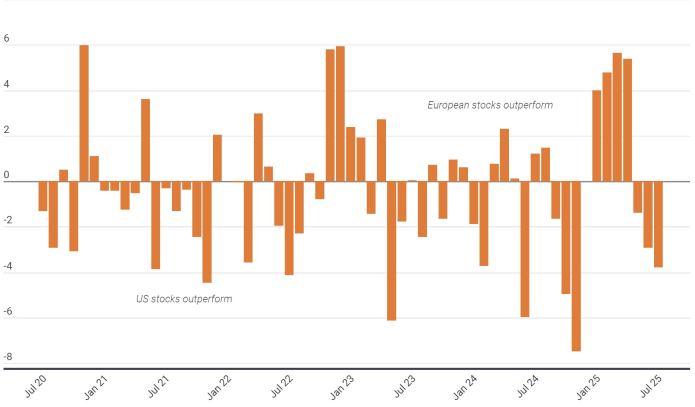

Source: Bloomberg, as of 31 July 2020 to 31 July 2025. Data are monthly and reflect total return (price change + dividends) in the Stoxx Europe 600 Index, which represents large-, mid-, and small-capitalization companies across 17 countries in the European region, and the S&P 500 Index, which reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

European equities have made a splash so far in 2025, with the STOXX Europe 600 Index returning 24.4% in the first half of the year in U.S. dollar terms, trouncing the S&P 500 Index’s gain of just 6.2%. The outperformance was remarkable considering that for more than a decade, U.S. stocks have been the ones to take the lead, often by a wide margin.

But European equites’ gains in 2025 could reflect the start of a new pattern.

Since late 2022, the STOXX Europe 600 has increasingly beaten out the S&P 500 on a monthly basis, sometimes by a significant spread. A number of reasons help explain this turn in performance: the weakening of the U.S. dollar, a resurgence in fiscal and defense spending measures by European governments, historically low valuations, eight cuts to the EU’s benchmark rate since June 2024, and growing prospects for deregulation of the continent’s banking system, which could unlock capital for private investment.

Plenty of downside risks also exist for the region. Chief among them: ongoing uncertainty around U.S. trade policies and the potentially negative impacts from tariffs on corporate margins and the continent’s economic growth. But on balance, the momentum in Europe has been moving in a positive direction – even as valuations for the region’s stocks remain attractively discounted relative to U.S. peers. There’s also more potential for upside, not least of which would be a ceasefire in the Russia-Ukraine war. In addition, politically, many European countries have been swinging to the right, which augurs well for the prospect of deregulation and market-friendly policies.

For investors with little or no exposure to the region, we believe now may be the time to reallocate for what finally could be more than a one-horse race.

International equities could help diversify investment portfolios given the prominence of sectors such as financials and industrials (i.e., not tech) outside the U.S. As the U.S. turns inward, countries are stepping up with stimulus, which will benefit companies critical to local economies. This kind of targeted investment could finally drive multiple expansion in select ex-U.S. firms, many of which trade at a discount to U.S. peers.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.