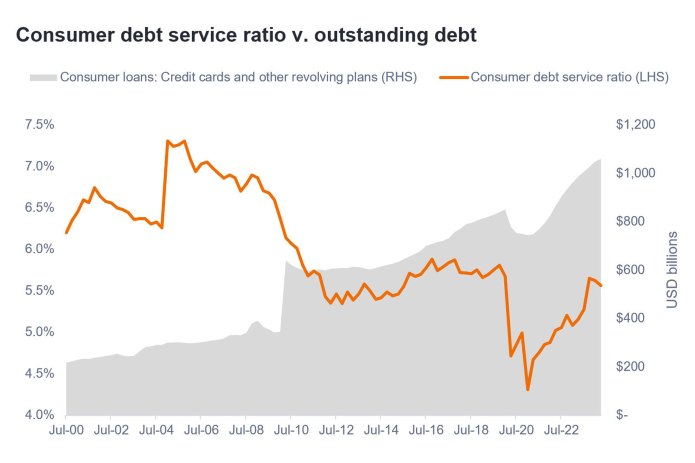

Source: Board of Governors of the U.S. Federal Reserve System, as of Q2 2024. Consumer debt service ratio = Consumer debt service payments as a percentage of disposable personal income.

The U.S. consumer is in much better shape than one might believe reading the press. While some lower-income households might be experiencing financial strain, middle- and upper-income households – which represent a much larger portion of the overall economy – have benefited from stock portfolios and home values rising to all-time highs, low levels of unemployment, and wages that continue to grow well ahead of their pre-COVID rates. As active fixed income managers, we have the ability to be selective about the types and quality of consumer credit we are exposed to and can seek to avoid concerning parts of the market.

– John Kerschner, Head of US Securitised Products

- The Chart to Watch series highlights data trends that matter. Our investment teams provide insight on what these mean for investors.