A series of forces is coalescing to alter much of the framework underpinning the global economy. How these – often policy-driven – shifts impact consumer behavior, corporate strategy, and the interaction between trading blocs will have ramifications for financial markets. This is especially true for fixed income given the asset class’s multiple roles of serving as a gauge of the cost of capital, a defensive asset, and a potential source of excess return. Going forward, bond investors will need a new playbook to maximize a fixed income allocation’s potential for capital preservation, income generation, diversification, and ability to dampen a broader portfolio’s volatility.

A changing world

It is essential for investors to understand the magnitude of the shifts occurring across the fixed-income landscape and what type of approach will be needed to optimize bond allocations for this new economic and market regime. The roughly 50-year bond bull market is over as the disinflationary forces of globalization have largely run their course, and in some cases are reversing. Furthermore, the era of extraordinary monetary policy accommodation that began with the Global Financial Crisis (GFC) and continued through the Covid-19 pandemic is being unwound as officials now must also account for managing inflation. At the same time, many advanced economies’ government deficit and debt profiles have continued on a potentially unsustainable trajectory – a development likely to cause a repricing of many of the world’s risk-free assets.

The degree to which these forces will impact individual countries and regions is likely to result in a less synchronized global economy as growth and inflation rates diverge, with policy reflecting local conditions. Investors must respond accordingly by recognizing the likelihood of a greater dispersion of risk and potential for excess return across regions and fixed-income categories.

Why the front end?

Higher secular inflation tends to translate to rising interest rate risk. Sovereign yield curves already reflect this sea change as many have experienced a steepening between front-end and mid-dated tenors. While the return of a durable term premium is in many respects a welcome development, the uncertainty surrounding inflation’s drivers – deglobalization, a large monetary base, and unstable currencies – is likely to lead to elevated volatility in longer-dated bonds. In many jurisdictions, term premiums may not sufficiently compensate investors for incurring additional duration exposure.

In contrast, now that global rates have largely reset to levels not consistently seen since prior to the GFC, the front end of yield curves arguably presents the potential for more attractive risk-adjusted returns. Furthermore, with global economies decoupling and monetary policy diverging, spreading a shorter-dated allocation across jurisdictions could give investors exposure to attractive yields where economic growth is resilient or inflation persistent and allow for capital appreciation in regions where lagging growth necessitates policy accommodation.

Rather than being solely driven by greater future macro uncertainty, the potential benefits of front-end exposure are moored in historical precedent. As illustrated in Exhibit 1, shorter-dated bonds, especially the 1-to-3-year category, tend to deliver higher Sharpe ratios than do longer-dated tenors over extended time horizons.

Exhibit 1: Sharpe ratios of U.S. bond market maturity groupings

Over long time horizons, shorter-dated fixed income securities exhibit higher Sharpe ratios, signifying a more attractive balance between return and incremental level of risk.

Source: Janus Henderson, as of 30 June 2025.

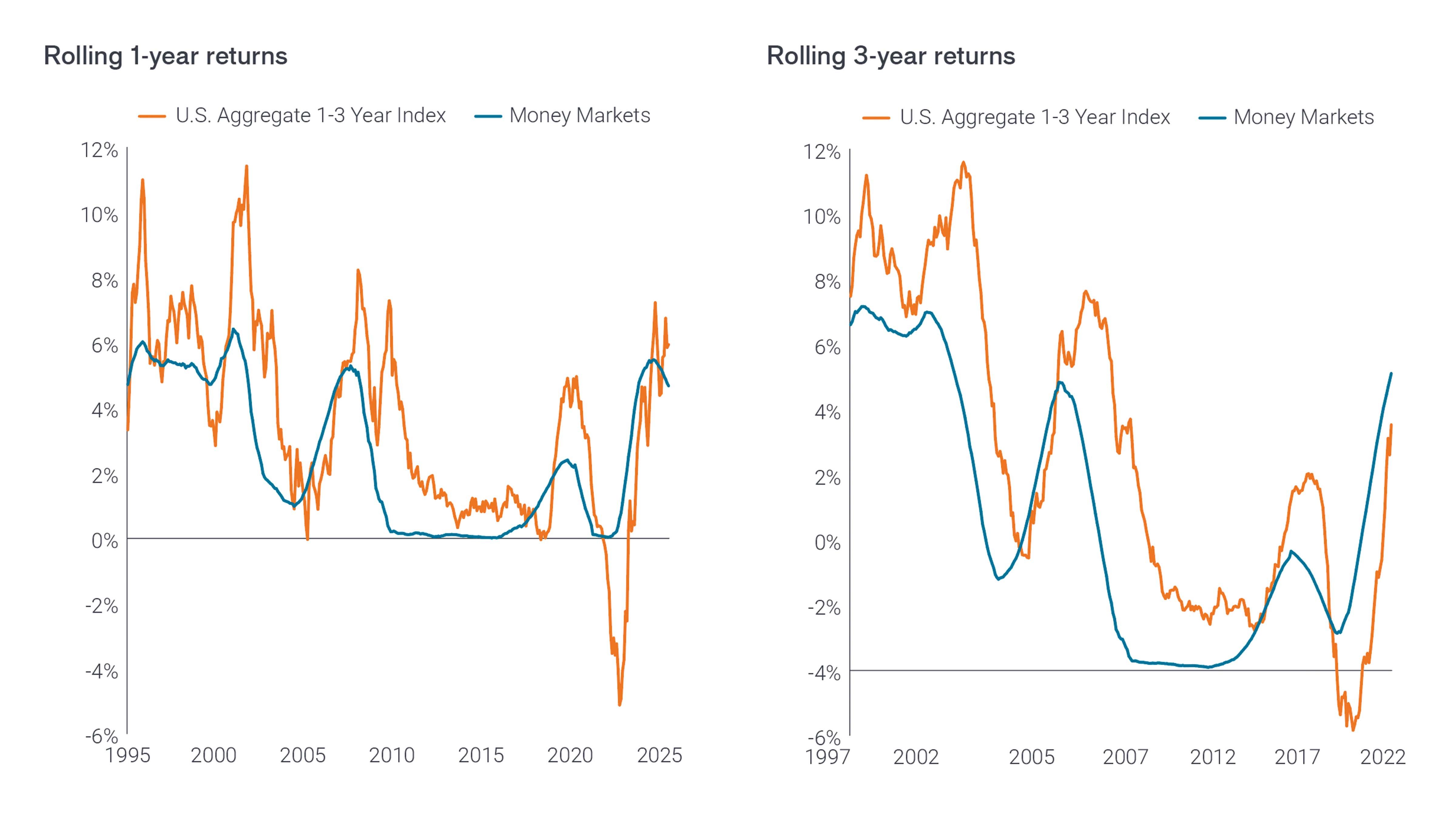

While the risks of elevated exposure to longer-dated bonds in a period of heighted uncertainty are evident, one may ask, why not virtually eliminate duration exposure by holding exclusively cash or cash-like instruments? Again, referencing historical trends and as seen in Exhibit 2, the Bloomberg U.S. 1–3-year Bond Index’s rolling one-year and three-year returns – calculated monthly – have outperformed money markets 75% and 84% of the time, respectively.

Exhibit 2: Reverting to the mean

Over the past several economic cycles, shorter-dated bonds have typically outperformed money markets, with the trend even more pronounced during periods of falling policy rates.

Source: Janus Henderson, as of 30 June 2025.

The Bloomberg U.S. Aggregate 1-3 Year Index is a subset of the Bloomberg U.S. Aggregate Index, and tracks investment grade, fixed-rate bonds, including Treasuries, government-related, corporate, and securitized issues. It only includes securities with a maturity between one and up to, but not including, three years.

Enhancing short-duration portfolios with credit

While the risk-reward profiles of longer-dated bonds may prove less attractive in this new regime, investors still have the potential to enhance returns by incorporating exposure to higher-quality corporate credits. Not only do these securities tend to compensate investors with a credit risk premium, but the spread between their yields and those of their risk-free benchmarks can dampen the effects of rate volatility – a characteristic that could prove beneficial in an inflationary era.

Furthermore, credit risk can be managed by concentrating allocations in shorter-dated issuance as investors tend to have greater visibility into corporate performance and financial health over near-term horizons. Similarly – and as is the case with sovereigns – shorter-dated credits tend to deliver roll-down yield where discounted market prices rise to par at maturity.

With credit, too, a global approach can fortify portfolios. Diverging economic cycles across regions mean that investors should be able to more readily find issuance buoyed by rising tides, enhancing both the prospects for diversification and excess returns. Regional diversification can also limit event risk. Recent banking crises in the U.S. and Europe, for example, were contained within those regions, with pricing in other advanced economies minimally affected.

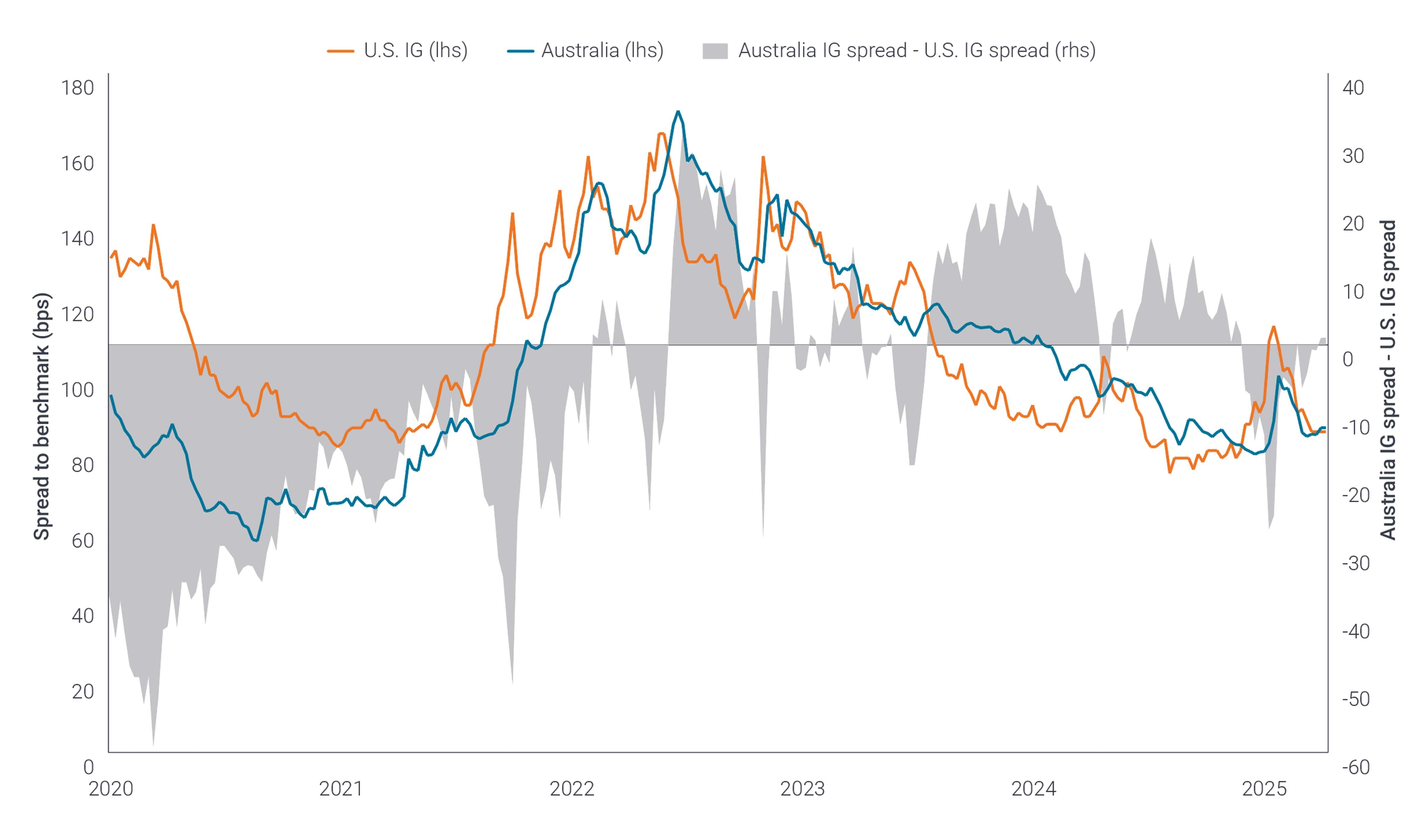

A global credit allocation also exposes investors to the unique market structures the credit stories that exist in various jurisdictions. Australian banks, for example, have been allowed to maintain their large size in a highly consolidated market in exchange for increased regulatory oversight. The upshot is healthy credit profiles as these banks carry high capitalization ratios and avoid venturing into business lines deemed risky.

Exhibit 3: U.S. and Australian investment-grade bond spreads

As monetary policy and economic conditions become less synchronized, differentials between bond spreads could also diverge, allowing investors to select regions with the most attractive risk-reward opportunities.

Source: Janus Henderson, as of 30 June 2025.

In many countries, certain companies and business verticals enjoy favored status either by operating within a strategically important sector or being partly – or wholly – owned by the state. Investors often consider these issuers’ vital role within the economy or relationship with the state as enhancing creditworthiness as they may enjoy implicit government backing.

A global credit allocation can capitalize on price differentials that may exist between similarly rated issuers. Issuance can be influenced by the domestic business cycle or prevailing rate regime. Consequently, a bond in particular industry and with a specific credit rating can trade at a premium or discount to a bond in a different jurisdiction. Investors’ tendency for home bias and specific preferences – environment, social and governance (ESG) considerations, for example – can also contribute to price differentials.

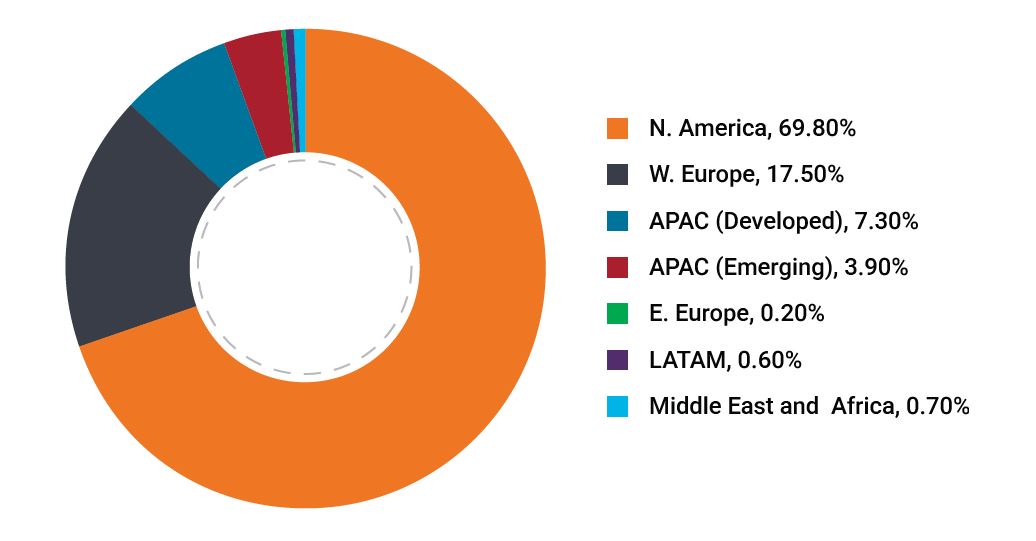

Perhaps the starkest example of how prices can diverge across markets is for those of the same issuer. Corporations have myriad reasons to issue bonds in different regions – from maintaining liquidity and a diverse investor base to catering to the aforementioned home bias. By deploying a global lens, investors can identify which of a corporation’s issuance offers the most attractive value. And lastly, when uncovering unique company stories, market structures, and relative value opportunities, investors will recognize the global bond market is not the equities market, whose returns over the past several years have been dominated by a handful of technology-focused, mega-cap U.S. stocks. With sound management and resilience prioritized over growth, attractive risk-adjusted opportunities can be found across jurisdictions.

Exhibit 4: Many jurisdictions, many unique opportunities

Well-managed companies can be found in every jurisdiction, and many leading multinationals – including U.S.-based companies – issue debt outside their home market and in a range of currencies.

Source: Janus Henderson, as of 30 June 2025.

In summary

While bond investors may be happy that the era of extraordinary monetary policy, low rates, and the reach for yield is behind them, the new regime presents an entirely new set of risks. In this era, there will be no monolithic approach to fixed income. Rather, investors can embrace the global nature of the bond market to enhance diversification and the potential for excess returns.

Diverging economies, however, present both opportunities and risks. A high level of diligence will be required to optimize risk-adjusted returns. And while longer-dated bonds may have to contend with the return of secular inflation, within shorter- dated issuance, ample opportunity exists for investors to express differentiated views with respect to both credit quality and regional factors. Proactively managing all these levers will be necessary when navigating a less certain global economy and bond market.

Download PDF

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Premium/Discount indicates whether a security is currently trading above (at a premium to) or below (at a discount to) its net asset value. Sharpe Ratio measures risk-adjusted performance using excess returns versus the “risk-free” rate and the volatility of those returns. A higher ratio means better return per unit of risk.

Sovereign debt securities are subject to the additional risk that, under some political, diplomatic, social or economic circumstances, some developing countries that issue lower quality debt securities may be unable or unwilling to make principal or interest payments as they come due.

Volatility measures risk using the dispersion of returns for a given investment. A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

IMPORTANT INFORMATION

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.