The Markets in Financial Instruments Directive (“MiFID II”)

EMT

Like many in the industry, Janus Henderson has agreed to use the European MiFID Template (EMT) as the format to disseminate information to distributors about our products.

We have appointed Donnelley Financial Solutions (DFS) to produce and provide EMTs for all our products and these are available on request. Please send any delivery requirements or SFTP details to PRIIPSMIFIDIISUPPORT@janushenderson.com.

Please send any questions or feedback regarding Janus Henderson’s EMT to MiFIDFeedback@janushenderson.com. This would include, where required, information on a distributor’s review of target market and any information on sales made outside the target market.

Other data providers/intermediaries who hold information about Janus Henderson funds will also have EMTs available.

We have prepared the EMTs using information we reasonably consider to be accurate. However, Janus Henderson makes no warranty that the information contained in any EMT is appropriate or sufficient for any particular use or in any particular territory.

EET

Janus Henderson use the European ESG Template (“EET”) to communicate ESG information to distributors about our products registered for sale in the European Union, in line with the industry guidance and schedule recommended by FinDatEx.

Please send requests for the Janus Henderson EET, or any questions arising, to

We have prepared the EETs using information we reasonably consider to be accurate. However, Janus Henderson makes no warranty that the information contained in any EET is appropriate or sufficient for any particular use or in any particular territory.

Policies

Janus Henderson’s Best Execution policy explains how Janus Henderson strives to achieve the best result for their clients whenever they trade financial instruments. It allows clients to understand the execution priorities across various asset classes and lists the counterparties and venues that enable Janus Henderson to achieve this.

Janus Henderson’s Conflicts of Interest policy explains how Janus Henderson identifies and avoids, mitigates and/or discloses conflicts of interest which might adversely affect its clients. It allows clients to understand the sources of potential conflicts and the controls that may be applied to manage them.

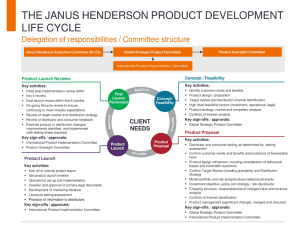

Product approval

process

MiFID II requires investment firms which manufacture financial instruments for sale to clients to maintain, operate and review a process for the approval of each financial instrument and significant adaptations of existing financial instruments before they are marketed or distributed to clients.

Investment firms are also required to assess whether the product is reaching the clients for whose needs, characteristics and objectives it was not considered compatible.

The Janus Henderson product approval process, outlined below, specifies an identified target market of end clients within the relevant category of clients for each financial instrument and ensures all relevant risks to the identified target market are assessed.

Within 3 months of a new product being launched the post implementation review process is started. Thereafter a new product will fall into the 6 monthly review that ensures products are satisfying investor needs and meeting regulatory requirements.

Complexity statements

Under MiFID II, all investment products will be defined as either “non-complex” or “complex”. These classifications will determine the conditions under which products can be distributed to different types of clients.

In accordance with Article 25(4)(a) of the MiFID II Directive, all Janus Henderson UCITS funds are automatically classed as non-complex.

We have applied the tests set out in Article 57 of MiFID II to our non-UCITS and AIFs and the following products also meet all the necessary criteria to be classed as non-complex.

- NURS

- PAIF

- Investment Trusts

FAQs

The following MiFID II FAQ provides answers to questions asked about Janus Henderson’s approach to MiFID II topics, including Costs & Charges; availability of the European MiFID Template (“EMT”) and Target Market. The FAQs will be regularly updated, as and when new questions are received.

Background

The Markets in Financial Instruments Directive (MiFID II) came into force on 3 January 2018. Distributors and advisors providing services under this regulation are required to provide information about all costs and charges within the funds they offer to their clients.