Central Bank Watch

November saw fewer major policy moves than prior months, but central bank signals continued to shape market expectations. Developed market policymakers largely held rates steady, emphasizing data dependence. In emerging markets, Korea’s shift in forward guidance hinted that it may be near the end of its current rate cut cycle.

Developed Markets

- Royal Bank of Australia (Nov. 4): Maintained its cash rate at 4.35%, citing moderating inflation and signs of cooling domestic demand. RBA reiterated data-dependence stance, signaling future moves will hinge on household spending and labor market resilience.

- Bank of England (Nov. 6): Held rates at 4.0%, as expected. BOE’s Monetary Policy Committee (MPC) voted 5-4 to leave rates unchanged, with Governor Bailey casting the deciding vote. Softer economic data and Bailey’s comments that each decision is becoming a “closer call” boosted expectations for a 25 bps rate cut at the December 18 meeting.

Emerging Markets

- People’s Bank of China (Nov. 20): the PBOC left its key rates – one-year and five-year Loan Prime Rates (LPR) – unchanged for a sixth straight month.

- Bank of Korea (Nov. 26): Held its benchmark interest rate unchanged at 2.5% for a fourth straight meeting. Notably, the BOK omitted prior language that the board would “maintain its rate cut stance” from its statement and replaced it with “the Board will decide whether and when to implement any further Base Rate cuts.”

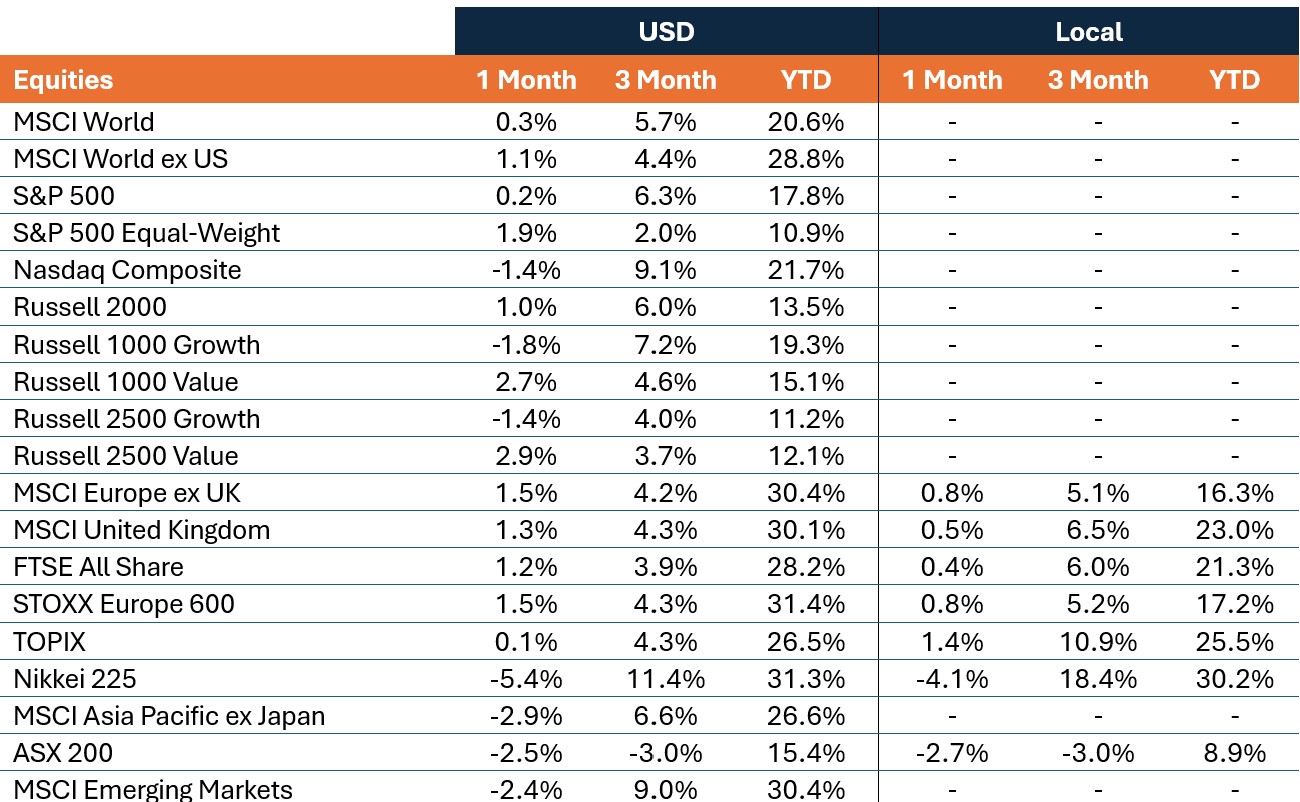

Market Performance

Total returns (%), periods ended November 30, 2025

Market Performance

Total returns (%), periods ended November 30, 2025

| USD | Local | |||||

| Equities | 1 Month | 3 Month | YTD | 1 Month | 3 Month | YTD |

| MSCI World | 0.3% | 5.7% | 20.6% | – | – | – |

| MSCI World ex US | 1.1% | 4.4% | 28.8% | – | – | – |

| S&P 500 | 0.2% | 6.3% | 17.8% | – | – | – |

| S&P 500 Equal-Weight | 1.9% | 2.0% | 10.9% | – | – | – |

| Nasdaq Composite | -1.4% | 9.1% | 21.7% | – | – | – |

| Russell 2000 | 1.0% | 6.0% | 13.5% | – | – | – |

| Russell 1000 Growth | -1.8% | 7.2% | 19.3% | – | – | – |

| Russell 1000 Value | 2.7% | 4.6% | 15.1% | – | – | – |

| Russell 2500 Growth | -1.4% | 4.0% | 11.2% | – | – | – |

| Russell 2500 Value | 2.9% | 3.7% | 12.1% | – | – | – |

| MSCI Europe ex UK | 1.5% | 4.2% | 30.4% | 0.8% | 5.1% | 16.3% |

| MSCI United Kingdom | 1.3% | 4.3% | 30.1% | 0.5% | 6.5% | 23.0% |

| FTSE All Share | 1.2% | 3.9% | 28.2% | 0.4% | 6.0% | 21.3% |

| STOXX Europe 600 | 1.5% | 4.3% | 31.4% | 0.8% | 5.2% | 17.2% |

| TOPIX | 0.1% | 4.3% | 26.5% | 1.4% | 10.9% | 25.5% |

| Nikkei 225 | -5.4% | 11.4% | 31.3% | -4.1% | 18.4% | 30.2% |

| MSCI Asia Pacific ex Japan | -2.9% | 6.6% | 26.6% | – | – | – |

| ASX 200 | -2.5% | -3.0% | 15.4% | -2.7% | -3.0% | 8.9% |

| MSCI Emerging Markets | -2.4% | 9.0% | 30.4% | – | – | – |

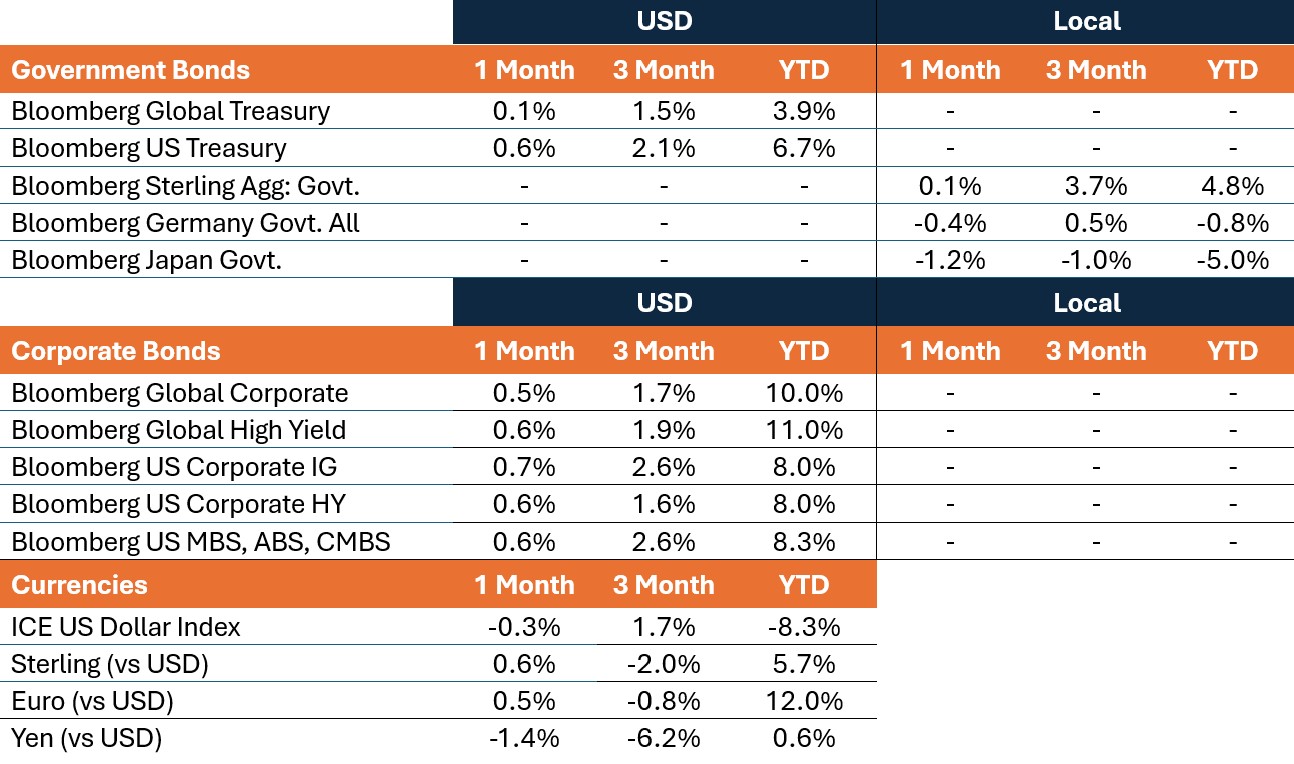

| USD | Local | |||||

| Government Bonds | 1 Month | 3 Month | YTD | 1 Month | 3 Month | YTD |

| Bloomberg Global Treasury | 0.1% | 1.5% | 3.9% | – | – | – |

| Bloomberg US Treasury | 0.6% | 2.1% | 6.7% | – | – | – |

| Bloomberg Sterling Agg: Govt. | – | – | – | 0.1% | 3.7% | 4.8% |

| Bloomberg Germany Govt. All | – | – | – | -0.4% | 0.5% | -0.8% |

| Bloomberg Japan Govt. | – | – | – | -1.2% | -1.0% | -5.0% |

| USD | Local | |||||

| Corporate Bonds | 1 Month | 3 Month | YTD | 1 Month | 3 Month | YTD |

| Bloomberg Global Corporate | 0.5% | 1.7% | 10.0% | – | – | – |

| Bloomberg Global High Yield | 0.6% | 1.9% | 11.0% | – | – | – |

| Bloomberg US Corporate IG | 0.7% | 2.6% | 8.0% | – | – | – |

| Bloomberg US Corporate HY | 0.6% | 1.6% | 8.0% | – | – | – |

| Bloomberg US MBS, ABS, CMBS | 0.6% | 2.6% | 8.3% | – | – | – |

| Currencies | 1 Month | 3 Month | YTD | |||

| ICE US Dollar Index | -0.3% | 1.7% | -8.3% | |||

| Sterling (vs USD) | 0.6% | -2.0% | 5.7% | |||

| Euro (vs USD) | 0.5% | -0.8% | 12.0% | |||

| Yen (vs USD) | -1.4% | -6.2% | 0.6% | |||