Subscribe

Sign up for timely perspectives delivered to your inbox.

As the world assesses what will change after the COVID-19 pandemic, Jim Cielinski, Global Head of Fixed Income, introduces the questions Janus Henderson expects to be key in setting investment strategy going forward.

We seek to share the insights of our investment teams to help inform our clients and, in the months ahead, will use these questions as a guide for our asset class leaders and investment teams to provide their views on whether we are likely to head down a positive or negative fork in the road.

Every crisis brings change. The COVID-19 coronavirus will be no different. It will alter the ways in which we interact, redefine how policy makers respond, and upend geopolitics and financial markets. However, there is much disagreement over how these changes will unfold, and never before have the answers to so many critical investment-related questions been so binary. Understanding these key issues will be essential for navigating the future investment landscape.

Predictions during crises are notoriously bad. Humans tend to fixate on how we will be forced to change the way we live and interact with one another. We surmise that travel will never be the same, we will not eat out as often, and half of us will forever work from home. But more often than not, humans seek a return to a comfort zone and strive to replace the things they enjoyed. If past crises are a guide, in 12 to 18 months, most of us will be doing many of the same things that we were doing six months ago.

There will be changes, of course. Disruptive trends tend to accelerate in times of crisis, and the volatility and stress associated with the COVID-19 pandemic will likely provide a catalyst to prompt rapid modifications in behaviour. The shopping experience, for one, may never quite be the same as trends in place pre-crisis take a firmer grip in the years ahead.

Most changes, however, will be designed to facilitate a return to the norm. For example, there were countless predictions that air travel would plummet in the wake of the 9/11 disaster. Instead, air travel soared to record levels, but there were large-scale adjustments in how airports and security functioned to permit that swift return. Likewise, we will still watch movies in a year’s time, although much more of that may be via at-home digital streaming than in cinemas. While that is critical for the streaming services and cinema companies, the consumption of movies in aggregate may not change by much.

As people, we will find different ways to do the same things. But as investors, we contend that there is no feasible way to return to the paradigm of old.

Speculation on how COVID-19 could impact our lifestyles may continue to dominate headlines, but it is critical for investors to look more broadly; many more important questions await.

Clearly, the path of the virus, the duration of shutdowns, and progress in testing, treatments, and vaccine development for COVID-19 will dictate market movements in the short term. Volatile markets force us to adopt an immediacy bias. But looking longer term, there are two things that indicate the economic world will never quite be the same. One, the policy response to this crisis has reminded us that policy makers are never truly out of tools, as had been suggested recently. Two, the aftershocks of the staggering amount of debt issuance will likely linger for decades.

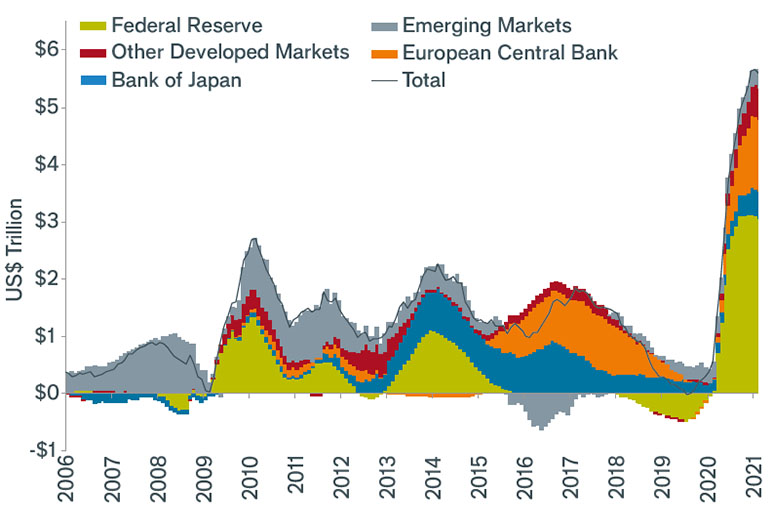

Crises are known to produce irreversible changes to monetary and fiscal policy and geopolitics. Policy responses are unpredictable – the impact of policy even more so. And with each crisis, a concept previously occupying the “lunatic fringe” moves ever closer to the norm. In 2007, how many people were predicting negative rates and $5 trillion of quantitative easing?

Speaking of negative rates, they have not been the panacea policy makers had hoped for. This will put continued pressure on quantitative easing to combat the economic contraction, essentially blurring the lines of where central bankers are simply lending money to corporate borrowers. We are entering a new era of direct intervention in asset and lending markets.

In less than three months, we have witnessed monetary policy break all bounds of what was considered possible, and fiscal policy is there to accompany it. After taking a backseat to monetary policy in recent years, fiscal policy has vaulted into the lead: mega-deficits are the new normal.

The policy response to the economic slowdown resulting from the spread and containment of COVID-19 is unprecedented.

Source: Citigroup, as at 20 April 2020. Data for 2020 and 2021 are estimated.

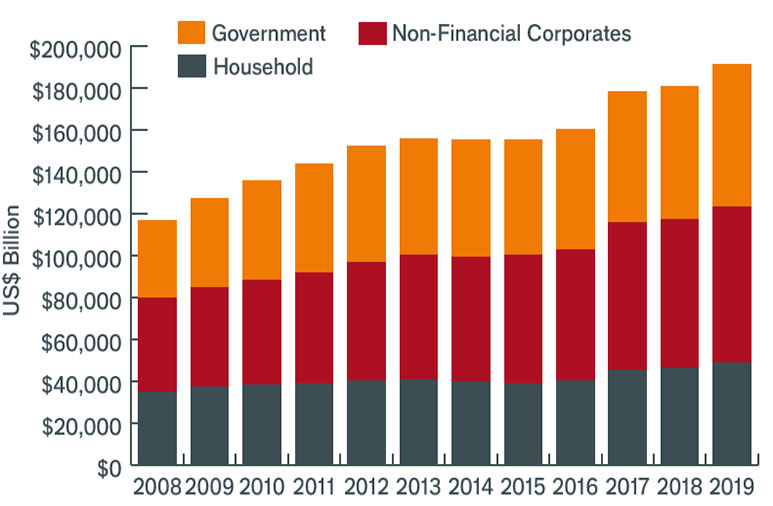

The lingering effect of that debt is the other “no going back” feature of this crisis. In 2008, there was an astonishing amount of debt issued to rescue economies from the Global Financial Crisis. Many called for the end of the debt supercycle as debt loads exploded to perceived unsustainable levels. But the decade since has shown that debt was, in fact, sustainable. As debt yet again soars to new records, will that still hold true?

Debt is not inherently bad. If the real return on assets is greater than financing costs, debt can provide a strong tailwind for growth. This is true for governments, corporations, and individuals. Equally, by helping to underwrite consumers and companies in times of stress, central banks can reduce the risk of higher debt loads and encourage more borrowing.

On the other hand, debt is the equivalent of ‘dis-saving’. And an economic identity holds that for every dis-saver, there must be a saver to fund it. This is the risk in a large global shock, as the swing to dis-saving by global governments has been surprisingly large. Will anyone be left to provide the global savings to address this growing imbalance? The answer to that question will tell us much about inflationary expectations, productivity, and wealth inequality.

Driven primarily by corporate and government borrowers, global debt loads have increased steadily since the Global Financial Crisis.

Source: Bank of International Settlements, as at May 2020.

The severity of the current slowdown is unprecedented. The policy response has been equally unprecedented. Both have led to increased uncertainty and more questions than answers. Markets are simply never the same after crises like these, and that is probably one prediction that will turn out to be true.

But as investors, it is often more important to ask the right questions than to have all the answers. Knowing which questions to ask is a first step to identifying the signposts for navigating volatility. And it helps to centre the mind on the factors that will truly drive markets in the months and years ahead.

The below list of questions is by no means exhaustive, but an investor who can answer them will have the keys to unlock the market puzzle spread out before us. Each of these issues is generating a plethora of opinions. Perfectly valid arguments have sprung up on both sides of each. Here we summarise some of the questions we believe to be key and provide a snapshot of the dichotomy that exists among prognosticators.

| The question | Glass Half-Full: from this something positive may emerge | Glass Half-Empty: curb your enthusiasm, less positive outcomes may be in store |

|---|---|---|

| Will we work and behave differently? |

Profound changes await us: more working from home, less business travel and more video conferencing, less of the sharing economy, more home cooking, etc. | Humans are adaptable but find ways to quickly return to the more comfortable aspects of the old norm. Outlandish predictions surface with every crisis, but society typically finds ways to revert to earlier behaviour. |

| Will wealth inequality get better or worse? | Past pandemics have been turning points for returning power to labour vs. capital; companies will need to pay up to lure good people back. | Monetary policy makers have taken the inequality playbook – boosting asset prices rather than incomes – and simply doubled down. Policy will further exacerbate it by giving companies access to cheap capital. |

| Are we looking at inflation or deflation? |

Goldilocks returns. The recession is deflationary, but the megapolicy response is inflationary – expect continued range-bound low inflation as demand remains subdued. | The economy has evolved into a money-printing machine, and policy makers will do anything in their power to avoid debt deflation. We have likely seen the bottom in inflation expectations. |

| Will we still care about Environmental, Social, Governance (ESG) issues? | ESG will be deemed more important than ever and expect the social “S” to grow in stature. If good ESG companies outperform in this downturn, it will be taken as proof of ESG’s worth. | ESG was a luxury for non-volatile times where active managers needed to show their worth; its impact will fade as returns and volatility take precedence. |

| Should interest rates go up or down? | Whether official or unofficial, a version of yield curve control is here to stay. Central banks want rates to stay low, and they have the ability to corner the market and implement financial repression tactics. Real rates will fall in a recession, so expect rates to remain low. | Rates are close to zero in just about every market; the printing presses have been ramped up, and we are likely to see higher inflation. How attractive will bonds be in this environment? |

| Will big companies keep getting bigger? |

No. There will be a reawakening of how important a local and independent fabric is to nations and people; expect a sea change in consumption behaviours when these lockdowns end. | Of course! Some of the biggest industries, including tech and online retail, were fortuitously positioned for a crisis of this nature, setting up those companies for continued growth. Bigger firms are better able to access cheap capital, allowing them to exterminate small- and medium-size enterprises already weakened by the crisis. |

| How do we pay for these massive deficits? |

No worries! We can embrace Modern Monetary Theory (MMT). Deficits do not really matter without high inflation, allowing them to persist. Our kids will sort this one out. | Austerity is around the corner. Deficits will shrink in 2021 given the one-off nature of the crisis, reducing growth. Anger at how corporations received better treatment than individuals will trigger a backlash and usher in a rise in corporate and upper-income tax rates. |

| Is this the end of the road for globalisation? |

We have seen how interconnected we are and will recognise that better coordination would have curtailed many of the costs of this crisis; repair will be quicker if responses are coordinated. | It is apparent now that an interconnected world brings risks; a more isolationist approach will better serve rich countries; deglobalisation will accelerate. |

| Will this profoundly change how we define ‘income strategies’? |

Rates will be lower than ever, and retirees need income more than ever. After a brief retreat, the search for yield will return with a vengeance. | Equity income is wounded; high dividend yields have become red flags for unsustainable companies that distribute profits. Investors will now accept lower yields, understanding there is no free lunch. |

| Are emerging markets (EM) a relative winner or loser from COVID-19? |

As China goes, so goes EM. More stimulus is coming in China, the economy has reopened, and COVID-19 is more controlled there than elsewhere. | EM is heading for the abyss; depreciating currencies coupled with excessive hard currency debt heightens risk; health care systems are ill-prepared, and default is easier than turning your back on citizens. |

| Will this bring the eurozone together? | Staring down the barrel, the eurozone will “do whatever it takes”, and this time that will mean taking the road to debt mutualisation in some form. There will be no turning back after this year. | This is likely the event that tears the eurozone apart as it tests the limits of unification, and that’s before we even mention Brexit. |

| Are business failures about to explode? | Money is everywhere, programmes are in place to limit defaults, corporations have termed out debt, and as long as this isn’t a drawn-out affair, a quick spike in failures will quickly recede. | Economies that are service-oriented and not in hard lockdown will take longer than expected to recover, leading to the type of negative growth that will induce business failure. |

| Is this good or bad for active managers? | Volatility is the tonic we needed as active managers, revealing that there is potential material outperformance vs. passive but also highlighting the need to more carefully define a desired outcome. | Active managers shouted that a “good bout of volatility” would reveal their worth, but performance numbers may show that, after fees, active failed to do so. A larger share of assets under management will flow to passive. |

Each of these topics deserves more attention than we have room for in this publication. And we do not profess to have the answers, but we do see value in laying the groundwork for, and hopefully contributing to, the next phase of debate.

Expect genuine uncertainty to be with us for many months and know that no amount of analysis will give us all the right answers. In the meantime, ask the right questions and be mindful of both the risks and the opportunities.

We hope you find the questions we have posed of interest, and we look forward to sharing the views of our investment teams on these in the months ahead. To discuss any of these questions in more detail and the related investment implications, please contact your Janus Henderson representative.

![]()