Equity outlook: Staying selective as higher rates take hold

Portfolio Manager Jeremiah Buckley evaluates the equity market as higher rates filter into the economy.

4 minute read

Key takeaways:

- Higher rates have begun to filter through the economy, creating stress in certain market segments, as we saw with the recent failure of two regional banks.

- In addition to higher rates, we expect increased regulation and tighter lending conditions could also have a negative economic impact and keep equity volatility elevated.

- At the same time, we have seen some economic progress, which could support improved profitability and higher earnings for select companies, and we remain constructive on equities.

Despite gains during the first quarter, markets were volatile and leadership was narrow, with most of the S&P 500® return driven by strength in a small group of mega-cap technology stocks. Inflation moderated to some extent, with Consumer Price Index (CPI) year-over-year growth easing slightly from 6.4% in January to 6.0% in February. While the Federal Reserve (Fed) continued to raise rates with two 25 basis point (bps) hikes in the quarter, it has slowed its pace considerably and now appears to be near the end of its tightening cycle.

Higher rates causing stress and ongoing volatility

We recently saw the impact of the Fed’s tighter policies with the failure of two regional banks, driven by duration risk-related concerns resulting from higher rates. This sparked unease throughout the financial system, prompting swift action from banking regulators and resulting in a significant sell-off in the banking industry. On top of higher rates, we expect increased financial regulation and tighter lending conditions could eventually have a negative economic impact. Volatility is also likely to continue as the effects of higher rates fully work their way through the economy.

Mixed signals, but signs of progress

Workforce participation has ticked up slightly; however, the labor market remains extremely tight, driving above-average wage growth and supporting consumer strength. While a strong consumer is certainly beneficial for economic growth, wage growth that has been stickier than expected has kept upward pressure on inflation. That said, we think enhanced labor force productivity will offset persistent wage inflation to some extent.

Excess inventories − particularly in consumer goods − that swelled as supply chains and transit times improved following the pandemic have now moderated to a large extent. Commodity prices have softened broadly as well, lowering the cost of many key economic inputs. Reopening in China, other parts of Asia, and Europe should also provide a tailwind, particularly for multinational companies doing business globally.

Earnings coming into focus

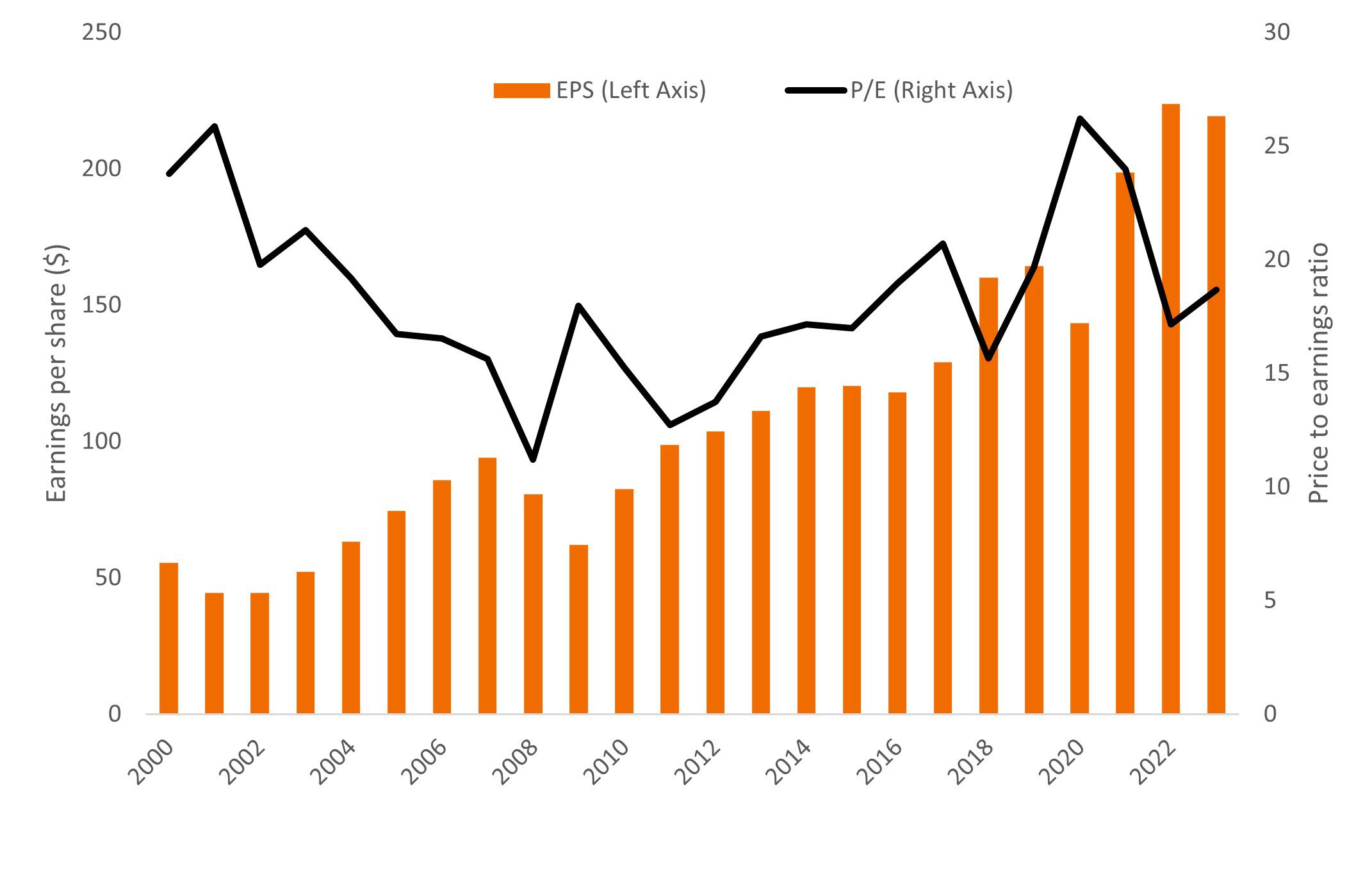

These factors – higher rates, sticky inflation, a tight labor market, and supply chain issues – lingered longer into 2022 than many expected, driving down 2022 and 2023 earnings results and expectations. Throughout 2022, areas such as travel and medical procedures remained disrupted as they recovered from the pandemic. We think there is opportunity in these and other pockets of the market as we return to more normalized earnings growth. Equity multiples now appear to be in a reasonable range relative to long-term trends due to the moderation in earnings and significant multiple contraction last year.

S&P 500 earnings per share (EPS) and price-to-earnings ratio (P/E)

Source: Bloomberg, as of 12 April 2023.

Source: Bloomberg, as of 12 April 2023.

We think recent improvements can lead to improved profitability and higher earnings for select companies moving forward. We continue to see strong corporate cash flow growth, along with some companies’ ability to raise prices to offset inflation. These increases tend to be sticky even after cost pressures ease, with some companies able to reap the benefits. We are optimistic that as the market begins to factor in 2024 earnings, stock prices − which over time are driven by long-term earnings growth – will adjust to improved future earnings expectations.

Staying selective

While we are cognizant of the standing risks from generally tighter financial conditions, we remain constructive on equities. In an environment where higher rates could diminish economic growth expectations, we think it is important to focus on companies that are successful in improving internal productivity and executing on innovation initiatives.

Furthermore, we believe an emphasis on companies with consistent cash flows and healthy balance sheets is even more important now, as businesses with these qualities have the potential to expand market share despite a slowing economy and do not have to borrow in a difficult financing environment to fund future growth.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa. Option-adjusted duration (OAD), or effective duration, takes into account expected cash flow fluctuations for bonds with embedded options, based on interest rate changes.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.