Notes from a visit to a high-end cable manufacturer – a company that is vital for the transmission of clean energy from production to consumption points.

Insights

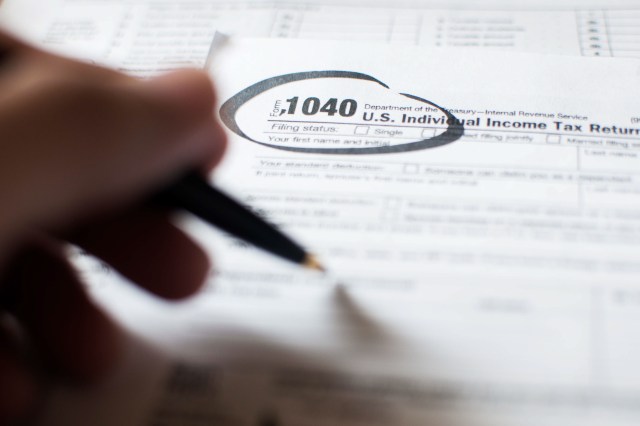

How the recent notice issued by the IRS impacts clients who have inherited retirement accounts.

The IRS has published its annual list of common income tax scams. Learn how to spot – and avoid – these common schemes.

Why assessing macroeconomic drivers such as government debt, national savings, and monetary policy are key to investing in the EM space.

How SMAs can help advisors and investors fortify their wealth management and estate planning strategies

The conditions that have buoyed credit markets in recent months look set to continue.

While stickier-than-expected inflation undoubtedly alters the timing of rate cuts, it likely does not affect the Fed’s goal of eventually easing restrictive policy.

An extended cycle may signal success in achieving a soft landing, but it also sets up a diverging set of risks for equities and bonds.

The sector has historically underperformed in the lead-up to U.S. presidential elections, but that may not be the case in 2024.

How investors can navigate growth opportunities and electricity bottlenecks as data centers proliferate.

nVIDIA's Blackwell chip launch and how technology and property companies are partnering to enable and benefit from genAI demand.