Source: Morgan Stanley, Janus Henderson Investors as at 30 September 2025.

While big tech is making headlines in the US, small caps benefit from much high pricing dispersion and market inefficiencies. Is this the area where active managers can shine?

The Magnificent 7 (MAG7), US tech stocks – Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia and Tesla – continue to dominate large-cap indices, driving much of recent market returns, and now accounting for a huge share of the S&P500 Index. This has left passive portfolios, especially market-weighted index funds, highly exposed to the fortunes of just a few companies. But what is notable is that beyond these mega-cap names is another group of stocks that can deliver higher growth at lower valuations.

Outsized potential from asymmetric investing

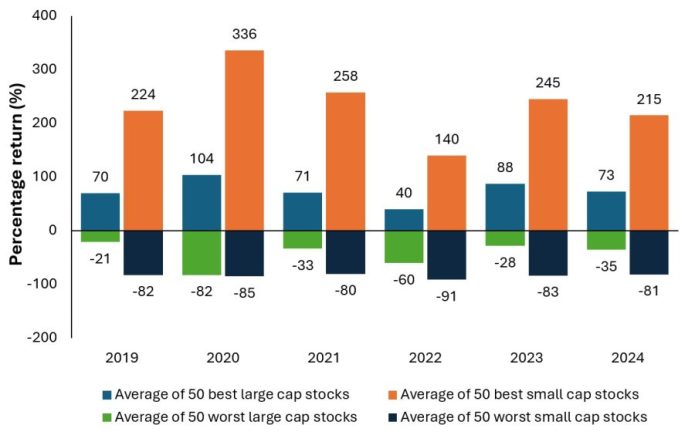

Small-cap investing offers distinctly asymmetrical potential for returns compared to large-cap investing. With less analyst coverage and lower liquidity, it is also a less efficient part of the market, resulting in a much higher dispersion of returns. This inefficiency offers skilled active managers an opportunity to enhance performance through bottom-up stock selection, crafting more diversified portfolios with reduced concentration risk.

Small-cap stocks also tend to be more exposed to extreme outcomes. On the upside, some can experience exponential growth. The downside risk, however, is higher business risks, less diversified revenue streams, and greater vulnerability to economic shocks. This results in a positively skewed distribution, where identifying a few winners and avoiding the biggest losers can significantly enhance returns. This emphasises the value of a process built on diligent research and analysis.

In comparison, large cap investing tends to have a more symmetric distribution of returns. Passive investing in large caps, such as through index funds, captures market returns at low costs, and lower volatility. But this comes with limited upside potential. And concentration risk in the index can make it potentially more difficult for active managers to consistently outperform their benchmarks, after fees.

Smaller companies with superior earnings growth have a consistent edge over larger-cap stocks. A process of rigorous, bottom-up stock selection, built to identify these companies rather than relying on macro or thematic bets, is central to delivering outperformance.

– Nick Sheridan, Portfolio Manager

Index: A statistical measure of a group or basket of securities or other financial instruments. Each index has its own calculation method, usually expressed as a change from a base value.

Large cap stocks: Well-established companies with a valuation (market capitalisation) above a certain size, although it varies between markets. It can also be used as a relative term. Large-cap indices, such as the UK’s FTSE 100 or the S&P 500 in the US, track the performance of the largest publicly traded companies rather than all stocks above a certain size.

Mega-cap stocks: The largest designation for companies in terms of market capitalisation. Companies with a valuation (market capitalisation) above $200 billion in the US are considered mega caps. These tend to be major, highly recognisable companies with international exposure, often comprising a significant weighting in an index.

Passive investing: An investment approach that involves tracking a particular market or index. It is called passive because it seeks to mirror an index, either fully or partially replicating it, rather than actively picking or choosing stocks to hold. The primary benefit of passive investing is exposure to a particular market with generally lower fees than you might find on an actively managed fund.

Small-cap stocks: Companies with a valuation (market capitalisation) at the smaller end of a market scale. Small-cap stocks tend to offer the potential for faster growth than their larger peers, but with greater volatility.

S&P 500 Index: The S&P 500 Index indicates the performance of the largest 500 listed US companies’ stocks.

MSCI World Large Cap Index: An index that captures the performance of large- and mid-cap companies across 23 developed markets.

MSCI World Small Cap Index: An index that covers small companies, in terms of market capitalisation, across 23 developed markets.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.