Market overview

After a strong run through the first 10 months of the year, global equities delivered a muted performance in November as risk aversion took hold before stocks regained their footing late in the month. The MSCI World Index rose 0.3% in U.S. dollar terms. Global government bonds posted mixed performance as yields declined in the U.S. but edged higher in the UK and Germany, while Japanese 10-year yields reached a 17-year high. Global corporate bonds delivered largely positive returns as high yield spreads narrowed.

Oil prices extended their four-month slide, with WTI down 4% and Brent off roughly 3%. The U.S. dollar index declined by 0.3% against a basket of global currencies after rallying more than 2% in the prior month. Gold surged more than 5% for its fifth straight monthly advance.

Key themes that drove markets

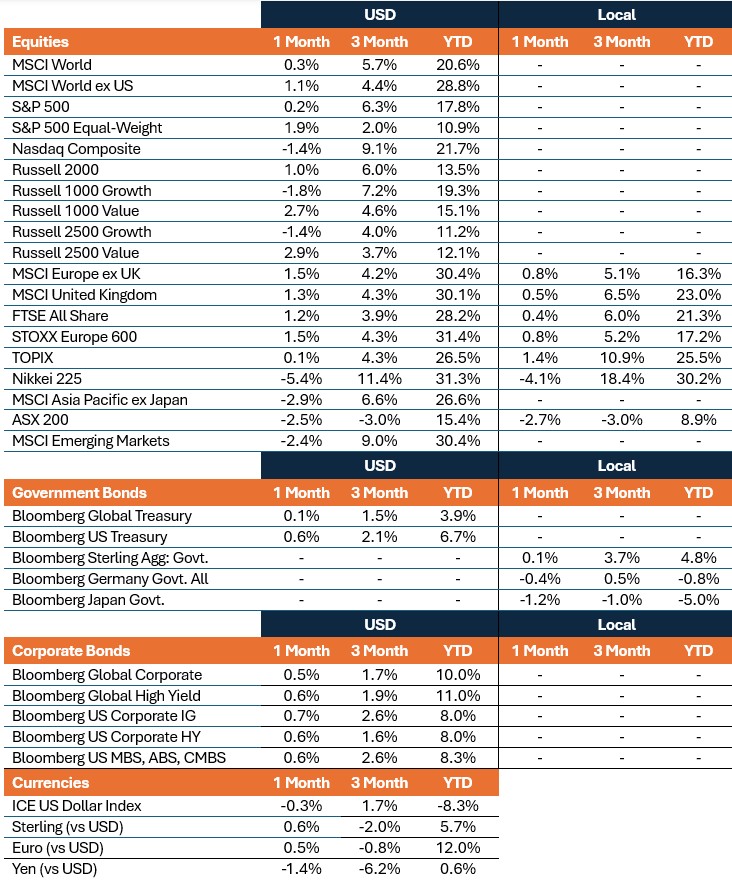

- Fed rate cut speculation spurs late-month rally: November saw a dramatic swing in expectations for a December rate cut. Odds had plunged below 30% mid-month after hawkish Fed commentary and October FOMC minutes, only to surge above 80% following dovish remarks from NY Fed President Williams on November 21. The reversal fueled a sharp equity rebound, underscoring how policy signals remain a dominant market catalyst.

Fed rate cut expectations (for Dec. 10 policy decision)

Source: Bloomberg; based on fed funds futures.

- AI enthusiasm meets debt scrutiny and competitive shifts: The AI trade faced renewed pressure as concerns over hyperscaler capex and debt-funded investment intensified. SoftBank’s sale of its entire Nvidia stake and Alphabet’s well-received Gemini 3 launch stoked debate over future AI leadership. Nvidia’s strong earnings report failed to prevent a more than 12% monthly decline for the stock, while shares of Alphabet gained nearly 14%.

- Global central banks diverge as policy paths sharpen: While Fed rate cut speculation dominated markets, the BoE held rates but fueled expectations for a December cut amid softer UK inflation data. In Japan, firmer inflation data pushed JGB yields toward 17-year highs and intensified expectations for the Bank of Japan to advance policy normalization, with a December (or early-2026) hike seen as increasingly likely.

- U.S. government shutdown ends, but data fog persists: Although the prolonged shutdown finally concluded, its ripple effects remain. Key economic reports for October and November won’t be available until after the December 10 Fed meeting, leaving policymakers and markets navigating with limited visibility.

- European equities hold firm as earnings top modest forecasts: European equities held record highs despite global volatility, buoyed by Q3 earnings beats and upward revisions to 2026 consensus estimates. Policy visibility improved in the UK as Chancellor Reeves’ Autumn Budget built a larger fiscal buffer, though sector-specific tax measures sparked rotation.

United States

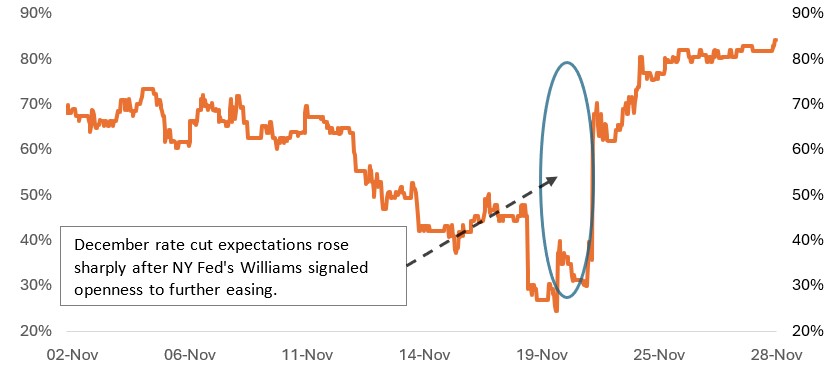

U.S. equities were mixed in November in a volatile month marked by big market swings and sector divergence. A late-month rally lifted the S&P 500 slightly, while value and defensive sectors outperformed growth and technology stocks.

The S&P 500 edged up 0.2% for its seventh straight monthly advance as stocks rallied in the final week of trading. At one point, the benchmark had been down more than 4% on the month. Healthcare led with a 9.3% gain – its best monthly performance since 2022 – supported by strong earnings and further M&A activity. Communication Services advanced 6.4%, largely driven by Alphabet (GOOGL +13.6%) as investors debated AI leadership. Information Technology fell 4.3% (after leading gainers last month), reflecting pressure on growth and AI-related names; Nvidia’s earnings beat failed to prevent a double-digit decline for the stock (NVDA -12.6%).

- The equal-weight S&P 500 notably outperformed the official cap-weighted benchmark, gaining 1.9%.

- The Nasdaq Composite declined 1.4%, pressured by weakness in technology and AI-related names, while the small-cap Russell 2000 gained 1.0%.

- Growth and mega-cap technology stocks lagged, while value and traditionally more defensive sectors outperformed. The Russell 2500 Growth Index declined 1.4%, whereas its value counterpart rose 2.7%.

Although the U.S. government shutdown came to an end (after 43 days), its lingering economic impacts and delayed data releases added to monetary policy uncertainty. Odds of a December Fed rate cut plunged below 30% mid-month after hawkish commentary and evidence of a split Fed in the October meeting minutes but then surged above 80% following dovish remarks from NY Fed President Williams. This reversal fueled a sharp stock market rally in the final week of trading.

Sector performance highlighted pronounced rotation

S&P 500 sector performance (November & year to date)

Source: Bloomberg. As of 30 November 2025.

Europe

Eurozone equities resilience was underpinned by earnings that beat muted forecasts and consensus 2026 estimates revised higher. The MSCI Europe ex UK Index rose 1.5% in U.S. dollar terms in November but gained a more modest 0.8% in euro. According to Bloomberg, European companies posted the smallest year-on-year EPS decline in a year (-1% vs. -6% expected), helping offset concerns about rising costs and fragile sentiment. Political risk lingered but was overshadowed by corporate strength, with France’s CAC 40 and Germany’s DAX hovering near record highs.

Macro conditions provided a supportive backdrop.

- Eurozone business activity held firm, with the composite PMI at 52.4, marking its 11th consecutive month above the 50 threshold even as manufacturing slipped back into contraction (49.7).

- Inflation remained close to target: Eurostat reported eurozone CPI eased to 2.1% in October, from 2.2% in September, confirming the initial estimate.

- These dynamics reinforced expectations that the European Central Bank (ECB) will maintain its extended pause.

UK equities posted solid gains, drawing support from earnings resilience and policy clarity following Chancellor Rachel Reeves’ Autumn Budget. The MSCI United Kingdom index rose 1.3% in U.S. dollar terms and up 0.5% in sterling.

- The UK budget emphasized fiscal discipline and a larger buffer of ~£22B versus prior headroom of £9.9B, which markets welcomed, but targeted tax hikes briefly unsettled sentiment.

- Borrowing costs spiked mid-month as gilt yields rose sharply on concerns about fiscal credibility before stabilizing after Reeves reaffirmed her commitment to debt reduction.

Across the STOXX 600 – comprising companies from 17 countries across developed Europe including the UK – sector performance was mixed.

- Healthcare led (+5.1% in euro terms), followed by Banks (+4.8%) and Construction & Materials (+3.8%), supported by upbeat earnings and resilient demand.

- Conversely, Technology (-4.9%) and Industrials (-4.5%) lagged. Defense-related names within Industrials were pressured as headlines suggesting progress in Ukraine-Russia peace talks weighed on sentiment toward the sector.

Asia Pacific

Japanese equities were mixed in November with signs of some profit-taking after October’s strong gains. The TOPIX was essentially flat in U.S. dollar terms (+0.1%) but advanced 1.4% in yen. In contrast, the Nikkei 225 fell 5.4% in U.S. dollar terms (down 4.1% locally), pressured by a pullback in AI and semiconductor-related stocks. Policy uncertainty added to volatility.

- Rising wage and CPI prints pushed Japanese government bond (JGB) yields toward 17-year highs amid intensifying speculation that the Bank of Japan could embark on rate hikes as soon as next month.

- Markets also digested plans for additional bond issuance to fund recently announced fiscal stimulus.

The MSCI AC Asia Pacific ex Japan Index fell 2.9% in U.S. dollar terms. Declines were most pronounced in markets that saw outsized gains driven by technology firms in the prior month. MSCI Korea fell 7.9% while MSCI Taiwan fell 5.0%, both in U.S. dollar terms. MSCI China slipped 2.5% as weak investment data and fiscal retrenchment weighed on sentiment, despite modest policy support. Australia’s ASX 200 dropped 2.5% in U.S. dollar terms, down 2.7% in AUD.

Emerging Markets

Emerging market equities retreated in November, with the MSCI Emerging Markets Index down 2.4% in U.S. dollar terms, reversing part of their recent rally (the benchmark remains up roughly 30% year to date).

- Weakness was concentrated in Asian markets where the global pullback in semiconductor and AI-related names weighed on performance. India bucked the trend with modest gains as the MSCI India Index rose 0.9% and the Nifty 50 added 1.3%.

- Latin America was a bright spot. The MSCI EM Latin America Index surging 6.1% on strong commodity-linked gains. Brazil (+7.7%) and Chile (+8.9%) led the region, buoyed by robust demand for metals and agricultural exports, while tariff relief on Brazilian beef and coffee added to optimism. Colombia (+6.5%) and Mexico (+2.9%) also advanced, though Argentina was flat as hopes for a U.S.-backed bailout faded after banks shelved a $20 billion rescue plan, pivoting to a smaller short-term loan package instead.

- In Europe, Hungary (+6.0%) and Czech Republic (+3.9%) outperformed, while Poland gained 1.6%.

Fixed Income

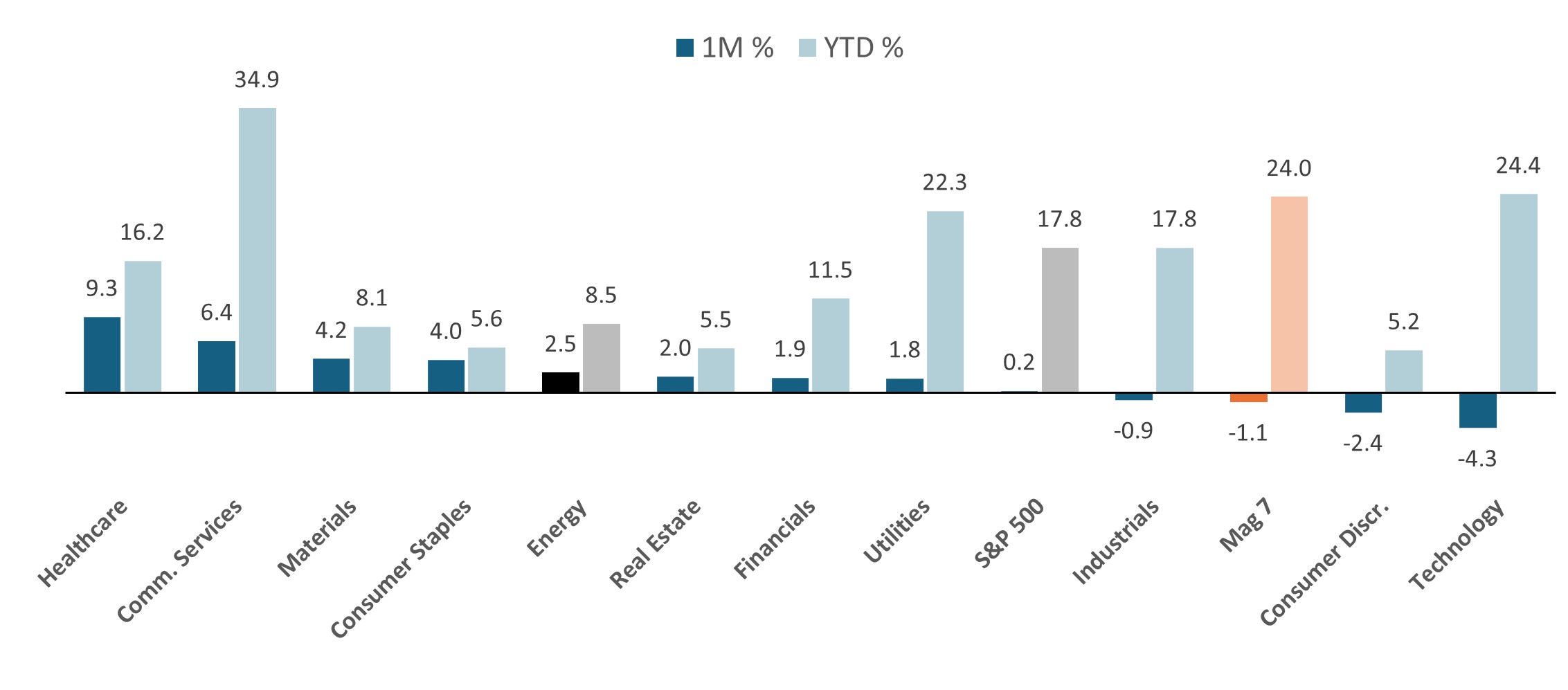

Global government bonds delivered mixed returns in November, with U.S. Treasuries leading gains as yields fell, while Japanese bonds lagged. Spread sectors posted modest positive returns, benefiting from improved risk sentiment late in the month.

- U.S. Treasuries outperformed as yields fell across the curve, with the 10-year ending at 4.02%, down about 9 basis points (bps) from October. The month was marked by dramatic swings in Fed rate cut expectations, with the yields on the 10-year topping 4.15% in mid-November before falling back toward 4.0% by the end of the month in wake of dovish comments from NY Fed Governor Williams.

U.S. Treasury Yield Curve (month-on-month change)

Source: Bloomberg, U.S. Treasury

- UK 10-year Gilt yields rose roughly 3 bps in a month dominated by Budget uncertainty. Ultimately the Budget proved largely uneventful, with details regarding lower Gilt issuance well received by investors. UK government bond returns were roughly flat on the month.

- In the eurozone, German Bunds underperformed amid concerns over increased debt issuance needed to fund fiscal expansion plans.

- In Asia, Japanese government bonds (JGB) underperformed, down more than 1% in yen. JGB yields continued to push higher with 10-year yields topping 1.8%, their highest since 2008, reflecting concerns around loose fiscal policy alongside growing expectations for BoJ to move forward with rate hikes as soon as next month.

10-year Japanese government bond yield climbs to a 17-year high

Source: Bloomberg

Spread sectors delivered positive returns, aided by late-month risk appetite.

- Global investment grade spreads widened by roughly 3 bps, while global high yield spreads tightened by 5 bps.

- In the U.S., investment grade spreads widened by 2 bps while high yields tightened by 12 bps, reflecting selective risk-taking.

- In securitized markets, asset-backed securities (ABS) and mortgage-backed securities (MBS) spreads widened marginally but remained well below historical averages.

Central Bank Watch

November saw fewer major policy moves than prior months, but central bank signals continued to shape market expectations. Developed market policymakers largely held rates steady, emphasizing data dependence. In emerging markets, Korea’s shift in forward guidance hinted that it may be near the end of its current rate cut cycle.

Developed Markets

- Royal Bank of Australia (Nov. 4): Maintained its cash rate at 4.35%, citing moderating inflation and signs of cooling domestic demand. RBA reiterated data-dependence stance, signaling future moves will hinge on household spending and labor market resilience.

- Bank of England (Nov. 6): Held rates at 4.0%, as expected. BOE’s Monetary Policy Committee (MPC) voted 5-4 to leave rates unchanged, with Governor Bailey casting the deciding vote. Softer economic data and Bailey’s comments that each decision is becoming a “closer call” boosted expectations for a 25 bps rate cut at the December 18 meeting.

Emerging Markets

- People’s Bank of China (Nov. 20): the PBOC left its key rates – one-year and five-year Loan Prime Rates (LPR) – unchanged for a sixth straight month.

- Bank of Korea (Nov. 26): Held its benchmark interest rate unchanged at 2.5% for a fourth straight meeting. Notably, the BOK omitted prior language that the board would “maintain its rate cut stance” from its statement and replaced it with “the Board will decide whether and when to implement any further Base Rate cuts.”

Key events on tap next month

- Dec. 10 – U.S. FOMC (Federal Reserve) rate decision

- Dec. 10-11 – China 2025 Central Economic Work Conference

- Dec. 17 – U.S. Nonfarm Payrolls, Unemployment Rate (November)

- Dec. 17 – UK Consumer Price Index (November)

- Dec. 17 – Eurozone Consumer Price Index (November)

- Dec. 18 – Bank of England (BOE) rate decision

- Dec. 18 – European Central Bank (ECB) rate decision

- Dec. 18 – U.S. Consumer Price Index (November)

- Dec. 19 – Bank of Japan (BOJ) rate decision

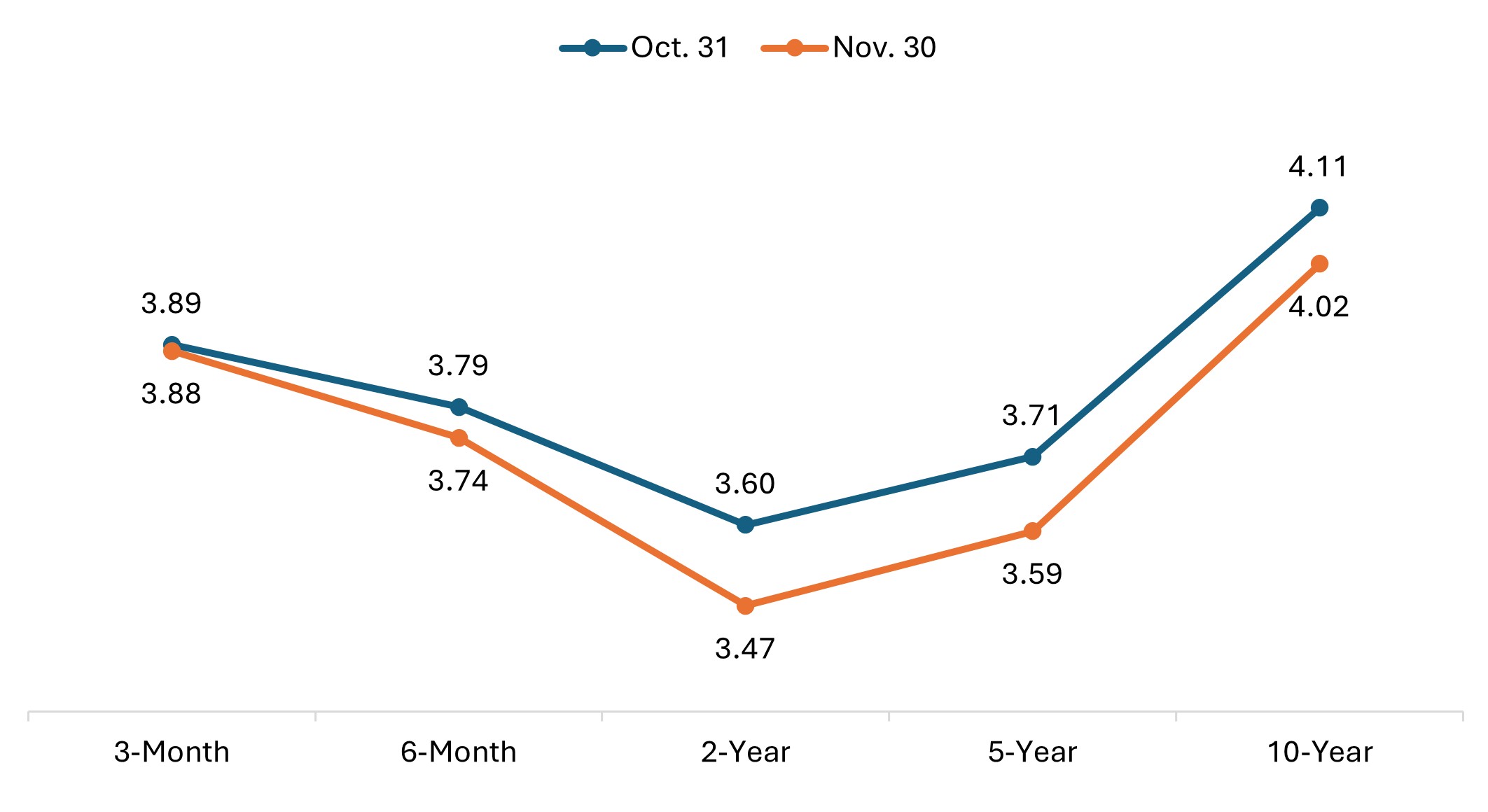

Market Performance

Total returns (%), periods ended November 30, 2025