Quarterly Update

Watch the investment team recap this quarter.

(Note: Filmed in October 2024).

ABOUT THIS FUND

A global equity fund that seeks to provide investors total returns – both capital appreciation and current income – associated with global real estate growth and development. The Fund seeks to own a portfolio of the most compelling real estate equities listed on regulated exchanges throughout the world. These companies will derive the main part of their revenue from the ownership, management and/or development of real estate. Our strategy is long only with the objective of producing strong relative performance while providing genuine exposure to global real estate fundamentals and managing risk by being benchmark aware.

WHY INVEST IN THIS FUND

Multi-Local Presence

Fund managers and analysts based in Europe, Asia and North America provide valuable local expertise in stock selection. Regional investment processes are tailored to each market.

Risk-Aware, Active Management

The portfolio managers take an active approach, emphasizing qualitative considerations, in-depth company research and quantitative projections.

High Conviction, All-Cap Portfolio

A “best ideas” stock portfolio selected from a wide universe, seeking to add value across the market-cap spectrum.

Potential Benefits of Listed Real Estate

Seeking current income and stable growth

Source: Janus Henderson Investors

Global real estate investing with conviction

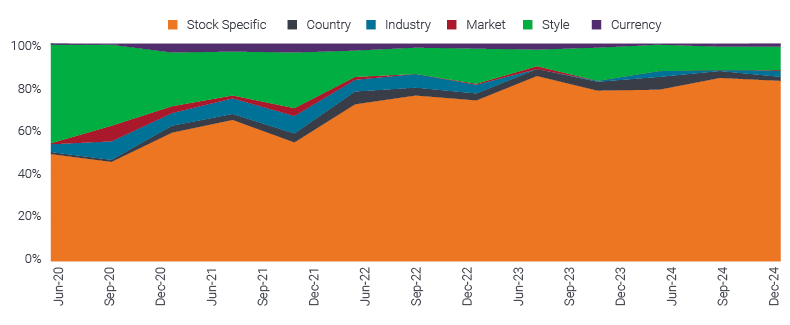

Decomposition of sources of active risk vs FTSE EPRA NAREIT Global Index

Source: Janus Henderson Investors, Barra, as of December 31, 2024.

Note: Based on a representative account.

©2024 MSCI Barra. All rights reserved. Active risk: a type of risk that a portfolio creates as it attempts to beat the returns of the benchmark against which it is compared. In this analysis we are using tracking error as a metric for active risk. Additional factors have been excluded from analysis. Exposures are subject to change without notice. Data is based on a representative account of the strategy and may vary from other accounts in the strategy, due to asset size and other factors. The representative account is believed to most closely reflect the current portfolio management style.

RATINGS AND AWARDS