Subscribe

Sign up for timely perspectives delivered to your inbox.

Using a combination of eight charts and tables, corporate credit portfolio managers Seth Meyer and Tom Ross consider some of the potential risks and opportunities within the high yield sector of fixed income.

Companies issue corporate bonds to raise funds, promising to pay the investor interest (the coupon) each year and repay the par value of the bond when the bond matures. High yield bonds are corporate bonds that carry a sub-investment grade credit rating. This means they are rated equal to or lower than Ba1 by Moody’s or BB+ by S&P or Fitch, the credit rating agencies. They are typically issued by companies with a higher risk of default (the failure to meet repayments to bondholders), which is why they offer higher yields to attract investors.

The high yield bond market is well developed and established, having its origins in the US more than 40 years ago. Today, the global high yield market comprises a vast range of issuing companies, from household giants such as Fiat Chrysler, Netflix and Banco do Brasil, through to small and medium-sized companies that are raising funding via the bond markets for the first time. This creates a diverse mix of issuers that can reward strong credit analysis.

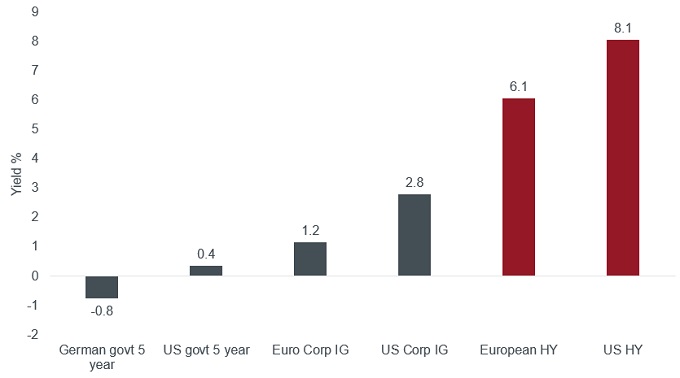

Trying to achieve an attractive yield on investments has become a challenge as central banks have driven interest rates lower. This has been compounded by unconventional policy measures such as central bank asset purchase schemes (quantitative easing), which involves creating money to purchase government and corporate bonds to keep financing costs low. As Figure 1 shows, high yield bonds offer a strong yield pick-up compared with other forms of debt.

Source: Bloomberg, govt = government, Generic German 5-Year Government Bond (GDBR5), Generic US 5-Year Government Bond (USGG5YR); ICE BofA Indices, Euro Corporate IG (investment grade) = ER00, US Corp IG = C0A0, European HY (high yield) = HP00, US HY = H0A0. Yield to maturity for government bonds, yield to worst for corporate bonds, as at 30 April 2020. Yield to worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting. Yields may vary and are not guaranteed.

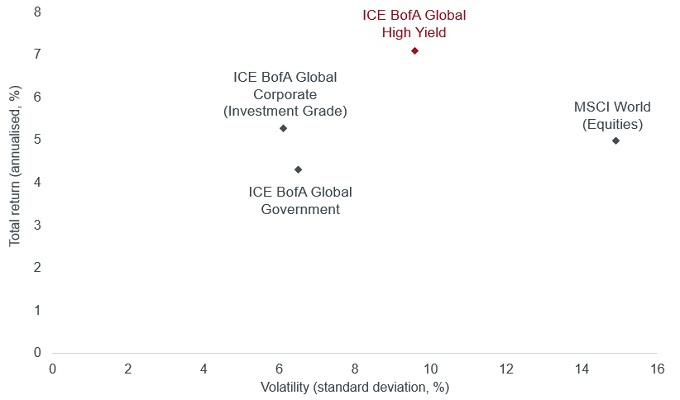

From a risk-return perspective, high yield bonds are typically seen as occupying the space between investment grade bonds and equities. As Figure 2 shows, over the last 20 years, global high yield bonds have outperformed government bonds, investment grade corporate bonds and equities, with much less volatility than equities. This argues for a strategic allocation to high yield in a diversified portfolio. The high income element in high yield bonds has been a valuable component of total return.

Source: Refinitiv Datastream, total return indices in US dollars, 31 December 1999 to 31 December 2019. Volatility is standard deviation, using monthly data returns. Past performance is not a guide to future performance.

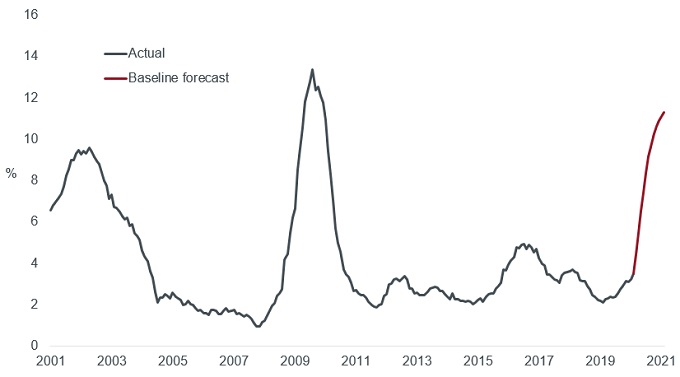

While typically not as volatile as equities, high yield bonds are issued by companies that are often sensitive to the economic cycle and to events within individual sectors and companies. By holding a diverse portfolio of high yield bonds, this can help an investor to reduce the idiosyncratic risk of an individual bond. High yield bond investors should be prepared to accept some volatility. For example, during the financial crisis, the global high yield bond market experienced a drawdown (peak to trough decline in value) of 36%*. Historically, however, the high yield market has a tendency to bounce back strongly after sharp falls as demonstrated in Figure 3.

Source: Refinitiv Datastream. Monthly rolling 12-month total returns, in US dollars, 30 April 2000 to 31 April 2020. *ICE BofA Global High Yield Bond Total Return Index, 21 May 2008 to 12 December 2008. Incidentally, the index had recovered its 21 May 2008 peak value by 5 August 2009. Past performance is not a guide to future performance.

High yield bonds are typically less sensitive to rises in interest rates or inflation because the spread (additional yield over equivalent government bond) often acts as a cushion, absorbing some of the rise in yields when government bond yields rise or interest rates rise. The combination of higher yields and shorter maturities means that high yield bonds typically have lower duration (sensitivity to interest rates) than other types of fixed income.

| Duration (years) | |

|---|---|

| European high yield | 4.0 |

| US high yield | 4.2 |

| European investment grade | 5.3 |

| US government | 7.4 |

| US investment grade | 8.0 |

| European government | 8.5 |

Source: Bloomberg, Refinitiv Datastream, indices as per Figure 1, European govt = ICE BofA European Union Government Index, US govt = ICE BofA US Treasury Index, effective duration, all maturities indices, as at 30 April 2020.

As the correlation table below demonstrates, high yield has had a low correlation with government bond markets, offering the potential as a diversifier within a fixed income portfolio.

| Global HY | Global IG | Global govt | Global equities | |

|---|---|---|---|---|

| Global high yield (HY) | 1.00 | |||

| Global investment grade (IG) | 0.63 | 1.00 | ||

| Global government (govt) | 0.21 | 0.80 | 1.00 | |

| Global equities | 0.74 | 0.47 | 0.12 | 1.00 |

Source: Refinitiv Datastream, indices as per Figure 2, correlation coefficients of monthly total returns in US dollars, 31 December 1999 to 31 December 2019

For a long-term investor, the heightened risk of default is the key driver of spread premia for high yield bonds. The COVID-19 coronavirus crisis is expected to cause an increase in global high yield default rates, although massive support measures by central banks and fiscal stimulus by governments mean the default rate is likely to be lower than it would have been given the expected scale of the economic downturn. In 2019, the oil and gas sector and the retail sector had the highest default rates and these sectors are likely to face ongoing challenges in 2020 as the structural headwinds of disruption combine with the cost of economic lockdowns. A selective approach to investment with a focus on rigorous fundamental research can help in avoiding defaults and in seeking to generate outperformance.

Source: Moody’s Default Report, 28 February 2001 to 31 March 2020. Forecast at 14 April 2020 for the year to 31 March 2021. The forecast is an estimate only and is not guaranteed.

Despite being relatively late in the credit cycle, high yield bond issuers had typically been using proceeds of issuance for refinancing rather than more aggressive and less bondholder-friendly activities such as share buy-backs and leveraged buyouts. There had been limited appetite for additional borrowing among high yield issuers. For example, net leverage as a proportion of earnings on European high yield bonds had fallen from close to 4 times in Q3 2018 to 3 times in Q3 2019.* Leverage is likely to rise in 2020 as companies are forced to borrow to make up for revenue shortfalls and earnings come under pressure.

The crossover space between investment grade and high yield can be a source of returns as mispricing often exists in this area. COVID-19 economic disruption means we are likely to be entering a period of heightened change in credit ratings and investors should probably expect downgrades to exceed upgrades. Investment grade bonds downgraded into the high yield space (so-called ‘fallen angels’) are not wholly unwelcome given limited high yield supply in recent years. Provided there is not a deluge – which could lead to spread widening – this can add valuable diversity. The decision by the US Federal Reserve to permit purchases of fallen angel bonds introduces an interesting dynamic by extending central bank support programmes directly to the high yield market for the first time.

*Source: Morgan Stanley, European Credit Strategy, 27 April 2020. Net leverage = Net debt/earnings before interest, tax, depreciation and amortisation.

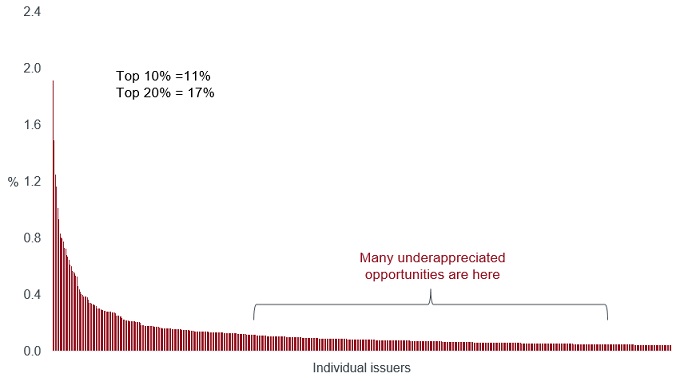

High yield tends to exhibit a higher level of idiosyncratic risk, with individual company factors proving a more significant determinant of the bond price than is the case for investment grade bonds. The high degree of idiosyncratic risk in high yield bonds means good credit analysis can be rewarded, making it fertile ground for active managers.

Under-researched issuers: Exchange traded funds (ETFs) and larger investors focus the bulk of their trading activity on the larger issuers due to their size. This leaves opportunities for active managers to identify value among the smaller under-researched issuers.

Source: Bloomberg, ICE BofA Global High Yield Constrained Index (HW0C), as at 30 April 2020.

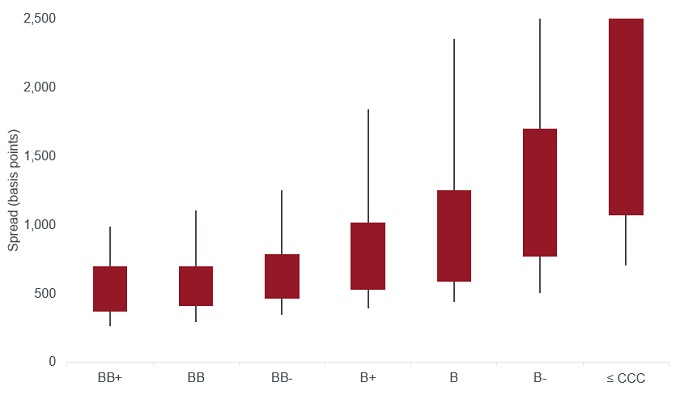

Breadth within each rating band: The market can hold very different views about issuers within the same rating band as demonstrated by the wide spread range in Figure 8. This means that it is possible, through careful credit analysis, to profit from mispricing or volatility in credit spreads.

Source: ICE BofA Global High Yield Bond Index, as at 30 April 2020. Chart shows the interquartile range (red box) and 5th/95th percentiles by rating category (grey line).

Cross-border and crossover: There has been an increase in cross-border issuance, with companies issuing in a country or currency outside their domicile, for example US-based companies issuing euro-denominated bonds to take advantage of lower yields in Europe, creating opportunities for investors with global coverage. In addition, movement of bonds between investment grade and high yield (fallen angels and rising stars) can create opportunities to profit from mispricing and forced selling.

ESG factors: Environmental, social and governance (ESG) factors are playing an increasingly important role in assessing the risks and opportunities that companies are facing. A thorough assessment of individual issuers can identify those companies on the right side of change and, therefore, in a stronger position to remain commercially relevant and to be able to meet their obligations to bondholders.

High yield bond holders rank above equity holders in the capital structure and therefore have a superior claim on the company’s assets. High yield bonds are, however, issued by companies where there is a higher risk of default. The main risks facing high yield bonds include:

The search for income among investors is likely to continue and has been made more profound by central bank policies that have brought down interest rates and anchored sovereign bond yields at low levels. Investors may be attracted to the higher yields offered by high yield bonds but they should recognise the additional risk attached to those yields. Over the long term, high yield bonds have offered an attractive total return but investors should not assume that the past will repeat itself. Today, companies are having to contend with the effects of the coronavirus, which is likely to accelerate disruptive trends and bring greater focus on the strength of company balance sheets and the resilience of business models. We would argue this calls for an even more selective approach to the asset class.