A long-haul journey to zero-carbon

European Equities Team members Richard Brown and David Barker, led by John Bennett, explore the many routes that the aviation industry can take to becoming a valued participant in the march to achieve net zero.

8 minute read

Key takeaways:

- The aviation industry is concentrating its focus on engine technology and sustainable fuels as a primary way to cut emissions and enable customers to reduce their overall climate impact.

- Longer term, hydrogen and fully electric aircrafts could change the aviation landscape, although there are many hurdles to overcome before these novel technologies become reality.

- If air traffic volumes remain robust, airlines will likely provide select opportunities for the diligent stock picker with those leading in new technologies likely creating the most value for shareholders.

As the world transitions to net zero carbon emissions, we have taken a look at some of the most high-emitting industries to discuss their place in a low carbon future.

In this article, we consider the aviation industry which is becoming increasingly more high profile in the net zero debate, not necessarily due to its overall level of greenhouse gas (GHG) emissions (which are above average, but not the worst) but due its discretionary nature. Society needs cement to build schools, steel for new hospitals, paper to replace plastics in food packing and chemicals in countless industrial processes. But is air travel viewed as essential?

Carla Denyer, the newly elected co-leader of the UK Green party proudly states she has not flown since 2009, and flight restrictions due to Covid-19 lockdown measures have certainly seen a growing appreciation of the ‘staycation’. We have also witnessed business travel more heavily scrutinised than ever before – corporates are keen to improve their sustainability profile and the enforced virtualisation of the meeting room has certainly made many long-distance trips less worthwhile. Indeed, the ‘work trip’ to the most sun-bathed office in the height of the British winter might not only raise a tut from colleagues for its frivolity but now also for its effect on the environment. At Janus Henderson, a certified CarbonNeutral® group since 2007*, business-related air travel has fallen by 92% since pre-pandemic levels (2021 versus 2019) and, while not all restrictions have been lifted, it seems likely to stay well below 2019 levels.

More broadly, we believe that air traffic growth is likely to remain robust – visiting family, exploring the world and pitching face-to-face are hard to substitute or forgo. The Danish prime minister, Mette Frederiksen, stated “to travel is to live and therefore we fly” when announcing the country’s ambitious new target to make domestic flights fossil fuel-free by 2030. What seems more likely is that there will be a growing share of environmentally conscious consumers seeking the best compromise, as well as growing government initiatives to encourage green tech adoption. Existing initiatives in Europe include the European Union Emissions Trading Scheme – which adds a financial incentive to cut emissions by allowing companies to trade carbon credits in order to meet their carbon requirements – the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) scheme, as well as a push to end tax exemptions on Kerosene.

Recently, we have noted the introduction of ‘Carbon Emissions Per Flight’ filters on flight search websites, including Google Flights, Skyscanner and Kayak showing how these emissions vary between airlines. For this reason, it is becoming increasingly important for airlines to consider carbon emissions in their strategic thinking.

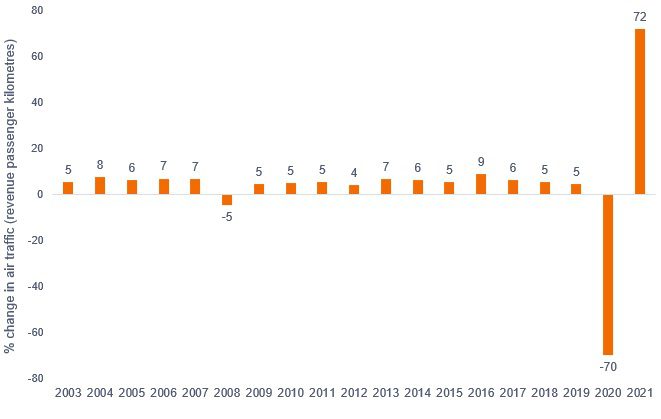

Source: IATA, Janus Henderson, October 2021, data based on revenue passenger-kilometres

Prior to the COVID-19 pandemic, the aviation industry contributed to around 2% of global CO2 emissions. If emissions growth continues at the prior rate, aviation carbon emissions would be set to triple by 2050.

So how best can the industry move forward to avoid this outcome?

The International Air Transport Association (IATA) has signed a resolution to achieve net-zero carbon emissions by 2050, with a plan that will abate a total of 21.2 gigatons of carbon between now and 2050.1 For airlines, (which are the owners/lessors of aircrafts) the most effective way of reducing total emissions is through investing in more efficient aircraft technology that is being developed by the aerospace supply chain. This supply chain is made up of airframers (eg Airbus, Boeing) and a vast global network of suppliers (such as Safran, MTU, Rolls-Royce, GKN and Meggitt in Europe). Developing products that offer superior environmental performance versus competitors will become a significant advantage for suppliers in the marketplace and will ultimately impact financial performance.

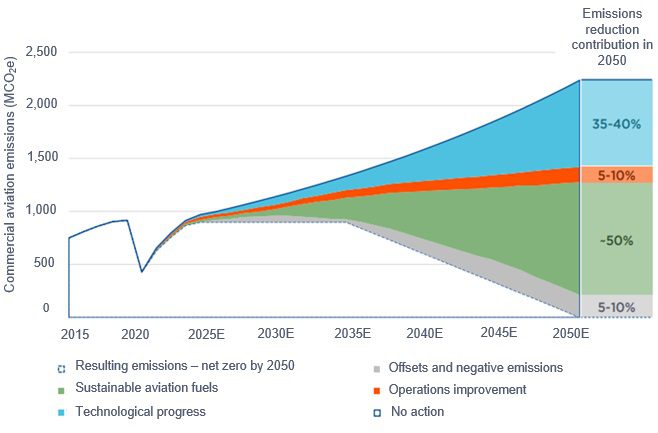

Today, the aerospace industry is concentrating its focus on engine technology and sustainable fuels as a primary way to cut emissions and enable customers to reduce its overall climate impact. As seen in figure 2, Safran, a global manufacturer of aircraft engines, estimates that it will be active in addressing nearly 90% of total CO2 reduction targets to reach net-zero commercial aviation by 2050, with 50% of reductions achieved through the adoption of Sustainable Aviation Fuels (SAF), 35-40% through next-generation engine and aircraft, 5-10% through operations efficiencies, and 5-10% through offsets and negative emissions.

Source: Safran, 2021. MCO2e = metric tonnes of carbon dioxide equivalents.

There is no guarantee that past trends will continue, or that forecasts will be realised.

Short term: Aircraft engines

In the short term, the replacement of today’s fleet with more advanced aerodynamics, materials technology and modern new engine option (neo) aircrafts will provide the most immediate carbon savings. This technology is available from manufacturers today and will help offset growth in emissions. A new A320neo for example, delivers 20% fuel savings per seat and CO2 reduction compared to the previous-generation aircraft, reducing CO2 emission by around 900 tonnes per aircraft per annum. However, these existing technologies alone are not enough to drive a decline in the industry’s emissions (especially if air traffic growth remains positive).

Medium term: Sustainable Aviation Fuels (SAFs)

SAFs are produced from sustainable feedstock such as used cooking oils, animal fats and crop residues, and can be used as a substitute for Kerosene. They are referred to as ‘drop-in’ fuels as they can be safely blended with existing fossil fuels. SAFs are considered net zero rather than zero carbon because carbon is still emitted in their production, but they still offer major life-cycle carbon reduction (up to 90%). By law, airlines are currently restricted to a 50% mix of SAFs until the safety is fully assessed but engine manufacturers such as Safran, Rolls-Royce and MTU already use certified SAF blends in existing engines in Europe, and are developing technology to enable 100% SAF certification.

The primary challenge with SAFs is production capacity, with currently less than 1% of annual aviation fuel provided by SAFs. Scale is limited by the availability of feedstocks, the cost (currently three to eight times more than kerosene), and the complex and expensive plant infrastructure needed to produce it. Currently, Finnish based Neste is the leader in the renewable fuels market, accounting for around 40% of total global renewable diesel fuels production capacity.2 In addition, Shell is set to produce more than 800,000 tonnes per year of renewable fuels at a new Rotterdam facility due to go on stream in 2024.3 The ability of producers to keep pace with demand in a cost-effective manner will be a crucial element in the carbon trajectory of the industry, especially as it is widely accepted that SAFs, which require huge capital outlay, are only a transition fuel. The European Commission has sought to encourage adoption with the ‘Fit For 55’ programme, proposing a SAF mandatory mix for airlines of 2% by 2025, 5% by 2030, and 63% by 2050.

Long term: Hydrogen, full electric and other novel technologies

Longer term, aircraft manufacturers are developing technologies such as hydrogen/all electric propulsion and blended wing bodies to achieve a net zero industry. This technology still faces notable hurdles however, as hydrogen provides more energy by mass than kerosene fuel, but delivers less energy by volume. This means that planes will need a total redesign to include huge fuel tanks, let alone a totally new fuelling infrastructure at airports. Full electric, while widely accepted as the route forward for cars, struggles to provide the level of thrust needed for planes without having a battery so heavy that it can’t get off the ground. Airbus aims to develop the world’s first zero-emission commercial aircraft by 2035 but we expect it to be much later in the decade before this is adopted more broadly for large passenger planes.

Conclusion

If air traffic volumes remain robust, airlines will likely provide select opportunities for the diligent stock picker. Aircraft manufacturers and their supply chains will be pivotal in the transition to net zero, with those leading in the new technologies likely creating the most value for shareholders. However, the market consensus can change regularly on this topic with lead times often taking longer than first forecast, once again highlighting the need for constant fundamental reassessment. Possibly the most important conclusion, like with so many industries involved in decarbonisation, is that it will come with meaningful inflation for consumers, supporting the argument that the next cycle will be more inflationary than the last.

*CarbonNeutral® certification applies to Janus Henderson Investors since 2017 and Henderson Global Investors prior to this date.

1 International Air Transport Association, Net-Zero Carbon Emissions by 2050 press release, October 2021

2 Neste Sustainability Report, 2020

3 Shell, media release: Shell to build one of Europe’s biggest biofuel facilities, September 2021

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.