Climate tipping points are critical thresholds beyond which environmental systems undergo irreversible, self-reinforcing changes –representing an underestimated risk in financial modeling. Unlike the smooth, incremental damage projected in many standard climate scenarios, tipping points can trigger abrupt, systemic shocks that ripple across economies, asset classes, and global markets. From the collapse of polar ice sheets leading to rapid sea level rise, to the disruption of the Atlantic Ocean circulation, these events could destabilise financial systems, reprice entire asset classes, and accelerate market transitions in ways that current risk models fail to capture.1,2

For long-term investors—including pension funds, sovereign wealth funds, insurance firms, and institutional asset managers—this isn’t just an environmental concern; it’s a financially material risk. For decades, many investors have approached climate risk under the assumption of a gradual, linear challenge that unfolds predictably over decades, allowing time to adjust portfolios, hedge exposures, and phase out stranded assets. But these assumptions underestimate a likely critical threat to financial systems: climate tipping points, which can force sudden portfolio revaluations due to triggering cascading economic disruptions.

Many current climate scenario analysis techniques that integrate the physical, transition and economic risks of climate change do so using simplified warming trends that do not integrate feedback loops and cascading effects of climate tipping points. These models offer a structured way to assess physical and transition risks under various standardised warming scenarios – 1.5°C, 2°C, 3°C. They assign a percentage-based value or a temperature outcome to climate based largely on linear changes, which risks providing markets a false sense of control and predictability.

As climate science advances, investors that rely on outdated risk frameworks could be exposed to unanticipated losses. In this article, we explore why climate tipping points matter for long-term investment decision-making, how they challenge conventional financial risk models, and what investors must do to safeguard portfolios from the economic shocks of these dynamic, nonlinear events.

5 key reasons why investors should care about the financial risks from climate tipping points:

- Underpricing climate risk: Many climate models fail to capture sudden, nonlinear disruptions caused by tipping points, which could lead to significant devaluation of entire asset classes.

- Inability to diversify against systemic shocks: Tipping points trigger cross-sectoral failures, such as the potential disruption of agriculture, energy, insurance, and infrastructure, making it difficult to diversify against climate tipping point risks.

- Increasing regulatory and litigation risks impacting companies: As the impacts of climate change become better understood, investors may face growing regulatory scrutiny and the risk of litigation for failing to account for known climate risks in their portfolios.

- Accelerating stranded assets: Sudden tipping points could accelerate the devaluation of real estate in vulnerable regions and climate-exposed infrastructure, compressing transition timelines from decades to years.

- Economic disruptions and opportunities: Exceeding tipping points could result in severe economic disruptions. But the transition to a low-carbon economy also presents new investment opportunities in sectors like renewable energy, sustainable agriculture, climate adaptation technologies (eg, sea walls, water resistant infrastructure, drought resistant crops), and carbon-free mobility.

What are climate tipping points and their impacts?

Scientists3 have identified 16 tipping elements capable of causing significant and irreversible shifts in the Earth’s climate system, comprising nine global ‘core’ tipping elements and seven regional ‘impact’ tipping elements. Research shows that multiple climate tipping points could be activated as the Earth progresses past 1.5°C of global warming for an extended period, resulting in irreversible and potentially catastrophic climate disruptions. Additionally, tipping point elements do not operate in isolation, but instead interact with each other causing ‘tipping cascades’, where the destabilisation of one tipping element increases the likelihood of triggering other tipping elements. The result of tipping cascades is even more rapid and accelerated global warming, increasing the likelihood of more tipping points to be exceeded.

Several tipping elements are already at risk under current global temperatures. Some of the most financially relevant approaching their critical tipping points including:

- Ice sheet collapse (Greenland & Antarctica): Global multi-meter sea level rises could result in trillions of dollars in damages, leaving coastal infrastructure and real estate flooded and stranded or uninsurable.

- Permafrost thawing: Release of massive amounts of methane (CH₄) and carbon dioxide (CO₂) intensifies global warming, further increasing the risk of ice sheet collapse along with other tipping points.

- Marine ecosystem collapse: A structural collapse of coral reefs results in loss of a carbon sink and further impacts biodiversity losses (reefs support ~25% of marine species), erosion of coastal protection, removal of economic benefits, and exacerbation of food insecurity, reducing human productivity.

- Amazon rainforest dieback: Collapse of a major carbon sink accelerates climate change and affects global commodity markets (eg, agriculture, timber, water security).

- Atlantic Ocean circulation (AMOC) shutdown: Disruptions to weather patterns, food production, and energy markets could destabilise entire economies.

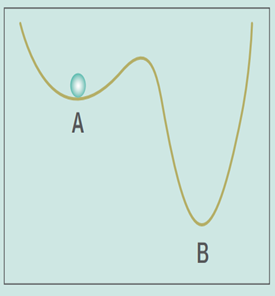

A useful way to understand tipping points is through a ball-in-a-basin model4 (Figure1):

Imagine a ball sitting in a valley (Point A), representing the current, stable climate state. Small disturbances (eg, rising temperatures, deforestation) may cause the ball to shift, but it remains in the valley. However, if pushed beyond a critical threshold, the ball crosses a ridge and falls into a new, deeper valley (Point B)—a fundamentally different and more unstable climate state.

Reversing this process, while theoretically possible, demands exponentially greater effort than the initial shift. Therefore, avoiding the shift could be exponentially less costly than attempting to reverse it. In many cases, returning to the original state is physically or economically infeasible within investment-relevant timeframes.

Unlike gradual climate changes, tipping points are particularly dangerous due to disruptions in the Earth’s climate system and the global economy.

- Self-Perpetuating Change: Once a climate tipping point is crossed, the process continues and accelerates on its own, even if the original force (eg, greenhouse gas emissions) is reduced or removed. This is due to positive feedback loops, where the change reinforces itself. For example, Arctic Sea ice loss reduces the Earth’s ability to reflect sunlight (ie, the “albedo effect”), causing further warming and more ice melt.

- Irreversibility: Although some tipping points may be theoretically reversible over thousands or millions of years, they are effectively permanent within investment- and policy-relevant timeframes. For example, the collapse of the Greenland Ice Sheet, once past a critical threshold, could take millennia to replace even if global temperatures drop.

- Accelerated Timescale: Unlike gradual climate changes, which occur incrementally, tipping points can cause sudden, runaway shifts in climate systems. Once triggered, the pace of change increases dramatically compared to human-induced warming trends. For example, the Atlantic Meridional Overturning Circulation (AMOC), which regulates global ocean currents, could shift abruptly, leading to extreme global weather pattern disruptions such as cooling the mild European weather, changing global precipitation patterns, causing droughts in Africa, impacting India’s monsoon season, and causing sea-level risings along the US East Coast.

- Large Scale: A climate tipping point affects large areas— equivalent to the size of major continental regions—and often has global repercussions. For example, Amazon rainforest dieback would disrupt the global carbon cycle, affecting temperatures worldwide.

- Significant Impact: To qualify as a tipping point, it must directly impact the Earth’s climate system (ie, biosphere), disrupt economic stability, or affect large populations. For example, a major sea level rise event caused by ice sheet collapse could displace hundreds of millions of people, threatening global real estate markets, insurance industries, and sovereign credit ratings.5

Proactively addressing climate change is substantially more cost-effective and less damaging than attempting to restore and reverse its effects after breaches occur. Adding the lens of climate tipping points further highlights the need for speeding up coordinated responses and actions already being done across multiple fronts. Rapidly reducing greenhouse gas emissions is critical, with a focus on phasing out fossil fuels, scaling renewable energy, and enhancing carbon removal technologies. Protecting natural carbon sinks, such as forests and wetlands, while halting deforestation and habitat destruction, is essential to maintaining climate stability. Reducing black carbon and aerosols can help protect the cryosphere and stabilise monsoon systems, preventing further disruptions. Strengthening climate adaptation and resilience strategies ensures infrastructure, economies, and food systems can withstand escalating climate impacts. Additionally, implementing strong climate policies, integrating climate risk into financial systems, and fostering social transformation through sustainable consumption and corporate responsibility can accelerate systemic change.

Global cooperation and financial support for vulnerable regions are also vital in mitigating cascading climate risks. Taking these actions now is not only more feasible but also far more cost-effective than attempting to reverse irreversible climate tipping points once they are crossed. By avoiding prolonged temperature rises above 1.5°C, we can significantly reduce the potential damages and economic costs associated with these tipping points. The accelerating risk of climate tipping points presents one of the most severe and underappreciated challenges to economic and environmental stability. Investors, businesses, and policymakers should integrate tipping point science into risk management frameworks.

Why do climate tipping points matter for long-term investment decision-making?

“All models are wrong, but some are useful”6

– George Box, British Statistician

Investment analysis often involves forecasting future cash flows and discounting them to their present value using an appropriate discount rate that reflects inherent risks and uncertainties. Greater uncertainty regarding future cash flows necessitates a higher discount rate, thereby reducing the present value of the investment. Traditional financial valuation methods, particularly Discounted Cash Flow (DCF) models, typically rely on short-term (i.e., 3-5 year) forecasts, followed by a linear transition period, and a long-term terminal value based on perpetual stable growth and profitability, which can sometimes account for 50-80% of the total valuation. By assuming long-term stability and gradual risk integration, DCF models can systematically underestimate and misprice the impact of climate risks and tipping points on asset values and economic stability. However, once triggered, climate tipping points can cause systemic shocks, leading to abrupt repricing of assets, stranded investments, supply chain disruptions, and economic instability—affecting asset terminal values. Therefore, it is crucial for investors to incorporate the potential impacts of climate tipping points into their valuation models to better assess and mitigate these risks.

A stable economy relies on predictable agricultural yields, resilient infrastructure, and sustainable supply chains, all of which are deeply influenced by climate patterns and biodiversity health. The potential for abrupt and severe changes from climate shifts introduces a high degree of uncertainty into long-term investment and financing decisions.

Understanding the dynamics and consequences of breaching climate tipping points is therefore essential for policymakers, investors, and businesses. For instance, the Amazon rainforest can tolerate up to 25% deforestation before reaching a tipping point7, after which it shifts from a carbon sink to a carbon source, causing cascading environmental, economic, and geopolitical disruptions. By comprehending these risks, investors can assess both the immediate and long-term impacts on the global climate system and hopefully make more informed investment decisions. This proactive approach is crucial to maintaining economic stability and avoiding the cascading effects of worse outcomes.

Climate scenario analysis is a key strategic tool for governments, businesses, and investors, offering a structured approach to assessing the financial and operational risks and opportunities of climate change under various future scenarios. By exploring multiple potential climate outcomes, decision-makers can enhance resilience, stress-test strategies, and make more informed, forward-looking investment choices. Regulatory frameworks, such as the International Sustainability Standards Board (ISSB), now adopting the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, are increasingly pushing businesses and investors to conduct climate scenario analysis for greater transparency and disclosure. In the financial sector, tools like Climate Value at Risk (CVaR) and Implied Temperature Rise (ITR) have gained rapid adoption as asset managers seek to quantify climate risks for their mandated TCFD reporting. Many institutions have turned to off-the-shelf data providers, relying on CVaR methodologies built on Integrated Assessment Models (IAMs) and standardised climate scenarios. These climate scenario models offer a structured way to assess physical and transition risks under different warming scenarios and policy responses, with the result typically expressed in one quantified metric—a percentage-based value at risk or a temperature outcome. While such climate scenario analysis and risk models can provide useful insights into the impacts of climate risks, they are not yet fully equipped to capture the full complexity of tipping points. Assigning a simplified quantitative metric can provide users, decision-makers, and financial markets with a sense of predictability, reinforcing the belief that climate risk is well understood and manageable. As a result, it is essential for investors, policymakers, and businesses to recognise limitations and to seek more comprehensive analyses that account for the possibility of crossing these critical thresholds. Further advancements in probabilistic modeling, artificial intelligence, and high-resolution Earth system simulations are needed to improve our understanding of how tipping points could impact climate and financial risks.

| Climate Value at Risk (CVaR) is a financial metric used to estimate the potential impact of climate-related risks—both physical (eg, extreme weather, sea level rise) and transition risks (eg, regulatory changes, market shifts due to decarbonisation)—on asset valuations and investment portfolios. It quantifies the expected financial loss under different climate scenarios, typically expressed as a percentage of portfolio value. While CVaR provides useful insights, it relies on model assumptions that may underestimate systemic risks, such as climate tipping points, feedback loops, and abrupt market repricing. | Implied Temperature Rise (ITR) is a forward-looking metric that estimates the global temperature increase associated with a company’s or portfolio’s current emissions trajectory, relative to the Paris Agreement goals. It translates carbon footprint and decarbonisation commitments into a projected warming outcome, typically expressed in degrees Celsius. While ITR provides a useful benchmark for assessing climate alignment, it can oversimplify complex transition dynamics and fails to account for nonlinear climate risks, such as tipping points and feedback loops. | Integrated Assessment Models (IAMs) are analytical tools that combine climate science, economics, and energy system dynamics to assess the potential impacts of climate change and policy responses. IAMs are widely used for scenario analysis, including in climate risk modeling, policy planning, and financial assessments. However, they struggle to capture deep uncertainties, nonlinear tipping points, and cascading system-wide risks, often leading to an underestimation of extreme climate impacts. |

Consequences of climate change escalates nonlinearly when ecosystems and infrastructure struggle to adapt to shifting baselines. Extreme events that once were rare outliers now occur more frequently, often pushing systems beyond their limits and triggering cascading failures. Key thresholds, such as ‘wet bulb temperature8 limits are critical factors in climate risk assessment, as exceeding 35°C (95°F) can be fatal for humans and disrupt economies, adding complexity to forecasting. Climate scenario testing must account for productivity losses in heat-exposed sectors (eg, agriculture, construction, logistics), supply chain disruptions, infrastructure stress, and increased energy demand for cooling. Persistently high temperatures can destabilise real estate values, increase insurance risks, accelerate climate migration, and heighten geopolitical instability. Without properly integrating tipping points into climate risk modeling and stress testing, investors and policymakers remain ill-equipped to manage the profound long-term threats posed by climate change. A more precise, forward-looking approach is essential to safeguard financial stability and mitigate global climate risks before markets are forced into reactive, disorderly adjustments.

Public awareness is increasingly recognised as a catalyst for systemic change in addressing climate change because it drives shifts in behaviours, policies, and economic systems necessary for large-scale decarbonisation. Social awareness and changing consumer preferences push businesses to adopt sustainable practices, while social movements and activism influence policymakers to implement ambitious climate policies. Investors can further accelerate corporate sustainability efforts, by integrating financially material climate risks into decision-making. Additionally, societal acceptance of renewable energy, electric mobility, and circular economy principles may speed up the transition to low-carbon solutions.

What investors can do to help safeguard portfolios

Given the uncertainties in modeling climate risks, it is crucial for investors to pair quantitative metrics with more comprehensive qualitative narratives that allows them to focus on the more subtle yet realistic aspects of climate risk that are often overlooked in current scenario models. To avoid being caught off guard by climate-driven financial shocks, investors can:

- Move beyond standard climate scenario models – Conduct scenario analyses that incorporate tail risks and tipping point events, rather than relying on gradual, linear projections of warming.

- Stress test for systemic climate shocks – Assess the resilience of portfolios against extreme, nonlinear risk scenarios with that go beyond incremental warming pathways using combined qualitative and quantitative, “what if” analysis.

- Adjust Discount Rates & Valuation Models – Adjust discount rates to reflect the potential for tipping points and nonlinear disruptions to better account for future climate shocks.

- Enhance Climate Due Diligence & Active Engagement – Evaluate whether portfolio companies are prepared for extreme climate disruptions, not just the regulatory transition risks. Additionally, engage with policymakers and regulators to ensure that climate risk models evolve to capture the full complexity of climate impacts.

- Align Investments with Likely More Aggressive Climate Policies – Align investment strategies with more aggressive policies and incentives, which are likely to be implemented as climate tipping point modeling becomes increasingly integrated into policymakers’ decision-making processes globally.

Conclusion

Investors’ understanding of climate opportunities and mitigating risks must evolve in response to emerging scientific insights and data. While existing climate models provide valuable projections, they have inherent limitations, particularly in capturing complex, nonlinear phenomena such as climate tipping points.

Key tipping elements—such as ice sheet collapse, permafrost thawing, and Amazon rainforest dieback—can trigger cascading effects, amplifying economic risks. Unlike gradual climate change, climate tipping points represent critical thresholds in our climate system, beyond which irreversible and potentially catastrophic changes may occur. Climate tipping points can lead to sudden, systemic disruptions across various sectors, challenging the stability of global financial markets and economies.

Traditional climate models struggle to fully capture these deep uncertainties, highlighting the importance of integrating advanced climate scenario analysis and comprehensive climate risk assessments into investment strategies and decision-making processes. To safeguard portfolios, investors should integrate tipping point science, stress-test for systemic shocks, and engage policymakers to improve climate risk disclosures. Proactively addressing climate risks now, rather than relying on future technological solutions, can be a more feasible and cost-effective strategy for investors and clients.

Carbon sink: Carbon sinks extract carbon dioxide (CO2) from the atmosphere and absorb more carbon than they release, making them essential to the fight against climate change. Natural carbon sinks include oceans, forests and mangroves.

Paris Agreement: The agreement’s main goal is to strengthen the global response to the threat of climate change by keeping a global temperature rise this century well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase even further to 1.5 degrees.

Stranded asset: An asset that suffers unanticipated or premature write-downs, devaluations, or conversions to liabilities due to climate change-related impacts.

Tipping point: A threshold, critical mass, moment that leads to dramatic, radical change.

Wet bulb limits: Measure the combined threshold of heat and humidity where the human body can no longer cool itself through sweating. Exceeding this limit can lead to overheating and potentially fatal heat stress.

Source: 1Lenton, T.M., Rockström, J., Gaffney, O., Rahmstorf, S., Richardson, K., Steffen, W. and Schellnhuber, H.J. (2019). Climate tipping points — too risky to bet against. Nature, 575(7784), pp.592–595.

Source: 2Kriegler, E., Hall, J.W., Held, H., Dawson, R. and Schellnhuber, H.J. (2009). Imprecise probability assessment of tipping points in the climate system. Proceedings of the National Academy of Sciences, 106(13), pp.5041–5046.

Source: 3Armstrong McKay, D.I., Staal, A., Abrams, J.F., Winkelmann, R., Sakschewski, B., Loriani, S., Fetzer, I., Cornell, S.E., Rockström, J. and Lenton, T.M. (2022). Exceeding 1.5°C global warming could trigger multiple climate tipping points. Science, [online] 377(6611).

Source: 4Hodgson, T. (2024). Systemic risk and climate tipping points, Thinking Ahead Institute

Source: 5George Box, British Statistician, Journal of the American Statistical Association (1976)

Source: 6Critical transitions in the Amazon forest system, Nature, 14 February 2024,

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.