Fixed income returns in 2022: Have our bonds betrayed us?

-

Greg Wilensky, CFA

Greg Wilensky, CFA

Head of U.S. Fixed Income | Portfolio Manager -

Michael Keough

Michael Keough

Portfolio Manager

Head of U.S. Fixed Income Greg Wilensky and Portfolio Manager Michael Keough discuss the recent drawdown in U.S. fixed income in a broader context, and address whether fixed income still has what it takes to merit an allocation in a diversified portfolio.

KEY TAKEAWAYS

- Fixed income assets have endured a challenging start to 2022, causing some investors to question an allocation to bonds in their portfolios.

- We argue that the recent negative returns on fixed income should be viewed with a longer-term perspective before considering extensive portfolio adjustments.

- Despite the negative returns on fixed income in 2022, we maintain that fixed income continues to bring defensive, diversifying and income-generating characteristics to investment portfolios.

KEY TAKEAWAYS

- Fixed income assets have endured a challenging start to 2022, causing some investors to question an allocation to bonds in their portfolios.

- We argue that the recent negative returns on fixed income should be viewed with a longer-term perspective before considering extensive portfolio adjustments.

- Despite the negative returns on fixed income in 2022, we maintain that fixed income continues to bring defensive, diversifying and income-generating characteristics to investment portfolios.

Views as of early June 2022.

Thus far, 2022 has not been kind to fixed income investors – year to date, the Bloomberg U.S. Aggregate Bond Index (Agg) is down 8.5%. Adding insult to injury, the bond market drawdown has come at precisely the point when investors needed it to offset negative returns in equity markets. Isn’t that what fixed income is supposed to do anyway – provide capital preservation when risk assets sell off? At the end of the first quarter, the Agg was down 5.9% for the year, while the S&P 500® Index was down 4.9%, and investors were asking tough questions of their fixed income allocations. Is it time to abandon fixed income? Why even hold bonds if they’re prone to equity-like volatility? At least equities have growth potential, but with bonds, I’m getting equity-like downside without the same opportunity for upside.

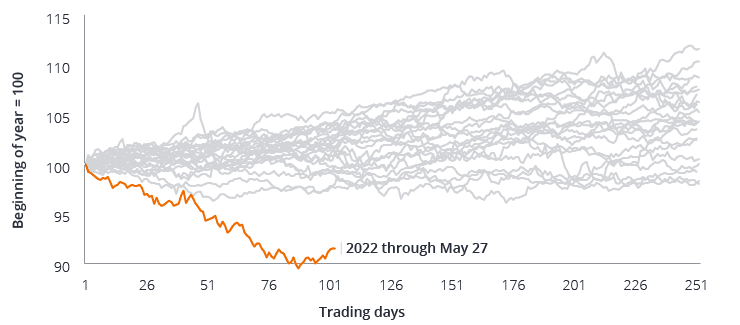

The negative year-to-date returns have been painful for investors, and they have come as a shock. Fixed income did something that would be considered atypical under normal market conditions – it went down a lot, and it did it in a very short period of time, as illustrated in Figure 1.

Figure 1: Agg investors face steep losses amid the pivot to monetary tighteningAnnual trajectory of U.S. Agg returns since 1999

Much has been written about the reasons for the move, namely inflation, war in Ukraine and the Federal Reserve’s (Fed) aggressive policy pivot. Most concerning from an economic perspective has been the persistent and broad-based nature of inflationary pressure in the U.S., and, in our view, this continues to be one of the biggest risk factors for fixed income assets. The reasons for the pullback aside, perhaps it’s useful at this point to zoom out and look at what happened in a broader context, how we might best interpret it, and finally, to answer the question that looms large: Does fixed income still provide the defensive, diversifying and income-earning characteristics that we’ve come to associate with the asset class?

What can Capuchin monkeys teach us about navigating fixed income markets?

Quite a bit, it turns out. For the better part of two decades, Laurie Santos, world-renowned professor of psychology at Yale University, has been studying the human mind, and what makes it unique. By comparing the cognition of humans to animals, she’s able to determine which of our cognitive abilities are unique to us, and which are shared with other species.

Following the 2008 Global Financial Crisis (GFC), Professor Santos decided to test whether loss aversion – our tendency to prefer avoiding losses more than acquiring equivalent gains – is as prevalent in Capuchin monkeys as it is in humans. After introducing her lab monkeys to the concept of money by giving them tokens they could exchange with researchers for food, she conducted an experiment where the monkeys were given a choice to purchase food from one of two researchers. The first researcher offered two grapes in exchange for one token. A second researcher would offer three grapes but would take one grape away before making the exchange. In both cases the monkeys ended up with an equivalent net result – two grapes in exchange for one token. Yet, the studies showed that the monkeys consistently preferred to shop from the first researcher. Apparently, they did not like to feel as if something had been taken from them. Sound familiar?

Perhaps our feelings toward the negative returns in fixed income are not dissimilar to the experiences of the Capuchin monkeys in Professor Santos’ experiment. Perhaps, over the past five years, the fixed income market has behaved more like the second researcher in the study, creating a particular expectation of gain, only to later take away some part of that gain, and in the process leaving us somewhat disappointed with what we got.

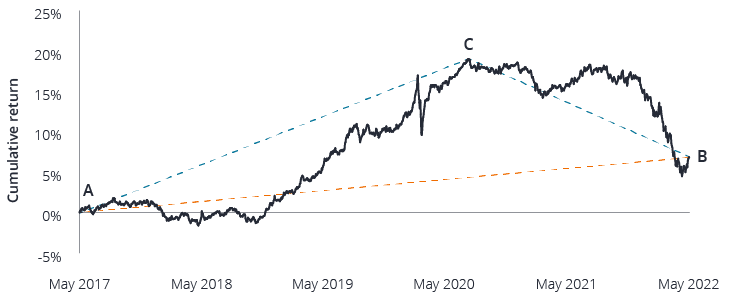

Let’s take a closer look at how this has unfolded. Figure 2 shows the total returns of the Agg over the last five years. The chart tells two distinct stories, yet each concludes at the same endpoint.

Point A to point B shows the hypothetical straight-line five-year cumulative total return on the Agg of 6.9%, or 1.3% annualized. While this return is nothing to get overly excited about, in our view, it doesn’t fall outside an investor’s range of expected outcomes for U.S. fixed income. It certainly doesn’t appear to be the type of return that would prompt investors to consider abandoning their fixed income allocations entirely.

The actual journey from point A to point C and then to point B tells a very different story, even though the endpoint is the same. From May 28, 2017, through August 6, 2020, the Agg rallied 19.0%, thanks to a dovish pivot from the Fed early in 2019 and the extremely accommodative monetary policy response to the COVID-19 crisis. Since August 6, 2020, however, the Agg has given back 12.1% of that original 19.0% return. Even though we’ve ended up in the same place, maybe we feel like we lost something along the way.

Figure 2: The five-year view – two stories, same endpointU.S. Agg cumulative returns

Does fixed income still behave like fixed income?

Professor Santos’ key takeaway from her study is that while our bias for loss aversion is likely embedded in millions of years of existence and evolution, if we’re able to identify our biases and biological limitations, we are better placed to overcome them. The importance of highlighting this for bond investors is that we want to see the recent pullback in the bond market in a broader context, and not overreact to the most recent events.

Now that we have some perspective on the journey we’ve taken over the past five years, we need to go a step further and ask if, during that time, on the whole, fixed income has behaved the way we’d expect it to, or if it has deviated from its true nature. Has it betrayed the trust we placed in it to do a particular job for us?

In line with a goals-based approach to fixed income, we can grade the asset class’ performance according to its ability to perform three key functions within portfolios.

- Defend – we look to fixed income to provide a lower volatility of returns relative to equities. The 5-year standard deviation on the Agg has been 4.0%, up marginally on its 10-year number of 3.5%. That compares to the 16.3% and 13.7% standard deviation on the S&P 500 over the same respective periods. In our view, bonds continue to be a lower volatility asset and they continue to provide more stability than equity-only portfolios.

- Diversify – we look to fixed income to diversify risk exposures in a portfolio. A key measure in this regard is the correlation between equities and fixed income. Looking at the data, the five-year correlation between the Agg and the S&P 500 is 0.15, compared to its 10-year correlation of 0.02. While the returns of equities and fixed income have been more correlated in the past five years, their correlation is still very low. In addition, in our view, the recent sharp move up in bond yields has increased the ability of fixed income to provide diversification to portfolios going forward.

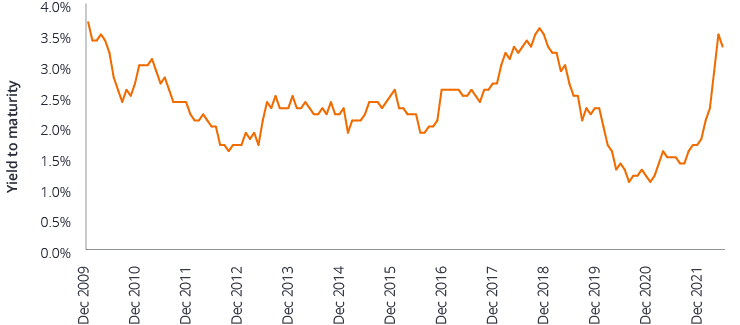

- Increase income – while 2020 and 2021 produced meager income for bond investors, with the rise in interest rates and the widening of credit spreads, yields in fixed income are now close to their post-GFC peak, at 3.3% as shown in Figure 3. So, while the price drops in bonds have been painful this year, buyers of fixed income today are benefiting from some of the highest yields available since the GFC. Where, in recent times, the moniker has been TINA (There Is No Alternative) to stocks, with higher yields on fixed income and a looming slowdown in global growth, TINARA (There Is Now A Reasonable Alternative) may be more appropriate.

Figure 3: Yields nearing their post-GFC peak

U.S. Agg yield to maturity

What should we do now?

In our opinion, it is as important now as it’s ever been that investors maintain investment discipline and portfolio diversification. Fixed income continues to bring defensive and diversifying characteristics to the table, as well as higher income at current yields, and we do not believe investors should abandon these tenets of portfolio management now.

Perhaps an argument can be made that yields on bonds have been falling steadily for 40 years, and now that rates are at historically low levels, bonds yields have nowhere to go but up. While it is an undeniable fact that bond yields have fallen steadily over the past four decades, and this has provided a tailwind for fixed income assets, it cannot be overlooked that falling yields have been a boon to equities in the same fashion. As yields have fallen, financing rates for companies have fallen too, and these lower interest charges on corporate borrowings have boosted company earnings. In addition, and more importantly, long term Treasury rates are a key input in the valuation of equities. As rates have steadily dropped, the value of equities has continued to receive a boost as the lower discount rate has increased the present value of future cash flows. Investors would do well to acknowledge that falling yields have been a tailwind to both equity and fixed income returns, and in the same way, equity markets are unlikely to be spared the challenges of a rising rate environment.

While a potentially rising rate environment may be more challenging for fixed income assets in the future, other asset classes will not be spared the same challenges. In our opinion, the better approach is to maintain an appropriate allocation to equities and fixed income according to an investor’s predetermined risk tolerances, and then work to actively manage within each asset class through security selection and dynamic asset allocation, with the goal of achieving better risk adjusted returns compared to the index.

STAY BALANCED DURING TURBULENT TIMES

Flexible. Resilient. Dynamic

Find out more