Knowledge. Shared Blog

March 2020

A Financial Professional’s Guide to the Coronavirus Correction

-

Matt Sommer, CFA, CFP®, CPWA®

Matt Sommer, CFA, CFP®, CPWA®

Sr. Managing Director

Volatile periods such as the one we are experiencing with the coronavirus-driven market correction offer an opportunity for financial professionals to demonstrate their value. Retirement and wealth strategies expert Matt Sommer and Han Na Lim, Ph.D., assistant professor at Kansas State University, outline three strategies financial professionals may want to consider to help clients navigate uncertainty.

Following the worst one-week performance for the U.S. stock market since the 2008 financial crisis, many clients are undoubtedly unnerved. Some investors may be tempted to liquidate their equity holdings, while others may be susceptible to overtures from other institutions or financial professionals.

While no one can predict the duration or severity of the current market correction, volatile periods such as this offer financial professionals an opportunity to cement their most important client relationships. We believe there are three areas where financial professionals can add value immediately: 1) incorporate behavioral science into advice and communications, 2) generate tax alpha through strategic tax-loss selling and Roth conversions, and 3) review fixed income mandates to assess correlation coefficients with equity managers and downside capture performance.

Incorporate Behavioral Science

While the financial professional-client relationship has historically been built on the transfer of information, more recently there has been the acknowledgement that financial professionals do much more than provide technical advice and recommendations. Financial professionals are instrumental in providing the encouragement and motivation for clients to take prescriptive actions such as saving more for retirement or establishing a wealth transfer plan. Similarly, financial professionals also help clients manage and mitigate the emotional aspects of staying invested during periods of market turmoil and declining portfolio valuations. According to Vanguard’s “Advisor’s Alpha” study, approximately half of the value financial professionals offer clients are these forms of behavioral coaching interventions.1

According to Daniel Kahneman, author of “Thinking, Fast and Slow,” individuals process information using either System 1 or System 2. System 1 processing is fast, instinctive, automatic and emotional. System 1 is based largely on heuristics, or mental shortcuts, and helps individuals save time through quick decision-making. Unfortunately, System 1 processing also results in emotional biases and cognitive errors if not corrected. System 2 processes information slowly, in a deliberate, conscious and logical progression.2

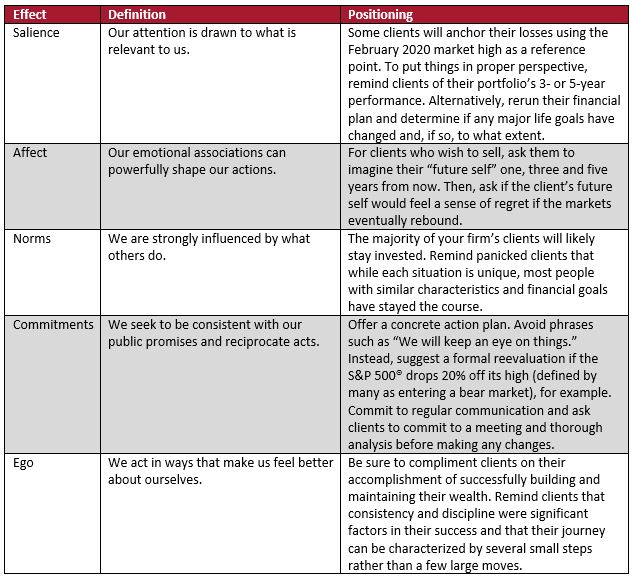

Panicked clients are processing recent market events relying heavily on System 1. The financial professional’s job in the days ahead is to help clients engage more System 2 processes, which should result in a more balanced and calm perspective. We suggest financial professionals consider using one or more of the techniques outlined in the table below.

How to Incorporate Behavioral Science into Financial Advice

[caption id=”attachment_275545″ align=”alignnone” width=”633″] This table is a modified version of the MINDSPACE theoretical framework. The first two columns come directly from the framework, while the third column has been modified to reflect current market conditions. Source: Vlaev, I., Nieboer, J., Martin, S., & Dolan, P. “How behavioural science can improve financial advice services,” Journal of Financial Services Marketing, March 2015.[/caption]

This table is a modified version of the MINDSPACE theoretical framework. The first two columns come directly from the framework, while the third column has been modified to reflect current market conditions. Source: Vlaev, I., Nieboer, J., Martin, S., & Dolan, P. “How behavioural science can improve financial advice services,” Journal of Financial Services Marketing, March 2015.[/caption]

Generate Tax Alpha

There are two potential tax planning opportunities financial professionals may want to consider recommending to clients. The first is to harvest capital losses. Tax-loss harvesting is an exercise typically associated with year-end planning. There is no reason, however, that taking capital losses could not occur at any time during the year. (As a reminder, to generate a capital loss, a wash sale must be avoided. A wash sale occurs when a security is sold at a loss and the same or a substantially similar security is bought within 30 calendar days before or after the sale.)

Of course, clients who sell a security for a loss and wait the 30 days are at risk of missing a sharp market rebound. One alternative may be to buy an equal number of shares in the existing security, then sell the original lot after 30 days of new purchase. Obviously, this alternative works best if the client has the liquidity to make an additional purchase. Clients who choose not to harvest losses presently may very well be rewarded with a market rebound but miss the opportunity to accumulate valuable capital losses. When it comes to tax-loss harvesting, there are no certainties if the intent is to hold the position long term. All options should be explored with clients and their tax financial professionals.

A second tax planning opportunity is to selectively convert individual equity positions from a traditional IRA to a Roth IRA. As a reminder, the income limitations on Roth conversion eligibility has been repealed. Any client, regardless of income, can convert all or part of their traditional IRA. Roth conversions can be executed by transferring specific holdings in-kind. For tax reporting purposes, the IRA custodian will report the fair market value of the security the day the conversion occurs.

This strategy works best if the traditional IRA currently holds a stock, mutual fund or ETF that has experienced a significant devaluation, but the future prospect remains favorable and the client intends to hold the position indefinitely. In short, the position can be converted at its presently depressed fair market value with the potential for all subsequent appreciation to occur within the tax-free shelter of a Roth IRA. As a reminder, a Roth conversion is irrevocable, so it is imperative that the client is certain of their decision and ample liquidity is available to pay the resulting income tax liability.

Review Fixed Income Mandates

Most investors view bonds as an investment that generates income. While this characterization is accurate, the primary purpose of owning bonds – especially in a low interest rate environment – is to provide diversification benefits. Although asset class correlations tend to converge during periods of extreme market volatility, bonds can still provide a buoying effect to help offset equity losses.

As defined by Morningstar, there are three major categories of U.S. intermediate bond mandates: core, core plus and multi-sector. The difference among these categories is based on the allowable high-yield allocation. High-yield allocations cannot exceed 5% for core managers, 35% for core plus managers and 65% for multi-sector managers. Larger allocations to high yield are likely to create an equity-like experience, thus reducing the diversification benefits of bond ownership. Further, security selection is paramount. Given the global impact and uncertainties of the coronavirus, those issuers that pass a vigorous fundamental analysis will be in the best position to satisfy future interest and principal obligations.

We recommend a review of bond managers and full assessment of their performance. This exercise may provide additional insights into how the managers perform during periods of market stress and, more importantly, how they complement equity managers in your client portfolios.

Next Steps

The current market environment is trying, both for financial financial professionals and market participants. Nonetheless, these periods of volatility and uncertainty offer an opportunity to learn new techniques that can improve client service. Your Janus Henderson Investors representative is available to share additional insights regarding the coronavirus and associated practice and wealth management resources.

1Source: The Vanguard Group. “Putting a value on your value: Quantifying Vanguard Advisor’s Alpha,” 2019.

2Source: Kahneman, D. Thinking, Fast and Slow. Farrar, Straus and Giroux, 2011.

Essentials of Wealth Planning

Comprehensive wealth planning strategies to provide unparalleled value to your best clients throughout the year with ideas on tax, financial, estate and retirement planning.

Learn More

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe