As the Trump administration enters its second year with a focus on affordability, investors must consider what the president’s latest policies will mean for markets.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

The fourth quarter of 2025 featured powerful secular themes that the Research Team believes will continue to create compelling opportunities across sectors in the year ahead.

Andy Acker and Dan Lyons explain why low valuations and improving fundamentals could help the healthcare sector stand out in 2026.

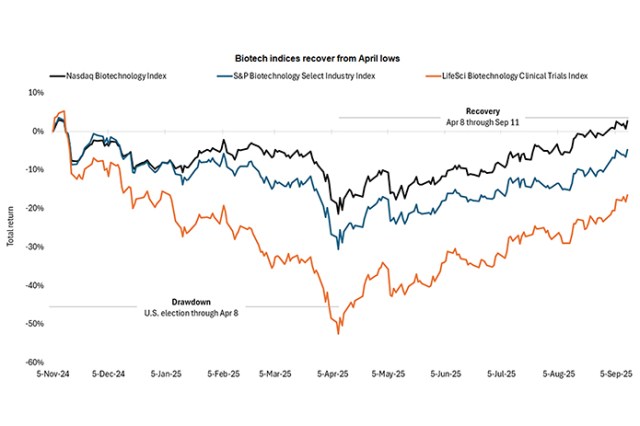

The biotech sector has rebounded from a sharp sell-off earlier this year and could deliver even more value to investors who know where to look.

Optimism is returning to the biotech space, and we see durable drivers behind the recent performance recovery.

New developments around pharmaceutical tariffs and U.S. drug pricing reform suggest the hit to the biopharma industry may, over time, be less than feared.

How pharmaceutical tariffs and drug pricing reform could help secure biopharma innovation over the long run.

As AI makes inroads into healthcare, opportunities for patients and investors grow.

Janus Henderson’s ‘Partnerships for a Brighter Future’ event in New York discussed AI and bionic enhancements that can support human resilience.

Ali Dibadj, CEO, spoke with Richard Clode and Agustin Mohedas about AI’s potential to unlock opportunities in trillion-dollar markets.

Scrubbing in to watch multiple pulse field ablation procedures, we learned about the benefits and risks of this exciting new treatment option for AFib patients.