Subscribe

Sign up for timely perspectives delivered to your inbox.

A widely-held view is that the covid-19 shock has been the trigger for a “late cycle” global economy to enter an overdue and probably sustained period of weakness, to be reflected in a trend rise in unemployment and widening output gaps.

This view is encapsulated by the latest IMF forecasts of a 4.9% fall in global GDP in 2020 followed by a rise of only 5.4% in 2021, implying that the level of GDP next year will be barely higher than in 2019 and about 6.5% lower than projected in January.

The cycle analysis here yields an opposite conclusion: rather than acting as a catalyst for a new period of cyclical weakness, the virus shock has magnified but probably marks the end of a pre-existing downswing dating back to early 2018. Key cycles are now shifting from acting as a headwind to providing a tailwind to global economic momentum.

The cycles methodology followed here is based on the “European” approach, which recognises independent cycles in the components of (investment) demand, rather than the dominant but misleading “American” approach, which asserts the notion of a single, all-encompassing “business” cycle*.

The European approach identifies three main cycles: a stockbuilding or inventory cycle ranging between 3 and 5 years in length (i.e. measured from low to low), a business investment cycle of 7 to 11 years and a longer-term housing cycle averaging 18 years.

Why no consumer spending cycle? Consumption is a derivative of the above cycles. It is influenced by employment trends, which echo the business investment cycle. Consumption booms typically occur during the late upswing phase of the housing cycle, reflecting house price-driven wealth effects and strong mortgage credit growth / home equity withdrawal.

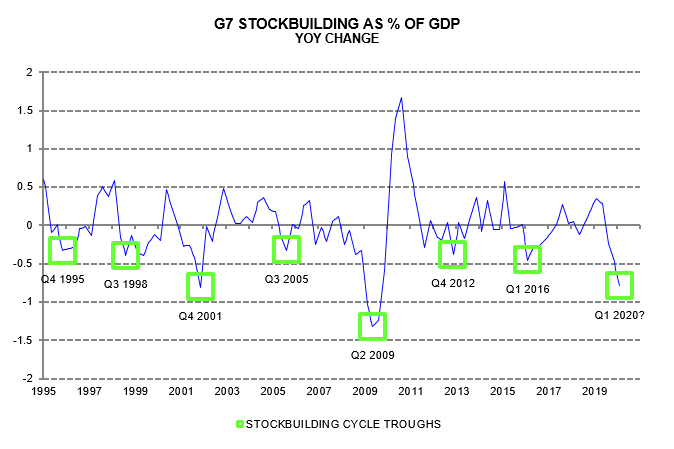

The first chart shows suggested dates of stockbuilding cycle lows, based on the contribution of stockbuilding to G7 annual GDP growth. The pre-covid view here was that the cycle had bottomed in Q4 2019. The shock appears to have shifted the low to Q1 2020. The negative GDP impact last quarter was larger than at many previous cycle lows and, at 4 years, the current cycle is already longer than a 3.4 year average.

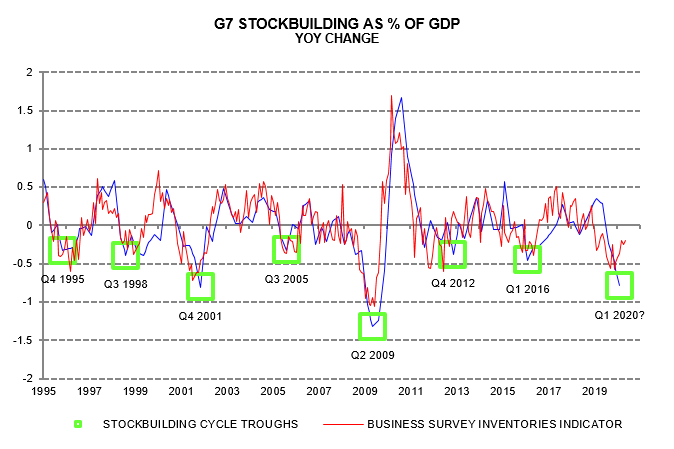

A business survey inventories indicator shown in the second chart correlates closely with the GDP growth contribution and supports the view that the bottom is in.

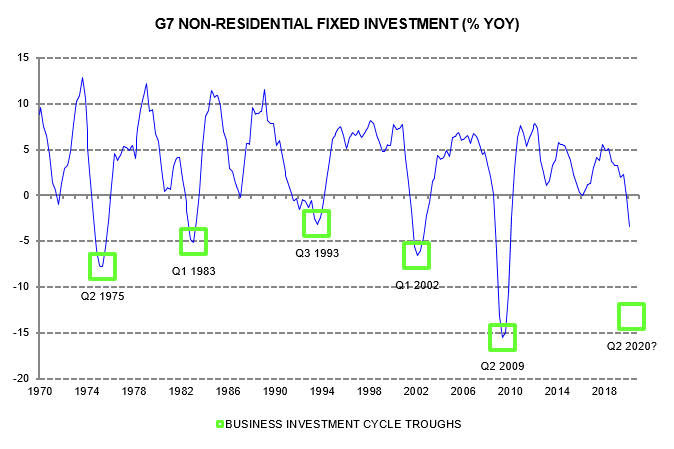

Suggested dates of business investment cycle lows are given in the third chart, showing annual growth of G7 non-housing fixed capital spending. With the previous trough in Q2 2009, the maximum 11 year length of this cycle implies that Q2 2020 is the latest possible date for the current cycle low.

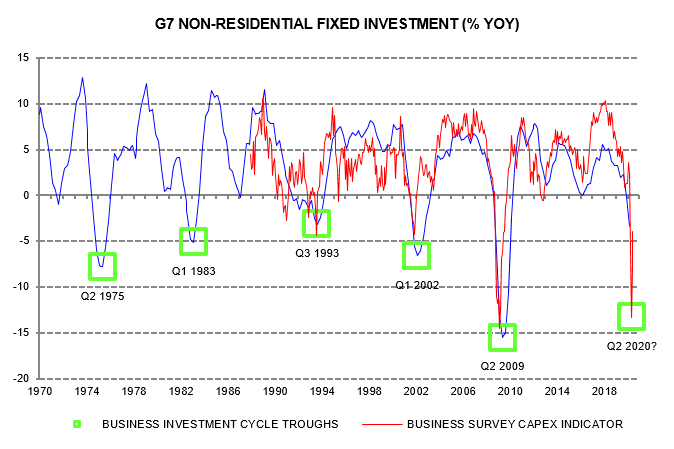

The annual investment fall was insufficiently large to mark a cycle low in Q1 but will be more pronounced in Q2. A Q2 trough is supported by a business survey capex indicator, which bottomed in April, rebounding significantly in May with a further increase indicated for June, based on partial data – fourth chart.

A counterargument is that investment is unlikely to bottom before profits. The lead time of profits at troughs historically, however, was often only one quarter. Profits weakened more than investment in Q1 and it is possible that their annual change bottomed in that quarter.

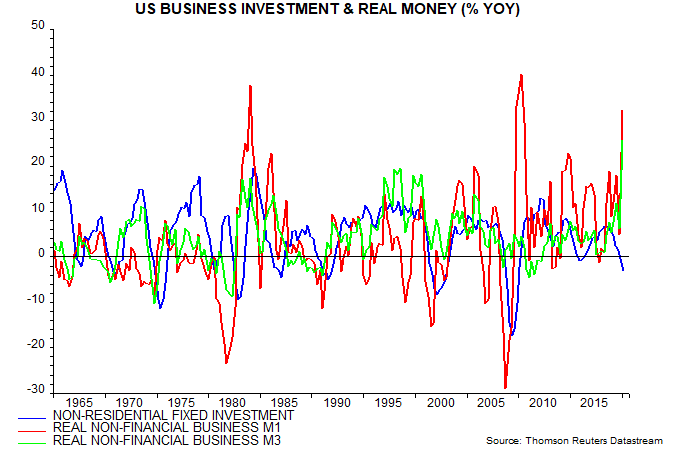

Business money trends are consistent with an investment trough having been reached. The fifth chart shows the relationship for the US, which has the longest business money data history, but the recent surge is echoed elsewhere.

A common misperception is that a business investment cycle recovery requires a rebound in “animal spirits”. This usually occurs later in the upswing. Replacement capital spending plays an important role in the initial revival: such spending is postponed during the downswing, creating a reservoir of pent-up demand that is released as economic conditions stabilise.

*Wesley C. Mitchell, the pioneer of the American approach, defined business cycles as fluctuations in overall economic activity varying in duration “from more than one year to ten or twelve years”. The wide range is a consequence of inappropriately aggregating component cycles, which has the effect of discarding valuable forecasting information based on their individual periodicities. One consequence is that the research agenda of Mitchell et al. focused on the development of leading indicators for forecasting.