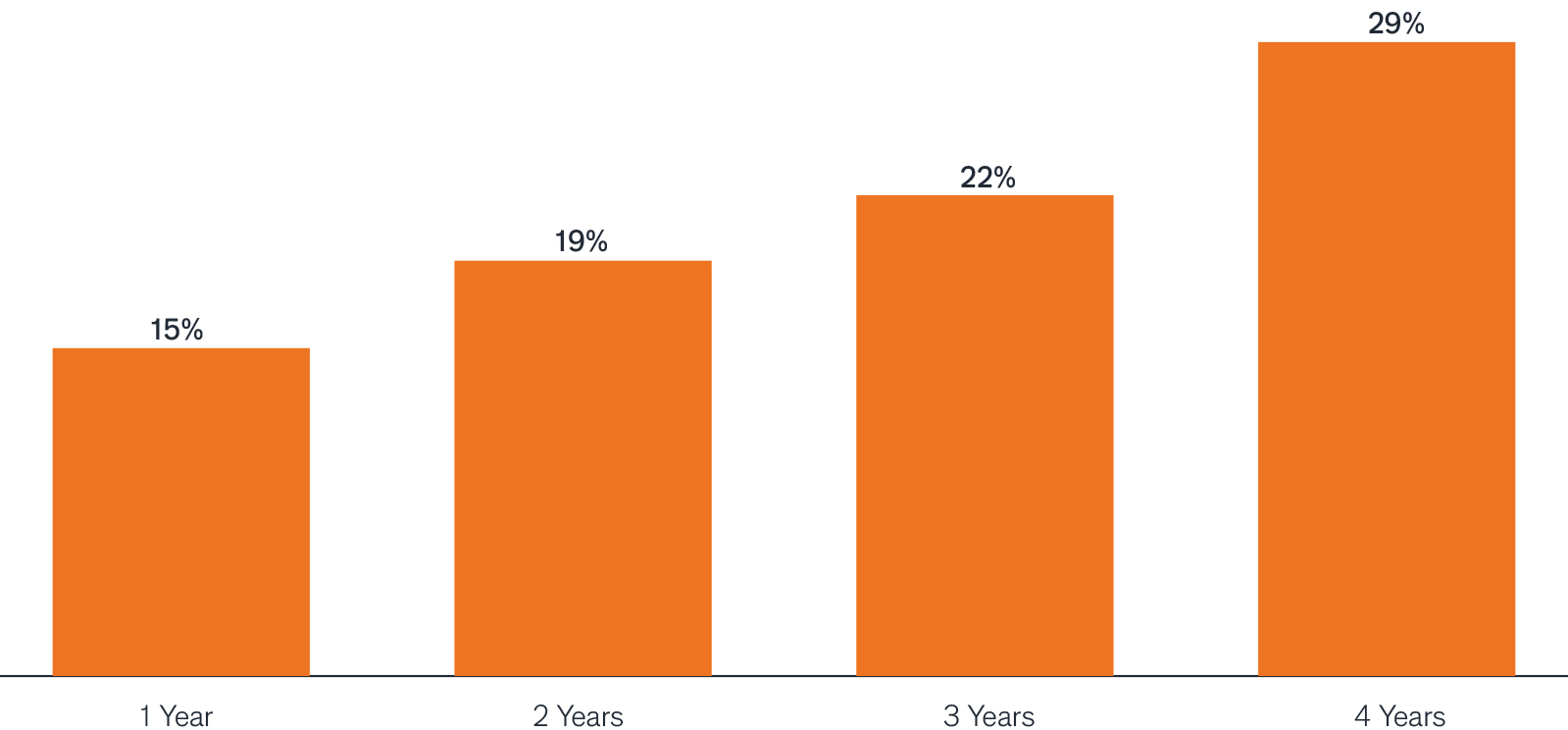

After living through this year’s volatility, “shock” is probably an understatement. On the bright side, while the history of the S&P 500® Index tells us there is likely more pain to come, it also tells us that patient investors have historically experienced more upside than downside over the long term. Since 1939, every time the S&P has crossed the 20% loss threshold into bear market territory, additional downside usually occurs. However, inclusive of that drawdown, the next 12 months have resulted, on average, in a positive gain of 15% and a full recovery has always occurred within four years.

In our view, we have now reached the point where investors should view the current landscape as a blank slate and seek to take advantage of new opportunities. No one can call the bottom, but anyone can call a dip: For medium- and long-term investors, the question shouldn’t be if they should take advantage, but how.

Throughout the year, we, like our clients, were weathering the endless assault of distressing headlines. Our response was to publish our Signal and Noise series in an attempt to filter the noise down to a few meaningful investment signals for patient investors:

The slowing growth, inflation, and interest rate volatility we are currently experiencing are generating market shocks of unusual prominence and magnitude. These shocks will likely drive ongoing volatility to which investors, unfortunately, will need to grow accustomed.

To help investors overcome that trifecta of market shocks, the Portfolio Construction and Strategy Team is focused on providing “shock therapy” in the form of portfolio solutions tailored to this new investing paradigm, while at the same time addressing the ubiquitous asset allocation gaps and concentrations we see in investor portfolios every day through our consultations with financial professionals.