In a world increasingly shaped by geopolitical realignment, technological disruption, and environmental urgency, the question for investors is no longer whether sustainability matters, but how best to capture its value. Here we, the Janus Henderson Global Sustainable Equity team, outline why the answer lies in a powerful combination: duration and innovation. This, we believe, is the ‘sweet spot’ where long-term compounding meets transformative change, and it’s the cornerstone of our strategy.

The power of the few: why stock-picking still matters

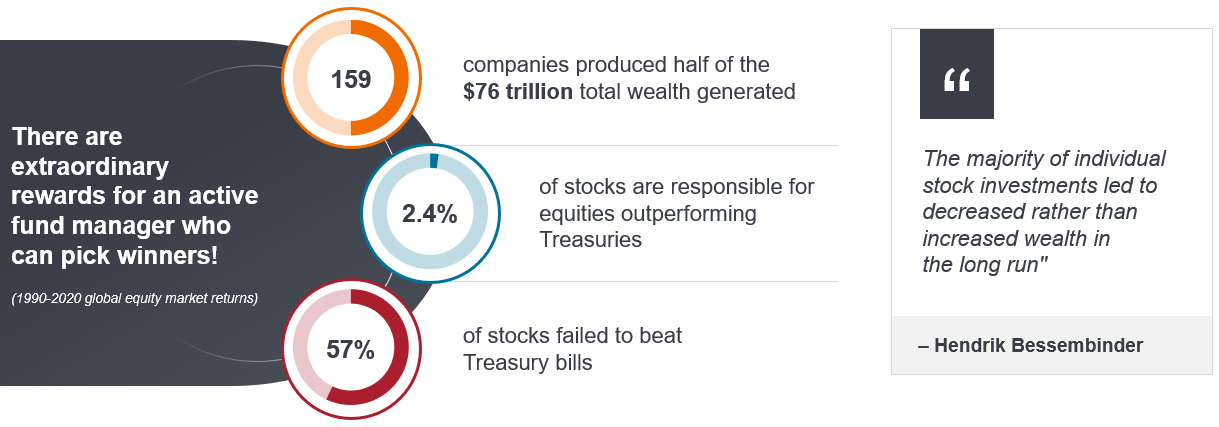

The case for active management has rarely been more compelling. A seminal study1 by economist Hendrik Bessembinder revealed a startling truth: just 2.4% of global stocks were responsible for all the net wealth created in equity markets between 1990 and 2020. Even more sobering, 57% of stocks failed to beat US Treasury bills over the same period.

Exhibit 1: The tremendous value of stock-picking

Source: Bessembinder; Morningstar

Note: Calculations based on total net wealth creation of individual US publicly traded stocks as a percentage of total US net wealth creation from all publicly traded US stocks.

This isn’t just a statistical curiosity – it’s a call to action. In a market where a tiny fraction of companies drive the lion’s share of returns, the ability to identify and hold these outliers is paramount. Passive strategies, often lauded for their low cost and broad exposure, have in recent years benefited from what we deem to be ‘stealth momentum’ – a concentration in a handful of mega-cap stocks. In 2024, the so-called Magnificent Seven accounted for about 50% of S&P 500 returns, despite comprising just 30% of the index.2

Our strategy is built to capitalise on this dynamic. By focusing on a concentrated portfolio of 50-70 high-conviction names, we aim to consistently identify the leading companies exposed to powerful secular trends that will shape the future and deliver outsized returns in the process.

Duration: the underappreciated force

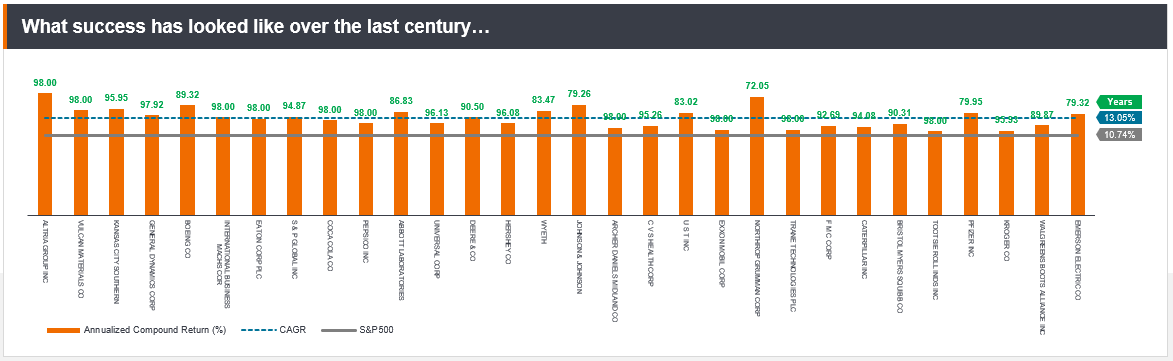

While innovation often steals the spotlight, duration – the ability of a business to endure and compound over time – is equally vital. Bessembinder’s research also showed that the top 30 US stocks over the past century delivered a modest 13% annual return, but their real power lay in longevity. These were not flash-in-the-pan disruptors, but businesses that compounded steadily over decades.

Exhibit 2: Duration is an underappreciated force

Source: ‘Which US Stocks Generated the Highest Long-Term Returns?’ Bessembinder; SSRN. Data as at 31 December 2023.

Note: References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned. Past performance does not predict future returns.

This insight on duration is central to our investment philosophy. We seek companies with proven business models, resilient cash flows, and the ability to adapt across market cycles. In a world obsessed with quarterly earnings and short-term narratives, we take the long view.

Innovation: The engine of sustainable growth

But duration alone isn’t enough. The world is changing fast. Resource constraints, climate change, and demographic shifts are reshaping the global economy. The Bessembinder analysis above shows that duration is key in long-term compounding of wealth, but the types of stocks that will deliver that compounding within the paradigm the world is currently facing have morphed. The businesses that will thrive are those that innovate in response to these megatrends.

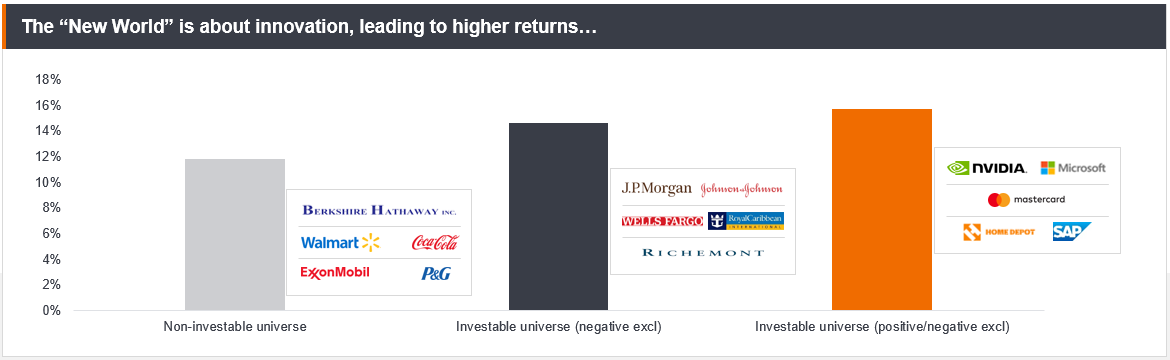

Our sustainability framework filters the investable universe through both negative screens (excluding harmful industries) and positive alignment with our proprietary sustainable development themes. The result is a diversified portfolio that not only seeks to avoid risk but actively seeks opportunity.

Over the last couple of decades, with the 2008-09 Global Financial Crisis (GFC) marking a watershed moment, we have witnessed a shift from so-called ‘Old Economy’ stocks being dominant towards the ascendancy of a ‘New World’. This is where constraints around resource availability, natural capital, and externalities, as well as an electric and digital revolution, have led to innovative companies being long-term outperformers.

We have analysed the total universe of global stocks and applied our sustainability filters to it, in order to gauge the returns profile of each cohort from the time of the GFC to the present day. The non-investable universe for us includes many of those aforementioned ‘Old Economy’ stocks, which is the bar on the left of Exhibit 3 below. We then applied negative filters to the universe of stocks, i.e. the exclusionary criteria that we look at, and we can see that the average returns of this group (middle bar) have been better than the returns of the non-investable universe. We then go a step further and apply our positive screening to the universe as well, i.e. the companies’ revenues must also align with one of our sustainable development themes, and we observe that the average returns of that group are the highest of them all (third bar).

Hence, sustainability to us is about the combination of duration and innovation. We invest in companies which are not only exposed to long duration investment trends and themes around electrification, infrastructure, health, digitalisation, water, efficiency, etc – but that are also focused on innovation, effectively balancing innovation and duration in our approach. This is the ‘New World’ of investing, where innovation and sustainability go hand in hand.

Exhibit 3: Sustainability is both about newness and duration – the ‘sweet spot’

Source: Janus Henderson Investors. Data range December 2008 – December 2024.

Note: References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned. Use of third-party names, marks or logos is purely for illustrative purposes and does not imply any association between any third party and Janus Henderson Investors, nor any endorsement or recommendation by or of any third party. Unless stated otherwise, trademarks are the exclusive property of their respective owners. Past performance does not predict future returns.

The ‘Lindy Effect’: why age matters

The ‘Lindy Effect’ posits that the longer something has survived, the longer it is likely to continue. This principle guides our approach to business model resilience. We tend to avoid speculative companies, for example those under 10 years old, focusing instead on those that have weathered multiple market cycles.

These are businesses with deep moats, strong stewardship, and a track record of adapting to change. Yet we don’t ignore innovation – companies like Uber and Spotify, while relatively young, have proven their durability and are part of our investable universe.

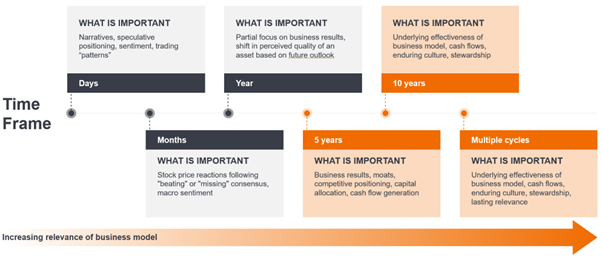

Choosing the right game

Investing is not a one-size-fits-all endeavour. As illustrated in our ‘game of choice’ framework below, there are fundamentally different approaches to the market. Some investors, like Renaissance Technologies, focus on short-term price patterns and sentiment. Others, like Berkshire Hathaway, prioritise business fundamentals and long-term value.

Exhibit 4: Our game of choice is focusing on leading global business models and franchises

Source: Janus Henderson Investors

To be clear, if well-executed, both approaches can work magnificently. However, we are firmly in the latter camp. Our focus is on business model relevance, not market noise. We analyse cash flows, competitive positioning, culture, and stewardship – not just earnings beats or macro headlines. This discipline allows us to stay true to our strategy, even when the market is chasing the ‘next big thing’.

The owner-operator mindset

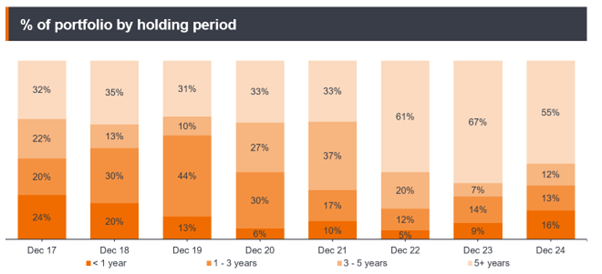

We view ourselves not as traders, but as owners of the businesses we invest in. This mindset is reflected in our holding periods: more than half of our portfolio has been held for over five years, and that proportion has steadily increased over time.

Exhibit 5: An “owner-operator” mentality

Source: Janus Henderson Investors

This long-term orientation allows us to ride out volatility, capture compounding returns, and engage meaningfully with management teams. It’s not just about picking outliers; it’s about backing them for the long haul.

Geopolitical flux: A test of conviction

The year 2025 has brought renewed geopolitical uncertainty. The US presidential election, trade wars, and shifting regulatory landscapes have all contributed to market volatility. Yet we remain optimistic.

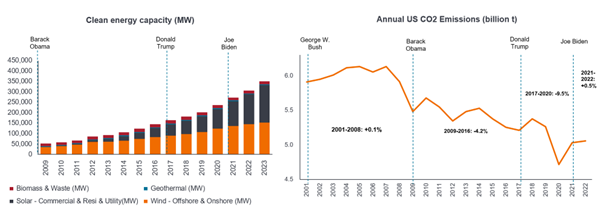

History shows that sustainability themes can thrive even under sceptical administrations. During Trump’s first term, the US added more renewable capacity than under Obama. Today, clean energy investments are nearing US$2 trillion annually, nearly double the amount allocated to fossil fuels.

Exhibit 6: But… the transition goes on

Source: ARNnet; IEA; World Economic Forum; Dean H. Barrett and Aderemi Haruna, Molecular Sciences Institute, School of Chemistry, University of the Witwatersrand; US Department of Energy; Jefferies Research, as at 30 November 2024.

Note: There is no guarantee that past trends will continue, or forecasts will be realised. Past performance does not predict future returns.

Moreover, companies operate on timelines far longer than political cycles. Their commitment to sustainability is driven by economics, not ideology. Solar is now one of the cheapest forms of electricity, and the transition to a low-carbon economy is well underway.

One big trade: The global context

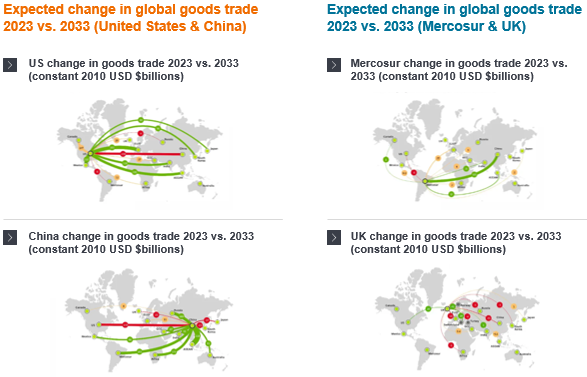

The world is increasingly interconnected. Capital flows, supply chains, and innovation ecosystems transcend borders. Furthermore, flux is the status quo in geopolitics; in the last several years alone, there have been many such realignments impacting the markets we operate in as a strategy.

Exhibit 7: Geopolitical realignment is the ever present

Source: BCG Global Trade Model 2024:UN Comtrade: Oxford Economics; HIS Markit; World Trade Organisation; BCG analysis

We anticipate geopolitical realignment to persist for many years to come. The anticipated changes in trade for both China and the US over the next decade, up to 2033, are illustrated below. Green lines indicate above-average growth, red lines signify a decline in trade, and yellow lines denote below-average growth. The thickness of the lines reflects the magnitude of the anticipated trade change.

Exhibit 8: Flux in the global order is status quo

Source: BCG Global Trade Model 2024:UN Comtrade: Oxford Economics; HIS Markit; World Trade Organisation; BCG analysis

Although direct trade between China and the US is expected to decrease significantly, their trade with Association of Southeast Asian Nations (ASEAN) and India is forecasted to expand considerably. Mercosur, a South American trading bloc that includes Argentina, Brazil, Uruguay, Bolivia, and Paraguay, is expected to maintain stable trade relations with Western countries. However, China, India, and ASEAN are projected to be significant contributors to the growth of South American exports. Conversely, the trade outlook for the UK appears less optimistic, with an expected trade growth of only 9% over the 10-year period.

In this context, sustainability is not a niche – it’s the foundation of global competitiveness. Our portfolio reflects this reality. We invest in companies that are not only aligned with sustainable development trends but are also positioned to lead in a multipolar world. Whether it’s digital infrastructure in Asia, water management in Europe, or healthcare innovation in the US, we seek out the best ideas, wherever they may be.

Keep calm and compound on

As we look ahead, the message is clear: sustainability is not a trend, it’s a strategy. And in a world of flux, the combination of duration and innovation offers a powerful compass.

We don’t chase narratives. We don’t time markets. We invest in enduring businesses solving real-world problems. And we do so with conviction, discipline, and a long-term view.

1Source: Long-Term Shareholder Returns: Evidence from 64,000 Global Stocks, Hendrik Bessembinder – W.P. Carey School of Business, Te-Feng Chen – Hong Kong Polytechnic University, Goeun Choi – Loyola Marymount University (College of Business Administration), K.C. John Wei -Hong Kong Polytechnic University

2Source: Seeking Alpha, ‘Magnificent Seven dominates S&P500, driving more than half of the 2024 gains’, (6 January 2025)

Active investing: An investment management approach where a fund manager actively aims to outperform or beat a specific index or benchmark through research, analysis and the investment choices they make. The opposite of Passive Investing.

Secular trends: Long-term trends that shape industries and economies, offering investment opportunities aligned with enduring societal changes.