Alternatives: the right time, the right place

The Portfolio Construction and Strategy Team considers the crucial role that alternatives can play in portfolio construction, at a time of real uncertainty for both equity and bond markets

2 minute read

This article is part of the latest Trends and Opportunities report, which seeks to provide therapy for recent market shocks by offering long-term perspective and potential solutions.

Alternative investments offer a potentially attractive proposition for investors looking to diversify their portfolios and reduce volatility.

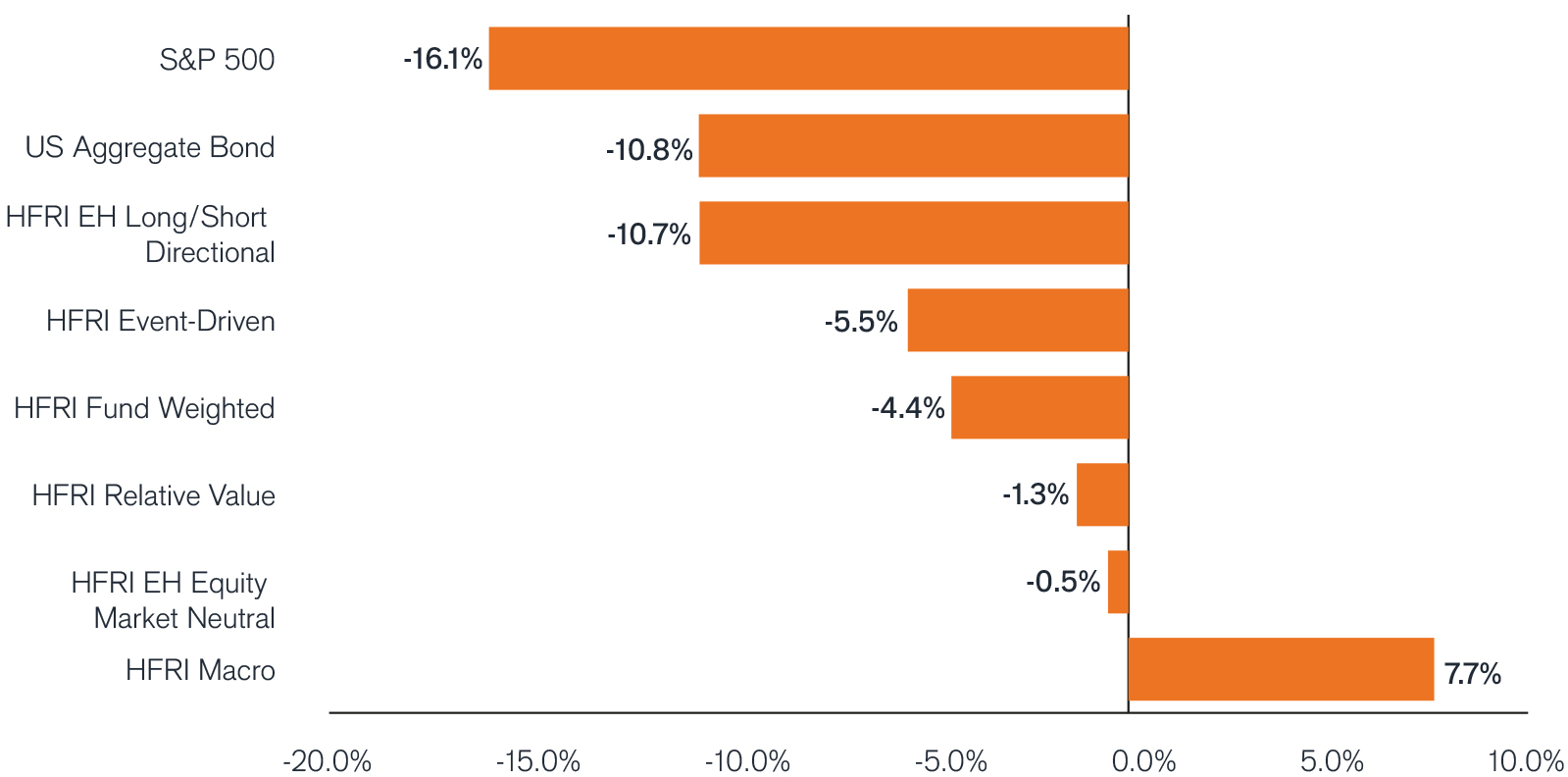

YTD Recap

- As the world’s major central banks have focused on fighting inflation, against a backdrop of slowing economic growth and latent geopolitical risks, both bonds and equities have sold off.

- Alternatives have delivered, on average, lower drawdowns and less volatility than equities and fixed income. In YTD, the broad HFRI Fund-Weighted Index posted a -6.0% return versus -16.1% for the S&P 500 Index and a -10.8% for the US for the US Agg Bond Index.

- As expected in volatile environments, there was significant return dispersion across different HFR alternative strategy indices.

Broad range of outcomes

Source: Morningstar, HFR, Inc. and Janus Henderson PCS. Period: YTD to 31 August 2022.

Outlook

- Alternative investments, and the uncorrelated returns they can generate, offer a potentially attractive proposition for investors looking to diversify their portfolios and reduce volatility.

- The macroeconomic outlook remains murky. The return potential for both equities and bonds remains highly uncertain amidst potentially higher inflation and interest rates than those experienced in many years.

- Unconstrained strategies that benefit from higher rates and/or volatility (Long/Short, Relative Value, Global Macro, and Trend Following) could offer diversified sources of returns, helping to defend portfolios in this environment.

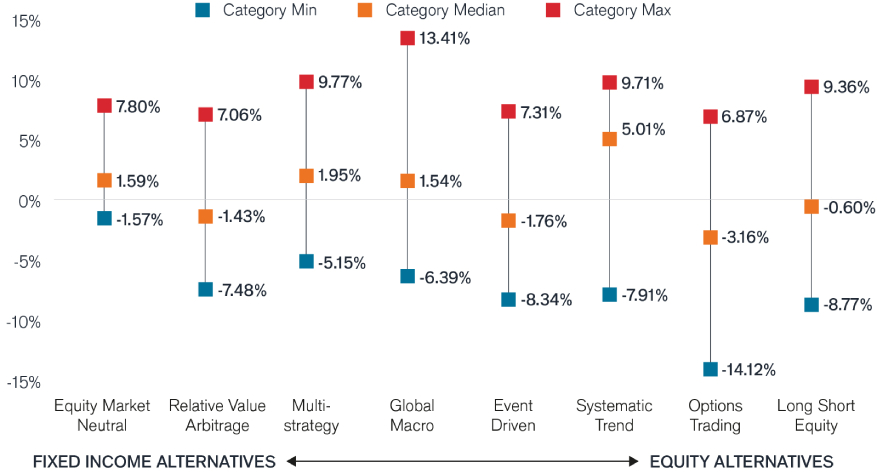

Due diligence is mandatory – wide dispersion in performance outcomes

Source: Morningstar and Janus Henderson PCS. Period: 5 years from Sept 2017 to August 2022.

PCS Perspective

- The importance of alternative investments has intensified this year and we believe they will form an even more critical role in portfolio construction going forward.

- We think investors need to identify what role an allocation to alternatives can perform in their portfolios, whether that be to diversify away from equities and fixed income or potentially dampen overall portfolio volatility.

- The current environment highlights the importance of allocating to different alternative strategies to improve diversification. Combining two or more alternative strategies can also potentially aid in dampening a portfolio’s overall volatility and limiting drawdowns.

- Be intentional about funding allocations and use strategies that will target the areas of your portfolio that most concern you.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.