Discover why portfolio structure, not bubble timing, determines resilience. Learn how equity income strategies help investors capture AI-driven growth while reducing volatility and protecting capital during downturns.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Marketing communication.

Why rational pricing and rising dispersion represent a rare opportunity for absolute return investors.

Surging supply from AI-driven tech giants is reshaping investment grade credit. Explore what this means for spreads, sector shifts, and investor strategies in 2026.

In their 2026 outlook, Lucas Klein and Marc Pinto discuss how AI and structural reforms, especially in Europe, present opportunities for selective investors.

From underdogs to potential frontrunners: are small caps ready for a resurgence in 2026?

Can European equities grow in 2026, fuelled by reforms, improved trade conditions, and a broadening macroeconomic rebound?

Daniel Siluk and Addison Maier argue that already elevated inflation coupled with fiscal stimulus should compel bond investors to assess risks along all points of the yield curve.

Alex Veroude explains why the credit cycle in fixed income still has further to run in 2026, but investors should build some resilience into their portfolios.

Investors concerned about high concentration in US stocks should look elsewhere to achieve better portfolio diversification.

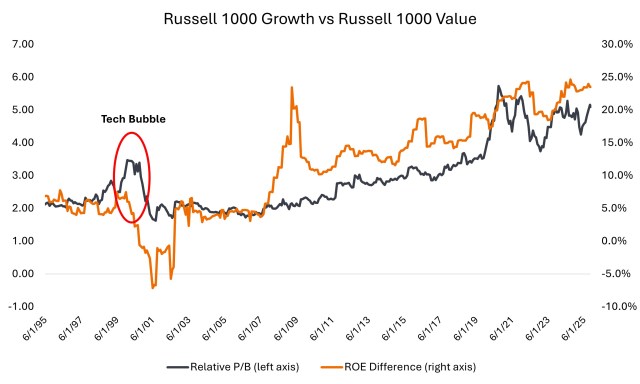

The market has become much less cyclical over time, and valuations have increased alongside growth and quality.

Diverging economic trajectories in Europe provide fixed income investors an opportunity to tailor duration and credit exposure based on local conditions.