Can a manager follow a value style and still be ESG?

Richard Brown, Client Portfolio Manager on the European Equities Team led by John Bennett, explains why it is prudent to apply a value lens when investing in the ESG space.

5 minute read

Key takeaways:

- ESG flows in Europe, which were previously impervious to risk-off moves in equity markets, have been negatively impacted by heightened market volatility in 2022

- Data shows a negligible relationship between the ESG score and market valuation of stocks, suggesting that a high ESG score does not equate to an expensive stock

- We believe that there are plenty of cheap shares with good ESG ratings for value managers to pick from

After witnessing accelerating inflows from 2016, European-based ESG equity funds registered their first quarter of outflows in Q2 2022. While heightened market uncertainty has impacted the vast majority of equity strategies in 2022, it is particularly interesting to see ESG flows turn negative, having been impervious to previous risk-off moves in equity markets.

It seems unlikely that the investment community and their client base are turning their back on investing sustainably. Rather, clients may be questioning how their ESG allocations have caused them to have such large sector and factor exposures to have caused dramatic underperformance in 2022. Such exposure, on average, presents as a large overweight position in technology and large underweight position in energy, leading toward a skew toward the growth style. While this positioning has benefitted many ESG portfolios in recent years, investors are now asking themselves if the next market cycle could be more inflationary.

Historical relationships suggest that if trend inflation is higher, interest rates will likely also be higher, and value stocks may perform better than growth stocks. When we look at the inflationary periods of the 1970s and 2003-2006 it was the telecommunications, utilities, energy, mining, and construction materials sectors that performed best. Many of these sectors are now included in broad exclusion lists adopted by many ESG funds.

So, where does this leave the client who wants to allocate capital responsibly and generate strong risk-adjusted returns? The traditional answer has been to invest with value managers, but can you be a value manager and ESG?

The quick answer; YES.

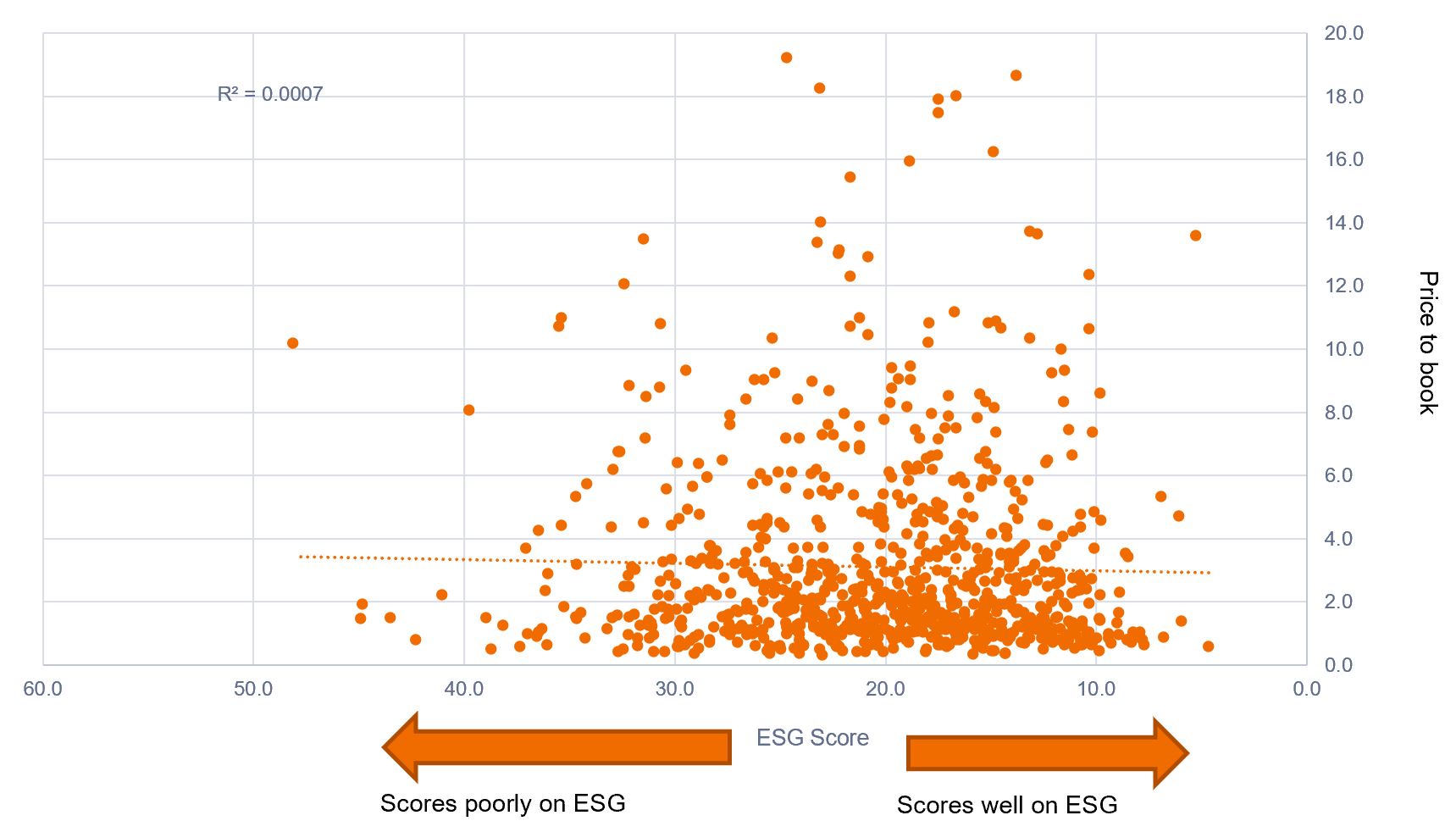

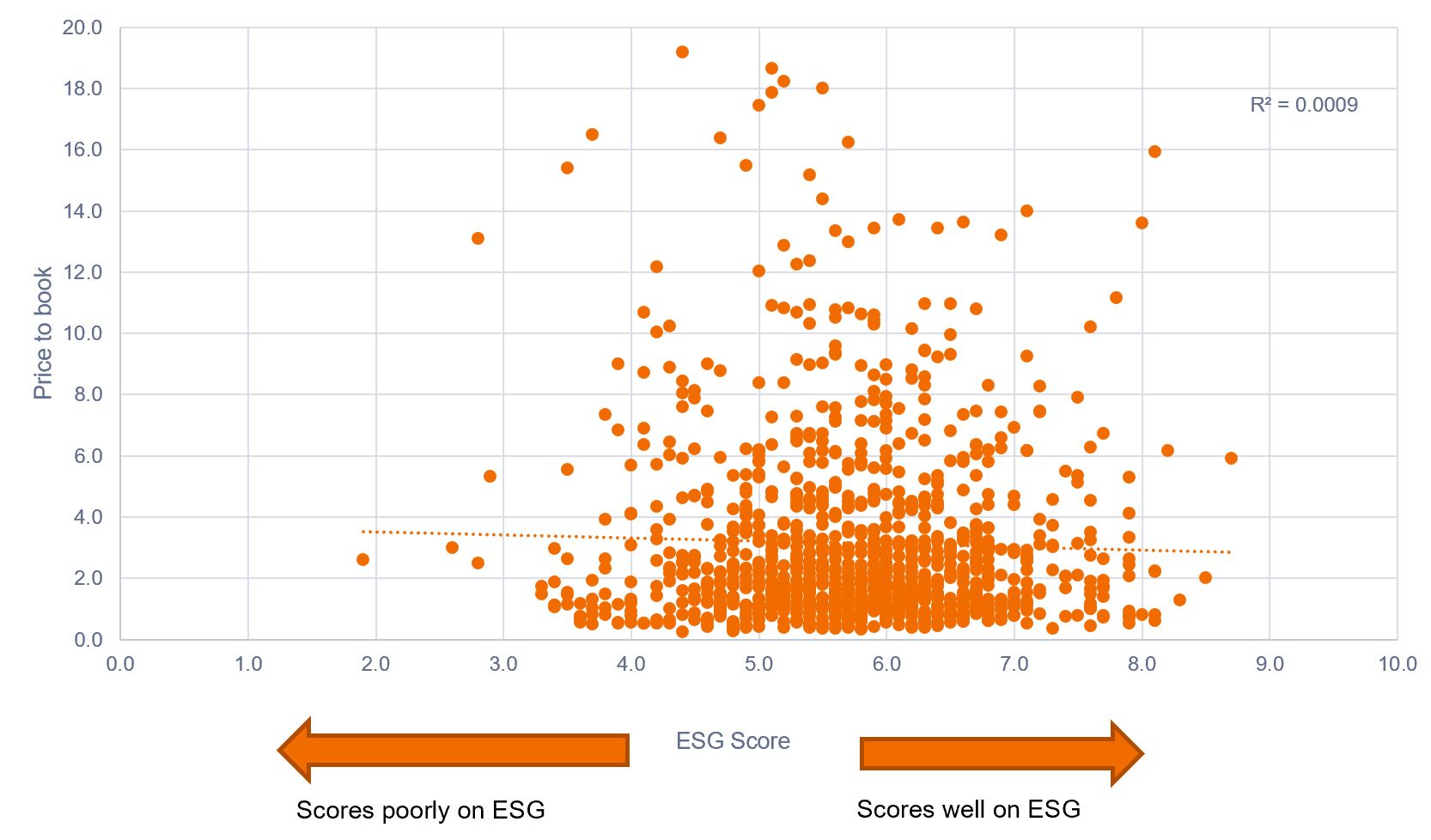

Charted here are the overall ESG scores of two third-party providers – MSCI and Sustainalytics – for the European equity market compared with their current valuations. Here, we have used a price-to-book ratio as the valuation metric for its relative stability versus an earnings multiple such as price-to-earnings. Both charts in figure 1 show a low/non-existent relationship (r squared <0.0009) between ESG score and valuation, suggesting that the universe does not consist exclusively of high ESG-scoring ‘expensive’ stocks. Rather, we believe that there are plenty of cheap shares with good ESG ratings for value managers to pick from.

Figure 1 – No correlation between ESG scores and market valuations

Source: MSCI, Janus Henderson Investors analysis, as at 30 June 2022

Source: Sustainalytics, Janus Henderson Investors analysis, as at 30 June 2022

The problem of overexposure to particular areas often arises when ESG criteria are applied broadly at the sector level rather than at the stock level. Let’s look more closely at those sectors that have proven to offer a hedge against inflation – energy, materials and utilities – and compare them against the largest consensual overweight expsosure currently – technology.

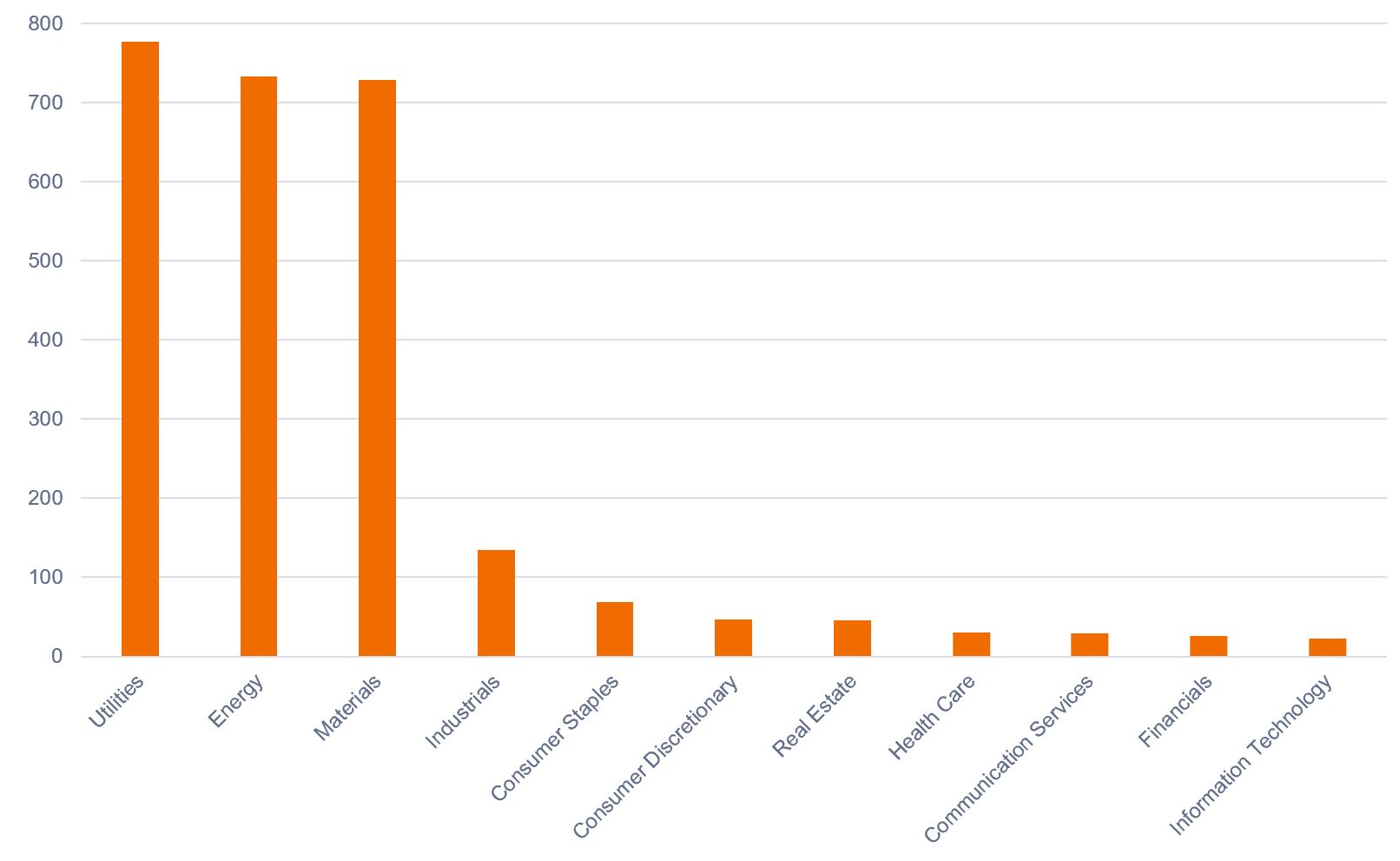

First, figure 2 looks at carbon intensity (the amount of scope 1 and 2 emmissions produced per unit of revenue).

Figure 2 – average carbon intensity per sector (scope 1 and 2)

Source: Janus Henderson Investors, MSCI as at 30 June 2022

At first glance, it might make sense to exclude the largest emitters in your investment universe in order to help the world reach a sustainable footing. But what this crude assessment fails to recognise is that many of the most carbon intensive stocks provide a hugely important and necessary social need – heating our homes, building schools and hospitals, etc. Moreover, these sectors will be important conduits to achieve an orderly transition to net zero carbon. From a portfolio construction perspective, to exclude these sectors would prevent capital being allocated to those areas that have helped to insulate investors during priods of higher inflation.

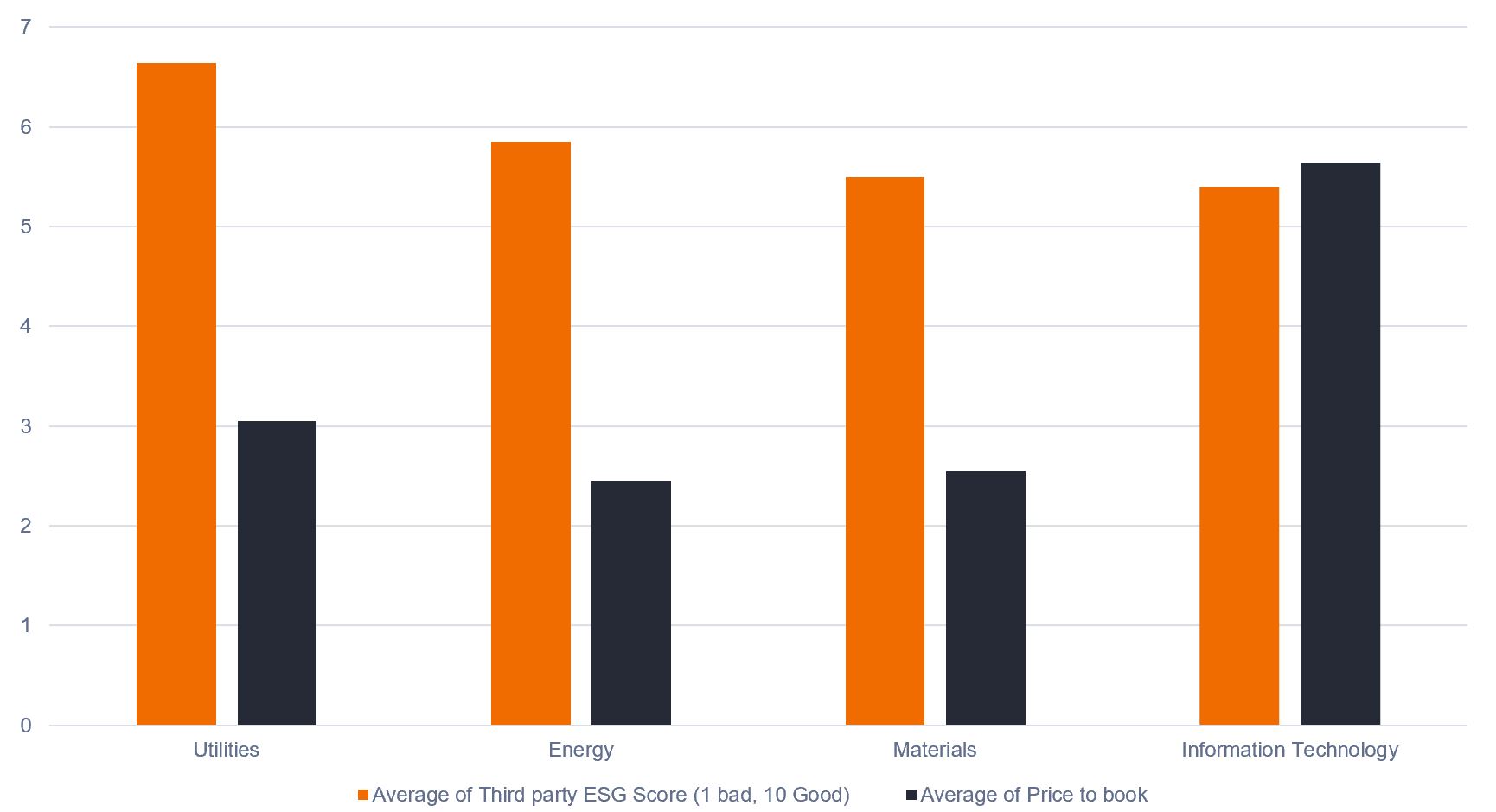

Drilling down into the headline ESG scores and valuation of these carbon-intensive sectors, it is interesting to see that the relatively carbon-intense sectors present a better ESG score and lower valuation compared to technology – figure 3. This could be an attractive opportunity for value managers who seek companies with strong ESG credentials at a reasonable price.

Figure 3 – headline ESG score and valuation

Source: Janus Henderson Investors, as at 30 June 2022

Conclusion

While it is hard to have strong conviction in the path of inflation over the medium term at this time, the market has increasingly priced in a higher rate environment than the one we have seen over the past 15 years. If this view remains, it is likely that investors will need to diversify their growth, and in particular tech, exposure to achieve their risk-adjusted investment goals. This should not mean compromising a desire to do so through responsible companies and management teams, but is likely best achieved by a manager who assesses each stock on a individual basis rather than through rigid broad sector exclusions.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Price-to-Book (P/B) Ratio measures share price compared to book value per share for a stock or stocks in a portfolio.

R-squared (R²) measures the relationship between portfolio and index performance on a scale of 0.00 (0%) to 1.00 (100%). A higher R² indicates more of the portfolio’s performance is affected by market movements and vice versa

Environmental, Social and Governance (ESG) or sustainable investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than, the broader market.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Growth stocks are subject to increased risk of loss and price volatility and may not realize their perceived growth potential.

Value stocks can continue to be undervalued by the market for long periods of time and may not appreciate to the extent expected.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.