Short duration CLOs: A defensive anchor in a shifting rate environment

With the US Federal Reserve resuming rate-cutting and other central banks firmly committed to easing, investors are reassessing fixed income allocations. In this context, maintaining diversification is critical, while short duration exposure plays a central role in managing risk.

As short-term rates decline amid slowing growth and easing inflation, the yield curve offers limited incentive to extend maturity: the 2s10s spread[1] sits at just ~50bps in the US and ~60bps in Europe. This underscores the minimal compensation for taking on additional duration risk. At the same time, long-end volatility remains elevated, reinforcing the need for caution. CLOs, particularly at the top of the capital structure, stand out with attractive spreads and low sensitivity to rate moves. Allocating to high-quality CLO tranches can mitigate duration risk while preserving yield, making them a strategic component in constructing resilient fixed income portfolios for 2026.

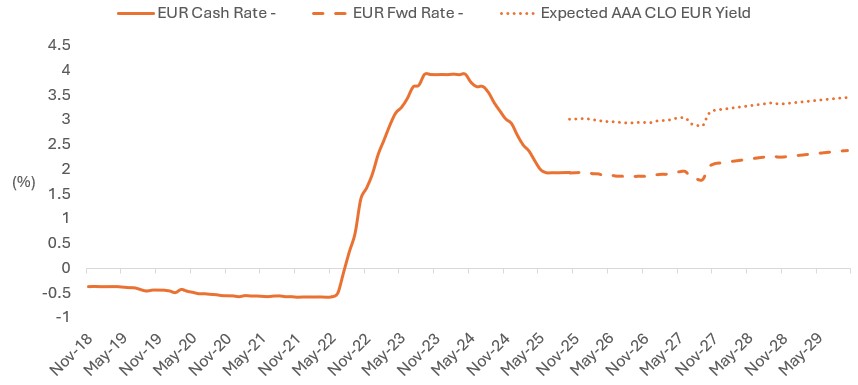

Figure 1: Retaining higher cash yields through AAA CLOs as cash rates fall

Source: Janus Henderson Investors, Bloomberg, as at 30 September 2025.Note: Chart showing historic cash rate, forward rates on the EUR OIS curve. Expected AAA CLO yield is the sum of the EUR forward Swap curve with end of month spread level on Citi EUR CLO AAA 2.0 index. There is no guarantee that past trends will continue, or that forecasts will be realised. For illustrative purposes only. Past performance does not predict future returns.

Relative value: CLOs stand out amid tight spreads

As we head into 2026, most fixed income sectors remain historically expensive, with investment grade (IG) credit spreads hovering near their tightest percentiles. In contrast, AAA-rated CLOs, while tighter than their long-term averages, still offer spreads closer to mid-range percentiles, making them one of the most compelling relative value opportunities across public credit markets.

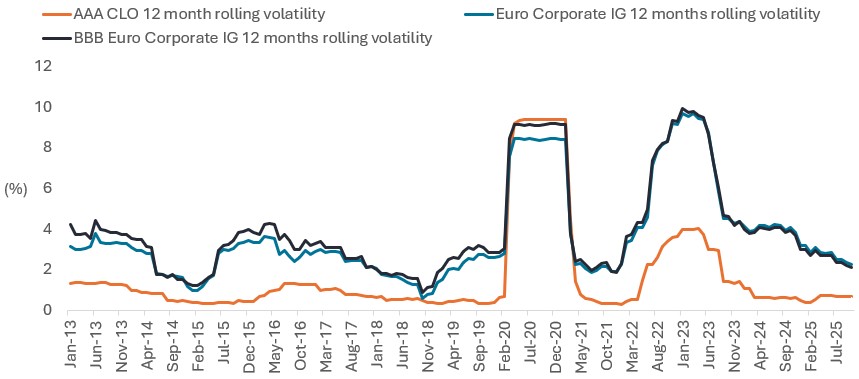

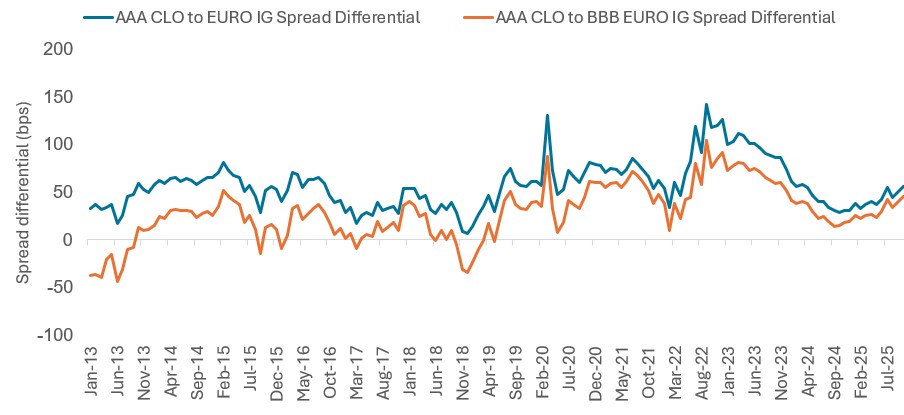

Beyond spread levels, investors should consider total return volatility. Over the past 12 months, CLOs have exhibited just 0.7% volatility, significantly lower than EUR IG at 2.2%, which continues to reflect rate-driven uncertainty (Figure 2). With central banks likely to maintain a cautious stance and rate volatility persisting, CLOs’ combination of low-price sensitivity and resilient carry is expected to endure. This positions the sector as a core allocation for investors seeking to balance yield and stability amid stretched fixed income valuations.

Figure 2: Post GFC AAA CLO deliver lower total returns volatility compared to IG corporate credit…

... and better relative value compared to broader IG and BBB IG (Figure 3)

Source: Janus Henderson Investors, Bloomberg, as at 31 October 2025. AAA CLO: JP Morgan European CLOIE AAA Index; BBB Euro IG: ICE BofA BBB Euro Corporate Index; Euro IG: ICE BofA Euro Corporate Index. Figure 2: 12-months rolling total return historical volatility. Figure 3: AAA CLO to IG Spread basis is the difference between AAA CLOs and Euro IG spreads based on the indices noted. A positive number indicates higher spreads in AAA CLOs relative to Euro IG.

Stable CLO spreads amid record issuance highlights broadening investor participation

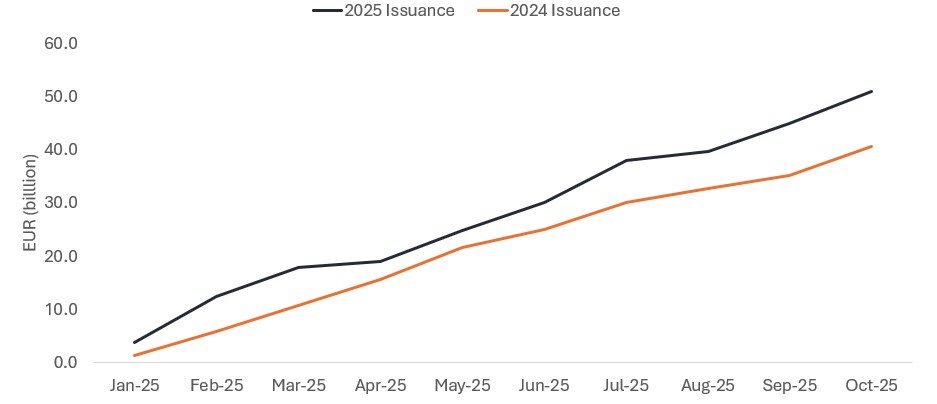

The European CLO market is on track for a record issuance year, with over €51 billion priced year-to-date, well ahead of the just over €40 billion seen over the same period last year (Figure 4). Notably, this surge in supply has been met with robust demand, as evidenced by the stability of AAA CLO spreads, which remain anchored around 120 basis points, broadly unchanged from the start of the year[2].

While research banks have yet to publish formal 2026 issuance forecasts, early indicators from deal pipelines and warehouse formation suggest continued strength ahead. This momentum reflects a broadening investor base, with increasing allocations to CLOs and securitised credit more broadly.

As investors seek differentiated sources of yield and resilience within fixed income, CLOs, particularly at the top of the capital structure, are gaining traction as a strategic allocation. The sector’s ability to absorb record volumes without spread dislocation underscore its depth and growing institutional relevance.

Source: Janus Henderson Investors, JP Morgan, year to date to 31 October 2025 compared to the same period in 2024.

Regulatory tailwinds reinforce CLO demand into 2026

Supportive regulatory developments are also set to strengthen the technical backdrop for CLOs through 2026 and beyond. The European Commission has identified securitisation as a key driver of economic growth, aiming to unlock bank lending and deepen capital markets by simplifying the EU’s Securitisation Framework. This policy shift is expected to further energise broader institutional participation.

In parallel, insurance regulators are recalibrating Solvency II capital charges, particularly for senior CLO tranches. Recent reforms propose significant reduction in spread risk capital requirements for AAA-rated CLOs, aligning them more closely with IG corporate credit. This marks a turning point for European insurers, who are already repositioning to capture the value offered by high-quality securitised assets. With regulatory barriers easing and spreads remaining attractive, CLOs are poised to benefit from sustained technical (demand) support.

Credit discipline and manager selection: key anchors in a fragmented risk landscape

In an increasingly complex macro and geopolitical environment, maintaining rigorous credit underwriting is essential. CLOs are well-positioned to offer stability amid uncertainty, thanks to their structural resilience and diversified exposure across over 25 sub-sectors , particularly in healthcare and services and other less cyclical sectors that represent significant allocations in European CLO portfolios.

Recent idiosyncratic events, such as the First Brands default, underscore the importance of deep corporate credit diligence, even when exposures are minimal. While CLOs provide insulation through diversification, any percolating systemic risks require heightened scrutiny.

CLO manager selection through 2026 will remain critical: with over 70 active managers and 700+ deals, performance dispersion remains material. Active strategies must be grounded in well-defined investment criteria, with a focus on CLO managers demonstrating robust underwriting, experienced teams, and proven tail-risk management. These attributes are central to our investment philosophy and key to ensuring stable performance. In volatile markets, the quality of credit selection and manager discipline will be decisive in driving outcomes.

Footnotes

[1] The 2s10s spread is the difference between the 10-year yield and the 2-year yield.

[2] Source: JP Morgan, Bloomberg, as at 31 October. JP Morgan European CLOIE AAA Index.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.