Subscribe

Sign up for timely perspectives delivered to your inbox.

Head of U.S. Fixed Income Greg Wilensky and Portfolio Manager Michael Keough discuss the risks recent bank failures pose to markets and how investors might position their portfolios accordingly.

2023 started with three important themes: An aggressive Federal Reserve (Fed) tightening cycle, inflation still above target, and economic releases showing resiliency. With that backdrop, markets were contemplating a range of economic outcomes, from a soft landing to a hard landing to no landing. But in March, things got even more “interesting.”

There is a saying, “The Fed hikes until something breaks,” and last month, something broke as Silicon Valley Bank (SVB) and Signature Bank (SBNY) failed and the Swiss government had to force a takeover of Credit Suisse by UBS. The implications of these events will be important to what plays out in the markets and economy in the months ahead.

While the final impact of these events is yet to be seen, our main takeaway is that we think the chances of a recession have increased, and the timing thereof might be pulled forward. In our view, this impacts how investors should be positioned for the evolving environment.

The recent turmoil in the banking sector came as a surprise to markets, as most participants viewed the sector as high quality after it spent the past 15 years building up robust capital positions following government regulation in the aftermath of the Global Financial Crisis. Difficulties in the banking sector can have a significant impact on expectations for the economy, the central bank tightening cycle, and market returns.

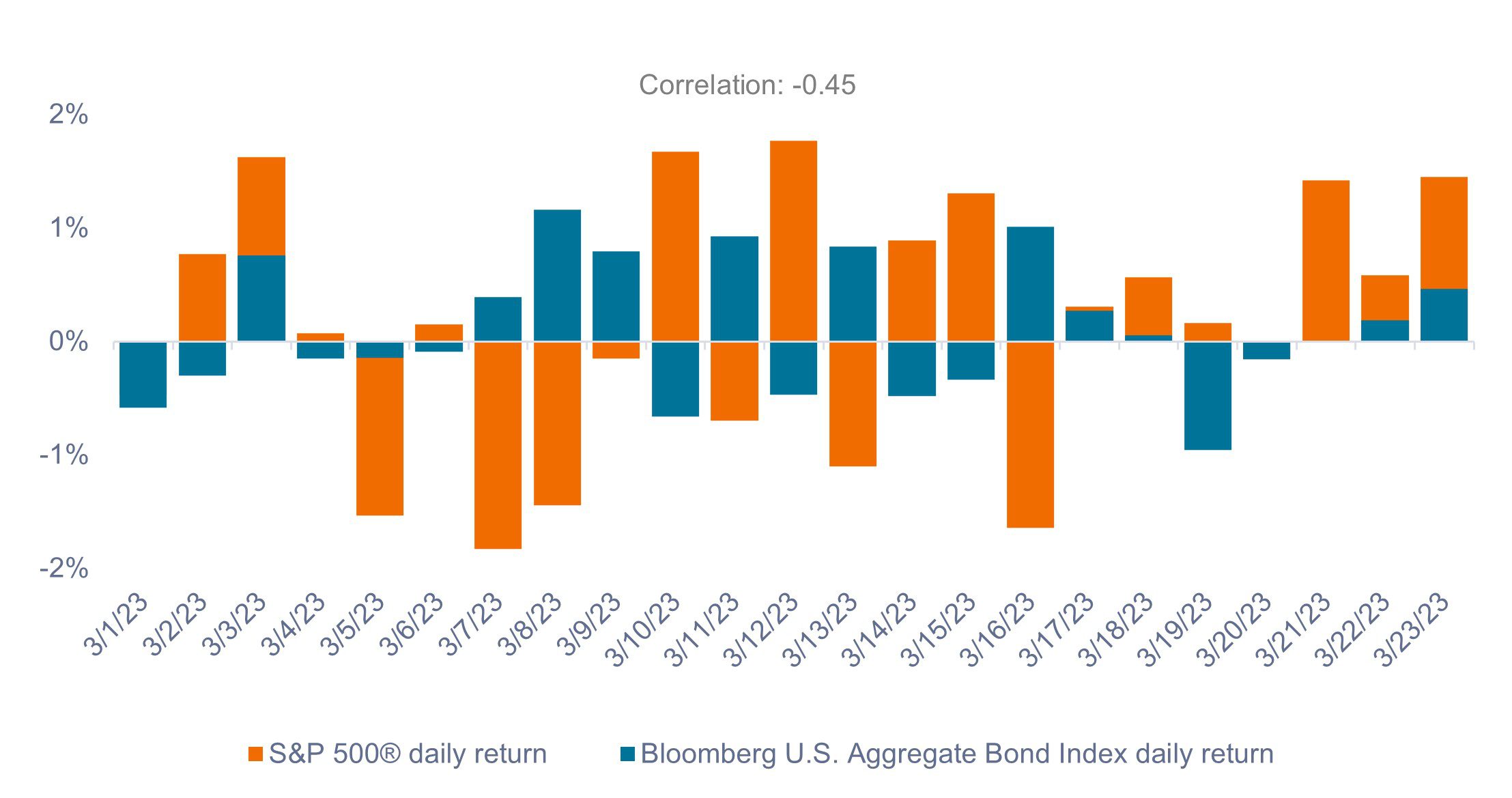

In our view, at times like these, high-quality fixed income can bring much-needed defensive characteristics to a portfolio. As shown in Figure 1, as equities sold off amid the banking sector stress in March, core fixed income largely moved inversely and provided the ballast investors have come to expect from their bond allocation.

Source: Bloomberg, as of March 31, 2023. Past performance is no guarantee of future results.

Source: Bloomberg, as of March 31, 2023. Past performance is no guarantee of future results.

Coming into 2023, we believed high-quality fixed income’s key characteristics of income and diversification had returned after the great reset in rates in 2022, and we felt investors would once again be well served by a core bond allocation. While we did not envision large bank failures, we did feel strongly that fixed income was a necessary portfolio construction tool, as the Fed’s tightening cycle to slow the economy and bring down inflation could create risks. In March, we saw fixed income deliver on what clients needed from their bond allocation.

While investors can appreciate the diversification benefits exhibited by bonds in recent weeks, the pressing question is whether recent bank failures are idiosyncratic events that will be contained or the early signs of a systemic banking crisis? We believe it is still too early to tell for sure, but for now they appear idiosyncratic, as the banks that failed had risks and challenges that were quite distinct from the broader banking sector.

That said, we do think that idiosyncratic events have the potential to become more systemic, particularly if investors and depositors continue to look for the weakest lamb in the flock, so to speak. Irrespective of whether it’s based on truth or rumor, the loss of faith in an institution can swiftly bring about its demise if it results in a run on the bank.

Importantly, banks are also facing a challenging interest rate environment, as short-term interest rates are high and the yield curve is inverted. In a normal interest rate environment, where long-term rates are above short-term rates, banks make money by taking in short-term deposits and lending those deposits at higher rates for longer terms. But when the yield curve inverts, their ability to lend at much higher rates than the rates they pay on deposits becomes more difficult.

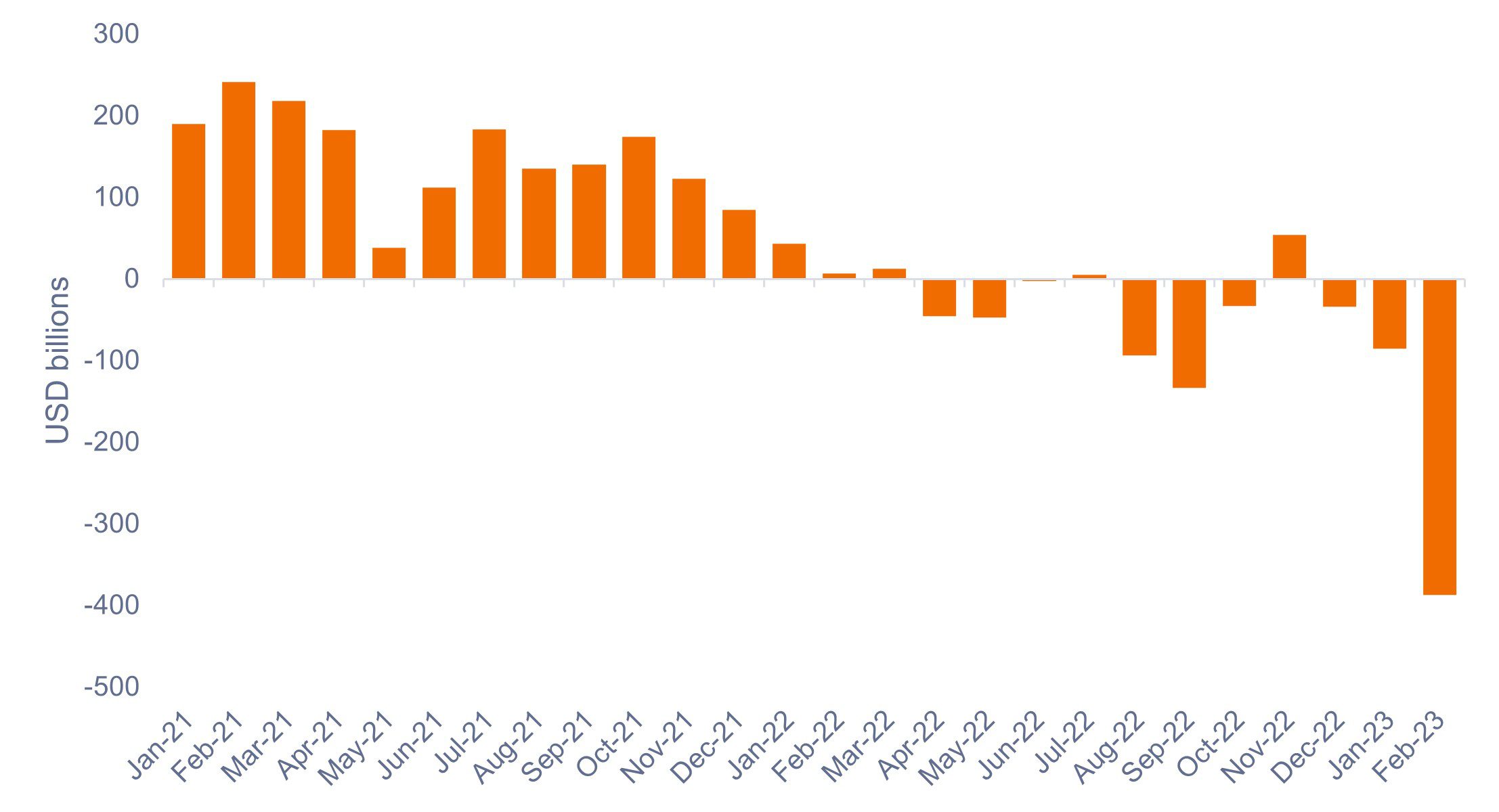

Further, as short-term rates have risen, banks are facing stiff competition for new deposits from higher-yielding money market and bond funds. As shown in Figure 2, U.S. banks have been experiencing a steady stream of deposit outflows since the Fed began raising rates in 2022. This will ultimately limit their capacity to make new loans, while also driving up rates on the loans they make as their funding costs rise.

Source: Board of Governors of the Federal Reserve System (US), as of March 22, 2023.

Source: Board of Governors of the Federal Reserve System (US), as of March 22, 2023.

Credit creation is a key driver of economic growth. Inasmuch as new deposits lead to new credit extension, the inverse also holds true: deposit outflows result in shrinking credit creation. If banks continue to see deposit outflows, we think this will place additional tightening on the economy. Banks will be forced to hold onto liquidity and tighten lending standards by making fewer, less risky, and more expensive loans, ultimately facilitating a slowdown in economic activity.

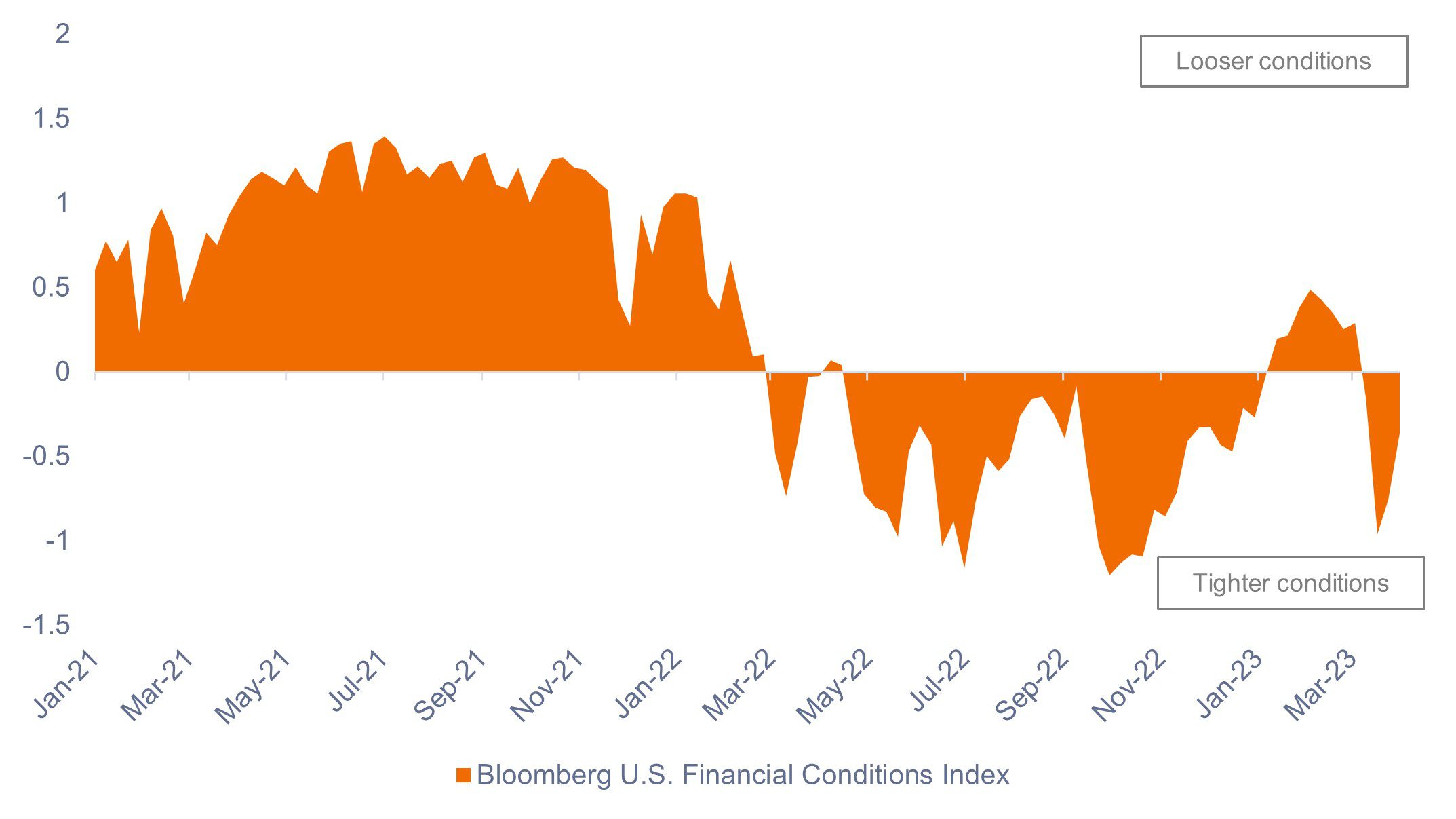

As shown in Figure 3, recent bank failures had a dramatic impact on tightening financial conditions after they’d started to ease early in 2023.

Source: Bloomberg, as of March 31, 2023.

Source: Bloomberg, as of March 31, 2023.

Whether or not we experience a systemic banking crisis, we do think the Fed is in an even tougher spot now as it tries to stave off bank failures while still working to rein in inflation. We believe this is a material negative for the economy and increases the chances of recession. In addition, we think the Fed is much closer to pausing following its 0.25% hike in March, as it considers the effects on the economy of tighter financial conditions and impending slower loan growth from banks.

As investors contemplate how to position their portfolios going forward, we highlight three key points to consider in navigating the current environment:

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Bloomberg U.S. Financial Conditions Index provides a daily statistical measure of the relative strength of the U.S. money markets, bond markets, and equity markets, and is considered an accurate gauge of the overall conditions in U.S. financial and credit markets.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Idiosyncratic risks are factors that are specific to a particular company and have little or no correlation with market risk..

An inverted yield curve occurs when short-term yields are higher than long-term yields.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.