Entering 2025 we suggested that, while volatility was to be expected, the outlook for global equities was largely positive. An economic hard landing had been averted, moderating inflation created a path for policy rates to become less restrictive, and the incoming Trump administration offered the prospect of a pro-growth agenda in the world’s largest economy.

While the path has taken some unforeseen turns – namely the market underappreciating the scale of President Trump’s tariff proposals – it appears that the most acute bout of volatility has passed and a series of complementary trends supportive of global equities is emerging. Among these are inferences that reciprocal tariffs won’t reach the levels initially advertised, the potential for the Federal Reserve (Fed) to continue lowering rates now that the worst-case scenario of tariff-induced inflation has receded, and market-friendly developments in Europe and Asia.

Although the coalescence of these forces should result in a continued broadening of equity returns, geopolitical and macro uncertainty could result in additional volatility over the near term. Such dislocations, however, can lead to attractive entry points in the growth stocks whose leadership over much of the past two years resulted in valuations possibly becoming unmoored from fundamentals.

No longer just a U.S. story

Trade may be under attack in the U.S., but other regions continue to prioritize the benefits of the free flow of goods. The eurozone was established decades ago for this very reason. New barriers to long-standing trading partners may force European leaders to initiate needed pro-growth reforms. We see improvements on this front. Easing onerous regulations on the trading bloc’s financial sector could lead to capital more easily flowing toward productive enterprises.

Another stimulative development is higher investment in the defense sector to address the challenges posed by a shifting geopolitical landscape. This has only been made possible due to nations such as Germany accepting higher budget deficits.

In Asia, Japan’s efforts to institute shareholder-friendly reforms and recent China stimulus prioritizing consumption should be supportive of the region’s equities.

As is also the case in the U.S., modest progress on trade should give global central banks flexibility to lower rates to support flagging economies. Such policy support and pro-market reforms may help compensate the world’s economy as it moves away from peak globalization. Meanwhile, the ascendent trends of nearshoring and reshoring present both risks and opportunities for the corporate sector. Reengineering global supply chains away from lowest-cost production sources along with higher barriers to entry carry economic costs, but the void left by multinationals will likely be filled by local or regional suppliers, creating opportunities for investors to identify the winners in this new regime.

Diverging policy and economic prospects could mark a shift away from U.S. market dominance. A common argument is that, with its exposure to themes like artificial intelligence (AI), there is little reason to invest outside the U.S. Yet technological innovation will invariably be dispersed throughout the global economy, boosting productivity across geographies and industries.

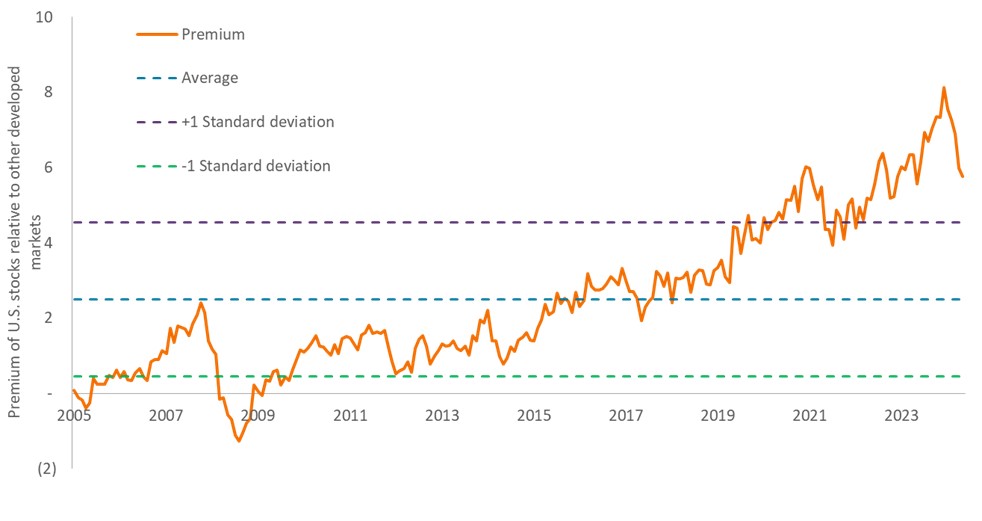

As myriad forces provide a tailwind for international stocks, investors may find it harder to justify the still near-record premium U.S. equities command relative to international peers. While much of the U.S. domination was premised on durable growth stories, market dynamics also played a role, with global flows pushing valuations higher. U.S. year-to-date underperformance may weaken that tailwind.

U.S. equities still command a hefty premium to international peers

While off its peak, the forward price-earnings ratio of U.S. large-cap stocks still resides well above its historical range relative to ex-U.S. peers, potentially creating attractive entry points for those seeking exposure to pro-growth international stories.

Source: Bloomberg, Janus Henderson Investors. As of 30 April 2025.

An acceleration in innovation

Roughly every 20 years, a wave of innovation emerges that compels corporations to rewrite their business models. AI has the power to be one of the greatest disruptors in this long line. For much of the past two years, investors seeking AI exposure focused on its ecosystem, namely the platforms and hardware essential to bringing this technology to market. We believe the next opportunity for investors is to seek out the companies that will most effectively harness the power of AI to expand markets, create new products, and increase efficiencies across their operations. As with every wave of innovation, some companies will find success while others will fail to grasp the magnitude of the opportunity.

Innovation is not limited to technology. Within healthcare, GLP-1 drugs continue to prove their efficacy in addressing a widening range of conditions. Not only are lives being saved, but there are also economic benefits in the form of fewer workdays lost to illness and the extension of careers. Such outcomes will be especially welcome in advanced countries with high rates of obesity and poor demographics.

Healthcare has thus far underperformed broader equities in 2025, with policy uncertainty in the U.S. being a contributing factor. However, we doubt authorities will stifle healthcare innovation given the sector’s recent track record, including advancements in gene therapies, biologics, and immunotherapies.

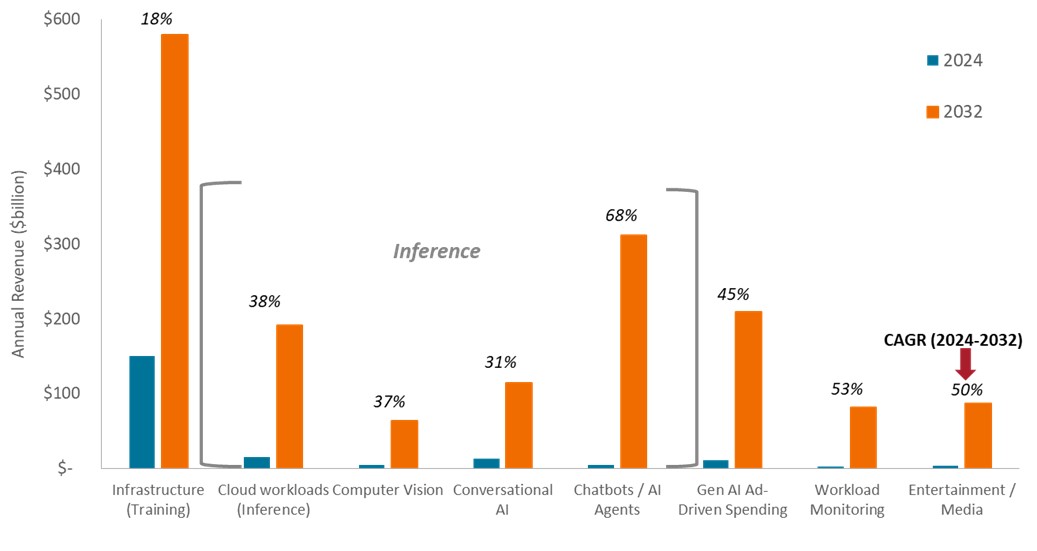

AI primed to unleash efficiencies across the global economy

As evidenced by the expected growth in a range of AI applications over the next several years, hardly a region or industry won’t find uses to harness this technology to grow markets, increase productivity, and boost earnings.

Source: Bloomberg Intelligence, as of 24 March 2025. The example provided is hypothetical; growth rates based on estimated 2032 revenue levels. No forecasts can be guaranteed. CAGR = compound annual growth rate.

Small caps gaining ground

Although our call for a market broadening has begun to play out, small caps – especially in the U.S. – have yet to fully participate. Weighing on U.S. small caps were growing concerns that a stagflationary environment could come to pass in the wake of tariffs, robbing smaller stocks of both the economic expansion and lower interest rates that tend to prove supportive of the asset class. These headwinds will likely prove ephemeral as greater clarity emerges on trade and a resumption of policy easing provides relief for rate-sensitive small caps. Globally, small caps could further benefit from two previously discussed trends: reshoring and the broad deployment of AI.

Staying proactive in volatile markets

The near-term outlook for global markets remains clouded given geopolitical and policy uncertainty. Developments have, however, moved in investors’ favor as policymakers recognize the likely drag on global growth posed by excessive trade barriers. As the global economic framework remains in flux and markets volatile, equity investors should prioritize resilient companies that are capable of growing earnings in a variety of economic environments and are exposed to durable, secular themes.

One cannot predict from where the next surge in innovation will emerge, but it inevitably will, upending legacy business models and industries upon its arrival. During disruptive times like these, investors should embrace volatility to seek out the companies that are best positioned to improve their business models. Volatility can also lead to price dislocations that provide attractive entry points to companies already recognized as being on the right side of disruption. Implicit in executing these tactics is a willingness to deviate from benchmarks, which do not reflect differentiated viewpoints nor allow for the agility necessary to separate the wheat from the chaff in these times of transition.

IMPORTANT INFORMATION

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Premium/Discount indicates whether a security is currently trading above (at a premium to) or below (at a discount to) its net asset value.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Volatility is the rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.