Sustainability reporting thresholds by group

Reporting entities |

Group 1 |

Group 2 |

Group 3 |

| Large entities and their controlled entities meeting at least two of three criteria | Revenue ≥ $500M Assets ≥ $1B Employees ≥ 500 |

Revenue ≥ $200M Assets ≥ $500M Employees ≥ 250 |

Revenue ≥ $50M Assets ≥ $25M Employees ≥ 100 |

| National Greenhouse and Energy Reporting (NGER) Reporters | Above NGER publication threshold in s13(1)(a) of the NGER Act 2007 | All other NGER reporters | N/A |

| Registered schemes, Registrable Superannuation Entities, and retail Corporate Collective Investment Vehicles | Same thresholds as Group 1 large entities and NGER reporters Reporting starts: Jan 1, 2025 |

Same thresholds as Group 2 large entities and NGER reporters Reporting starts: Jul 1, 2026 |

Same thresholds as Group 3 large entities Reporting starts: Jul 1, 2027 |

Source: Janus Henderson, Australian Accounting Standards Board (AASB)

Australia has joined many global counterparts by introducing mandatory sustainability reporting for companies and other select legal entities. This initiative, the Climate-related financial disclosure (CRFD), was mandated by the Australian Government in partnership with the key regulator Australian Securities and Investments Commission (ASIC). CRFD began at the start of 2025 and will be implemented over a three-year period. Larger companies are required to comply first, with the following criteria set for mandatory reporting by the end of the third year:

- Companies with consolidated revenue exceeding $50 million,

- Companies with consolidated gross assets over $50 million, and

- Companies with more than 100 employees.

For asset owners, mandatory reporting will apply only to those with at least $5 billion in assets under management (AUM) and that are registered schemes, registrable superannuation entities, or retail corporate collective investment vehicles (CCIV). This requirement for asset owners will commence in Group 2, starting after July 1, 2026.

The timing for the release of these reports will be aligned with the start of a company’s or asset manager’s financial year reporting. The earliest reports from the first group are expected at the beginning of 2026, applicable to those whose reporting period aligns with the calendar year.

While this new regulation will become a legal requirement, many companies have already been doing voluntary reporting in their sustainability reports. It has been reported that this is the case for 82% of the ASX2001.

For those not familiar with these sustainability reports, they are comprehensive documents, often extending to 100 pages, that ESG professionals spend hours reading through. They provide valuable insights into a company’s environmental targets, performance and initiatives, alongside information on employee welfare such as gender pay equality, workplace diversity, staff retention, and charitable contributions.

What Information is required in the mandatory sustainability reports?

First year requirements include:

- Information on the governance and strategy for risk management in relation to risks, opportunities and climate targets, including any financial impact

- Disclosure of scope 1 & 2 emissions using the National Greenhouse and Energy Reporting (NGER) measurement

- Reporting on climate adaptation strategies, e.g. managing risks related to floods, fires, etc

- Any transition plans, including how they plan to achieve climate related targets

- Warming scenario analysis indicating the implied temperature rise above pre-industrial levels forecasted to the end of the century

- A section outlining assumptions and limitations in the report, and

- A director’s declaration.

Sustainability reports must be included within a company’s annual report or linked to a separate sustainability report embedded within the annual report.

Second year expansion:

By the second year, this report needs to have expanded to include the company’s scope 3 emissions, which ASIC notes will be estimates collated on a ‘best endeavours’ basis without undue costs.

From discussions we have had with companies, it is evident that data is still difficult to obtain, with some sectors having no set methodology for reporting of emissions. For example, Rabobank shared how they issue carbon calculators to farmers in their loan book, whereas Nestle are often using Sustainability NGOs to build out their primary data from within their supply chain. Our sense is that it is difficult to have good visibility and confidence in obtaining correct data, but we believe this will evolve.

First three years:

In the first three years of this new reporting regime, there will be modified liability for directors, with immunity for scope 3 emissions (including financed emissions), scenario analysis and transition plans. This means that directors will not be held liable for inaccuracies in these disclosures if they have taken reasonable care and acted ethically.

From 2028, directors will assume full liability for these disclosures.

What is climate data useful for and how will practitioners use these reports?

As a fixed income investor, data and disclosures in these reports often help steer our questions to an issuer during company engagement. The information helps us home in on the areas where the company might be underperforming against their peers, or is not on track to meet their targets.

There are some industries where it is obvious as to what climate risks are – for example, those with high carbon footprints and in ‘hard to abate’ sectors such as energy, mining and airline companies.

For other companies, it’s essential to delve deeper into the sources of their emissions, particularly the components of their scope 3 emissions, and assess the measures they are taking to reduce them. We are interested to know whether the company has a credible pathway for decarbonisation, have they set targets, are they on track to meet them, how are they reporting and how are they engaging with their supply chain, amongst other things.

Our ESG due diligence starts through analysing the data, reading the company’s own sustainability reports and examining third party research reports. This will form the basis of our questions during company engagements and help us assess the ESG risks of a company and the mitigation strategies in play. It all forms part of our ESG integration in the investment portfolios we manage.

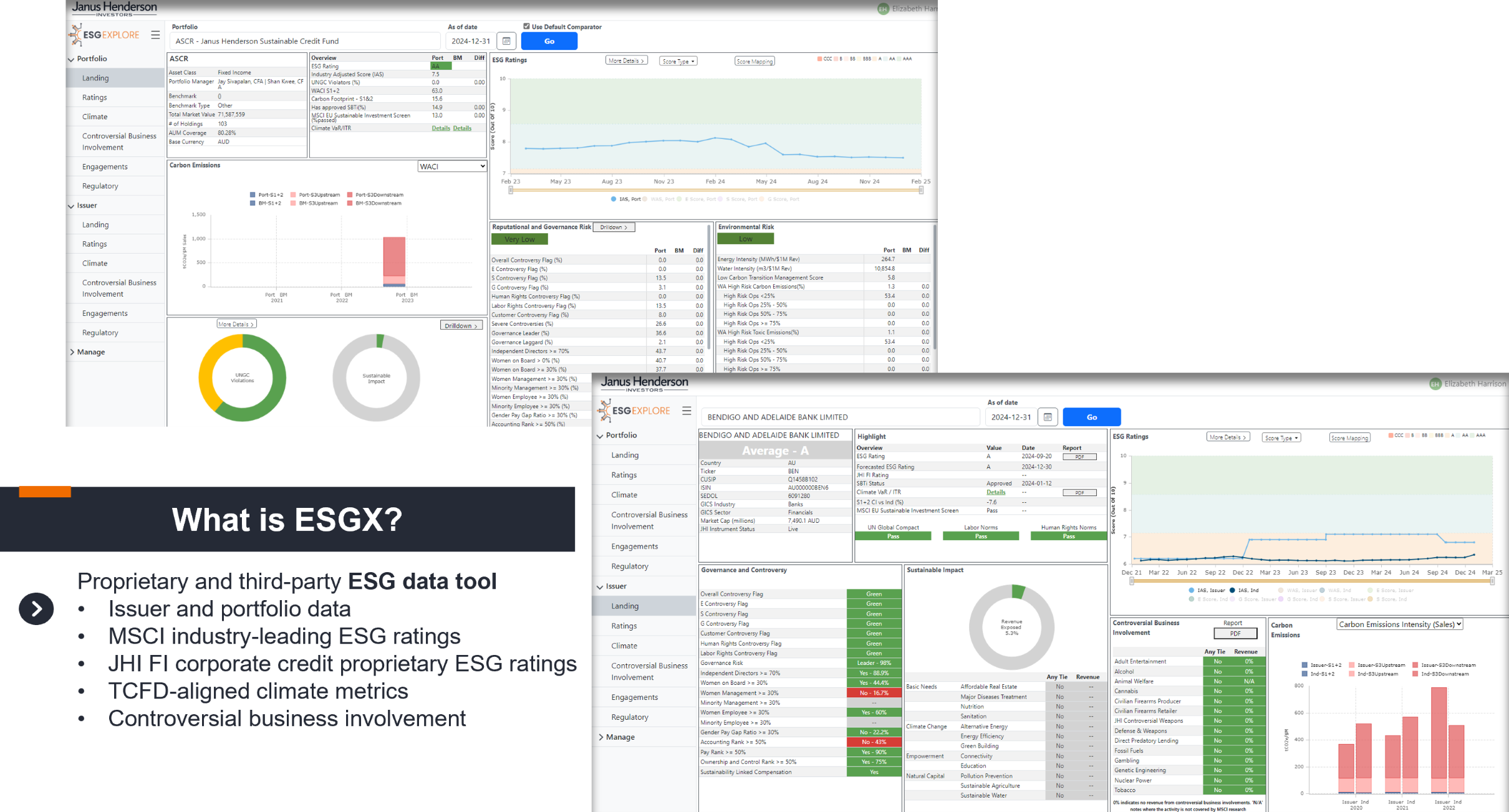

How do we capture ESG metrics for issuers in our portfolio?

Source: Janus Henderson Investors

Note: For illustrative purposes only

At Janus Henderson, we use MSCI as our preferred data provider. For ease of usage, we have created a proprietary data capture platform called ESG Explore which imports MSCI data. It allows the user to easily search for an issuer and obtain climate data and other ESG metrics such as controversial business involvement, controversies, MSCI risk ratings etc. Further, this same information can be calculated on a portfolio level with the total carbon emissions, weighted average carbon intensity, implied temperature rises of the asset pool and any product involvement all disclosed (where data is available).

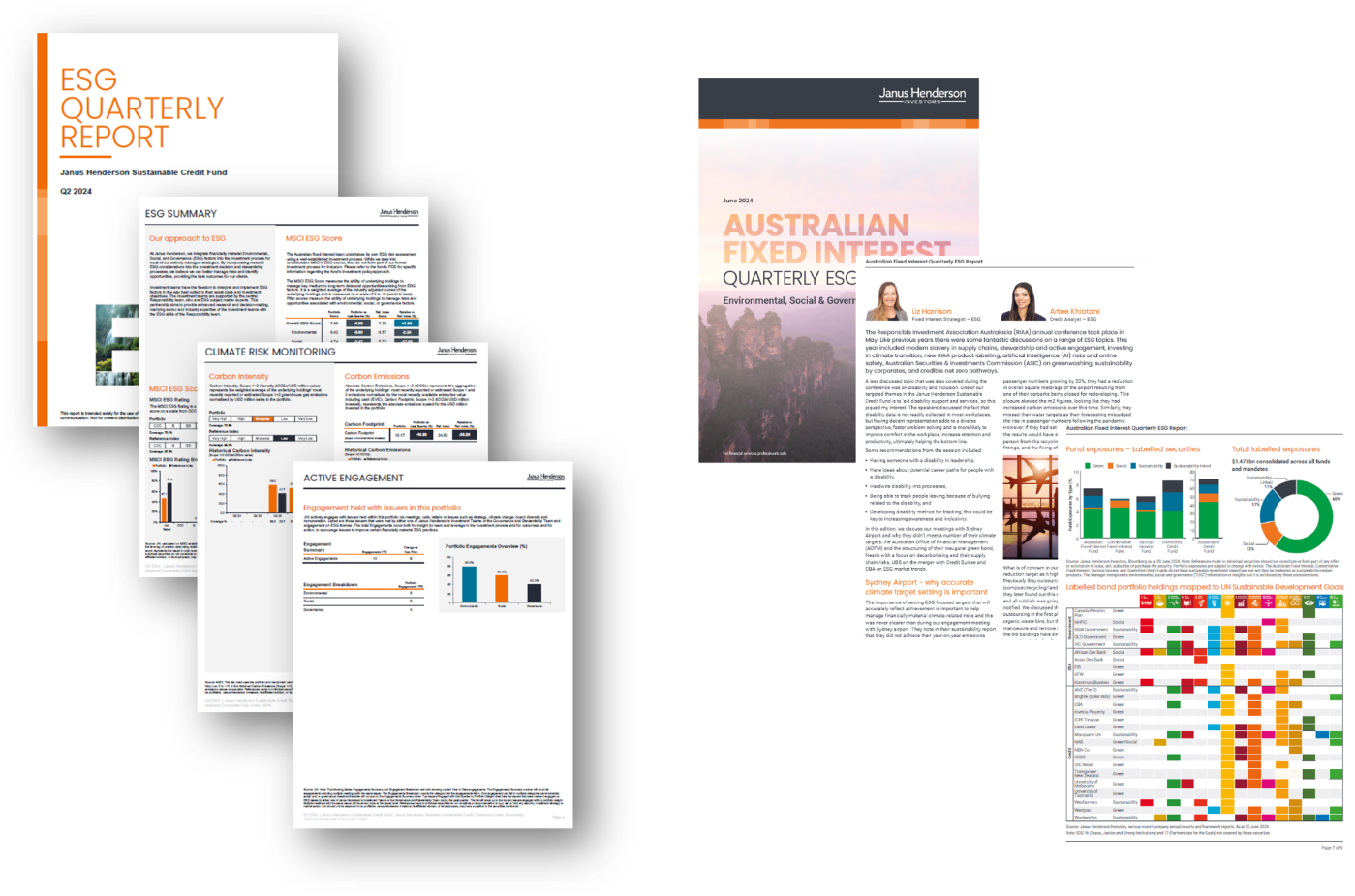

What reporting do we have available to assist asset owners?

Source: Janus Henderson Investors

The ESG data of our investment portfolios is then used to create our ESG reporting for the portfolios in which our clients’ invest. For asset owners that need to undertake the mandatory sustainability reporting, they will need to report on scope 3 emissions from year 2. Their scope 3 emissions will comprise the scope 1 & 2 emissions of issuers within their investment portfolio. Our ESG reporting details the portfolio’s carbon footprint (scope 1+2 tCO2e/USDmn invested), carbon emissions (scope 1+2 tCO2e) and weighted average carbon intensity (scope 1+2 tCO2e/USDmn sales), all reported quarterly.

However, as it stands there are limitations with the availability of ESG data, with some issuers still not publishing their emissions or there is no coverage on that company by MSCI. This should improve as all companies are phased into the mandatory climate disclosure reporting.

We would welcome the opportunity to discuss these new reporting requirements with you in more detail. Please reach out to your usual Janus Henderson representative if you would like further information.

1Source: ACSI, Promises, Pathways & Performance, Climate change disclosure in the ASX200, July 2024

The information provided does not constitute legal advice. No representation or warranty, express or implied, is made by Janus Henderson Investors in or in relation to this information, including its accuracy. In providing the information Janus Henderson does not assume any responsibility to the receiver.