Investors have been contending with particularly volatile markets in 2025. As tariff-driven economic uncertainty continues, how should investors be thinking about asset allocation?

We have seen some notable volatility this year, with the S&P 500® Index losing over 12% of its value in a matter of days in April. The drop of 4.8% on April 3 followed by a fall of 6.0% the following day marked only the 13th time since 1929 that the benchmark experienced back-to-back trading days with declines of 4.5% or more.1

Then, President Trump authorized a 90-day pause on global tariffs, excluding China, and the index staged one of its most impressive one-day rallies ever, with April 9 registering in the top 10 of one-day gains in the index’s history. And volatility has persisted as trade disputes raise concerns about inflation expectations, consumer and business sentiment, and a possible recession.

In this uncertain environment, we think it’s prudent for investors to maintain a balanced portfolio and diversified risk exposures. Global diversification in particular remains critical as different countries see varying degrees of tariff risk, stimulus potential, and underlying economic strength.

What role does diversification play in weathering uncertain markets, and how does active management help investors find opportunity in volatility?

Diversification is important during any market environment, but especially in times of uncertainty. Being diversified across asset classes and sectors can help investors avoid significant drawdowns in one area of concentration. When the economic outlook is unclear and markets express uncertainty, the combination of diversification and a bias toward higher-quality investments across asset classes can offer a sound strategy for staying invested amid potential downside risk.

When volatility creates significant variation in returns across different asset classes, one benefit of being active is having the flexibility to dynamically adjust asset allocations. Within multi-asset portfolios, we can quickly shift weightings toward the strongest, higher-quality opportunities, and reduce exposures to challenged market segments, all with the goal of seeking greater consistency of returns from a truly diversified portfolio. As one example, we can not only adjust our overall fixed-income exposure, but we can specifically focus on high-quality fixed income to add ballast through assets that are more negatively correlated to equity returns during periods of uncertainty.

What guidance would you share with investors who are feeling nervous about elevated volatility?

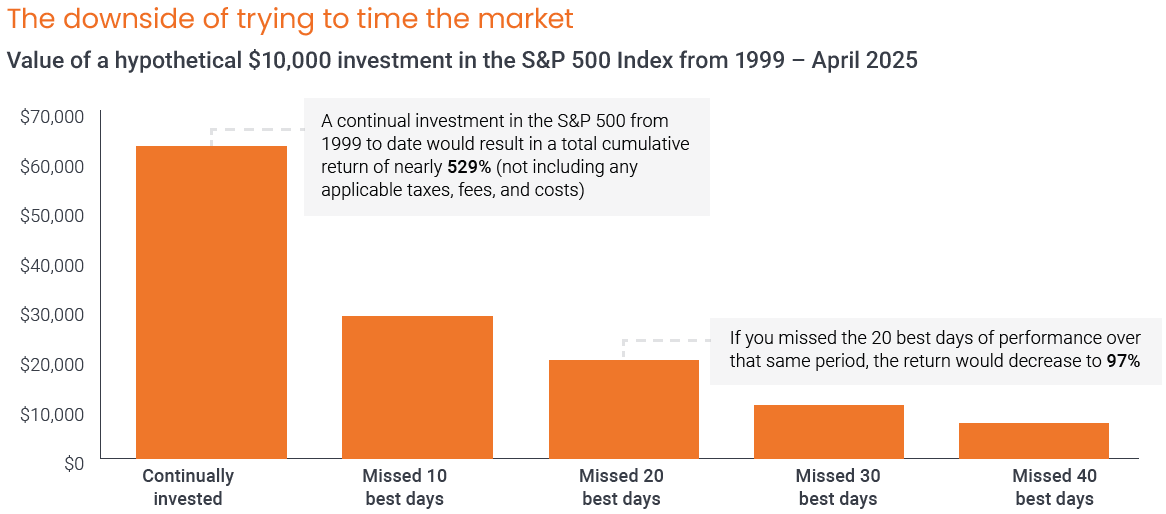

We understand how unsettling volatility can be. Dramatic market swings and talk of a possible recession make it tempting to run for safety. But trying to time the market can often cause more damage to a portfolio than market volatility itself. If your time horizon allows, I will advocate on the side of staying invested.

Source: Bloomberg, as at 10 April 2025. Past performance is no guarantee of future results.

Stocks have often gone on to stage significant moves to the upside following large drawdowns. Case-in-point, the S&P 500’s 9.5% rally on April 9. Additionally, through recessions and the typical post-12-month recovery, cash has historically been the worst performer when pitted against U.S.-based equities and fixed income.

I’d also point out that volatility typically creates opportunities to invest in significantly undervalued assets—to upgrade portfolios, so to speak. Active managers in particular have the chance to capitalize on beaten-down valuations to upgrade positions, and/or shift industry exposures. We have the latitude to look at a wider spectrum of companies, beyond the indices, to find quality business models and companies we think have the potential to adapt to a new global trade paradigm and outperform over the long term. Staying invested with an active approach can potentially carry investors through a downturn with better-than-expected upside.

How can Janus Henderson Direct Advice help investors navigate challenging environments and stay on track with their retirement objectives?

Direct Advice programs and their portfolios deliver a combination of institutional-caliber investment management paired with customized investment guidance. The program is designed to give you confidence in your retirement journey by providing straightforward, diversified investment options matched to your risk preferences and investment goals. Depending on your needs, we offer Active Advice and Snapshot Advice for retirement accounts.

In Active Advice, investors are placed in one of six portfolios designed to match risk tolerance, time horizon, and investment goals by targeting different allocations of equities and fixed income. The portfolio target allocations range from 100% fixed income to 100% equities, and are updated quarterly to maintain consistency with their respective investment strategy and react to the latest market conditions.

Investors in Snapshot Advice are offered a point-in-time recommendation into one of three Global Allocation Strategies. The three strategies offer broad global diversification in a single investment by utilizing the full spectrum of Janus Henderson investment expertise and solutions. The strategies are not rebalanced quarterly and designed to match a specific level of risk and return potential on an ongoing basis.

With both programs, you’ll receive free investment guidance from our team of licensed Investment Consultants. There are no additional costs for advice beyond the underlying fund expenses.

1 Bloomberg, as at 5 April 2025