It can be a challenge to identify the direction of asset prices when market moves are often predicated on the announcement of a single person. Wild market swings – once worthy of headlines – are at risk of becoming tedious. Aggressive price anchoring (start with a shockingly high tariff so that anything lower seems reasonable) by the White House means the world has had to adjust rapidly to a potentially new trade regime.

At the time of writing, only a handful of countries had reached a preliminary agreement with the US and legal opposition means some of the tariff increases might yet be revoked. The final tariffs could therefore be worse than expected, provoking recessionary fears and higher inflation, or more moderate, likely triggering a relief rally. Either way, outcomes among countries will differ. The US would be among the most impacted – its consumers will likely face higher prices and this may weigh on economic growth as households retrench and companies revisit investment plans. Ironically, Europe and China may see lower inflation as goods destined for the US seek an outlet in these regions.

President Trump sees unpredictability as a useful bargaining tool, but it also widens the range of economic outcomes. Fixed income markets dislike uncertainty and term premiums have risen on longer-dated US bonds as investors demand more compensation (higher bond yields) to lend for longer periods.

A well-worn path

But we should not fixate on tariffs. Most of the moves we have seen in fixed income markets reflect longer-term trends – not least the repricing of the cost of capital. The zero and negative interest rate policies that characterised the decade after the Global Financial Crisis are now viewed as an aberration.

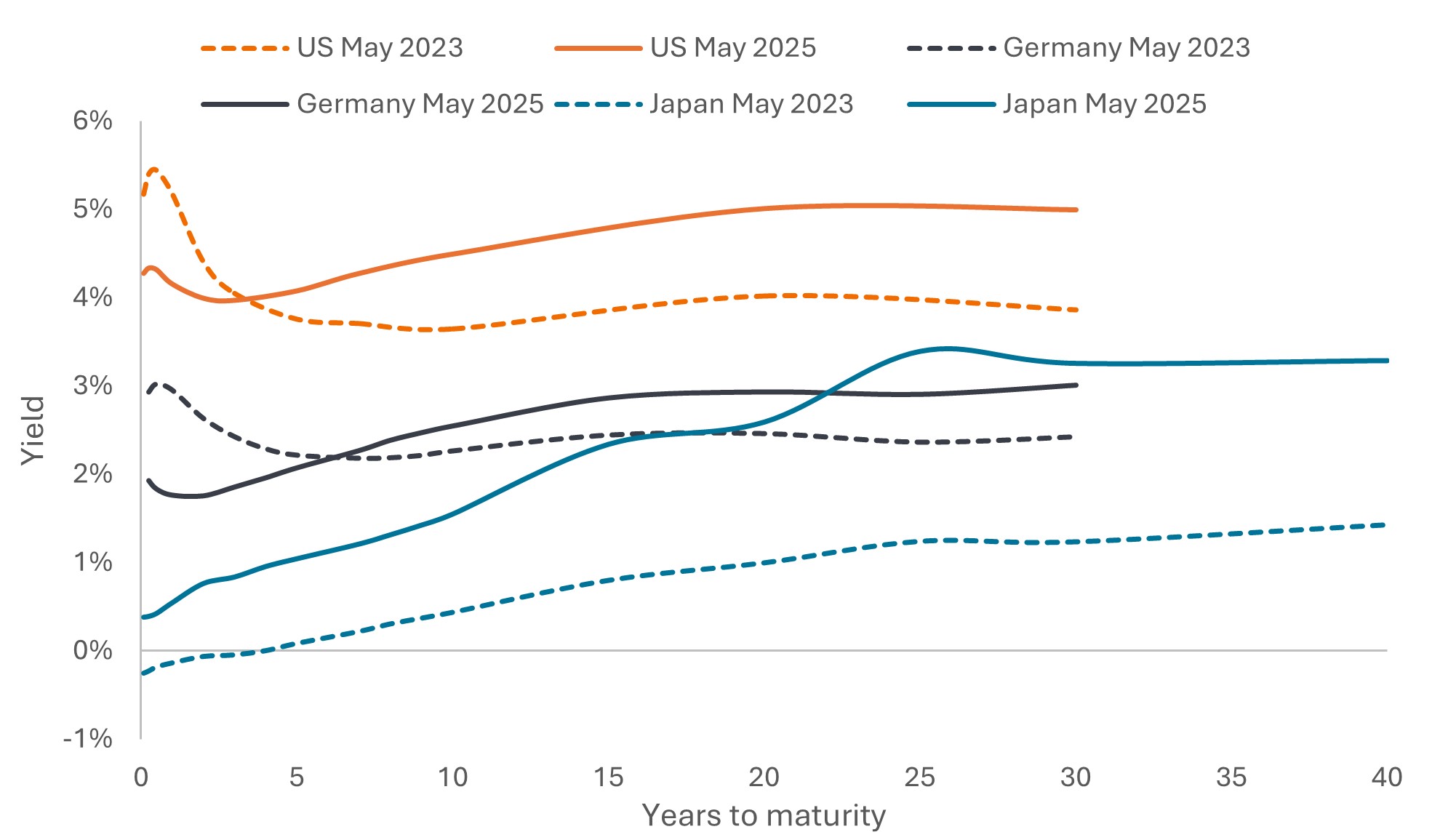

We have returned to a path where markets pay attention to debt. Many governments are lacking fiscal discipline (borrowing is high despite economies being at or near full employment) and defence spending is ramping up. Throw into the mix central banks actively shrinking their balance sheets and the onus is on the private sector to buy all the newly created government debt. Structural reform, such as the Dutch pension fund transition, meanwhile, is likely to encourage allocations towards equities. Longer-dated bond yields have therefore risen. This is a global phenomenon: yield curves, which plot government bond yields against their term to maturity, have steepened in Germany and Japan, not just the US (Figure 1).

Figure 1: Yield curves have steepened globally

Source: Bloomberg, US Treasury bond, German government bond, Japanese government bond, yield to maturity, 31 May 2023 and 28 May 2025. Yields may vary over time and are not guaranteed.

The flip side of higher bond yields is that investors can harvest higher income. Coupon or interest income has historically been the biggest contributor to fixed income total returns over time. Do we think longer dated bonds are near their peak yields? Probably, but concerns about fiscal discipline, US Federal Reserve (Fed) independence (Jerome Powell’s term as Fed chair expires in May 2026), and the willingness – or otherwise – of overseas investors to hold US assets could create volatility in the coming months. That said, while there may be more willingness for non-US investors to diversify away from US Treasuries, we still see US Treasuries playing a critical role in investors’ portfolios for decades to come.

Consulting the map

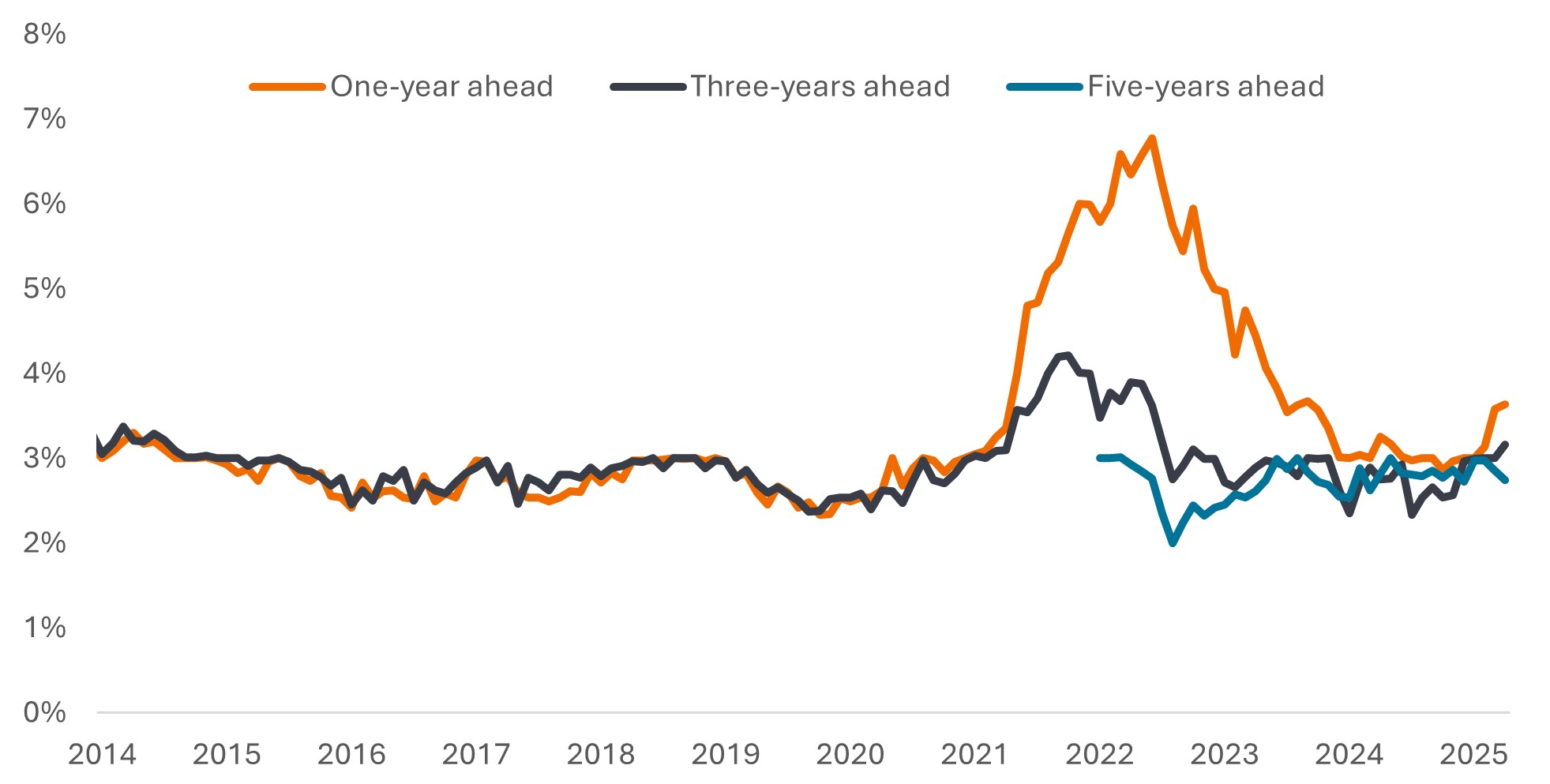

Inflation has subsided globally from the highs of 2022, but its downward path had already started to flatten somewhat and that was before the potential impact from increased trade friction. Moderating inflation allowed major central banks (outside of Japan) to lower interest rates over the past 12 months and we see a path to further cuts from the European Central Bank (contained inflation) and the Bank of England (soft economic growth). If tariffs weigh on the US economy, we could see cuts before year-end, but the Fed has been vocal about needing to see more data. The collapse in the oil price could be a harbinger of impending economic weakness (and not just a reflection of rising OPEC output) but the Fed could face a credibility issue if it cuts interest rates with inflation above its target. The Fed will be keeping a watchful eye on inflation expectations (Figure 2). Much will depend on how labour markets play out over the coming months.

Figure 2: US inflation expectations

Median one-, three-, and five-year ahead expected inflation rate

Source: Survey of Consumer Expectations, © 2013-25 Federal Reserve Bank of New York (FRBNY). April survey released 8 May 2025.

Some of the yield curve steepening described earlier reflects rate cuts, and any further cuts are likely to flow through to the front of the yield curve, with the impact on longer-dated bonds more equivocal. In such an environment, we believe high quality, shorter-maturity bonds offer more insulation from uncertainty. Investors may also look more globally, where the path to interest rate cuts is more clearly signposted.

Looking across the valley

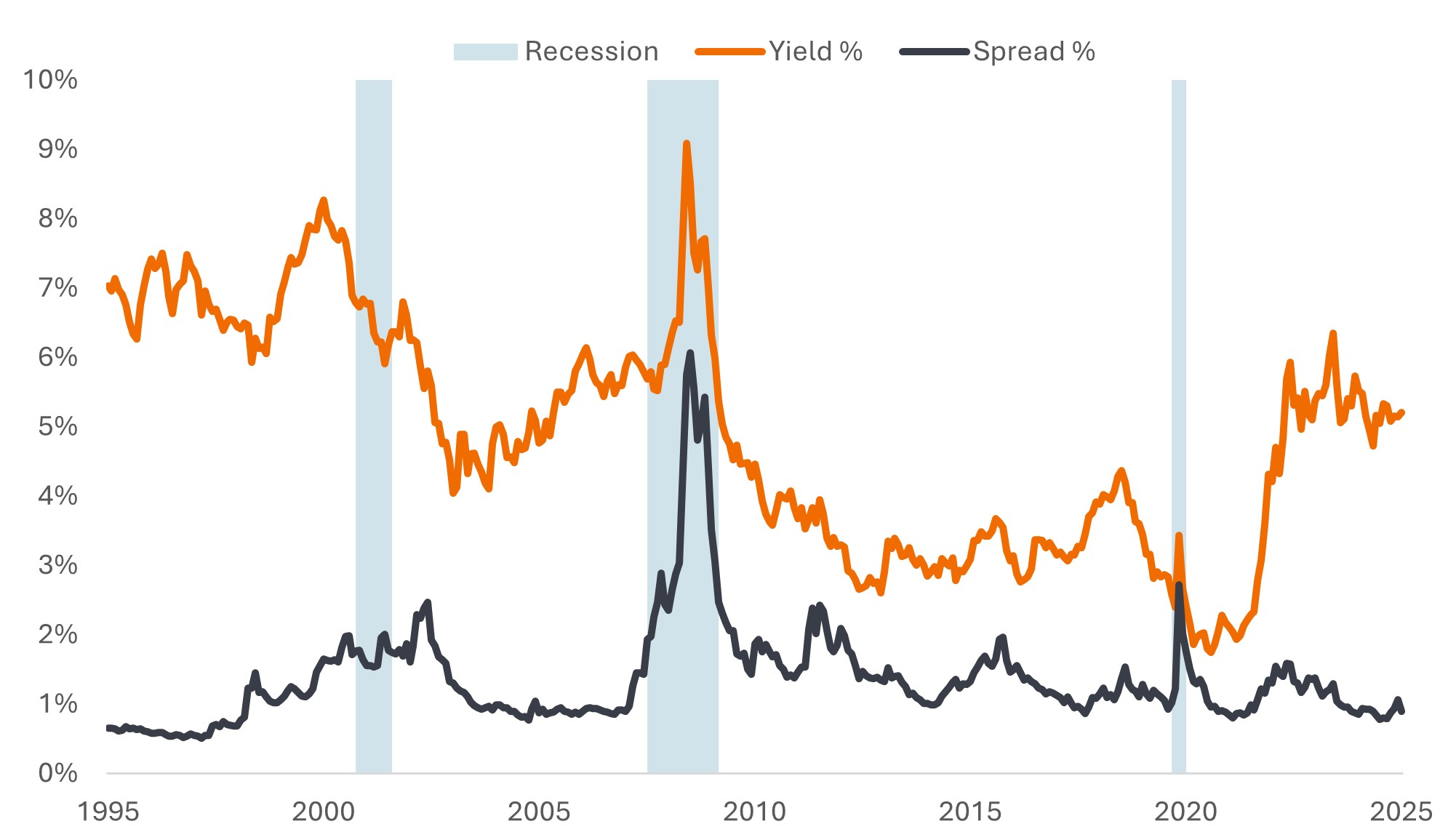

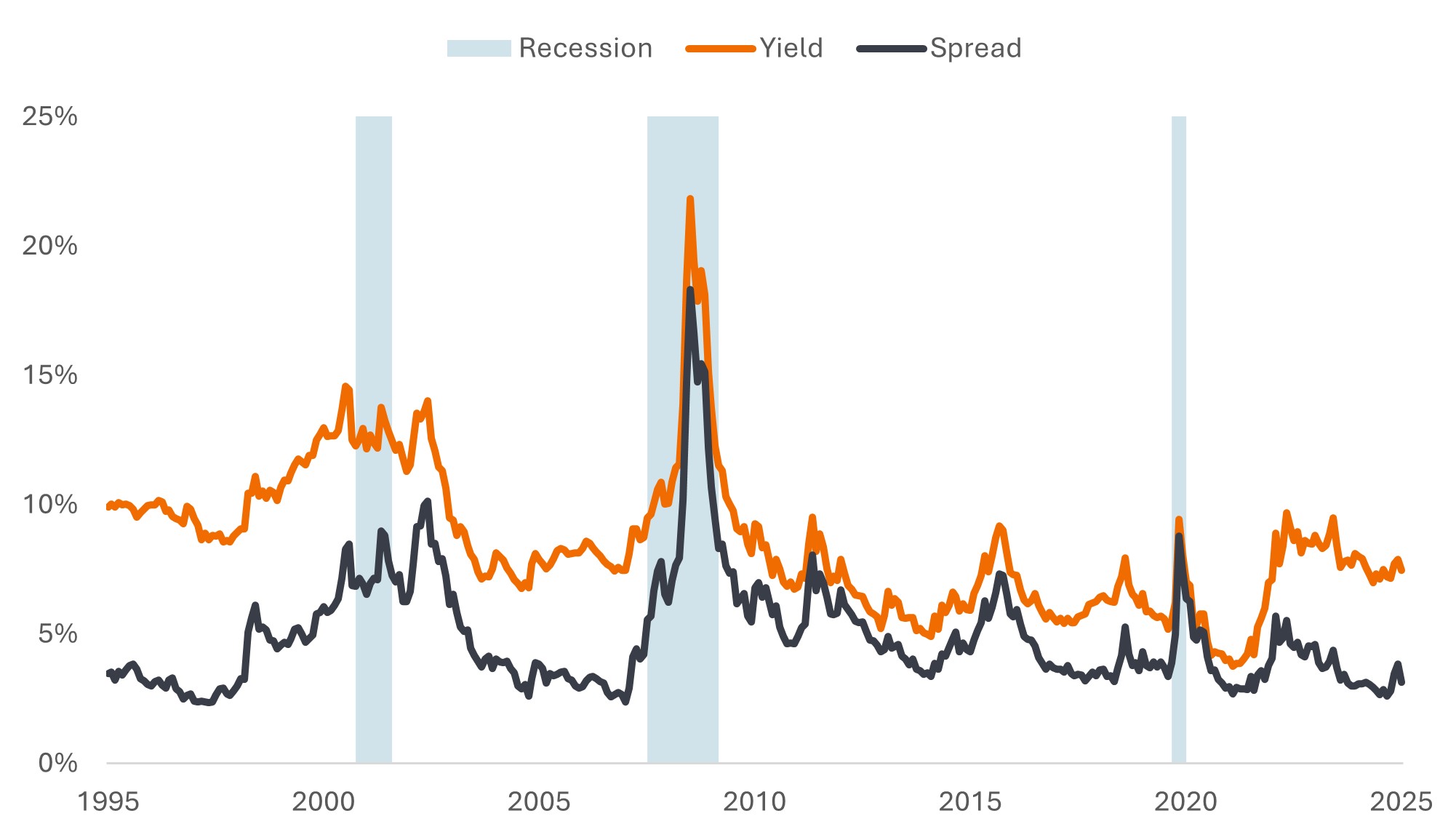

Credit spreads (the additional yield a corporate bond pays over a government bond of similar maturity) widened during the tariff panic in April but have since retraced those moves. Spreads are at relatively low levels historically and – in common with equity markets – are not pricing in a recession (Figures 3a,3b).

Figure 3a: Credit spreads are low but yields remain historically attractive

US investment grade corporate bond yields and spreads

Source: Bloomberg, Bloomberg US Corporate Bond Index, yield to worst and option-adjusted spread (OAS), 31 May1995 to 30 May 2025. The yield to worst is the lowest yield a bond with a special feature (such as a call option) can achieve provided the issuer does not default. When used to describe an index, this statistic represents the weighted average across all the underlying bonds held. Recession periods are in accordance with The National Bureau of Economic Research. Yields may vary over time and are not guaranteed.

Figure 3b: Ditto in high yield

US high yield corporate bond yields and spreads

Source: Bloomberg, Bloomberg US Corporate High Yield Bond Index, yield to worst and option-adjusted spread (OAS), 31 May 1995 to 30 May 2025. Yields may vary over time and are not guaranteed.

But do they need to? Trade uncertainty is likely to weigh on growth this year, but slower growth rather than recession remains the base case for most economists. Corporate bond fundamentals were strong before the tariff announcements, with many companies operating from a position of financial health with solid earnings. One could make the case that the tariff shock might be the equivalent of the energy crisis in 2015 or the eurozone debt crisis in 2011 and argue that spreads should be higher. But investors appear ready to look at today’s yields (which are comparable or higher to back then) and are willing to lend to companies, as evidenced by the strong appetite for new issuance.

Given the arguments on both sides, we see value in being nimble. Our preference is to favour corporate borrowers that are less exposed to trade disruption and have resilient business models, but with yields relatively high we stand ready to take advantage of price inefficiencies among riskier areas of the market.

Support from securitised

We have argued for some time that investors should consider the full range of the fixed income asset class. Securitised sectors may be unfamiliar terrain to many, but in our view they are attractively priced with high credit quality. Asset backed securities (ABS) and AAA-rated collateralised loan obligations (AAA CLOs) can offer alternate ways for investors to gain exposure to attractive yields with low duration, courtesy of their floating rate structure. Wide spread levels, low interest rate sensitivity and the amortising structure of AAA CLOs helped this area of fixed income prove resilient during the recent tariff volatility.

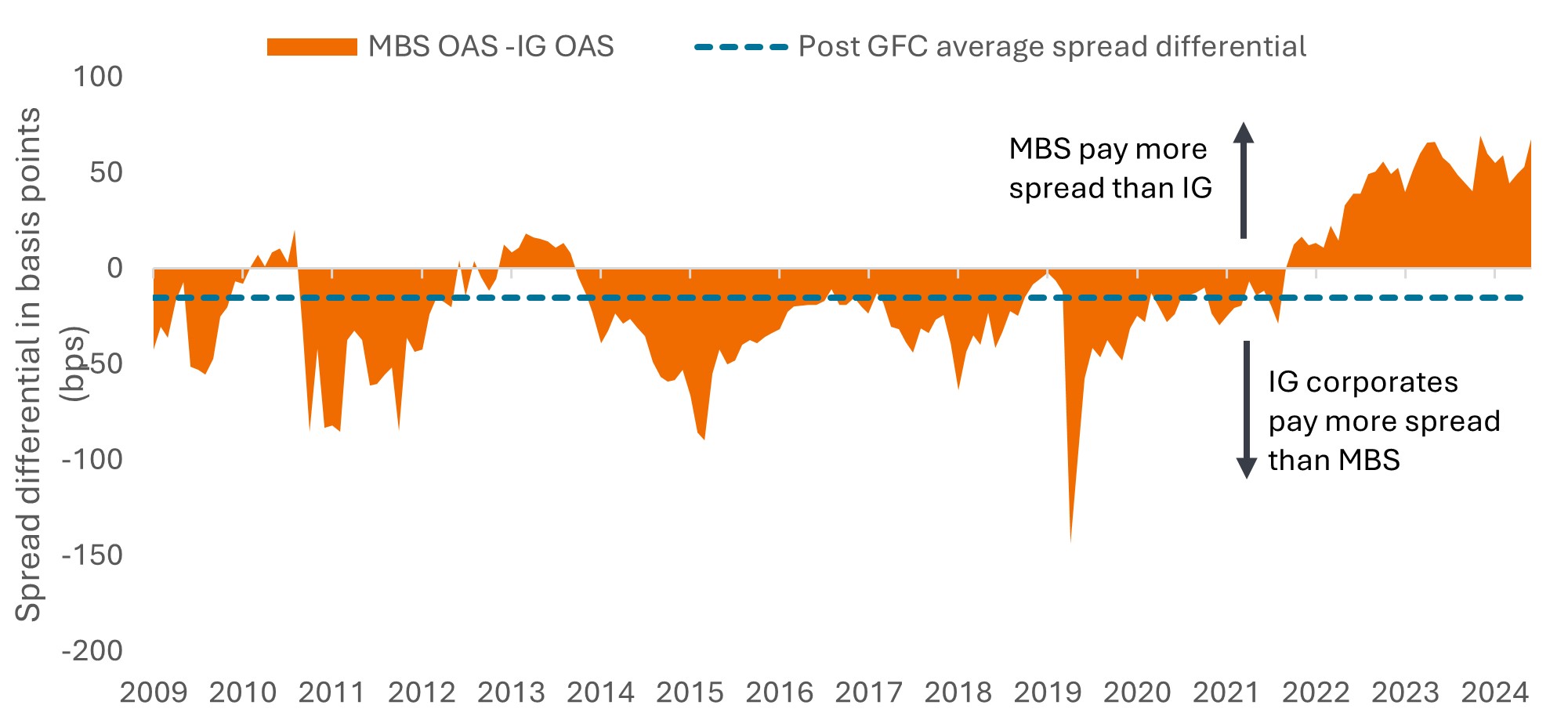

Agency mortgage-backed securities (MBS) continue to look attractive due to their relative cheapness versus investment-grade corporate bonds, their history of acting as a ballast when equity markets sell off, and their unusually low prepayment risk. Prepayment typically increases when interest rates fall and homeowners switch to lower rate mortgages. This can lead to MBS not fully capturing the gains from falling interest rates. Today, however, there is little incentive for US borrowers to repay their mortgage early when current mortgage rates are well above the levels at which the loans were taken out a few years ago.

In recent years, higher interest rates and quantitative tightening have weighed on MBS leading to the anomalous position where spreads are higher than on US investment grade (IG) corporates. With the prospect of quantitative easing (QE) ending and further rate cuts, we see this spread anomaly unwinding, making current levels a potentially attractive entry point (Figure 4).

Figure 4: MBS current coupon spread differential over US IG corporate spreads

Source: Bloomberg, Credit Suisse, Janus Henderson Investors, as of 27 May 2025. Agency MBS current coupon spread reflects the spread over 5/10-year US Treasury blend. IG spread is Bloomberg US Corporate Bond Index option-adjusted spread (OAS). Basis point (bp) equals 1/100 of a percentage point, 1bp = 0.01%. Past performance does not predict future returns.

Investors will always be confronted with a changing financial landscape. Right now, it may seem more challenging than usual, but we see the income offered by fixed income as providing a stabilising force, offering diversity to more turbulent equity markets. By having a well-stocked kit bag that blends different forms of fixed income, investors have the potential to gain exposure to varied income streams and help insulate against risk in a particular area. Through an active approach – one that harnesses enduring trends and moves tactically to capture opportunities – we believe investors can progress more surefootedly towards their investment goals.

IMPORTANT INFORMATION

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Quantitative Tightening (QT) is a government monetary policy occasionally used to decrease the money supply by either selling government securities or letting them mature and removing them from its cash balances.

Quantitative Easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market

Securitized products such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed income securities.

Past performance does not predict future returns. There is no guarantee that past trends will continue or forecasts will be realised.

The Bloomberg US Corporate Bond Index measures the investment grade fixed-rate, taxable corporate bond market. It includes USD-denominated securities issued by US and non-US industrial, utility and financial issuers.

The Bloomberg US Corporate High Yield Bond Index measures the US denominated high yield, fixed-rate corporate bond market.

Asset-backed Securities (ABS): A financial security that is ‘backed’ (or collateralised) with existing assets (such as loans, credit card debts or leases), usually ones that generate some form of income (cash flow) over time.

Basis points: Basis point (bp) equals 1/100 of a percentage point, 1bp = 0.01%.

Collateralised loan obligations (CLO): A bundle of generally lower quality leveraged loans to companies that are grouped together into a single security, which generates income (debt payments) from the underlying loans. The regulated nature of the bonds that CLOs hold means that in the event of default, the investor is near the front of the queue to claim on a borrower’s assets. AAA has the highest credit rating and represents the most secure tranche.

Corporate bond: A bond issued by a company. Bonds offer a return to investors in the form of periodic payments and the eventual return of the original money invested at issue on the maturity date.

Corporate fundamentals are the underlying factors that contribute to the price of an investment. For a company, this can include the level of debt (leverage) in the company, its ability to generate cash and its ability to service that debt.

Coupon: A regular interest payment that is paid on a bond, described as a percentage of the face value of an investment. For example, if a bond has a face value of $100 and a 5% annual coupon, the bond will pay $5 a year in interest.

Credit rating: A score given by a credit rating agency such as S&P Global Ratings, Moody’s and Fitch on the creditworthiness of a borrower. For example, S&P ranks investment grade bonds from the highest AAA down to BBB and high yields bonds from BB through B down to CCC in terms of declining quality and greater risk, i.e. CCC rated borrowers carry a greater risk of default.

Credit spread. The difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

Diversification: A way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario. Please note diversification neither assures a profit nor eliminates the risk of experiencing losses.

Duration: A measure of the sensitivity of a bond’s price to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa. Bond prices rise when their yields fall and vice versa.

Federal Reserve (Fed): The central bank of the US which determines its monetary policy.

Fiscal policy: Describes government policy relating to setting tax rates and spending levels. Fiscal discipline is where governments do not borrow excessively, i.e. keeping borrowing as a percentage of the output of the economy low so that the overall debt burden does not expand aggressively.

High yield bond: Also known as a sub-investment grade bond, or ‘junk’ bond. These bonds usually carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher interest rate (coupon) to compensate for the additional risk.

Inflation: The rate at which prices of goods and services are rising in the economy. The Consumer Price Index is a measure of inflation that examines the price change of a basket of consumer goods and services over time. The Personal Consumption Expenditures Price Index is a measure of prices that people living in the US pay for goods and services.

Investment grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Issuance: The act of making bonds available to investors by the borrowing (issuing) company, typically through a sale of bonds to the public or financial institutions.

Maturity: The maturity date of a bond is the date when the principal investment (and any final coupon) is paid to investors. Shorter-dated bonds generally mature within 5 years, medium-term bonds within 5 to 10 years, and longer-dated bonds after 10+ years.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money.

Mortgage-backed security (MBS): A security which is secured (or ‘backed’) by a collection of mortgages. Investors receive periodic payments derived from the underlying mortgages, similar to the coupon on bonds. Similar to an asset-backed security. Mortgage-backed securities may be more sensitive to interest rate changes. They are subject to ‘extension risk’, where borrowers extend the duration of their mortgages as interest rates rise, and ‘prepayment risk’, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

OPEC: Organisation of the Petroleum Exporting Countries. An inter-governmental organisation consisting of many of the major oil-producing nations that co-ordinates the policies of its member countries in oil production and sales to help stabilise oil prices.

Quantitative Tightening (QT) is a government monetary policy occasionally used to decrease the money supply by either selling government securities or letting them mature and removing them from its cash balances.

Quantitative Easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market.

Tariff: A tax or duty imposed by the government of one country on the import of goods from another country.

Term premia: This is the extra return that investors demand to hold a longer-term bond instead of investing in a series of short-term bonds. It is the compensation investors require for bearing the risk that interest rates may change over the life of the bond.

Total return: The combined return from income and any change in capital value of an investment.

US Treasury bond: A term used to describe US government bonds.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate. For a bond, at its most simple, this is calculated as the coupon payment divided by the current bond price.

Yield to maturity: The total rate of return earned when a bond makes all interest payments and repays the original principal.

Yield to worst: The lowest yield a bond (index) can achieve provided the issuer(s) does not default; it takes into account special features such as call options (that give issuers the right to call back, or redeem, a bond at a specified date).

Volatility measures risk using the dispersion of returns for a given investment. The rate and extent at which the price of a portfolio, security or index moves up and down.