Subscribe

Sign up for timely perspectives delivered to your inbox.

Valuations in equities and bonds continue to shift as investors scrutinize the outlook for both company and economic fundamentals. Portfolio Managers Jeremiah Buckley and Greg Wilensky help make sense of the fluctuations.

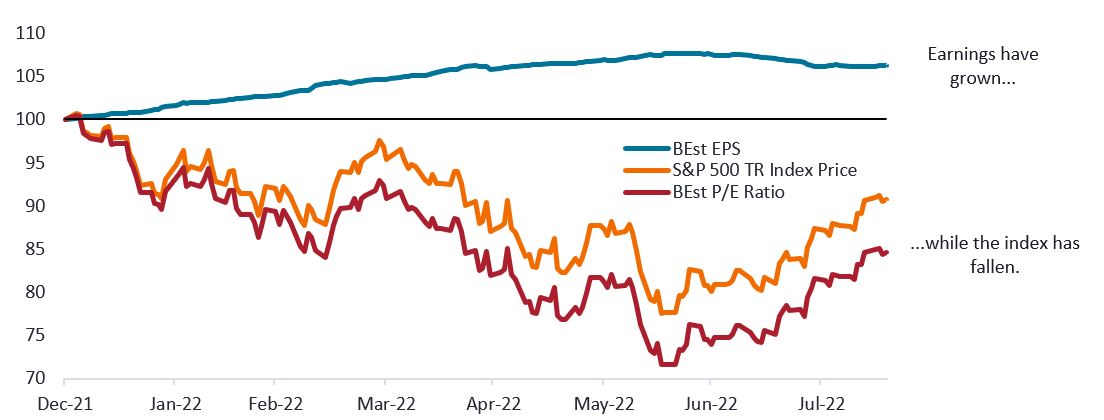

The S&P 500® Index sunk into bear market territory earlier this year. Having recovered somewhat from those levels, investors are left to question whether the worst is over. Considering multiple contraction, the potential for negative earnings revisions, and other market risks, it is instructive to examine where valuations now stand. The chart below shows the S&P 500 price-to-earnings ratio (P/E), which we can break into the index’s price return and earnings. What we have observed this year is that the market drawdown has been primarily due to P/E multiple contraction. Earnings estimates for the S&P 500 have not changed dramatically this year and, in fact, have continued to grow while the index price has dropped. In other words, while earnings are still growing, investors are willing to pay less for those earnings.

S&P 500 Price Performance, Earnings and P/E Ratio

Source: Bloomberg, at 18 August 22.

We began the year expecting S&P 500 earnings growth in the double digits, but that has moderated as several factors ‒ including higher interest rates, higher commodity prices (particularly in energy), and a stronger dollar ‒ have weighed on growth, particularly for multinational corporations and manufacturers. However, many companies have been passing along price increases to customers for the last few quarters. These increases tend to be sticky even after cost pressures ease, and companies are seeing the benefits through higher sales and improving margins.

From a valuation perspective, given the multiple contraction this year, we also believe the equity risk premium, while still generally high relative to history, is now closer to a more normal and rational level. Given these conditions, we expect earnings can grow through the rest of the year and the first half of 2023 ‒ albeit more modestly – and stock prices, which over time are driven by long-term earnings growth, can also begin to move more in line with earnings expectations.

As in the equity market, investors must also consider the balance between fundamentals and valuations when gauging the bond market. At the start of the year, bond spreads were extremely low but have since moved closer to historical norms. Where spreads evolve from here will depend largely on the path of the economy ‒ whether we are able to have a “soft landing”, or the economy sinks further. If the economy does enter an extended period of below-trend or negative growth ‒ which looks increasingly likely ‒ there is the potential for spreads to widen further, particularly given their levels relative to previous periods of below-trend growth or recessions.

That said, if we were to enter a significant downturn, reasonably strong corporate and household fundamentals lead us to expect that defaults will be well below the average of prior recessions. Likewise, if the economic backdrop were to materially improve, with inflation decreasing rapidly and growth remaining relatively stable, high-yield and investment grade corporate bonds would look very attractive at current spread levels.

Nominal bond yields are also significantly higher than at the beginning of the year. For fixed income investors, the fact that both spreads and Treasury yields have increased materially creates a healthier outlook for long-term returns, giving bonds the potential to offer diversification and ballast once again in cross-asset portfolios. In general, we believe volatility like that we have experienced this year can be somewhat of a silver lining by creating dislocations in markets. As valuations and fundamentals realign, perceptive investors can adjust portfolios based on the opportunities that are now being presented.

[jh_content_filter spoke=”bepa,dkpa,fipa,iepa,lupa,nopa,chpa-en,social,dkii,fiii,deii,nlii,noii,swii,arpa,brpa,clpa,copa,mxpa,pepa,uypa,ukii,ukpa”]For more of Jeremiah and Greg’s insight on the equity and bond markets, please listen to their full conversation on our Global Perspectives podcast.[/jh_content_filter]

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Fixed income securities are subject to interest rate, inflation, credit and default risk. As interest rates rise, bond prices usually fall, and vice versa.

High-yield bonds, or “junk” bonds, involve a greater risk of default and price volatility.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. With government bonds, the investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the United States government, are generally considered to be free of credit risk and typically carry lower yields than other securities.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

[jh_content_filter spoke=”hkpi-en, hkpi-zh”]

[/jh_content_filter]