Not expecting to use the large lifetime gift and estate tax exemption? You may want to reconsider. Here’s a creative way some investors are using the exemption to reduce income taxes: Upstream gifting.

The concept is best explained by this anecdote from Ben.

The story of my father’s stock

My father acquired 10,000 shares of Apple (AAPL) at the close of business on December 30, 1983. He paid $800 for the stock. At the time of this writing, that same 10,000 shares of AAPL (including splits and reinvested dividends) are worth nearly $5 million!

That’s the good news. The bad news is that the $4,999,200 gain my father realized may be subject to federal and state income taxes totaling as much as $1.5 million. (Ouch!)

This one holding makes up the vast majority of dad’s estate. He knows he should diversify his investment portfolio, but he absolutely HATES the idea of paying the taxes on the gains.

Of course, there are several diversification strategies available to dad, but one that is often overlooked is surprisingly straightforward: Upstream gifting.

But first, Plan A

Dad hopes he will never need to tap the value of the stock during his lifetime, but he is fiscally conservative, so making a gift of the stock to me is a hard sell. However, while the value of the stock is large, it is well under the current lifetime gift and estate tax exemption ($13.99 million in 2025).

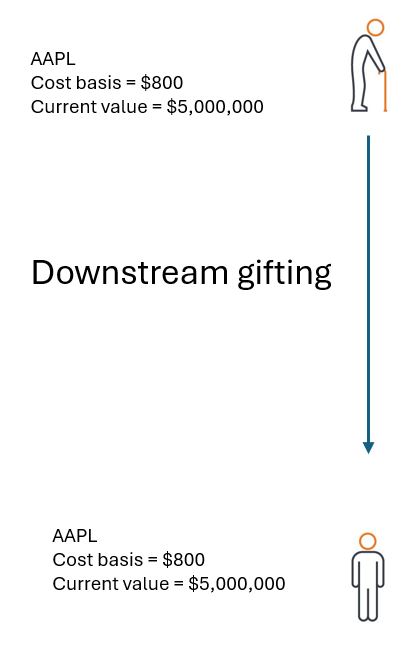

Let’s say my father gifts me the 10,000 shares of Apple stock. By doing so, he achieves his legacy planning and wealth transfer goals, and I receive assets he wishes to give. Let’s call this example “downstream gifting.”

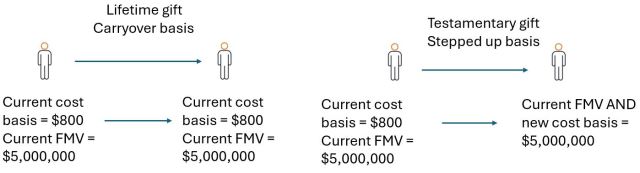

Viola! Dad no longer has a concentrated portfolio with huge unrealized capital gains. Problem is, now I have a concentrated portfolio with huge unrealized capital gains. That’s because gifting an appreciated asset during one’s lifetime transfers not only the value of the asset but also the cost basis of the asset. The problem is not solved, it is simply transferred to me. And dad no longer has the stock!

Dad floats the idea of a step-up in basis, but I remind him that the owner of the stock must die for a recipient to receive the step-up on the stock. Dad is quick to tell me he is unwilling to end his life for an income tax break for me. And on that point, we are in total agreement.

Plan B: Upstream gifting

Faced with this conundrum, I turned to my colleague, Jeff, who proposed the idea of upstream gifting as Plan B.

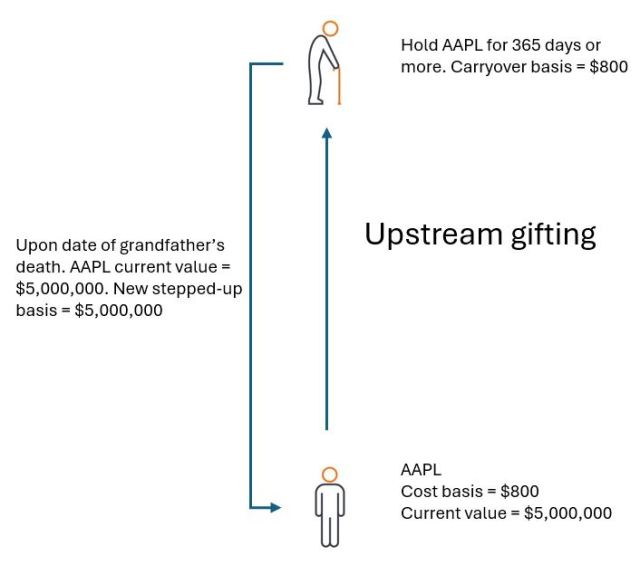

Instead of giving the Apple stock to me, Jeff suggested my dad could give the stock to his dad (my grandfather), who is healthy for a 90-year-old but not likely to live longer than my dad.

To do this, grandpa would set up an account in his name and Social Security number, receive a transfer of the stock, and take the carryover basis. Now, to achieve dad’s goals of portfolio diversification and reduction/elimination of income tax, Jeff explained that the following must take place:

- Grandpa must not sell the position. He must hold it until his death.

- Grandpa must update his estate planning documents or beneficiary designations to gift this position back to dad at the time of grandpa’s death.

- Grandpa must live at least one year following the date of the gift.

Assuming A, B, and C all occur, upon grandpa’s death, dad would receive his same Apple stock but with a stepped-up basis.

Dad can now sell some or all of the stock at little or no capital gain and, consequently, with little or no income tax: A savings of $1.5 million!

Of course, this strategy requires planning and communication between all parties involved. And as simple as it is, the strategy is not without risk. What if Grandpa incurs large medical bills or meets the second love of his life? What if he does not live for another year? What if the law changes to eliminate the step-up in basis at death? All these risks – and more – must be weighed before engaging in this strategy. It is essential for investors to retain the advice of their tax preparer or accountant and their attorney before implementing this technique.

That said, in the right situation, and with proper guidance and awareness, upstream gifting may allow investors to use common tools in an uncommon way to achieve a desired outcome. And it is a prime example of a novel strategy financial professionals can employ to help reinforce the value they bring to their investors.

The information contained herein is for educational purposes only and should not be construed as financial, legal or tax advice. Circumstances may change over time so it may be appropriate to evaluate strategy with the assistance of a financial professional. Federal and state laws and regulations are complex and subject to change. Laws of a particular state or laws that may be applicable to a particular situation may have an impact on the applicability, accuracy, or completeness of the information provided. Janus Henderson does not have information related to and does not review or verify particular financial or tax situations, and is not liable for use of, or any position taken in reliance on, such information.