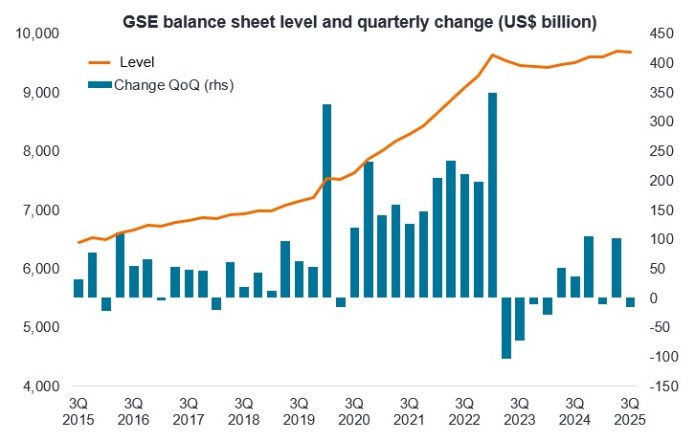

Source: FRED, St. Louis Fed, Government-Sponsored Enterprises; Total Assets (Balance Sheet), QoQ = quarter-on-quarter, 3Q 2015 to 3Q 2025.

Washington’s latest policy actions, both from the Trump administration and the U.S. Federal Reserve (Fed), are injecting large amounts of liquidity into the financial system, even as officials insist that they are not reviving quantitative easing (QE). Most notably, the administration ordered the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac to purchase US$200 billion of mortgage‑backed securities, aiming to push down mortgage rates and support housing demand.1

In the coming months, we will start to see this flow through to the official figures reported in the chart above. Mortgage rates on 30-year fixes have already come down from close to 7% a year ago to 6.1% in early February 2026.2 This lower rate should help the housing market but is not so low that it will trigger a large wave of prepayments. Stability in MBS should have a positive read across to other areas of residential credit and commercial mortgage-backed securities.

Meanwhile, the Fed has restarted balance‑sheet expansion by buying short‑term Treasury bills, with estimated purchases of US$220–300 billion in the first year.3 Combined with recent rate cuts and the expectation for further cuts, the policy mix is accommodative. This influx of liquidity can buoy asset prices by creating a perceived “floor” under markets and placing a lid on fixed income spreads.

We remain very constructive on credit as growth remains resilient, inflation is contained and favorable policy action in mortgages has the potential to trigger positive second-round effects across securitized assets.

– John Lloyd, Fixed Income Portfolio Manager.

For more views, visit our latest:

Multi-Sector Credit Asset Allocation Perspectives

1Source: White House, 8 January 2026.

2Source: Bloomberg, Freddie Mac 30-year mortgage rate, 6.95% as of 30 January 2025 and 6.11% as of 5 February 2026. Rates may vary over time and are not guaranteed.

3Source: Federal Reserve, Janus Henderson estimates, 11 December 2025.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage-backed securities and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

Agency Mortgage-Backed Securities (Agency MBS): A type of asset-backed security that is specifically secured by a collection of mortgages. These securities are issued by one of the three government-sponsored enterprises (GSEs): Fannie Mae (Federal National Mortgage Association), Freddie Mac (Federal Home Loan Mortgage Corporation), or Ginnie Mae (Government National Mortgage Association). They buy mortgages and either hold them to maturity or repackage them into Agency MBS, which helps provide liquidity to the mortgage market.

Balance sheet: A financial statement that summarises an entity’s assets and liabilities at a particular point in time.

Fiscal policy: Government policy related to setting tax rates and spending levels.

Liquidity: How quickly and easily an asset can be bought and sold (and/or converted into cash). Higher money supply typically increases liquidity.

Monetary policy: The policies of a central bank aimed at influencing inflation and economic growth. Monetary policy tools include setting interest rates and controlling the supply of money.

Prepayment: The risk that a borrower pays off a loan such as a mortgage earlier than scheduled, typically when interest rates fall and refinancing becomes attractive. This can affect MBS as it forces investors to reinvest the principal at lower, less favorable rates.

Spread: The difference in yield between securities with similar maturity but different credit quality, often used to describe the difference in yield between corporate bonds and government bonds. Widening spreads generally indicate a deteriorating creditworthiness of corporate borrowers, while narrowing indicates improving.

Quantitative Easing (QE): A central bank monetary policy occasionally used to increase the money supply and lower financing costs by buying government securities or other securities from the market.

Treasury bill: Short-dated debt securities issued by the U.S. government with a maturity of one year or less.