The Global Sustainable Equity Team share a simple yet ambitious mission: to deliver outstanding investment returns to clients; to be leaders in sustainable investing; and, as active managers, to play a part in making the world a better place.

Investing with intentionality

We seek to intentionally identify companies which have a positive impact while avoiding those that do harm. As such, we invest in companies with resilience and compounding growth characteristics that seek to address environmental and social change. As co-signatories of the Net Zero Carbon 20 initiative, we are fully committed to delivering a low carbon strategy in line with carbon-neutrality targets.

Committed to a consistent, repeatable process

The four pillars of our sustainable investment approach remain as pertinent today as they did three decades ago while the advancement of sustainable knowledge has continually shaped our investment approach. Overall, the strategy remains rooted in its core beliefs.

A transparent approach to leading sustainable investing

Our proprietary methodology to align each portfolio company to the UN Sustainable Development Goals is one of the first investment methods formally recognised by the UN. As leaders in sustainable investing, we share our success.

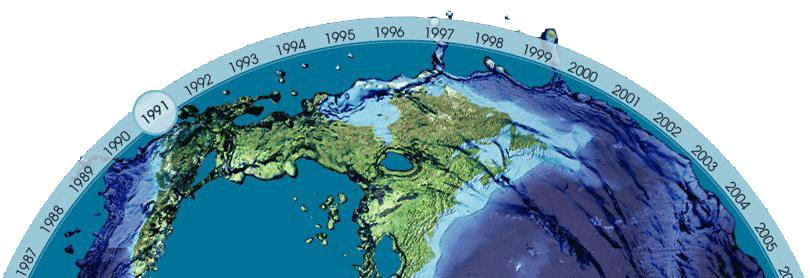

To celebrate 30 years of sustainable investing we take a look back at the developments that have shaped sustainable investing and the world we live in today.

A process built on three decades of experience

| “People now recognise that there is this strong alignment between thinking about big sustainable development issues and achieving economic growth” - Hamish Chamberlayne, Head of Global Sustainable Equities, Portfolio Manager |

How the fund has performed

By identifying companies that are on the right side of disruption, the team aim to provide clients with a persistent return source, deliver future compound growth and help mitigate downside risk.

Over 30 years of sustainability expertise

|

|

Key documents

Related insights

Meet the team

Hamish Chamberlayne, CFA

Hamish Chamberlayne, CFA

Head of Global Sustainable Equities | Portfolio Manager

20 years of financial industry experience | London Based

Aaron Scully, CFA

Aaron Scully, CFA

Portfolio Manager

25 years of financial industry experience | Denver Based

Invest with purpose for a better tomorrow

We believe in investing for the future, not borrowing from it. We also believe it is our responsibility to aim to deliver strong, risk-adjusted returns for our clients. Our teams invest with a sense of purpose to seek to accomplish both objectives.