Quarterly Update

The investment team recap this quarter.

(Note: Filmed in October 2025).

Investment objective

The Fund aims to achieve a return through capital growth and income, that is above the average return expected from an investment in European shares. The Fund invests in shares of companies with their registered office in or which do most of their business (directly or through subsidiaries) in Europe in any industry. The Fund may also invest in money market instruments and bank deposits. The Fund may use derivatives to reduce risk or to manage the Fund more efficiently.

About this fund

A large-cap focused fund seeking to capture outperformance by anticipating catalysts for change across European (ex-UK) companies and industries. Portfolio construction blends sector themes with compelling stock-specific stories to provide access to sustainable long-term growth trends.

Investment approach

Dynamic approach

Actively seeks to capture opportunities in all market conditions using a repeatable approach focused on fundamental research and thought leadership.

Blend style

Flexible, blended investment style, tilting to growth or value depending on the market environment.

Regional expertise

Experienced team supported by a strong European equities franchise, focused on company engagement, active stock selection and risk management.

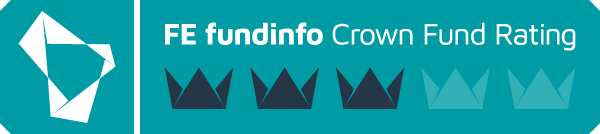

RATINGS AND AWARDS

S&P assigns a Principal Stability Fund Rating (PSFR) for money market funds within a range from AAAm (highest) to Dm (lowest), where AAAm indicates S&P's opinion of a fund's extremely strong capacity to maintain principal stability and to limit exposure to principal losses due to credit risk and Dm indicates a failure to maintain principal stability resulting in a realized or unrealized loss of principal. Ratings do not eliminate risk and should not be used as the sole basis for evaluating an investment product. Please see Ratings Criteria at disclosure.spglobal.com/ratings/en/regulatory/ratings-criteria for further information. A fee was paid for the use of this data.

RATINGS AND AWARDS

S&P assigns a Principal Stability Fund Rating (PSFR) for money market funds within a range from AAAm (highest) to Dm (lowest), where AAAm indicates S&P's opinion of a fund's extremely strong capacity to maintain principal stability and to limit exposure to principal losses due to credit risk and Dm indicates a failure to maintain principal stability resulting in a realized or unrealized loss of principal. Ratings do not eliminate risk and should not be used as the sole basis for evaluating an investment product. Please see Ratings Criteria at disclosure.spglobal.com/ratings/en/regulatory/ratings-criteria for further information. A fee was paid for the use of this data.