Financial markets have grappled with significant volatility in 2025 so far. Fears have growth over global trade relations and legislative turmoil, a slowing US economy after a long period of dominance and concerns that valuations in the US technology sector may be overblown.

This was particularly acute in April, following the announcement of US President Trump’s intended tariffs, which led to a substantial global sell-off, amid heightened fears of retaliatory tariffs and the increasing risk of global recession.

Markets thankfully found a foothold, rebounding on hopes that an all-out global trade war could be avoided after the US backtracked, initially suspending tariffs for 90 days. More recently, we have seen progress in discussions between the US and China, but the lack of clarity about the economic and investment environment continues to fuel disruption. This rise in uncertainty has been reflected in the VIX, which reached its highest level since the start of the COVID crisis.

Is uncertainty just part of the ride?

Financial market orthodoxy argues that volatility and uncertainty is just part of the journey for investors. Strategies like ‘buying the dip’ (where investors purchase assets during downturns in the expectation that the price will rebound), and ‘60/40’ (a multi-asset strategy that involves allocating 60% of your portfolio to equities, and 40% to bonds) have been a solid option for investors since the turn of the century.

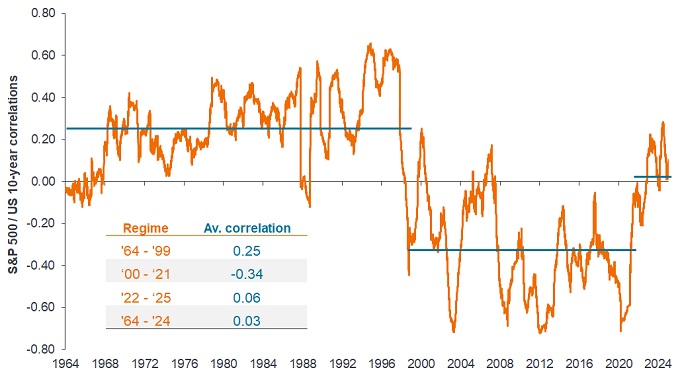

A persistent period of negative correlation between equities and bonds has meant that holding a simple diversified portfolio of these two asset classes baked in some mitigation against volatility. But it is easy to forget that in the decades that preceded this, there was a long period where equity and bond markets had positive correlation, ie. equities and bond prices moved in the same direction at the same time (Exhibit 1).

Exhibit 1: Bonds are not always a natural diversifier for equities

Source: Bloomberg, Janus Henderson Investors analysis, 31 January 1964 to 31 January 2025. Rolling 12-month correlations based on monthly data. Past performance does not predict future returns.

Gone are the days of rising tides lifting all boats

Clearly, today’s market conditions are a far cry from the environment and regime that defined the post-financial crisis era. The strength of equity markets, particularly the US, made it a very rewarding period for investors to add risk to their portfolios, rather than focus on managing exposure and diversification. A regime of ‘near-zero’ interest rates ensured that companies could take on and manage large tranches of debt to fund investment, mergers and acquisitions (and dividends). Similarly, consumers dipped deep into credit to fund purchases, rather than opting to build up savings over time.

This was conducive to a period in which economic output and consumer demand both grew, and stock prices generally gained, with less distinction between well-managed businesses with good products, and uncompetitive firms leaning hard on cheap credit. However, following the most recent inflation cycle, which saw rising prices for essentials like food and heating, and central banks around the world opting to tighten monetary policy, we have started to see greater dispersion in stock pricing.

The argument here is that as we return to a more normalised period of inflation and interest rates, investors should be considering what other options they can use to improve diversification in their portfolios, taking greater consideration of stock selection, and potentially ‘smoothing the journey’.

Looking beyond traditional assets

During times of elevated volatility, and heightened geopolitical and trade uncertainty, we think it is important to emphasise the opportunities for portfolio diversification in the alternatives space. Our particular focus is equity absolute return, which thrives on the heightened trading prospects when stock markets experience more normalised dispersion in pricing. This scenario is a boon for strategies rooted in active management or intensive fundamental analysis, paving the way for them to showcase their stock selection capabilities – particularly for those strategies that can capitalise on both the long and the short side.

Looking ahead, we anticipate a gradual decline in interest rates, albeit with the potential for trade uncertainties to prompt central banks to intervene once more as they try to manage varying mandates of price stability or employment. We believe policy makers in the western world are intent on permanently shifting away from the era of cheap borrowing, setting the stage for more a more persistent environment of rational dispersion between asset prices.

While we talk about the broader improved environment for equity stock picking, it should be placed in context against more current market uncertainties and volatility. We believe a strategy aimed at delivering consistent real returns, irrespective of market trends, and equipped to yield positive outcomes even in downturns, can play an important role to help navigate today’s unpredictable financial waters.

Alternatives: An investment that is not included among the traditional asset classes of equities, bonds or cash, such as property or infrastructure, hedge funds, long/short (or absolute return) strategies, commodities, private equity, art, derivatives, or cryptocurrencies.

Correlation/negative correlation: Correlation indicates how far the price movements of two variables (eg. equity or fund returns) move in relation to each other. A correlation of +1.0 means that both variables have a strong association in the direction they move. A figure near zero suggests a weak or non-existent relationship between the two variables. If the correlation is below zero, it implies they move in opposite directions in response to the same drivers – ie. negative correlation.

Diversification: A way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario. Assets with low correlation should provide the most diversification.

Dividend: A variable discretionary payment made by a company to its shareholders.

Inflation: The rate at which the prices of goods and services are rising in an economy. The Consumer Price Index (CPI) and Retail Price Index (RPI) are two common measures.

Stock dispersion: How much the returns of each variable (eg. stocks in a benchmark) differ from the average return of the benchmark.

Stock picking/pickers: Stock picking strategies are those that rely on the quality of their insight or analysis to correctly identify those stocks that are better positioned to deliver performance, relative to a generic index or benchmark.

Tariffs: A tax or duty imposed by a government on goods imported from other countries.

VIX Index: Produced by CBOE, the VIX is a broadly used barometer of market uncertainty, giving a measure of 30-day expected volatility in the US stock market.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.