Equity outlook: Staying selective as higher rates take hold

Portfolio Manager Jeremiah Buckley evaluates the equity market as higher rates filter into the economy.

4 minute read

Key takeaways:

- Higher rates have begun to filter through the economy, creating stress in certain market segments, as we saw with the recent failure of two regional banks.

- In addition to higher rates, we expect increased regulation and tighter lending conditions could also have a negative economic impact and keep equity volatility elevated.

- At the same time, we have seen some economic progress, which could support improved profitability and higher earnings for select companies, and we remain constructive on equities.

Despite gains during the first quarter, markets were volatile and leadership was narrow, with most of the S&P 500® return driven by strength in a small group of mega-cap technology stocks. Inflation moderated to some extent, with Consumer Price Index (CPI) year-over-year growth easing slightly from 6.4% in January to 6.0% in February. While the Federal Reserve (Fed) continued to raise rates with two 25 basis point (bps) hikes in the quarter, it has slowed its pace considerably and now appears to be near the end of its tightening cycle.

Higher rates causing stress and ongoing volatility

We recently saw the impact of the Fed’s tighter policies with the failure of two regional banks, driven by duration risk-related concerns resulting from higher rates. This sparked unease throughout the financial system, prompting swift action from banking regulators and resulting in a significant sell-off in the banking industry. On top of higher rates, we expect increased financial regulation and tighter lending conditions could eventually have a negative economic impact. Volatility is also likely to continue as the effects of higher rates fully work their way through the economy.

Mixed signals, but signs of progress

Workforce participation has ticked up slightly; however, the labor market remains extremely tight, driving above-average wage growth and supporting consumer strength. While a strong consumer is certainly beneficial for economic growth, wage growth that has been stickier than expected has kept upward pressure on inflation. That said, we think enhanced labor force productivity will offset persistent wage inflation to some extent.

Excess inventories − particularly in consumer goods − that swelled as supply chains and transit times improved following the pandemic have now moderated to a large extent. Commodity prices have softened broadly as well, lowering the cost of many key economic inputs. Reopening in China, other parts of Asia, and Europe should also provide a tailwind, particularly for multinational companies doing business globally.

Earnings coming into focus

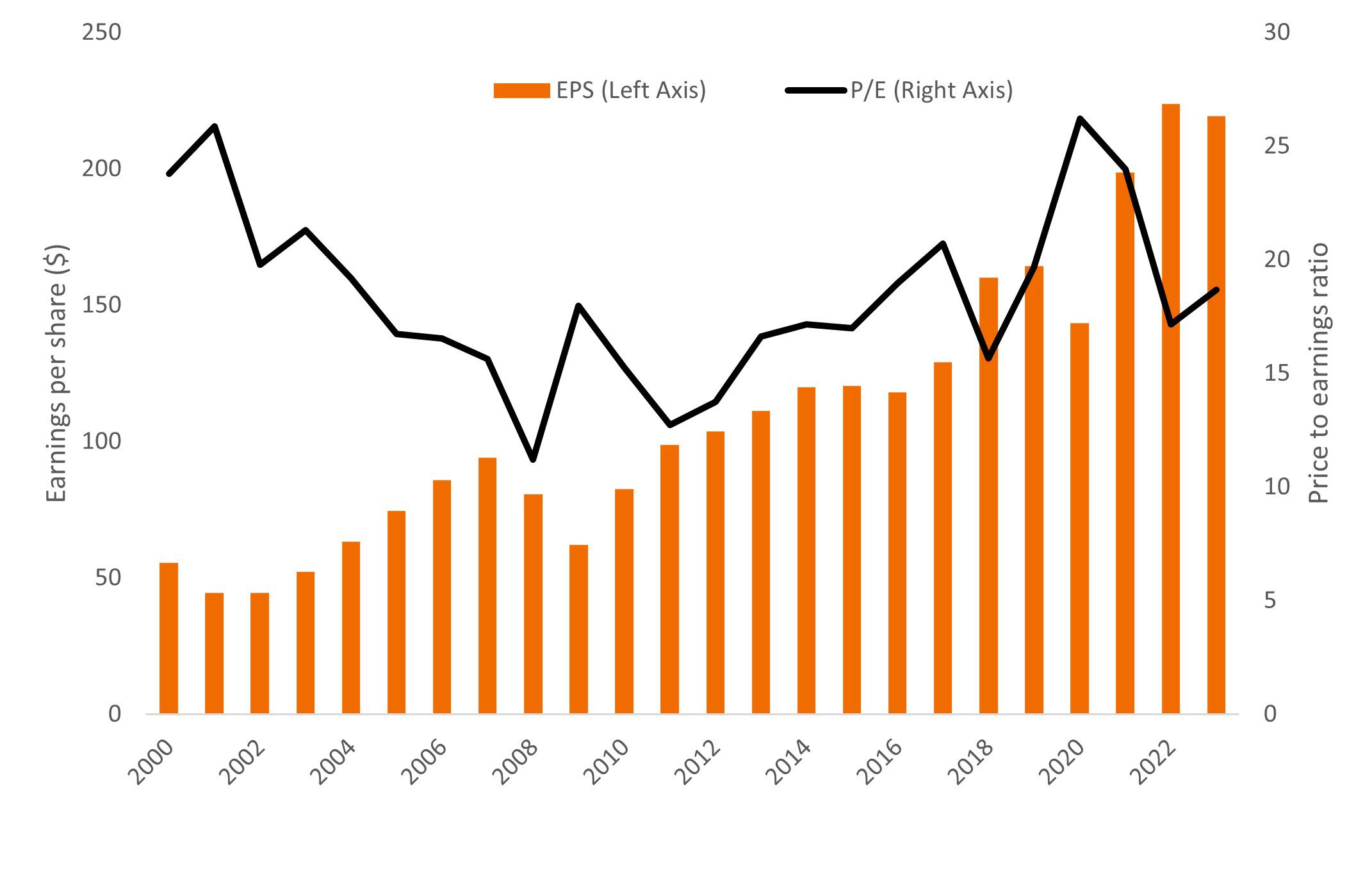

These factors – higher rates, sticky inflation, a tight labor market, and supply chain issues – lingered longer into 2022 than many expected, driving down 2022 and 2023 earnings results and expectations. Throughout 2022, areas such as travel and medical procedures remained disrupted as they recovered from the pandemic. We think there is opportunity in these and other pockets of the market as we return to more normalized earnings growth. Equity multiples now appear to be in a reasonable range relative to long-term trends due to the moderation in earnings and significant multiple contraction last year.

S&P 500 earnings per share (EPS) and price-to-earnings ratio (P/E)

Source: Bloomberg, as of 12 April 2023.

Source: Bloomberg, as of 12 April 2023.

We think recent improvements can lead to improved profitability and higher earnings for select companies moving forward. We continue to see strong corporate cash flow growth, along with some companies’ ability to raise prices to offset inflation. These increases tend to be sticky even after cost pressures ease, with some companies able to reap the benefits. We are optimistic that as the market begins to factor in 2024 earnings, stock prices − which over time are driven by long-term earnings growth – will adjust to improved future earnings expectations.

Staying selective

While we are cognizant of the standing risks from generally tighter financial conditions, we remain constructive on equities. In an environment where higher rates could diminish economic growth expectations, we think it is important to focus on companies that are successful in improving internal productivity and executing on innovation initiatives.

Furthermore, we believe an emphasis on companies with consistent cash flows and healthy balance sheets is even more important now, as businesses with these qualities have the potential to expand market share despite a slowing economy and do not have to borrow in a difficult financing environment to fund future growth.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa. Option-adjusted duration (OAD), or effective duration, takes into account expected cash flow fluctuations for bonds with embedded options, based on interest rate changes.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.