“Prediction is difficult, especially about the future,” a quote often ascribed to Neils Bohr, the Nobel prize-winning physicist, but can equally be applied to financial markets. Recent weeks have seen market participants rapidly re-adjusting their forecasts for interest rates.

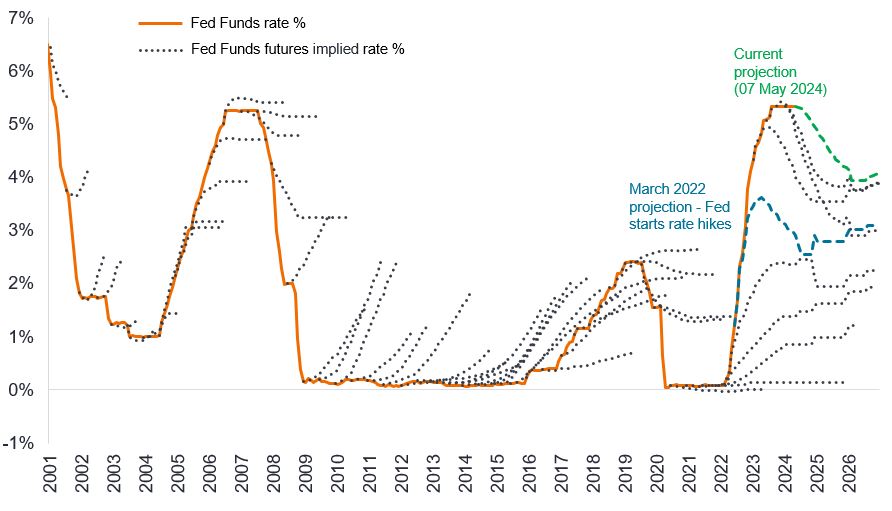

The truth is that the market has a patchy record when it comes to forecasting as Figure 1 shows. The dotted lines reflect the futures market’s expectation of where the US Federal Reserve’s (Fed) funds rate would be. Invariably, the market over- or under-estimates the actual moves in the Fed’s policy rate.

Figure 1: Market expectations versus actual interest rate direction

Source: Bloomberg, Federal Funds rate, Fed funds futures 30 day rates, six month intervals, 2001 to 2024. There is no guarantee that past trends will continue, or forecasts will be realised. Past performance does not predict future returns.

Rates divergence

Furthermore, amid all the focus on the Fed, it is easy to miss what is happening elsewhere. The Swiss National Bank, with its cut in March, fired the starting gun on cutting interest rates in developed markets. In early May, Sweden’s Riksbank followed with its first rate cut of the cycle. Meanwhile many emerging markets have been reducing rates since late last year. Even the notion that the European Central Bank (ECB) has historically followed the Fed is not strictly true. In 2011, the ECB raised rates, although this was an episode it may prefer to forget as it rapidly unwound the short-lived tightening in response to fresh economic weakness.

Fast forward to today and we should probably expect a decoupling in policy between the ECB and the Fed, not least because a relatively weaker Eurozone economy and firmer progress on reducing inflation offers a clearer path for the ECB to begin cutting rates before the Fed.

It was always likely that Europe’s economy would respond more forcefully to the rate hikes that have taken place over the past couple of years. This is because European companies operate with shorter-term debt that needs refinancing more regularly and on average have more floating-rate debt. In addition, European households typically have mortgages on shorter fixed-rate periods than in the US, creating a more rapid transmission effect for monetary policy.

Fundamental attractions

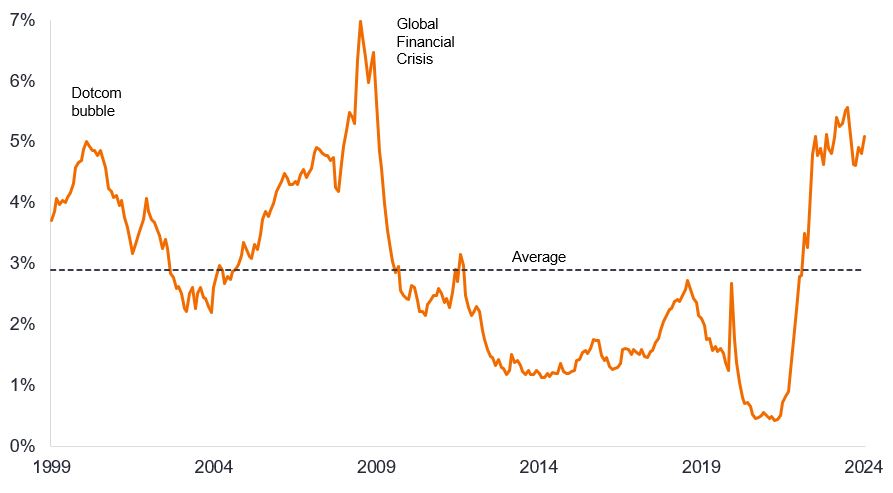

Second guessing the timing of central banks’ moves can, however, become a distraction to the fundamental attractiveness of assets. The irony is that the rates uncertainty has created an opportunity. Yields on short-term investment grade corporate bonds are hovering around their most attractive levels in more than a decade. In fact, yields are at levels which – since the turn of the millennium – would be more typically associated with crises (Figure 2).

Figure 2: Yield on global short-dated investment grade corporate bonds

Source: Bloomberg, ICE BofA 1-3 year Global Corporate Index, yield to worst, 30 April 1999 to 30 April 2024. Yields may vary over time and are not guaranteed. Past performance does not predict future returns.

What is particularly powerful today is the level of real yield (yield adjusted for inflation) that an investor can achieve from short-dated corporate bonds. In Europe, short-dated investment grade corporate bonds are currently yielding more than 1.6% above the rate of Eurozone inflation. This compares with a real yield that was typically negative over the past decade (Figure 3).

Figure 3: Real yields are well above the historical average

Source: Bloomberg, ICE BofA 1-3 year Euro Corporate Index, yield to worst, CPI shown is Euro Area Consumer Price Index (MUICP), year-on-year (yoy) percentage change, 30 April 2014 to 30 April 2024. IG = Investment Grade. There is no guarantee that past trends will continue, or forecasts will be realised. Yields may vary over time and are not guaranteed. Past performance does not predict future returns.

We cannot say for certain that the ECB will embark on rate cuts in June. What we do know, however, is that today an investor in short-dated corporate bonds can achieve a level of yield that is not only relatively high historically, but is also offering a yield that provides ample compensation for current inflation.

The message from the most recent Fed policy meeting on 1 May was that even in their “wait and see” data-dependent mode, the bar to a rate hike is high. The subsequent weaker-than-expected non-farm US payrolls data covering the month of April was in keeping with recent softening in US purchasing manager survey data, hinting that the strength in US economic data in the previous six months may be waning. Meanwhile, comments from members of the ECB governing council lean towards rate cuts coming closer. In our view, this creates an asymmetric opportunity: limited risk that rates move higher, but the prospect that shorter-dated bond yields could respond (decline) quickly to any weakness in the economic data and/or confirmation that rate cuts are commencing.

As a result, we believe that investors sitting in cash should be alert to the fact that rates on cash are likely to head lower in the coming months. In our view, short-dated investment grade corporate bonds offer an opportunity to lock in attractive yields without taking on excessive duration or credit risk.

ICE BofA 1-3 year Euro Corporate Index tracks EUR denominated investment grade corporate debt publicly issued in the eurobond or Euro member domestic markets, with a remaining term to final maturity less than 3 years

ICE BofA 1-3 year Global Corporate Index tracks investment grade corporate debt publicly issued in the major domestic and eurobond markets, with a remaining term to final maturity less than 3 years.

Credit risk: The risk that a borrower will default on its contractual obligations to investors, by failing to make the required debt payments. Anything that improves conditions for a company can help to lower credit risk.

Corporate bonds: A debt security issued by a company. Bonds offer a return to investors in the form of periodic payments and the eventual return of the original money invested at issue on the maturity date.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

Duration: The sensitivity of a bond’s price to a change in interest rates.

Floating rate debt: Debt that is on a variable interest rate.

High yield: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub-investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk.

Inflation: The rate at which prices of goods and services are rising in the economy.

Interest rate future: A contract that allows buyers and sellers to lock in rates on an interest-bearing asset.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings.

Maturity: The maturity date of a bond is the date when the principal investment (and any final coupon) is paid to investors. Shorter-dated bonds generally mature within 5 years, medium-term bonds within 5 to 10 years, and longer-dated bonds after 10+ years.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

Yield: The level of income on a security, typically expressed as a percentage rate. For a bond, at its most simple, this is calculated as the annual coupon payment divided by the current bond price.

Yield to worst: The lowest yield a bond with a special feature (such as a call option) can achieve provided the issuer does not default. When used to describe a portfolio, this statistic represents the weighted average across all the underlying bonds held.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.