How are you managing risk amid market volatility, particularly with continued uncertainty around tariffs and economic growth?

No portfolio is immune to volatility, but we’ve found that focusing on quality businesses can help manage risk effectively in this environment. Our approach centers on fundamental analysis rather than trying to predict policy or economic shifts. We prioritize companies with sustainable earnings growth, high-quality balance sheets, and experienced management teams.

That doesn’t mean these companies are exempt from downturns, but we want to own businesses that will use challenging environments to strengthen their competitive position, take market share, and lean into the opportunities a downturn presents. We remain disciplined in avoiding investments where valuations aren’t fully supported by expected earnings growth.

We’re stress testing our models for tariff impacts and downturns, but always with the goal of thinking about where a stock will be three to five years from now, not six months from now. We don’t want to overemphasize shorter-term earnings impacts unless we think they’ll affect longer-term earnings power, such as with highly leveraged companies that might need to play defense.

Given the potential impact of tariffs on corporate profitability, how are you evaluating companies?

First, we look at gross margins and pricing power. As growth investors, our approach naturally leads us toward companies with higher gross margins, which provides insulation against tariff costs. For example, technology represents about 25% of the Russell Midcap Growth benchmark. Software businesses have 80% gross margins and don’t import goods, so there’s virtually zero tariff impact for them.

In other areas like healthcare or industrials, while gross margins might not be 80% and there may be some raw materials involved, the majority of the value add is in the intellectual property. The raw materials percentage of the cost stack isn’t big, so they can handle these challenges with a relatively modest impact.

Pricing power is equally important: If a company can pass increases on to customers, they won’t feel the impact as severely. But businesses with fixed pricing or pricing pressure may face a much different situation.

What are you hearing from companies about how they’re adjusting?

We’re engaging with companies that are exposed to tariffs to understand their contingency plans. It’s still early, but we’re hearing a mix of responses. Many companies are implementing easier fixes they can make quickly even though they come with cost headwinds.

For example, a company that recently reported earnings sells products from the U.S. to China but has a production facility in Taiwan. They’re ramping up that facility, though it will take a quarter or so to reach desired capacity. Interestingly, this is a move they would make even if tariffs eased. In another example, a product manufacturer relocated certain processes from Canada to Tennessee to sidestep potential duties.

Conversely, we’re seeing some companies defer bigger capital investment decisions given the uncertain environment. There are also some directly impacted companies that are scrambling to figure out how to adapt.

What is your view on current valuations in mid-cap growth?

Despite the volatility year to date, there remain plenty of companies with valuations that are out of line with fundamentals. We’ve seen a broader market correction, but there are still speculative names in pockets of the mid-cap universe that have performed well. This is particularly evident in certain software areas and what we call “defensive growth companies” – moderate growers trading at exceptionally high multiples because they offer defensive characteristics the market continues to value highly.

That said, the correction has created pockets of opportunity. We’re selectively repositioning into higher-quality names where valuations are better aligned with fundamentals, but we remain cautious on areas where the market hasn’t fully reset.

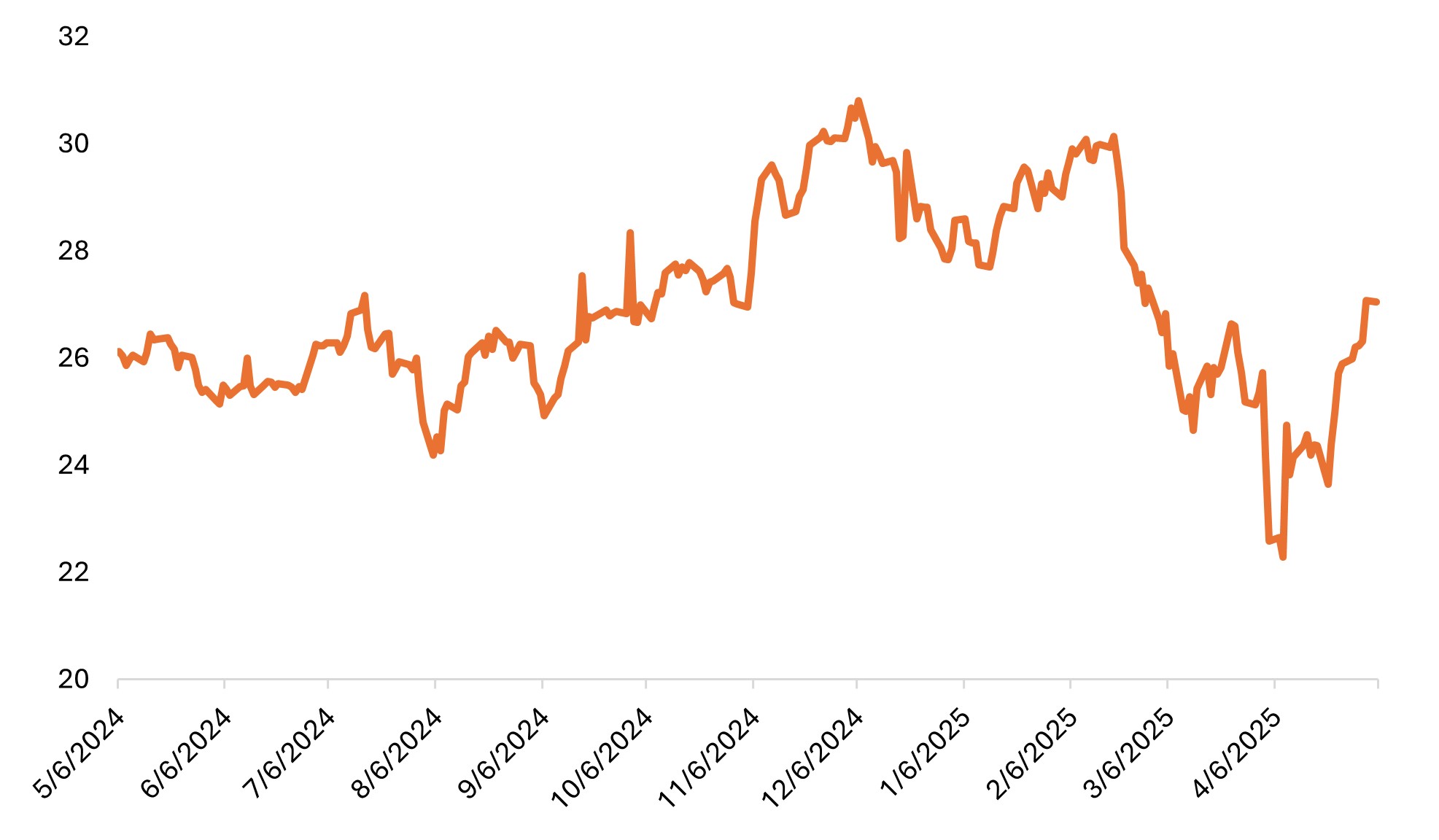

Russell Midcap Growth Index Forward Price/Earnings

05/05/2024 – 05/05/2025

Source: Bloomberg, as at 5 May 2025. Forward P/E based on blended forward 12-month estimates.

AI has driven significant market movements so far in 2025. What’s your outlook given recent shifts in sentiment?

We’re seeing a recalibration in AI market expectations. Broadly speaking, the market sentiment has shifted from predominantly optimistic to more nuanced, with investors asking what’s next for AI.

Recent developments – from DeepSeek advances to Microsoft signaling potential spending slowdowns – suggest frontier AI models may be plateauing. This changing landscape represents a significant shift in market dynamics and could remain a source of volatility going forward. And that volatility won’t be limited to “Magnificent 7” stocks, as AI is a key driver for power, components, and software as a service companies.

But it’s important to maintain perspective. We believe AI remains a genuine innovation with meaningful implications for productivity and business models. Unlike the dot-com bubble, the companies financing AI development have done so primarily through operating cash flow rather than debt. These companies have generated earnings without creating balance sheet problems.

Following a period of rapid investment, we’re witnessing an inevitable deceleration in growth rates as the market awaits evidence of returns and successful commercial applications.

In the mid-cap space, we favor companies with clear paths to monetization over speculative names trading at unsustainable valuations. And as the technology develops beyond the largest players, we believe some mid-cap companies represent the “next wave” of AI opportunities.

Russell Midcap® Growth Index reflects the performance of U.S. mid-cap equities with higher price-to-book ratios and higher forecasted growth values.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.