Flip flop: What MBS investors can learn from Zillow’s failed house-flipping business

Head of U.S. Securitised Products John Kerschner and Portfolio Manager Nick Childs discuss what investors in mortgage-backed securities (MBS) can learn from Zillow’s failed house-flipping business.

6 minute read

Key takeaways:

- The failure of Zillow’s house-flipping business underlines the risks in trying to value non-homogeneous assets in a homogeneous way.

- As an active manager of MBS, we think this principle applies to the mortgage market, too. Therefore, we think it might make more sense to value these assets on an individual basis.

- In our view, the general tendency toward passive MBS exposure offers a meaningful opportunity to improve risk-adjusted returns through active management.

In 2018, Zillow CEO Richard Barton excitedly announced that the online real-estate marketplace would be entering the lucrative house-flipping business.

According to Barton, the plan for the new venture, dubbed Zillow Offers, entailed the company entering select U.S. housing markets, purchasing and renovating homes, and reselling them at a profit. The firm would rely on its proprietary algorithm, or Zestimate, to forecast future home prices, which would inform how much the company should pay for the houses it purchased.

Fast forward to November 2021, when Barton again made an announcement regarding Zillow Offers. This time, however, it was to let the market know that the company would be shuttering the venture after losing $1 billion in the preceding three years.

So, what happened? At the root of the problem was Zillow’s attempt to value heterogeneous assets homogeneously.

Houses are not widgets

Aside from some obvious similarities, all houses are at least a little – and often a lot –different from others, and these differences should be considered when valuing a home.

Zillow spent a lot of money to learn a hard lesson here. It is incredibly difficult, if not impossible, to value heterogenous assets homogenously. Even houses in sub-developments, which may share comparable floor plans, can vary greatly in value depending on characteristics such as fixtures and fittings, wear and tear, and location within the subdivision.

The house-flipping business has always been a people-intensive one. Each home is typically evaluated, bought, renovated, and sold individually, often by an experienced person or group of people with extensive industry experience and knowledge of the local market. Zillow hoped to reduce the reliance on people in favor of a technological model, or algorithm, that they believed could automate the valuation process.

But there was one major flaw in this approach: While Zillow claimed their Zestimate is an accurate algorithm, they came to realize it was not accurate enough for flipping houses. The company admitted it had repeatedly overpaid for homes it purchased and had to sell at a loss later.

The lesson for mortgage investors

The Zillow case showed us that when it comes to non-homogenous assets like houses, it might make more sense to value these assets on a case-by-case basis. As such, we think there is value to be extracted in focusing on small individual idiosyncrasies instead of leaning too heavily on algorithms that must rely on broad assumptions regarding such idiosyncrasies.

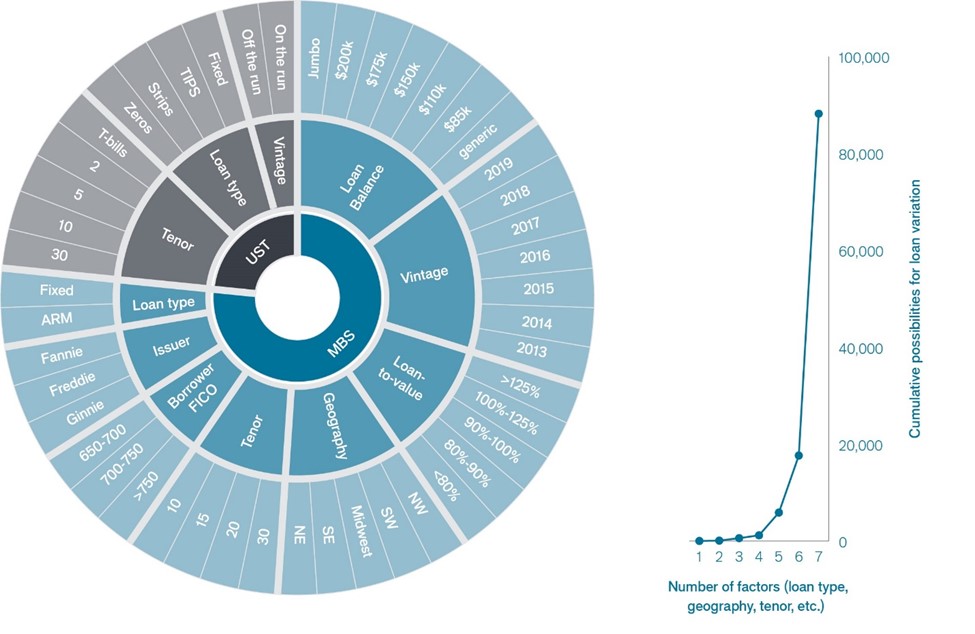

We think this principle applies to the mortgage market as well. Not only are mortgages loans against non-homogenous homes, but the mortgages themselves are also non-homogenous because they have many variables affecting their value, as shown in Exhibit 1.

Exhibit 1: Variations of MBS vs. U.S. Treasuries

A significant number of factors influence bond prices in the MBS market.

Source: Janus Henderson Investors. The factors shown are representative and are not comprehensive. For illustrative purposes only.

MBS: How different are they, really?

The MBS market is unique due to the wide dispersion of idiosyncratic loans that comprise the universe of securities.

Unlike the Treasury market, which is comprised of just one borrower (the U.S government), the mortgage market contains millions of borrowers. In addition, individual mortgage-backed securities are made up of pools of loans, each with a unique geography of borrowers with different credit ratings, loan-to-value ratios, and loan sizes – to name just a few.

The pricing of mortgages typically depends on quantitative models that group the loans according to categories, such as by issuer, coupon, or geographic region. This high-level organization is effective at simplifying the market, thereby getting a reasonable estimate for a fair price. However, the simplifications can mask the diversity in the securities, and thus the nuances that determine a more accurate price. As in the case of Zillow, models can only take one so far.

Accurately pricing all these individual loans requires significant expertise, experience, and investment in technology. But with the right people, process, and investment philosophy in place, we believe improved risk-adjusted returns and outperformance relative to the benchmark over the long term is possible.

If you own the Agg, you own mortgages

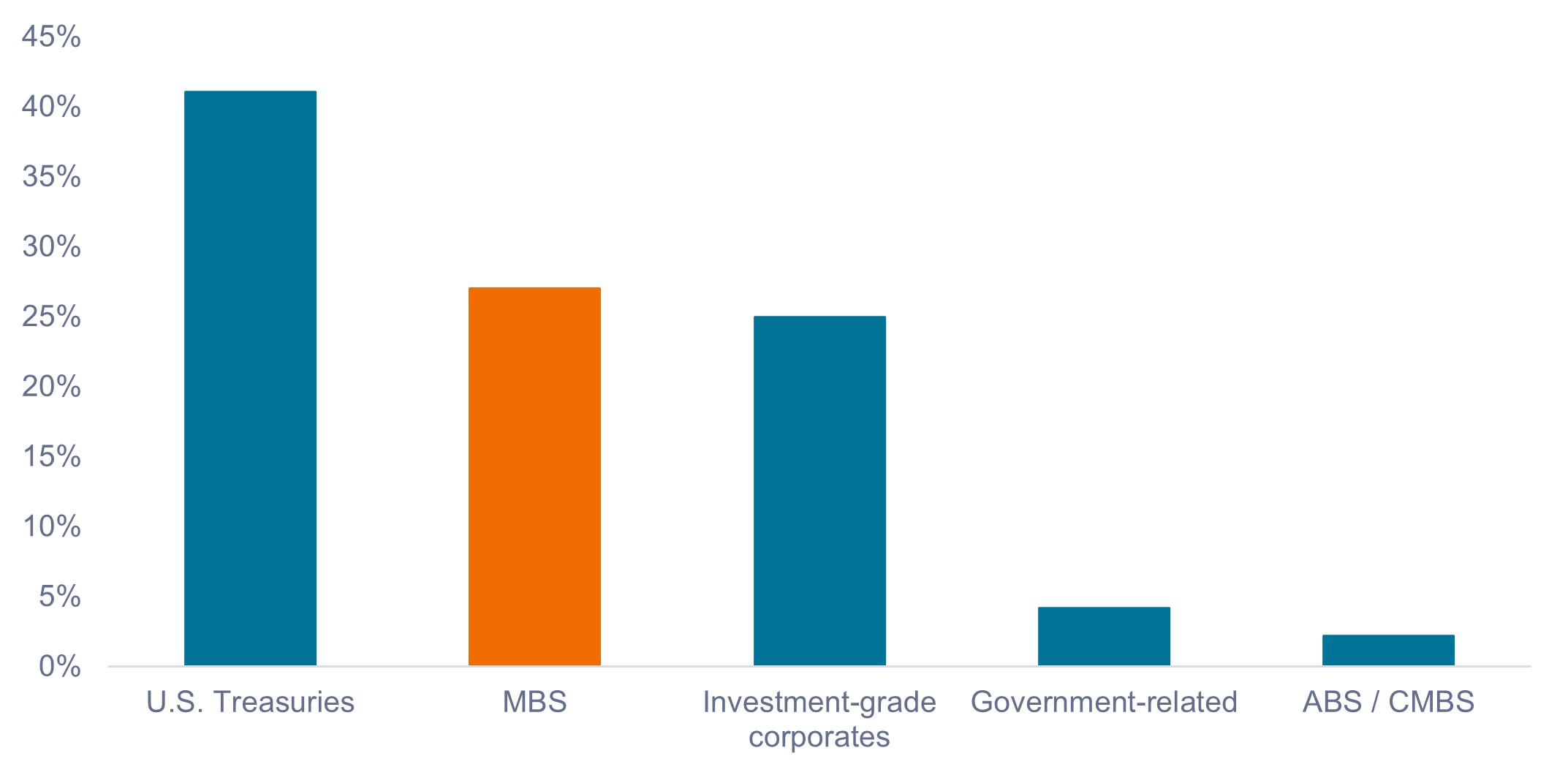

A substantial 27% of the Bloomberg U.S. Aggregate Bond Index (Agg) is allocated to MBS, as shown in Exhibit 2.

Exhibit 2: Bloomberg U.S. Aggregate Bond Index weights

MBS commands a significant weighting in Agg-like portfolios – an opportunity for active management.

Source: Bloomberg, as of 30 June 2023. ABS / CMBS represents asset-backed securities and commercial mortgage-backed securities.

Source: Bloomberg, as of 30 June 2023. ABS / CMBS represents asset-backed securities and commercial mortgage-backed securities.

For investors in “Agg-like” mutual funds, or for investment managers and financial professionals who have decided to “build up” their Agg exposure using asset class-specific ETFs and mutual funds, there is a noticeable bias toward owning the entire Bloomberg U.S. MBS Index. We think this passive MBS exposure offers a meaningful opportunity to improve risk-adjusted returns through active management, for two reasons.

First, as outlined above, we believe alpha returns on MBS – or the excess return earned above the benchmark return – may be gained from the accumulation of small, independent, idiosyncratic risks.

Second, it’s important to note that a large group of investors impacts the MBS market with non-economic motives, including the Federal Reserve (Fed), foreign governments, and even U.S. banks. These investors often enter the market for reasons other than acquiring yield, and their actions can cause price dislocations. For example, commercial banks may have a capital requirement to fulfill, while the Fed’s motivation has been to ease or tighten domestic financial conditions by purchasing or selling bonds in the open market.

While investors who own the entire MBS universe have exposure to the risk and reward of the index as a whole, we think owning the entire index limits the opportunity for investors to potentially profit from the abovementioned market dislocations and mispriced assets.

Our approach

In our opinion, basing MBS positioning on a top-down, macroeconomic view is fraught with challenges, as is trying to predict the market’s direction by being overweight or underweight the market as a whole.

We believe it is better to limit the aggregate beta, duration, and convexity1 risks – in other words, to build the MBS portfolio to match the risks of the benchmark index as closely as possible – and focus on bottom-up security selection opportunities in seeking to generate excess return, or alpha.

Zillow showed us it doesn’t always make sense to buy every house on the street. We think the same applies to investing in MBS.

1 Convexity demonstrates how the duration of a bond changes as the interest rate changes.

Alpha compares risk-adjusted performance relative to an index. Positive alpha means outperformance on a risk-adjusted basis.

Beta measures the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Idiosyncratic risks are factors that are specific to a particular company and have little or no correlation with market risk.

IMPORTANT INFORMATION

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

- The Fund invests in Asset-Backed Securities (ABS) and other forms of securitised investments, which may be subject to greater credit / default, liquidity, interest rate and prepayment and extension risks, compared to other investments such as government or corporate issued bonds and this may negatively impact the realised return on investment in the securities.