First-quarter 2025 earnings season concluded with solid results despite economic and trade policy uncertainty. 78% of S&P 500 companies exceeded earnings per share estimates, with constituents reporting 12.9% earnings growth, marking back-to-back quarterly double-digit growth.1

However, shifting trade policies and persistent tariff threats have created uncertainty for businesses around cost of goods, supply chain stability, and competitive positioning. This uncertainty has weighed on corporate guidance, with 68 S&P 500 companies issuing negative earnings per share guidance, above the five-year average of 57.1

Here’s what our analysts are hearing from earnings calls and company engagements about potential fundamental impacts across market sectors, presented roughly in order of tariff exposure and sensitivity.

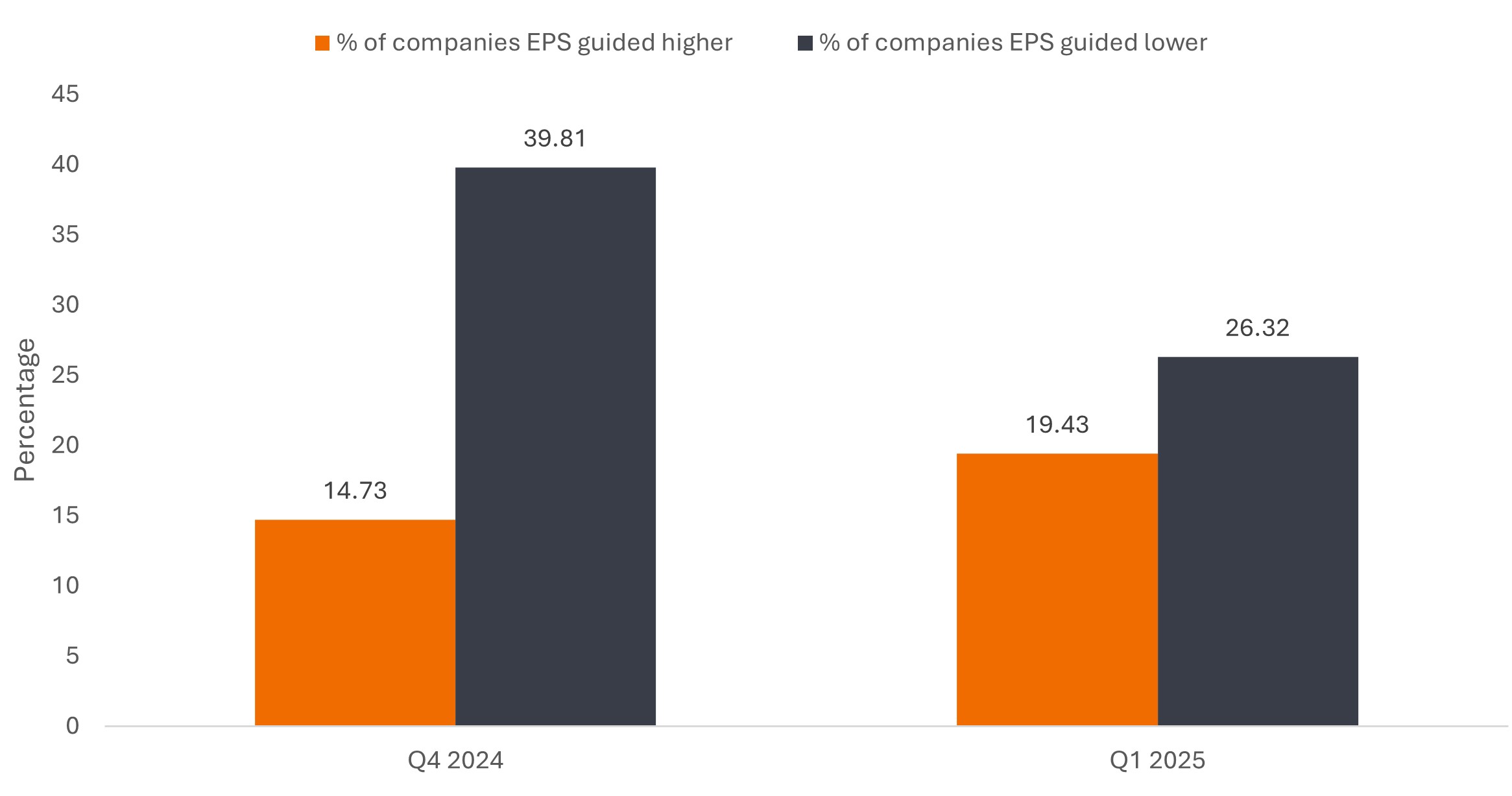

Figure 1: Company guidance

There has been a higher percentage of companies reporting lower earnings per share (EPS) guidance in back-to-back earnings seasons, reflecting tariff pressures.

Source: Bloomberg, data as at 6 June 2025. Percentage based on universe of S&P 500 constituents that have changed guidance during the period.

Consumer: Scale advantages emerge as price increases loom

Consumer companies began quantifying reserves for potential tariff scenarios during first-quarter reporting. Some companies have provided specific quarterly impact estimates, while others have pulled full-year guidance entirely. The timing creates challenges because retailers are implementing price increases on merchandise decisions made months earlier, forcing them to flow higher costs through their income statements immediately. As a result, the second quarter could be the worst quarter from a year-over-year perspective for gross margins.

Innovation is occurring at every level of the supply chain in response to these pressures. Companies are employing multiple mitigation strategies, including changing vendors to move production away from heavily tariffed countries, negotiating price concessions from existing suppliers, and substituting materials where possible.

Walmart led the charge in acknowledging pricing reality, stating that current tariff rates leave no choice but to raise prices across the retail industry. This provided air cover for the rest of the industry to say and do the same thing, given Walmart’s massive market influence.

We believe scale matters more than ever in this environment because retailing is a low-margin business. When supply chains face disruption, large companies like Home Depot, Walmart, and Amazon can leverage their size to negotiate better terms and find alternative suppliers. Individual product outages don’t mean as much to a retailer with thousands of stores as they might to a smaller competitor. Off-price retailers are particularly well positioned as they benefit from excess inventory and merchandise from companies unable to absorb the full cost impact.

Technology: Minimal impact for now, but uncertainty ahead

Current direct tariff impacts remain limited in the tech sector due to electronics exemptions covering PCs, smartphones, and servers. However, there’s a pending Section 232 investigation that could potentially impose direct tariffs on these products later this year.

Beyond the direct hits, we believe indirect impacts center on demand sensitivity. When pricing goes up, consumers become more selective about discretionary technology purchases such as PCs and smartphones. PC makers could respond to cost pressures by offering older processor models to maintain price points, essentially keeping PC prices flat but using lower-specification components.

The bright spot is artificial intelligence (AI) infrastructure spending, which remains highly resilient. Companies like Meta, Microsoft, Amazon, and Google are planning for long-term data center capacity requirements and won’t alter their investment plans based on tariff regimes that change from week to week. These companies all reported being constrained by compute capacity, not cost, which strengthens the outlook for chip companies.

As an example of remarkable supply chain agility, Apple is moving most iPhone assembly destined for the U.S. market to India within three months. In our view, this is a much better outcome than initially feared.

Notably, Mexico is emerging as a significant winner, with most AI servers entering the U.S. already assembled there under United States-Mexico-Canada (USMCA) trade agreement protection. This positions Mexico as a potential long-term alternative to China for electronics production.

Industrials and materials: Not as bad as feared

The tariff impact on industrials and materials was not as large as feared for three key reasons. First, most industrials operate local-for-local manufacturing models, which limits cross-border exposure. Second, the supply chains already saw some shifting from the first Trump administration. Third, the biggest exposure is Mexico, which has been mostly exempt under USMCA.

When we look at the actual numbers and estimated 2025 impact of tariffs, we believe it is fairly manageable for companies. The gross impact on cost of goods sold landed in the low-single to mid-single-digit percentage range for most companies, with many expecting to achieve a net-zero impact through cost discipline and pricing. Automotive represents a notable exception, with huge impacts reported at major manufacturers like GM and Ford.

Most companies are being thoughtful about their response, evaluating price increases for implementation in June or the second half of the year. There’s also talk of projects and capital expenditure decisions being paused or pushed out given the uncertainty. This approach kicks the can down the road on inflation until tariff policy reaches a steadier state, making it more of a third- or fourth-quarter event.

Energy & utilities: Limited direct exposure overall

Energy and utilities have been relatively unaffected from a direct tariff impact, but they do face exposure from secondary impacts, particularly around oil demand concerns. For energy companies, onshore drilling uses a lot of steel for drill pipe and casing. Higher costs for these oil country tubular goods will impact well economics, representing about 10% to 20% of total well cost. These cost increases are easier to absorb when oil prices are higher but can have a more meaningful impact as a barrel of crude oil approaches $50.

The good news is that energy products like oil and natural gas have been exempt from tariffs so far, and utilities are even less impacted directly by tariffs. Some equipment like transformers may be imported, but if tariffs increase the cost of these components, it’s a direct pass through via higher rates to customers. Depending on the state, there could be lag effects based on when utilities ultimately recover the costs, but the main takeaway is that utilities are well protected.

Companies generally estimate the hit from tariffs will be 1% to 3% of their multi-year capital plans, with potential to get this impact lower as each utility works through mitigation opportunities with their vendors.

Healthcare: Reshoring strategies and manageable impacts

Most pharmaceutical companies characterize tariff impacts as manageable as the industry awaits policy announcements. The likely tariff range of 10%-25% could end up having relatively minimal effect on pharmaceutical cost of goods, which generally runs in the low single-digit to low double-digit percentage of revenue.

The bigger issue is around most favored nation pricing, which is interlinked with tariff negotiations as the Trump administration tries to equalize pharmaceutical pricing between the U.S. and international markets. Some pharmaceutical firms are reshoring production to the U.S., which could reduce tariff exposure and potentially position them for more favorable policy treatment.

Medical device makers are taking a similar approach, anticipating that they can eventually offset most tariffs through pricing adjustments, supply chain modifications, and relocating manufacturing. For now, this industry has generally guided to a worst-case impact ahead of trade negotiations.

Financial services: Economic-dependent

First-quarter financial services fundamentals were solid, with banks reporting no meaningful tariff impacts and consumer spending continuing to grow at a healthy pace. However, this may be a function of consumers pulling forward some purchases ahead of potential price increases.

The bigger question is whether banks are on the precipice of a broader economic slowdown. Banks are a direct representation of economic output when considering things like lending volumes, payments activity, capital markets activity, and of course, credit losses.

The uncertainty around tariffs does seem to be slowing some types of market activity in the financials sector. For example, M&A activity has declined, which has been a headwind for some investment banks. On the other hand, volatility has led to significant trading volumes, which has helped some of those same firms as well as investment exchange companies.

Uncertainty is also affecting commercial banking activity, with some clients reluctant to move forward with their investment plans and capital expenditures.

Communication services: Indirect exposure through discretionary spending

Communication services companies face indirect exposure to tariffs through discretionary spending impacts on streaming services and potential data center cost increases from higher infrastructure expenses. While consumers aren’t likely to cancel services like social media platforms, there may be more churn in streaming plans and wireless services if discretionary spending tightens.

The positive trend in spending on live entertainment could also face pressure. Concert and festival attendance has been strong so far, but this type of discretionary spending has historically been economically sensitive and could see declines if uncertainty continues.

1 Source: FactSet Earnings Insight Infographic: Q1 2025 By the Numbers as at 29 May 2025.

Volatility measures risk using the dispersion of returns for a given investment.