Who dares wins: is now the time to add risk?

Recent market consensus has been to de-risk amid a challenging market environment. But is consensus now the right place to be, or do investors run the risk of missing out on some of the best long-term buying opportunities? The Portfolio Construction and Strategy Team explain why now might be the time to be brave while others flee.

5 minute read

Key takeaways:

- Most market commentators today recommend keeping equity risk low, rotating what remains of your equity allocation into quality equities, avoiding riskier credit and increasing exposure to government bonds.

- However, data shows that in most instances where market sentiment has been low, global equity markets have produced strong returns in the subsequent years.

- While it is pertinent for risk-averse investors to guard their capital, we do believe there are instances where market sentiment reaches such a low point that the most material surprises are likely to be on the upside.

2022 has been difficult for many reasons. Not just because of challenged market and economic conditions, but also due to the fact that these challenges have come off the back of a torrid two years from the start of the COVID-19 pandemic. This year was heralded as the return to normality, yet at times it feels like there is as much uncertainty today as there was in 2020. Investors are understandably jaded and jumpy.

With that in mind, it is no surprise that the array of negative market and economic news has created consensus around portfolio positioning. There is no shortage of market commentary advocating for a largely consistent approach to building a portfolio today. Dial-in to most investment webcasts, read most publications and you will most likely see recommendations that now is the time to be “risk-off.” That is, look to keep equity risk low, rotate what remains of your equity allocation into quality equities, avoid riskier credit and increase allocations to government bonds.

What is particularly striking is just how universal those market views are.

Investors have largely followed this advice with material outflows from risk assets across the board. Only alternative funds and to a much lesser extent commodity funds have been spared the exodus.

There is nothing necessarily wrong with those views or those actions. Looking back over 2022, taking such actions would have gone a long way to preserving capital or at least reducing losses. We as a team have advocated similar positioning for quite some time. For investors with lower risk tolerances, such an approach is and remains sensible as the world grapples with a dangerous combination of record interest rate rises, significant inflation and faltering global economic growth.

However, we do believe there does become a stage where sentiment in markets reaches such a low point that the most material surprises are likely to be on the upside.

Sentiment is at record lows…

With a myriad of negative press on global economic conditions and the markets, trying to find any positive views is challenging. This is reflected in sentiment indicators which have now hit record lows – exhibit 1.

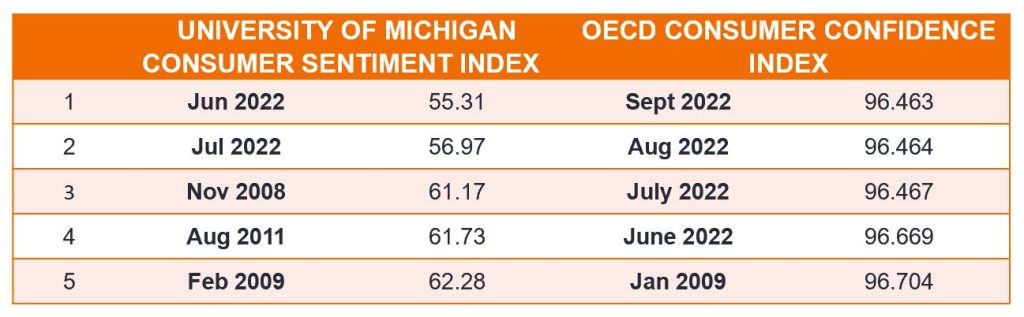

Exhibit 1: Worst five sentiment index readings since 1987

Source: Bloomberg, OECD, Janus Henderson Investors. Data runs from January 1987 to 30 September 2022.

It takes a level of courage to start considering an opposing market view. Yet we feel that this is an avenue worth exploring for investors with the risk tolerance to accept volatility in the immediate term.

The best long-term investment entry points rarely occur during times of market exuberance but can be during periods of deep declines and low market confidence.

It is important to state here that we can’t say that where the bottom of the market is – no one can. In this current market environment, there are simply too many variables and as such there remains a strong chance that markets could decline further.

However, what we do know with certainty is that markets go through boom-and-bust cycles.

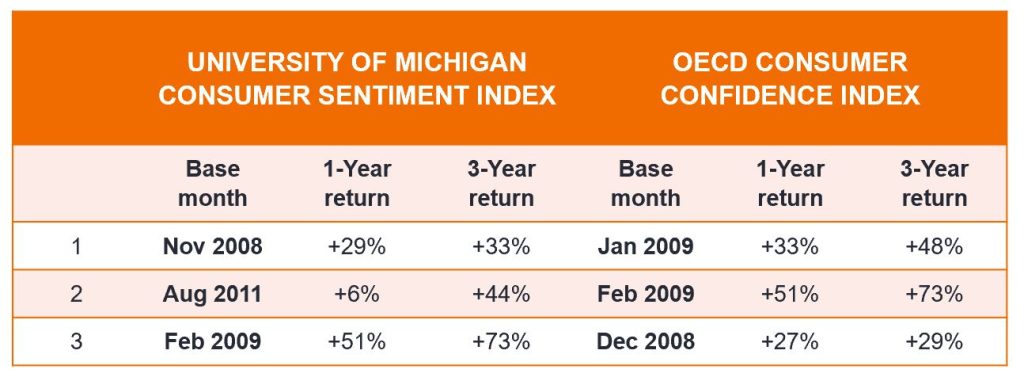

If we go back to the sentiment indices shown in the previous table and remove 2022 from the equation, it is interesting to see what happened to equity markets in the subsequent 1 and 3 years from these low readings, as shown in exhibit 2.

Exhibit 2: 1- and 3- year global equity return following worst sentiment indicators

Source: Global Equities Returns as measured by the MSCI World Index in USD terms, excluding 2022. Bloomberg, Organisation for Economic Co-operation and Development (OECD), Janus Henderson Investors, as at 30 September 2022.

While we are looking at very few data points, and therefore must be cautious with drawing conclusions, what we do see is that in all but 2011, global equities recovered materially with 12 months, and ALL produced extremely strong 3-year returns.

We believe there is a clear link between confidence levels and equity returns.

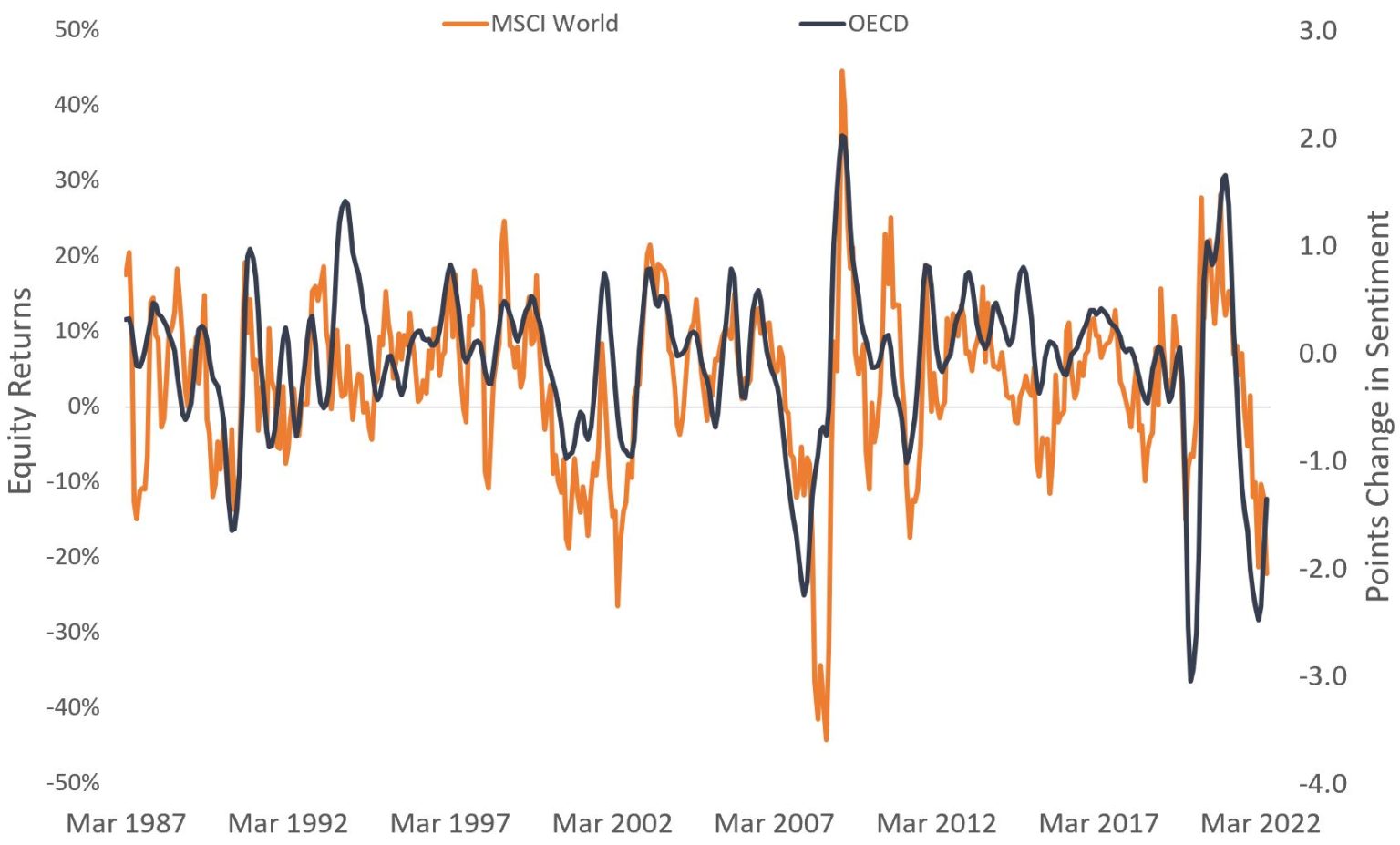

In exhibit 3 we show the rolling 6-month global equity market returns against the change in Consumer Confidence Index for the OECD.

Exhibit 3: Rolling 6-month global equity returns vs 6-month change in global sentiment index

Source: Global Equities Returns as measured by the MSCI World Index in USD terms. Bloomberg, OECD, Janus Henderson Investors, as at 30 September 2022. Past performance does not predict future returns.

The very close relationship between changes in confidence and market returns can be observed. At the timing of writing, the Confidence Index while still declining (a declining index is depicted by the change in index being below 0), is declining at a slowing rate, which is yet to be reflected in equity market returns.

Where to from here?

In many of our recent client consultations, the Janus Henderson Portfolio Construction & Strategy (PCS) team have been hearing of a universal fear of markets, a desire to remain “risk off” and in some cases “closing up shop” for the rest of the year.

However, when we look through history, environments such as these have been the critical moments where being brave as others flee have presented the best buying opportunities. That is not to say markets will suddenly recover – markets may well continue to struggle. But at some point, that will change.

Time will tell whether we are at, near or someway from the bottom of the market but what we can say with certainty is that markets always recover, and right now we are an awfully long way from the top.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.