A surprising amount of long-term return can be lost simply because investments were placed in the wrong account type. With more assets flowing into Roth accounts due to SECURE 2.0, the opportunity to improve clients’ after-tax results through thoughtful asset location has never been greater.

Furthermore, the increasing availability of investment vehicles that may have unique tax and return characteristics – such as private credit/equity, diversified alternatives, and model portfolios – further highlights the importance of taking a strategic approach to asset location.

The SECURE 2.0 Roth catch-up mandate

There are several compelling reasons to consider funding a Roth IRA or Roth 401(k). Investors benefit from tax-free withdrawals once certain rules are met, additional tax diversification when paired with non-qualified and tax-deferred accounts, and increased flexibility for beneficiaries once the account is inherited. With the SECURE 2.0 provision requiring high earners’ catch-up contributions to be made on a Roth basis beginning this year, more dollars than ever are flowing into Roth accounts.

I have discussed some of the considerations for plan sponsors and participants elsewhere. Today, I would like to focus on a separate issue that is becoming increasingly important as Roth balances grow: The question of how investors should allocate investments within their accounts and across their overall household portfolio.

The difference between asset allocation and asset location

The foundation of any investment strategy is asset allocation and, of course, proper diversification. However, diversification should generally be considered at the household level rather than within each individual account, since it often does not make sense from a taxation perspective to apply the same allocation uniformly across all accounts.

This leads to the concept of asset location, which is the practice of placing the right investments in the right types of accounts, such as taxable, traditional, or Roth. Vanguard research has quantified the potential value of effective asset location at roughly 0 to 60 basis points (bps).1 When combined with an optimized withdrawal sequence, there is the potential for an additional 100 bps or more of value.2

Together, these concepts demonstrate why the changes introduced by SECURE 2.0 create a timely opportunity to revisit asset allocation, asset location, tax diversification, and retirement income strategy decisions with clients.

A framework for asset location

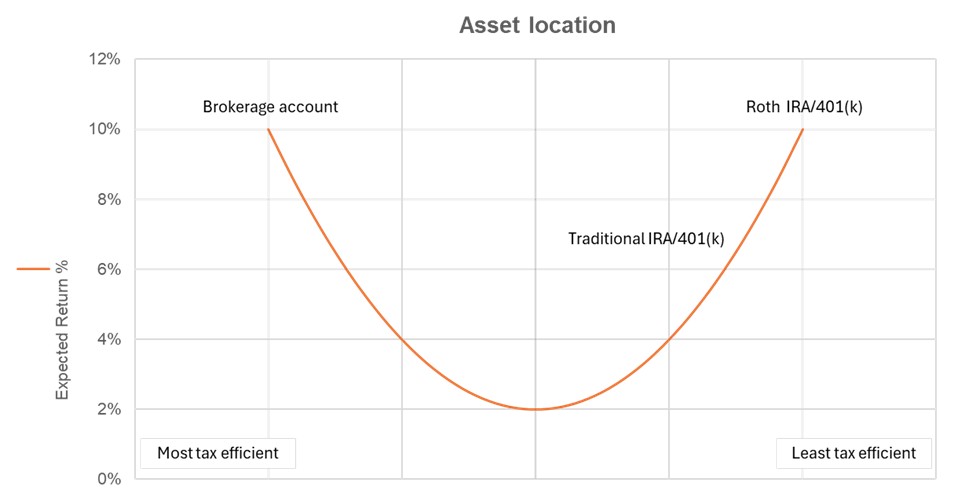

Two factors drive effective asset location:

- Expected return. This is the most important factor. Investments that are expected to experience higher growth can create greater tax drag in taxable or tax-deferred accounts, resulting in larger tax bills in the future.

- Tax efficiency. This is influenced by turnover within a fund and by the level of ongoing taxable income. Higher tax drag generally indicates an investment is a better candidate for a tax-preferred account.

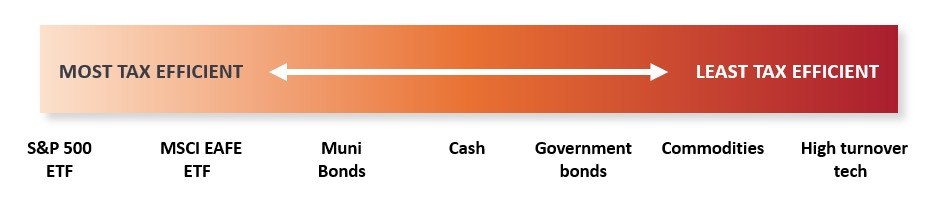

Given these two considerations, an asset location priority list should start with expected return and then incorporate tax inefficiency. A simplified version of a framework originally featured in The Kitces Report3 is as follows.

* Expected return percentages are hypothetical and are only being used for demonstrative purposes.

This spectrum continues to evolve as advisor portfolios become more diversified through the addition of different investment types. Alternatives and private credit strategies often generate significant income and can be tax inefficient. Securitized fixed income can also produce complex income streams that may be better suited to tax-deferred accounts. Tech-focused equities, particularly those with high turnover or rapid price appreciation, may benefit from placement in Roth accounts, where expected return is maximized through tax-free growth.

Source: Janus Henderson Investors.

Of course, the above illustration is just an example; advisors may develop similar spectrums based on specific client holdings. Furthermore, as new investment types become available to retail investors, including private credit, private equity, diversified alternatives, model portfolios, and hedge funds, this framework may require updates.

Implementation and ongoing management

The implementation and management of asset-location strategies are critical to their effectiveness and to ensuring clients understand the potential advantages. Asset location should be implemented across accounts that support the same goal or, if goals differ, the same time horizon. If a client expects to begin taking retirement income sooner rather than later, adjustments may be necessary to ensure the strategy continues to support their financial needs.

Ongoing oversight is essential. As withdrawals occur or new contributions are made, it is important to monitor both allocation and location to ensure the portfolio remains aligned with the intended strategy.

Beyond the technical implementation, advisors must consider investor psychology. Even when the purpose and benefits of asset location have been explained clearly, clients may still focus on individual account performance rather than household-level results. For example, a client may notice that their Roth account is outperforming their traditional IRA and conclude that all accounts should be invested the same way. If this occurs, it provides an opportunity to revisit the principles of household allocation, tax diversification, and after-tax performance.

Conclusion

The continued growth of Roth accounts, accelerated by SECURE 2.0, presents an opportunity for advisors and clients to reassess how investments are allocated and located. Whether those investments are inside a client’s 401(k) account or in individual accounts outside the retirement plan, thoughtful asset location can support improved after-tax outcomes and strengthen long-term retirement planning.

2 Ibid.

3 The Kitches Report, “Exploring The Benefits Of Asset Location.” February 2014.

IMPORTANT INFORMATION

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Tax information contained herein is not intended or written to be used, and it cannot be used by taxpayers for the purposes of avoiding penalties that may be imposed on taxpayers. Such tax information and any estate planning information is general in nature, is provided for informational and educational purposes only, and should not be construed as legal or tax advice.