Demystifying emerging markets debt hard currency

Emerging markets are entering a new era of decoupling in growth from the rest of the world. Different countries and diverse return drivers can be accessed through emerging markets debt hard currency.

2 minute read

Key takeaways:

- Emerging markets debt hard currency (EMD HC) offers unrivalled scale, compelling diversification and attractive return potential.

- Myths pervade the emerging markets debt asset class which detach perception from reality around defaults, leverage to the developed market cycle and

ESG risks. - In the sovereign space, the unique nature of borrowers mitigates default risk, while the broad issuer base allows investors to tap into diversification potential and gain from ESG upgrades driven by policy improvements.

A decoupling story

Post-COVID inflationary pressures have laid the groundwork for a possible decoupling in global monetary policy. Although each central bank reacted differently to the pandemic, the common policy reaction has been to tighten monetary policy to tame rising prices. Slowing growth indicates we may well be nearing the end of this tightening cycle. Since emerging market (EM) economies were relatively more proactive in policy tightening, we believe they could lead developed market (DM) peers in easing, as seen in Angola and Costa Rica.

Policy-driven headwinds are more significant for DMs than EMs, where the feedthrough of monetary policy to the economy is greater given higher indebtedness. Stronger commodity prices are also more favourable for some EMs, which can benefit from the China rebound as intra-EM trade has flourished. Emerging markets growth is expected to decouple from the rest of the world including the US. Growing three times as fast as DMs, these economies are expected to account for nearly 80% of global growth over 2023 and 20241. Structural growth drivers such as technological innovation and an expanding working age population help underpin this. After all, 86% of the global population resides in EM and developing economies2.

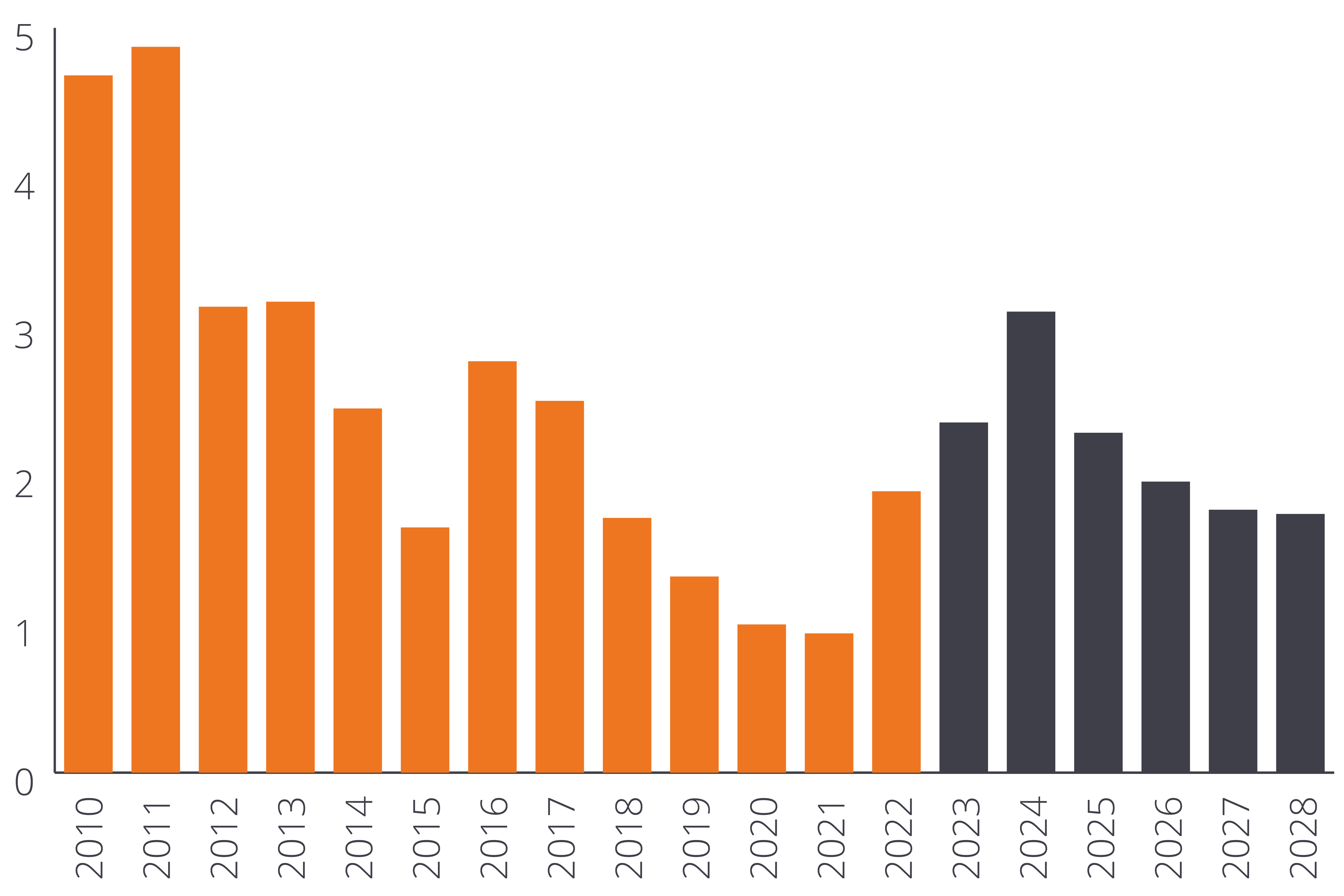

Figure 1: GDP growth rate difference between EM and the US

Source: Macrobond, IMF, Janus Henderson, as at 7 March 2023. There is no guarantee that past trends will continue, or forecasts will be realised.

1 Source: IMF World Economic outlook, April 2023. Gross domestic output in percent change (constant prices).

2 Source: IMF World Economic outlook, April 2023.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.