The importance of sector allocation

Sector allocation is one of the most consistent drivers of tracking error and alpha in active high yield bond portfolios. In today’s U.S. high yield market, sector tilts have become even more crucial as bond-level dispersion narrows. We expect sector dispersion to remain elevated, shaped by policy uncertainty and uneven technology risk – including those associated with AI.

Deep fundamental research is essential to uncover themes that will influence markets, and early identification and conviction around these themes are key to successful sector positioning. One such theme is the rapid buildout of AI infrastructure and the significant capital investment it attracts.

IPPs emerge as beneficiaries of AI theme

When ChatGPT reignited interest in AI, fixed income opportunities were initially concentrated in investment grade and private credit markets, leaving few options in high yield. By 2024, the U.S. high yield electric utilities sector emerged as an early beneficiary of the AI theme. Independent Power Producers (IPPs), which own and operate generation assets, stood out as direct beneficiaries of rising power prices. AI data centers consume enormous amounts of energy, driving both power consumption and prices higher.

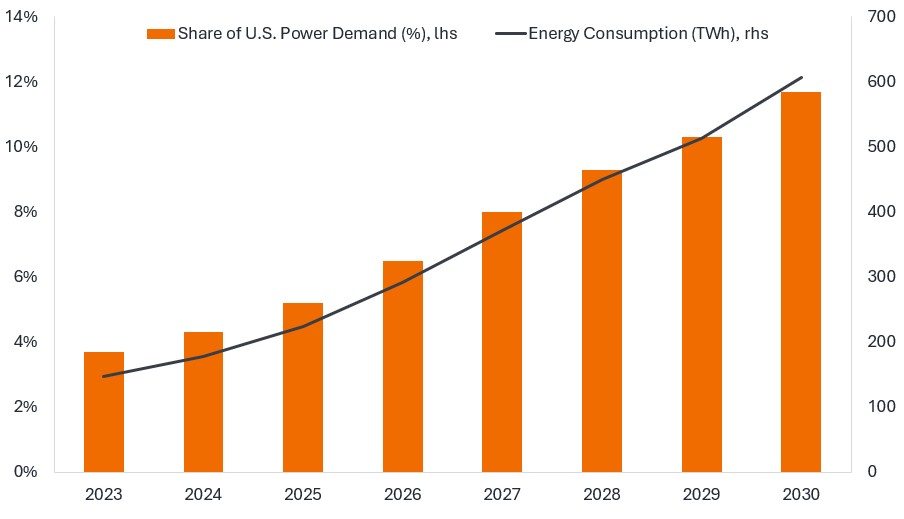

Figure 1: Demand for power for data centers is expected to rise significantly in the U.S.

U.S. data center share of U.S. power demand (%) and U.S. data center energy consumption (TWh)

Source: McKinsey & Company, Global Energy Perspective 2023, October 2023. Share of U.S. data center energy consumption (TWh = Terawatt hour) and data center share of U.S. power demand (%). Figures beyond 2024 are estimates. There is no guarantee that past trends will continue, or forecasts will be realized.

Hyperscalers have publicly acknowledged that power availability is one of their largest constraints in building new AI data centers. Earlier this year, Amazon and Talen Energy announced the largest nuclear power purchase agreement (PPA) to date – a 17-year, $18 billion agreement for up to 1.92 GW of capacity.1 Power constraints have become so acute that some hyperscalers are now contracting with companies deploying modular microgrids using small gas turbines to quickly energize new facilities.

The AI datacenter ecosystem: New opportunities emerge

Throughout 2025, demand for AI data centers continued to surge, exposing severe power constraints and highlighting the challenges of building new generation capacity. Companies that had already secured grid access found themselves in a uniquely advantageous position.

Attention soon shifted to Bitcoin miners – firms that had locked in substantial power for energy-intensive mining, but historically struggled with rising network difficulty, high energy costs, and crypto price volatility. Among them, TeraWulf emerged as the first to pivot toward High-Performance Computing (HPC) and tap the high yield market.

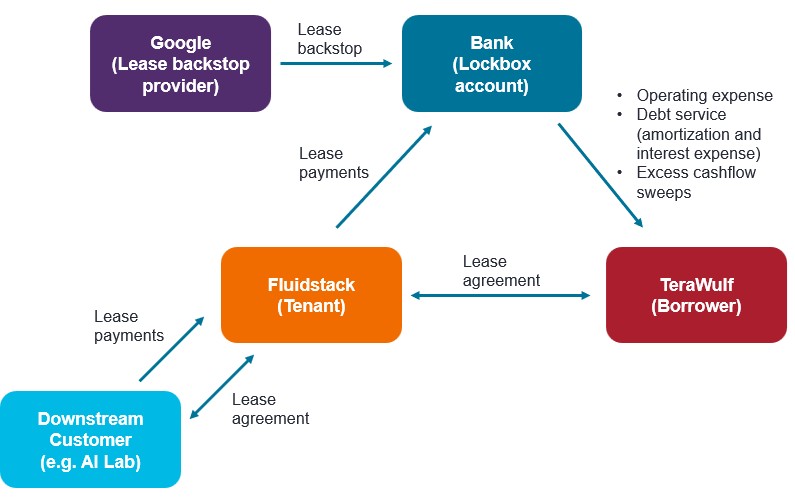

This strategic move re-rated TeraWulf from a cyclical, low-multiple business to one with higher margins and long-term contracted earnings. Its high yield bond deal, aimed at funding an AI data center buildout, carried construction risk and involved little-known counterparties, requiring an innovative structure backed by Google to secure financing. As shown in Figure 2, Google provides a lease backstop, and lease cash flows from the tenant are deposited directly into an agent-controlled account (the lockbox). These funds are automatically applied first to mandatory debt amortization and interest payments for lenders, ensuring that debt service is prioritized and fully covered before any remaining cash can be used for operating expenses or other purposes. Initially, the rationale behind Google’s involvement was unclear, but we believe an opportunity to deploy Google’s Tensor Processing Unit (TPU) chips at the facility was a driver.

Also emerging onto the scene have been specialist data center operators known as “neo-clouds”: a “neo-cloud” is a new generation of cloud provider built specifically for AI and HPC. Unlike traditional hyperscalers, neo-clouds focus exclusively on leading-edge infrastructure, ultra-fast networking, and environments optimized for training and running large AI models. Fluidstack and CoreWeave are two leading providers. For example, Fluidstack leases a powered shell – a building with electrical infrastructure – from TeraWulf, installs Google-designed TPU clusters and supporting equipment, and sells compute capacity to downstream customers such as hyperscalers or AI labs that do not wish to undertake the data center operations themselves.

Figure 2: Simplified relationship structure

Cash flows (from lease payments) under lockbox structure to help ensure prioritization of mandatory amortization

Source: Janus Henderson Investors, December 2025. For illustrative purposes only. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

While Fluidstack has no public debt outstanding, CoreWeave has already issued two high yield bond deals this year and a convertible bond.2 Hyperscalers typically issue in the investment grade market, and most AI labs remain privately funded, but notably, xAI (developer of the Grok LLM) entered the high yield market with a deal earlier this summer.

Other suppliers to the AI ecosystem

As investors gained clarity on what goes into an AI data center, new opportunities emerged among suppliers to other parts of the ecosystem – particularly in memory and networking.

Memory remains highly cyclical, and we believe we are in the early stages of a supercycle, supported by rising price expectations and low supply. Also emerging is NAND memory: as AI evolves from text-based to multimodal (image and video generation), demand for flash memory should accelerate, as it is the only NAND type fast enough to support these workloads. Kioxia, a Japanese NAND memory leader, tapped the U.S. high yield market with its inaugural bond deal earlier in 2025, and has emerged as an additional way to gain exposure to AI hardware within the high yield investment universe. Networking providers are also benefiting from the need to interconnect GPUs within racks, link racks across buildings, and connect data centers to each other and the broader internet. High yield names like Ciena and Coherent supply critical networking equipment, while Level 3 Communications’ fiber network enables AI data centers to communicate across regions and with end-users.

The competitive landscape: Forming alliances

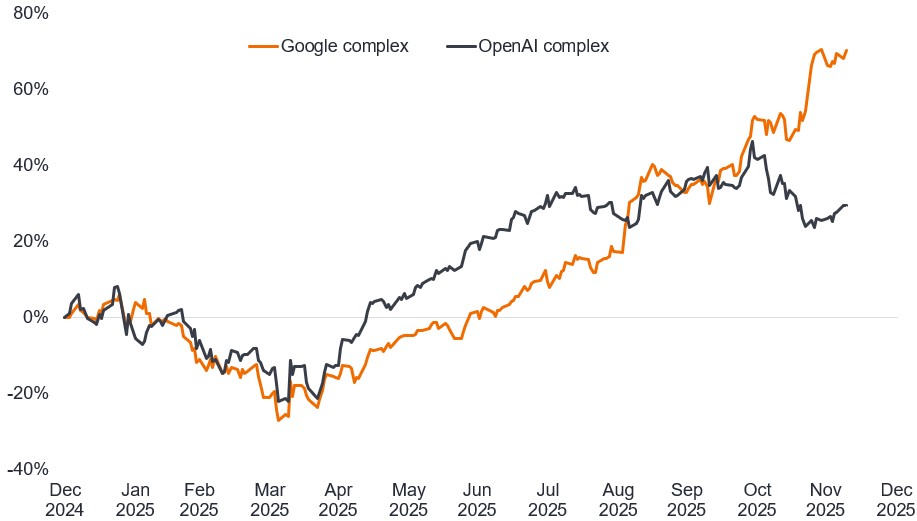

Recently, Google’s Tensor Processing Unit (TPU) has drawn attention as a rival to Nvidia’s Graphics Processing Unit (GPU) for AI data centers. GPUs are versatile and support a wide range of workloads, while TPUs are designed for certain AI tasks – faster in those areas, though less flexible and largely specialized for Google’s ecosystem and corresponding workloads. Beyond chips, Google competes with Microsoft in enterprise software through Google Workspace (Docs, Sheets, Gmail, Meet) versus Microsoft 365 (Word, Excel, Outlook, Teams), and its Gemini large language model (LLM) challenges OpenAI’s ChatGPT. In short, Google is fighting on three AI fronts: hardware against Nvidia, AI-enabled enterprise software against Microsoft, and LLMs against OpenAI. Two major alliances have emerged: the ‘Google complex,’ including Broadcom (which co-designs TPUs), Fluidstack, and TeraWulf/Cipher Mining; and the ‘OpenAI complex,’ featuring Nvidia, CoreWeave, Applied Digital, and non-Google hyperscalers such as Microsoft and Oracle. Price action is moving swiftly as the market constantly reevaluates which players are gaining a competitive edge in the AI race.

Figure 3: Price action in equity markets reflects shifting sentiment towards alliances

Price performance of Google complex and OpenAI complex

Source: Bloomberg, Janus Henderson calculations, Google complex is market cap weighted basket comprising Google, Broadcom, Lumentum, Cipher Mining, and TeraWulf; OpenAI complex comprises NVIDIA, Microsoft, Oracle, Softbank, Coreweave, Applied Digital. Price performance in US dollars from 31 December 2024 to 9 December 2025. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned. Past performance does not predict future returns.

Looking ahead

Opportunities to invest around the AI theme in high yield have steadily expanded, and we expect this trend to continue. This broadens the ways portfolio managers can drive alpha through both sector allocation and security selection in AI-exposed industries. Over time, many of these companies may become less reliant on the high yield market as they gain access to other funding sources, including securitized credit and private debt. Some existing high-yield bonds could be called early and refinanced into asset-backed securities (ABS) structures. Meanwhile, the massive capex programs of investment grade hyperscalers will benefit the entire ecosystem, as spending flows across the AI data center supply chain – where many participants remain high yield issuers.

1Source: Talen Energy presentation, ‘Executing our strategy: Validating the thesis on power & data intersection’, 11 June 2025.

2Source: Bloomberg, correct at 11 December 2025.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Alpha: Alpha is the difference between a portfolio’s return and its benchmark index after adjusting for the level of risk taken. This measure is used to help determine whether an actively-managed portfolio has added value relative to a benchmark index, taking into account the risk taken. A positive alpha indicates that a manager has added value.

Asset-backed securities (ABS): A financial security that is ‘backed’ (or collateralized) with existing assets (such as loans, credit card debts, or leases), usually ones that generate some form of income or cash flow over time.

Bitcoin miner: A Bitcoin miner is an individual or entity that uses powerful computers to validate transactions and add them as new blocks to the Bitcoin blockchain, securing the network and earning rewards (new Bitcoin + transaction fees) for solving complex mathematical puzzles.

Capital expenditure (capex): Money invested to acquire or upgrade fixed assets such as buildings, machinery, equipment, or vehicles in order to maintain or improve operations and foster future growth.

Cash flow: The net balance of cash that moves in and out of a company. Positive cash flow shows more money is moving in than out, while negative cash flow means more money is moving out than into the company.

ChatGPT: A generative AI tool that is trained to follow an instruction in a prompt and provide a detailed response.

Dispersion: The extent to which a distribution of data points is stretched or squeezed. If the data points cluster around certain values, then dispersion is low, whereas if they are more spread out, then dispersion is high. Higher dispersion opens up opportunities for asset managers to outperform by selecting the winners and avoiding the losers.

Convertible bond: Bonds that provide holders the right (but not the obligation) to convert into a specified number of shares of common stock in the issuing company.

Corporate bond: A bond issued by a company. Bonds offer a return to investors in the form of periodic payments and the eventual return of the original money invested at issue on the maturity date.

Credit rating: An independent assessment of the creditworthiness of a borrower by a recognized agency such as S&P Global Ratings, Moody’s or Fitch. Standardized scores such as ‘AAA’ (a high credit rating) or ‘B’ (a low credit rating) are used, although other agencies may present their ratings in different formats.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

Graphics Processing Unit (GPU): A specialized electronic circuit designed to process images for graphics-intensive tasks such as gaming or video but also increasingly used for powerful computations for AI.

High Performance Computing (HPC): Computing that uses supercomputers or clusters of computers to perform large-scale operations for AI or complex simulations at exceptional speeds.

High yield bond: Also known as a sub-investment grade bond, or ‘junk’ bond. These bonds usually carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher interest rate (coupon) to compensate for the additional risk.

Hyperscalers: Companies that provide infrastructure for cloud, networking, and internet services at scale.

Independent Power Producer (IPP): A company or entity that owns or operates facilities for the generation of electricity but operates outside of the traditional public utility model.

Investment grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Issuance: The act of making bonds available to investors by the borrowing (issuing) company, typically through a sale of bonds to the public or financial institutions.

Lockbox (cash controls structure): A bank provided service where payments are directed to a designated account and the bank collects, processes and deposits funds.

Microgrid (modular microgrid): A localized self-contained electrical network that generates, distributes and manages power for a specific area, like a campus, acting as a mini version of the power grid.

NAND flash memory: A non-volatile storage technology that retains data without power, using floating-gate transistors to trap electrical charges in cells.

Power Purchase Agreement (PPA): A long-term contract between an energy producer and a buyer to purchase a specific amount of electricity at a negotiated rate for a set period.

Supercycle: A prolonged period of expansion and above-average growth in a particular market, asset class or sector.

Tensor Processing Unit (TPU): Google-designed application-specific integrated circuit (ASIC) optimized for training and inference of AI models.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate. For a bond, at its most simple, this is calculated as the coupon payment divided by the current bond price.

Volatility: A measure of risk using the dispersion of returns for a given investment. The rate and extent at which the price of a portfolio, security or index moves up and down.